5 Costs to Keep in Mind When Picking an HSA

Layers of explicit and implicit costs make HSA expenses tough to evaluate.

Health savings account investors will have a tough time comparing costs of one HSA to another because of layers of fees and potential opportunity costs embedded at most providers. In October, we released a report that evaluated and ranked 10 of the largest HSA investment accounts available to individuals. Costs differ significantly from one provider to the next and factored heavily into our evaluations. This article highlights five types of explicit and implicit costs that HSA investors should be mindful of.

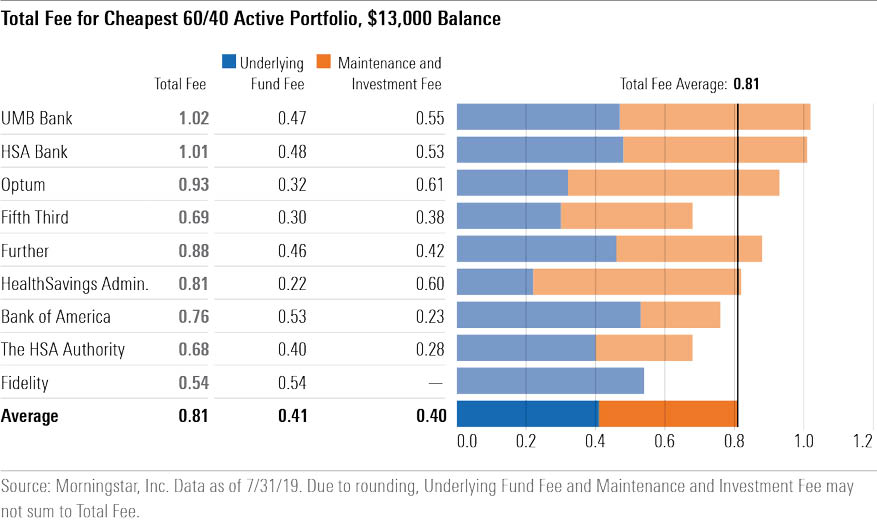

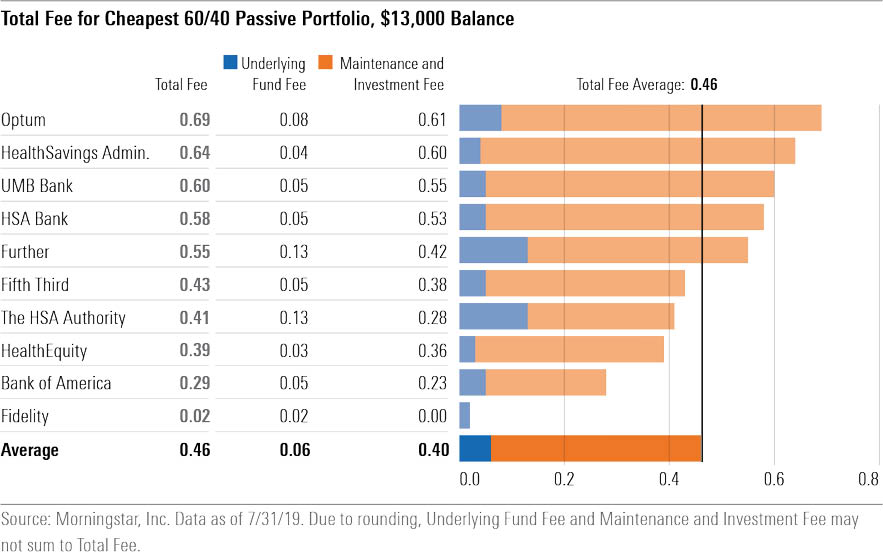

Underlying Fund Fees, Maintenance Fees, and Investment Fees HSA investors can't avoid underlying fund fees, but they can minimize them. To make an apples-to-apples comparison across the 10 HSAs we evaluated, we built the cheapest active and the cheapest passive 60% stock/40% bond portfolios at each provider using the following asset class weights:

- 45% U.S. large caps

- 15% foreign developed/world stocks

- 40% U.S. investment-grade bonds

Most HSAs also charge maintenance fees, which cover administrative costs, and investment fees for the privilege to invest. Maintenance fees are typically dollar-based fees, whereas investment fees can be dollar-based or percentage fees that are levied on account assets. To incorporate these expenses into our analysis, we converted dollar-based fees to percentage terms, assuming an investment account balance of $13,000--roughly the average balance across the HSAs we assessed in 2019. We then layered each provider’s maintenance and investment fees onto its underlying fund fees to come up with an expense ratio for both 60/40 portfolios. We also assumed a checking account balance of $2,000--also the average across providers we assessed--which led to fee reductions at providers that begin to waive or reduce maintenance fees at that level.

Exhibits 1 and 2 shows that combining these three fees leads to a wide dispersion in expense ratios from one provider to the next. Fees range from 0.54% to 1.02% for the active portfolio and 0.02% to 0.69% for the passive portfolio.

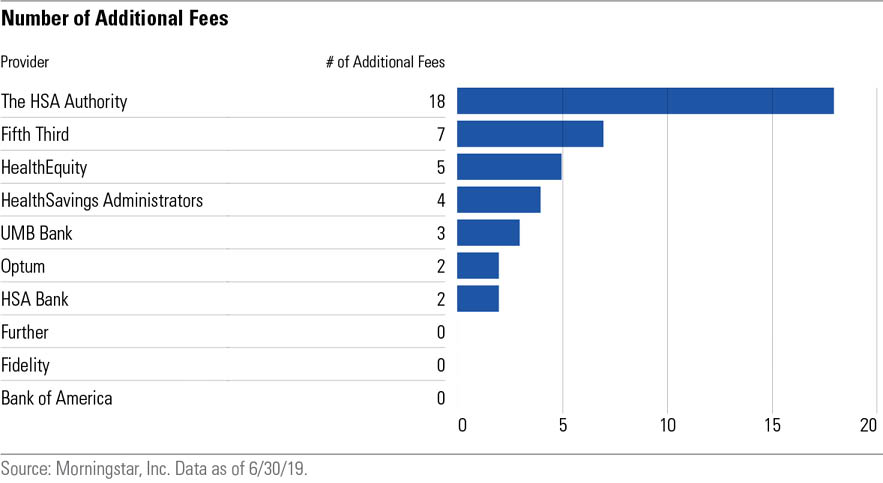

Additional Fees Investors must also remain vigilant of additional fees, such as those levied on account overdrafts, excess contributions, and paper (as opposed to electronic) statements. These fees tend to occur infrequently or can often be avoided, but they can add up over time if investors aren't careful. Exhibit 3 shows the number of additional fees present at each provider. In general, these fees range from as low as $2 to as high as $40. Bank of America, Fidelity, and Further stand out for not attaching any additional fees. Meanwhile, The HSA Authority's 18 additional fees represent an outlier.

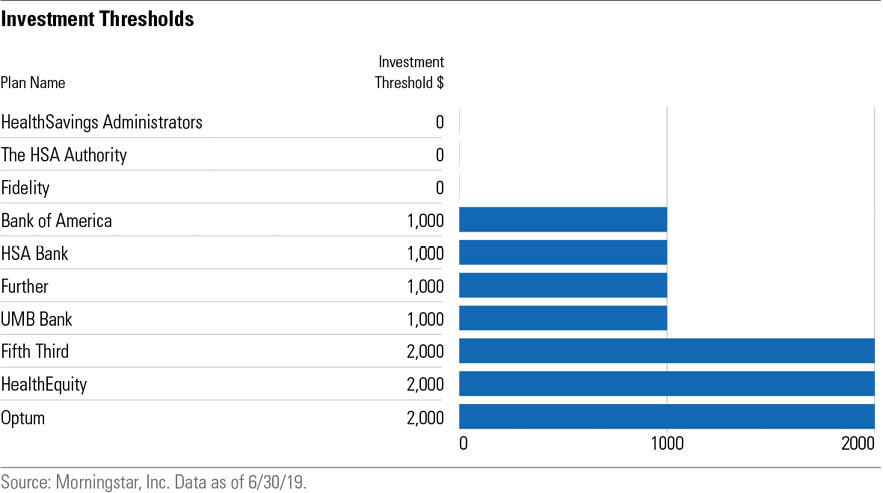

Investment Thresholds: An Opportunity Cost The majority of providers impose an investment threshold, which requires investors to maintain a certain balance in their checking account before they can begin investing. As a result, HSA investors face an opportunity cost. Seven of the 10 providers we evaluated have an investment threshold of $1,000 or $2,000, as outlined in Exhibit 4. To quantify the impact of that, consider the average HSA investor, who we assume has a total balance of $15,000 ($13,000 in the investment account, $2,000 in the checking account). Assuming an investor could earn 6% annually and considering the fact that the best HSA checking accounts currently offer a return of only about 1%, the opportunity cost of parking $1,000 in the checking account is 0.33% annually. Providers that require investors to keep $2,000 in the checking account create about a 0.67% annual opportunity cost. That's a material indirect expense for investors who want to shift all of their HSA assets into the investment account. All else equal, HSA investors are better off in HSAs with no investment thresholds.

Fidelity, HealthSavings Administrators, and The HSA Authority laudably avoid investment thresholds. On the other end of the spectrum, Fifth Third, HealthEquity, and Optum require a hefty $2,000 investment threshold.

The Cheapest of Them All Fidelity's HSA by far looks the most attractive from a fee standpoint. Although its active portfolio has the highest underlying fund fee of the group, its passive portfolio has the cheapest underlying fund fee, plus it is the only provider that eschews both maintenance and investment fees. As a result, Fidelity has the lowest expense ratio for both the active and passive portfolio. Fidelity also gets ahead by charging no additional fees, and it doesn't impose an investment threshold. Such considerations highlight why Fidelity's HSA is our favorite pick.

What About Your Employer's HSA? We evaluated HSAs from the perspective of an individual who is shopping for an HSA on her own as opposed to using one offered by her employer. If your employer offers an HSA, give it a close look. Sometimes employers cover fees that you'd have to pay if you bought the HSA on your own, plus your employer might contribute to your HSA if you select its offering. That said, if you aren't happy with your employer's HSA but you still want to take advantage of its HSA contribution (as you should, if it is offered), there is a work-around for that. You can own two HSAs side by side, meaning you can make regular contributions to your employer HSA, receive your employer's contribution into that account, and then regularly shift those assets to an HSA of your choosing. Because Fidelity essentially offers its HSA free of charge, it likely stacks up well versus your employer plan. It might be an operational headache to constantly shift dollars from one HSA to another, but the cost savings could be worth it.

Footnote: We only considered HSAs that offer FDIC insurance on the checking account, as we believe spenders’ healthcare dollars should be safeguarded in the event of a catastrophe.

/s3.amazonaws.com/arc-authors/morningstar/41940ba6-d0f1-493c-af96-52ad9419064e.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZKOY2ZAHLJVJJMCLXHIVFME56M.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/IGTBIPRO7NEEVJCDNBPNUYEKEY.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HDPMMDGUA5CUHI254MRUHYEFWU.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/41940ba6-d0f1-493c-af96-52ad9419064e.jpg)