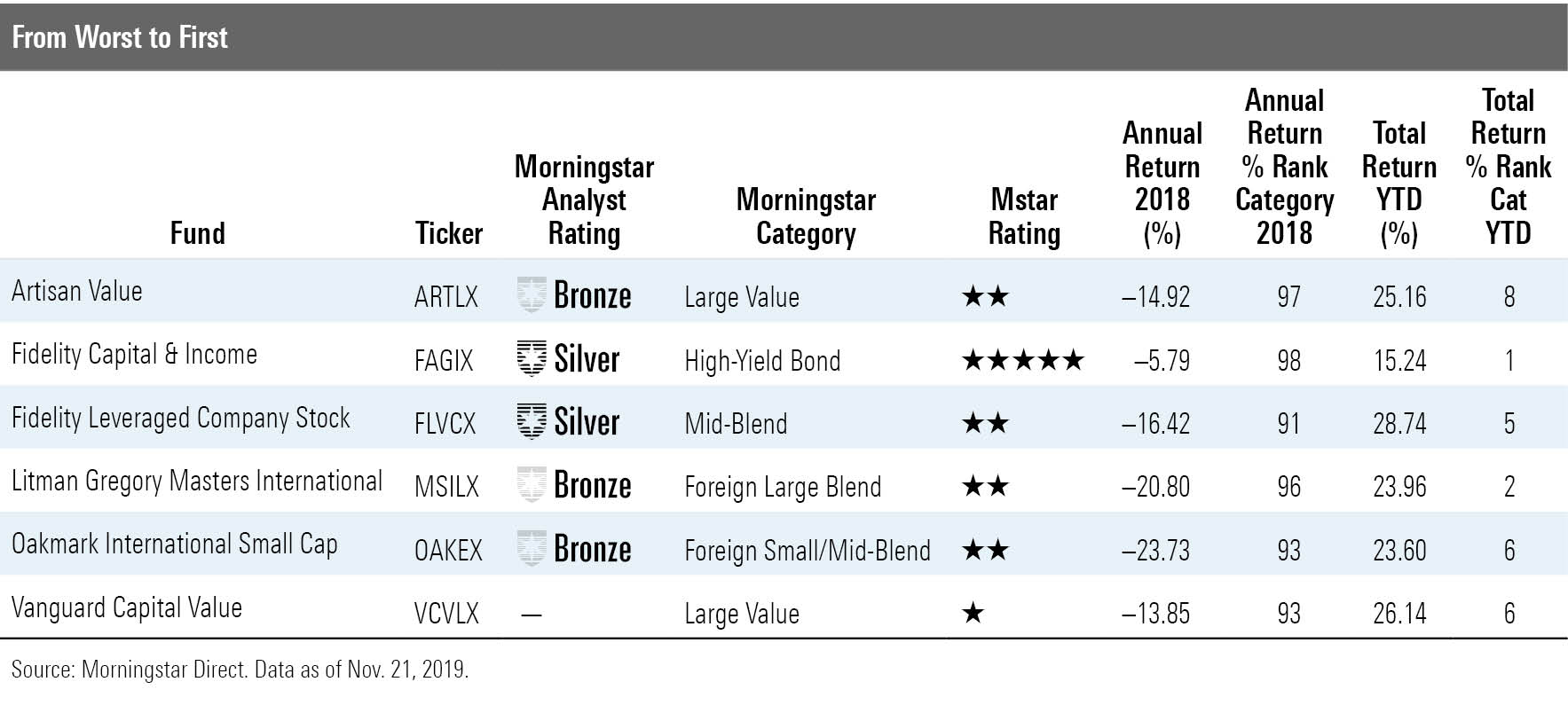

Funds That Went From Worst to First

These six funds have rebounded nicely in 2019.

As investors review their results for the year and plot a course for the future, some will no doubt be tempted to dump the holding that did worst and reallocate that money to the managers who did best. Yet a review of the greatest turnarounds this year suggests that your biggest winner in 2020 might be one of your biggest disappointments from 2019. At a minimum, be sure you aren't selling simply because the fund's style is lagging.

Here's a look at six prominent funds that have gone from worst to first. One thing that links all of them is that they persevered with their strategy rather than pivoting to something else. As Vanguard founder Jack Bogle liked to say in bear markets: Don't just do something, sit there!

It's been a rewarding year for Fidelity Leveraged Company Stock FLVCX. Following a brutal 16.4% loss in 2018, manager Mark Notkin had his fund up 28.74% in 2019 through Nov. 21. That's from the bottom decile to the top decile.

How did he go from worst to first? He stuck to his guns. As the name implies, the strategy here is to have high-yield veteran Notkin pick companies with lots of debt that he knows from the high-yield bond side and thinks will make good equity bets. In some ways, the fund is like a high-yield bond fund, only with greater return potential but much lower yield.

That leverage makes the fund hyper exposed to the economy and each holding's swings in fortune. Shares of Air Canada and meat processor JBS have soared. This is always a feast and famine fund, though, and catching years like 2019 means tolerating years like 2018.

Fidelity Capital & Income FAGIX is yet another Notkin vehicle. In this case, it's a high-yield bond fund that rebounded from a 5.8% loss to a 15.2% gain. As I mentioned, the equity version has higher highs and lower lows, but the drivers are similar. Notkin has about 20% of the fund in many of those same stocks as Fidelity Leveraged Company Stock, and his aggressive style is on display with his bond selection, too.

Needless to say, you probably shouldn't own both funds.

Bronze-rated Artisan Value ARTLX is another fund that has picked itself off the mat. The fund's 14.92% loss in 2018 was one of the worst in value land, but it has gained 25.2% for the year to date in 2019. You might see manager retirements in 2016 and 2018 and wonder if those changes spurred the turnaround. Not necessarily. This is a pretty low-turnover fund, and manager Jim Kieffer has been on board since its 2006 inception.

Like Notkin's funds, this one has a lot of economically sensitive holdings that have surged. Names like Synchrony Financial SYF, AutoNation AN, and NXP Semiconductors NXPI have led the way. Overall, Kieffer is running neck and neck with the Russell 1000 Value Index since the fund's 2006 launch.

Vanguard Capital Value VCVLX has followed 2018's 13.85% loss with a 26.15% gain. In this case, manager change is part of the story. Comanager Peter Higgins stepped down in 2016, leaving Wellington's David Palmer as the sole manager. A potent mix of deep-value stocks plus tech has made the fund a rather extreme performer, which generally hasn't had enough reward to justify the risks.

Palmer has remade the fund into a more traditional value fund with less tech, though the ride remains pretty bumpy. Much of the top of the portfolio are names added since Higgins' departure. Even after this year, though, the 1-star fund will have its work cut out for it.

Bronze-rated Oakmark International Small Cap OAKEX has long been in the shadow of David Herro's more successful fund, Gold-rated Oakmark International OAKIX. That's for good reason; the large-cap fund has consistently trounced its little brother. But this year, the small-cap fund is running about 400 basis points ahead with a 23.6% return following a dismal 23.7% loss in 2018. (Speaking of having your work cut out for you.)

Once again, you have economically sensitive names leading the way. If you've stuck through this fund through thick and thin, you've certainly earned this year's decent return.

Bronze-rated Litman Gregory Masters International MSILX isn't really supposed to be on this list. The portfolio is farmed out to five separate managers at five different firms. Each picks a focused portfolio of favorite names, but the diversity of styles ought to smooth out the extreme results.

But this fund does have a value bent with managers such as Lazard's Mark Little and Herro. Combining their top picks has actually made for a very bumpy ride that is only occasionally rewarding. This year, big weightings in industrials and consumer cyclicals have helped. It's been a while since I could say something like that given the long, dark winter for value.

Note: The previous version of this article incorrectly stated that Fidelity Capital & Income's performance was down 58%. The correct number is 5.8%.

/s3.amazonaws.com/arc-authors/morningstar/fcc1768d-a037-447d-8b7d-b44a20e0fcf2.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZKOY2ZAHLJVJJMCLXHIVFME56M.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/IGTBIPRO7NEEVJCDNBPNUYEKEY.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HDPMMDGUA5CUHI254MRUHYEFWU.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/fcc1768d-a037-447d-8b7d-b44a20e0fcf2.jpg)