Micro-Caps Under the Microscope

An up-close look at common characteristics of the market’s smallest names.

Micro-cap stocks may be unfamiliar to many. Investors can be forgiven for overlooking this segment of the U.S. stock market, which, per CRSP’s definition, accounts for 2% of the total investable market capitalization of the U.S. stock market. But micro-cap stocks can play a role in a portfolio, even if it is a bit part. This asset class offers low correlations with the upper reaches of the market-cap ladder. It might also serve as a more liquid, less costly, and more readily accessible proxy for a private equity allocation.

However, this asset-class is not without its drawbacks. Chief among these are greater volatility and limited liquidity and capacity. Also, for fund investors, there are few options for exposure to this sliver of the market. It is a market segment where indexing is challenged. Fortunately, there are some better alternatives.

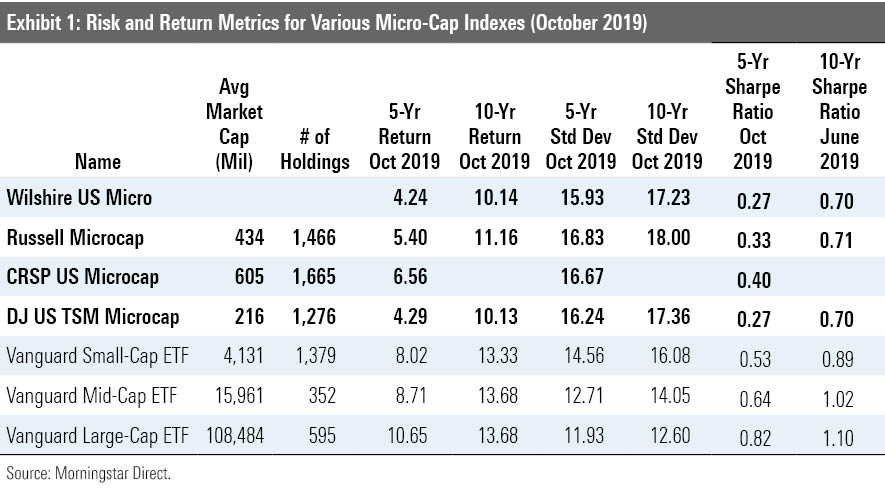

Measuring Micro-Caps The Russell Microcap Index is widely utilized as a proxy for micro-cap stocks. As of May 2019, the index had 1,491 holdings and an average market capitalization of $499 million. The market cap of the index's constituents ranged from $30 million to $1 billion.

Micro-cap stocks tend to be riskier than small-, mid-, and large-cap stocks. Smaller companies tend to be riskier. They often have weaker balance sheets, more limited product and service offerings, limited geographic diversification, and less experienced managements than larger companies.

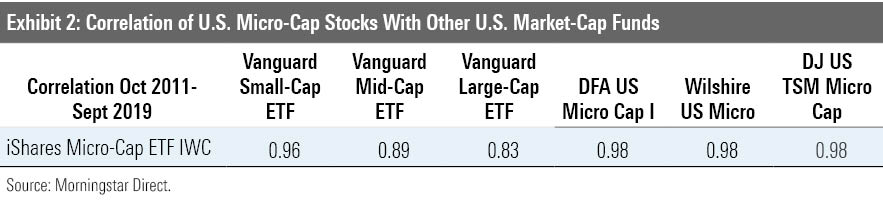

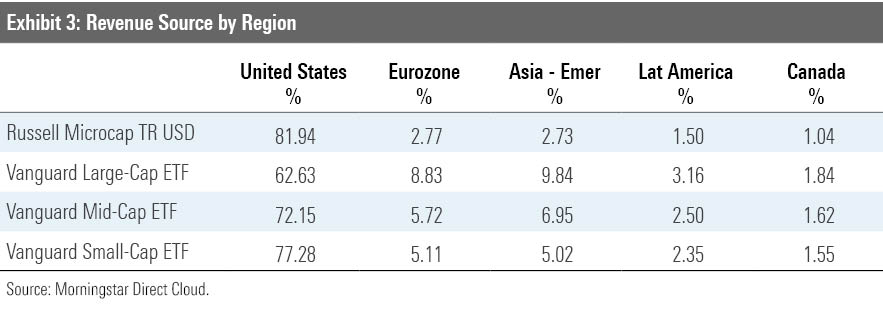

What Do Micro-Caps Offer? Investors have historically allocated only a small fraction of their portfolios to micro-caps. It is difficult to find fault in this. Micro-caps' liquidity and capacity are constrained and risks abound. But an allocation to this market segment may have some prospective benefits in the context of a diversified equity allocation. Most notably, micro-caps have some diversification potential. This is evidenced by the fact that they are not perfectly correlated to other segments of the U.S. market-cap spectrum. Exhibit 2 denotes the correlation of iShares Russell Microcap Index IWC with different U.S. market-cap ranges proxied by Vanguard exchange-traded funds over the 10 years through September 2019. The further up the market-cap ladder we climb, the more the correlation with micro-caps decreases. This makes sense, as micro-cap companies tend to be less diversified than large caps along the dimensions mentioned above. For example, Exhibit 3 shows that micro-cap stocks tend to be far more reliant on domestic revenue sources than larger-cap stocks.

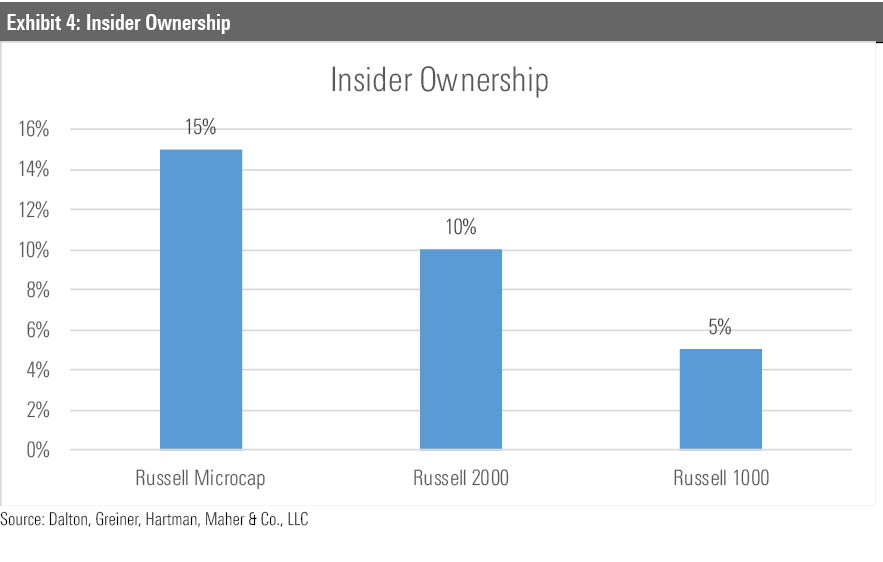

A Proxy for Private Equity? Micro-cap stocks are widely discussed as a more transparent alternative to private equity investments. They tend to be early stage startup firms but provide more liquidity, more transparency (private equity investments lack real-time pricing), and lower fees than private equity investments. Compared with larger companies, they also tend to be more closely held, meaning that key executives may own a significant quantity of company shares.1 This promotes alignment of interests between executives and the investing public. Additionally, micro-caps may be attractive acquisition targets for larger companies seeking an innovative product or entry into a new market.

The Drawbacks of Micro-Caps The primary drawback of investing in micro-caps is their higher volatility compared with large-, mid-, and small-cap stocks. Also, the costs of obtaining information on these companies and monitoring them tends to be higher as they receive less--if any--attention from Wall Street. Higher trading costs are another key drawback. These stocks can go for days, weeks, or months without trading a single share. Investors transacting in these tiny stocks can easily push prices against them--moving them higher when they buy and lower when they sell.

While micro-caps' limited liquidity can be costly, it can also contribute to their long-run returns. Micro-cap investors may earn a liquidity risk premium over the long term. Compared with more liquid stocks, investors in less-liquid stocks expect higher returns as compensation for holding illiquid names--and for incurring the above-mentioned costs. The magnitude of this liquidity premium varies across the micro-cap spectrum. It is more likely to be larger further down the cap spectrum and diminish as you go higher up the cap spectrum. In fact, micro-caps have historically generated much of their outperformance from the liquidity premium.2,3

A Mini Menu There are a limited number of options to invest in this tiny sliver of the market, which is a difficult space for fund managers to navigate in a cost-effective manner.

Indexing micro-caps is particularly difficult. Micro-cap indexes need to implement liquidity screens to create investable proxies for this miniature market segment. These screens can distort indexes’ representativeness of the opportunity set and may diminish the illiquidity premium. This is a no-win proposition and brings into question the efficacy of indexing as an approach to micro-cap indexing. Also, the mechanical buying and selling of these illiquid names in response to index changes tends to have significant implicit costs. All told, indexing micro-caps is generally an unattractive proposition.

The iShares Russell Microcap Index tracks the bottom half of the Russell 2000 along with the next 2,000 smallest stocks. The fund, however, won't own all of those securities, and it follows a modified version of the Russell Microcap that tosses out companies whose stocks fail to maintain sufficient trading volumes, which diminishes the fund’s ability to accurately represent the micro-cap space. This fund falls prey to the above-mentioned drawbacks of indexing within micro-caps and sports an expense ratio of 0.60%.

DFA US Micro Cap DFSCX takes steps to mitigate the above-mentioned drawbacks. Dimensional Fund Advisors utilizes a flexible trading approach to help navigate this illiquid landscape. More specifically, the firm will substitute one stock for another that demonstrates similar characteristics but is less costly to trade. Also, it often acts as a liquidity provider in thinly traded stocks, allowing them to secure more-favorable prices. The fund’s 0.52% expense ratio falls below the small-blend category average. Also, Dimensional uses securities lending revenue to offset expenses. However, DFA’s funds are only available through a select group of fee-only advisors or some 401(k) plans. Although this fund is classified within the small-blend section of the Morningstar Style Box, its ability to offer diversified exposure to the smallest U.S. stocks while keeping trading costs down earns it a Morningstar Analyst Rating of Silver.

References 1. Dalton, Greiner, Hartman, Maher & Co., LLC. 2019. "Microcaps: Value Uncovered." 2. Foundry Partners LLC. 2018. "A case for microcap investing." 3. Ibbotson, Chen, Kim, and Hu. 2013. "Liquidity as an Investment Style."

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/T2LGZCEHBZBJJPPKHO7Y4EEKSM.png)

/d10o6nnig0wrdw.cloudfront.net/04-18-2024/t_34ccafe52c7c46979f1073e515ef92d4_name_file_960x540_1600_v4_.jpg)

/d10o6nnig0wrdw.cloudfront.net/04-09-2024/t_e87d9a06e6904d6f97765a0784117913_name_file_960x540_1600_v4_.jpg)