How One ESG-Focused Shop Continues to Stand Out

A look at where Parnassus Investments has focused its recent efforts.

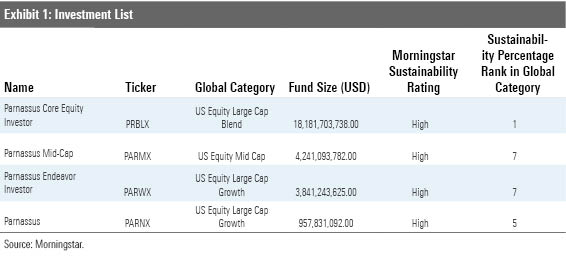

More fund managers are incorporating environmental, social, and governance, or ESG, criteria into investment decisions. A record number of sustainable funds launched in 2018, while many existing funds added sustainability or ESG criteria to their prospectuses, according to Morningstar's Sustainable Funds U.S. Landscape Report. With 35 years of history and $28.5 billion in assets under management, Parnassus is the largest and one of the oldest sustainability-focused U.S. fund managers. As socially responsible investing has become more prevalent, pioneers and major players in the field such as Parnassus have evolved. Looking at Parnassus' recent initiatives is a good way to gauge where socially responsible investing trends may be heading next. Fossil Fuel Divestment Parnassus has long filtered out firms that derive significant revenue from alcohol, tobacco, weapons, nuclear power, or gambling, as many socially responsible funds do. In September 2019, the firm also started shunning fossil fuel-companies to reflect the consensus that they contribute to global warming and its own managers' and analysts' concerns that many fossil fuel firms will become less relevant as economy shifts to low-carbon alternatives.

The decision didn’t actually change the portfolios much. Parnassus PARNX and Parnassus Endeavor PARWX have been fossil-fuel-free since 2015, while Parnassus Core Equity PRBLX and Parnassus Mid Cap PARMX typically have had light fossil fuel stakes and sold what little they had by May 2019. It is too soon to tell whether this move will add to or detract from returns, or if fossil fuel firms are really doomed to irrelevance, but Parnassus’ decision does differentiate it from other ESG strategies. According to Morningstar’s data, 62 funds in the large-blend Morningstar Category incorporate ESG criteria in processes, but just 10 have committed to avoiding fossil-fuel stocks; three are Parnassus funds.

Engagement and Reporting Parnassus stands out in other ways. The firm's ESG analysis extends beyond these exclusionary screens. It emphasizes positive ESG criteria in its security selection and it encourages companies it owns to improve in ESG areas. There are just 11 large-blend funds, including three Parnassus funds, that use shareholder engagement, including raising resolutions, actively voting shareholder proxies, and direct company engagement, to pursue ESG goals with portfolio companies, According to Morningstar's data.

More recently, the firm has tried to measure and disclose the impact of its engagements and of its responsible investments. The firm’s first ESG stewardship reports in 2019 compared the holdings’ sustainable revenues to those of appropriate indexes. The reports also reported that conversations with executives at Mondelez International MDLZ, a large holding in Parnassus Core Equity and Parnassus, helped press the snack food company to commit to switch to all-recyclable packing by 2025. Talks with CVS Health CVS and Sysco SYY also led to progress on ESG issues. The reports also shared the firm’s shareholder proxy votes on ESG proposals, such as linking executive compensation to sustainability goals and addressing gender pay equity.

These recent initiatives demonstrate the firm’s continued commitment to socially responsible investing and should help it stand out among the growing number of strategies trying to capitalize on demand for ESG investments. Indeed, it raises the bar for ESG-focused managers.

/s3.amazonaws.com/arc-authors/morningstar/08cbdaf4-9b79-4c95-ba7d-22ade66dc6fc.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZKOY2ZAHLJVJJMCLXHIVFME56M.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/IGTBIPRO7NEEVJCDNBPNUYEKEY.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HDPMMDGUA5CUHI254MRUHYEFWU.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/08cbdaf4-9b79-4c95-ba7d-22ade66dc6fc.jpg)