How Have the Largest Funds Performed?

Pretty well, all things considered.

Buying the Leaders In most industries, buying the leaders is a sound strategy. The best-selling automobile is well-made; the biggest wireless network is a reliable choice; and the top tourist destination is good fun. Maybe the same logic applies to mutual funds. Maybe investors can improve their odds by buying the very largest funds--which, presumably, have earned that status through superior results.

There will be rebuttals, chief among them that giant funds' happiest days are behind them. To the extent that managerial skill created their strong results, rather than merely fortune, that ability has been neutralized by their great bulk. Today's leaders will not be the next generation's winners. Invest instead in their smaller, nimbler competitors.

We can argue back and forth, or we can look at the numbers. That's an easy call: Run the test. Thus, I identified November 2009's largest mutual funds, then retrieved their subsequent performance. The test is fair. The current decade has been long bull market, while the previous one was notably rocky, containing both the 2000-02 technology stock crash and the 2008 financial crisis. Succeeding through both time periods suggests that a fund may possess ongoing strengths.

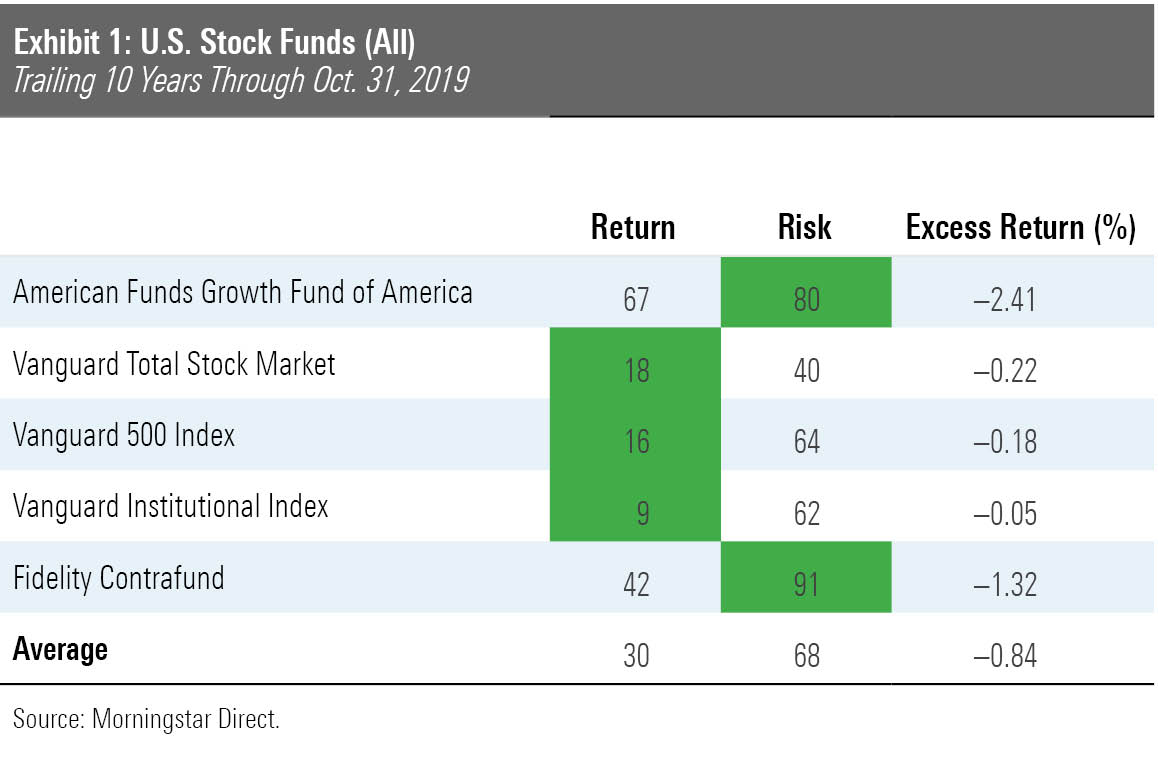

The tables that follow provide the 10-year rankings, within their respective investment categories, for the five leading funds from four broad investment groups: 1) diversified U.S. equity, 2) international equity, 3) taxable bond, and 4) allocation. In addition, the tables show each fund's excess (or shortfall) return, when compared with the index that Morningstar assigns to its category.

Before proceeding, a word of warning. Under Morningstar's percentile system, 1 signifies the highest score, which means that it's the best score for return but the worst for risk. This often confuses me, and it may catch you off-guard as well. Consequently, I have color-coded the category rankings for our mutual benefit. Results that place in the top quintile are shaded green, while those in the bottom quintile appear in red.

Domestic Equities

The bad news for the biggest U.S. stock funds was that none outgained their category indexes. The good news was that those category indexes were the among world's best performers for the decade, for any asset class, so the funds recorded excellent absolute returns. In addition, half of their 10 percentile scores were green, while none were red.

That's cheating, you may object. Three of the five are index funds. However, this study does not test only the largest active funds. It evaluates instead the largest overall funds, regardless of how they are run. The hypothesis is that investors are collectively wise. That wisdom, presumably, extends to knowing when to index, and when to use actively managed funds.

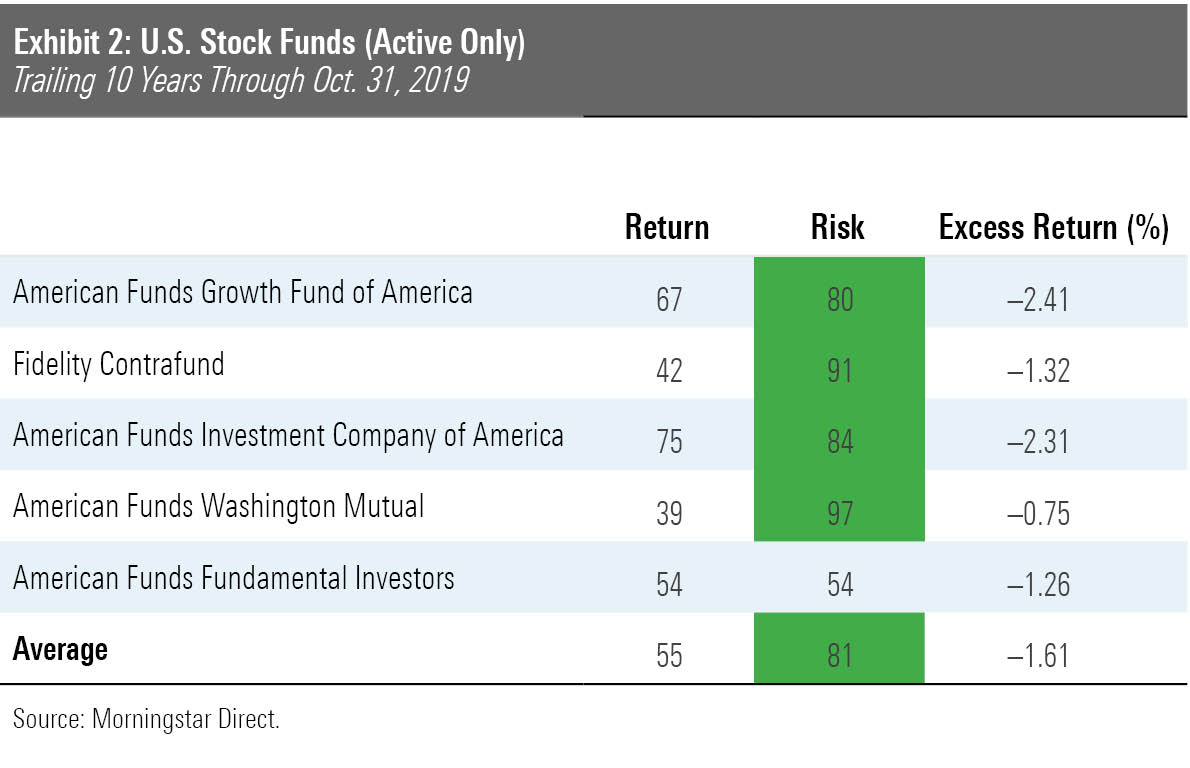

Nonetheless, for the sake of argument (and because my spirit is generous), I will provide the active-only version:

When the index funds are scrubbed, the return percentiles drop. None of the five active funds posted particularly strong relative returns. Conversely, the risk scores improve, so that even the average lands in the top quintile. The academics would call this a good showing. Those who believe that "you can't spend risk," and that the active funds should be penalized for the opportunity cost of not taking full advantage of a glorious bull market, would disagree.

Looking Overseas

Onward to international-stock funds:

Once again, a modestly positive result, although in different form than with the U.S. equities. Four of the five international-stock funds beat their benchmarks, two of them handsomely. Their risks were also moderate, save for outlier Dodge & Cox International Stock DODFX. But their relative-to-category percentiles were unimpressive. In summary: Domestic-stock funds outshone their competitors (on a risk/return basis) but not the indexes, while the reverse held for international-stock funds.

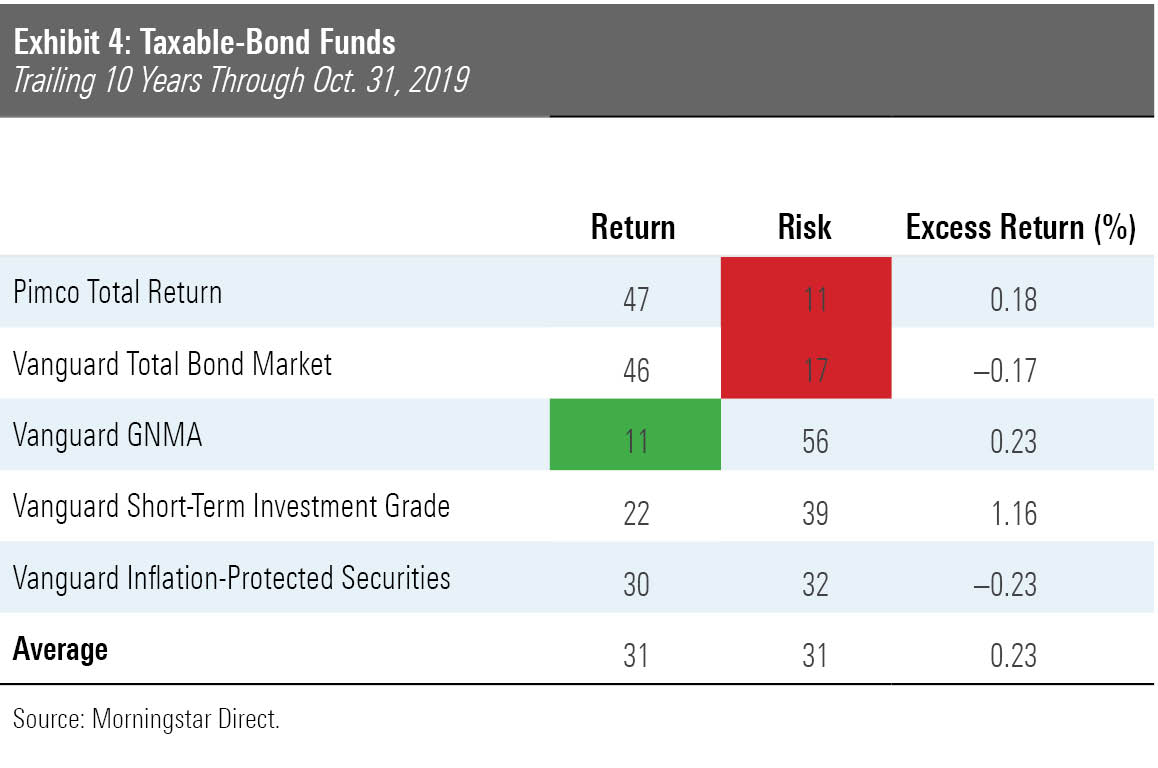

Considering Bonds

Next come taxable-bond funds:

A third-straight qualified success. All five funds outgained the category's average return, with three of the five also besting their benchmarks. True, Pimco Total Return's PTTRX ride was temporarily bumpy--as well as troubling, given 2014's ongoing headlines--but in the grand scheme of things, the fund was barely more volatile than Vanguard's bond-index fund. As problems go, Pimco Total Return's were very tame.

Once again, it may be protested that this list doesn't truly assess investors' ability to select active managers, since the three nonindex Vanguard funds are so carefully run as to be quasi-indexes, in practice. Once again, that's fine. Entering the decade, bond-fund buyers favored conservative management and extremely low costs over grand promises accompanied by higher costs. You can't say that they were wrong.

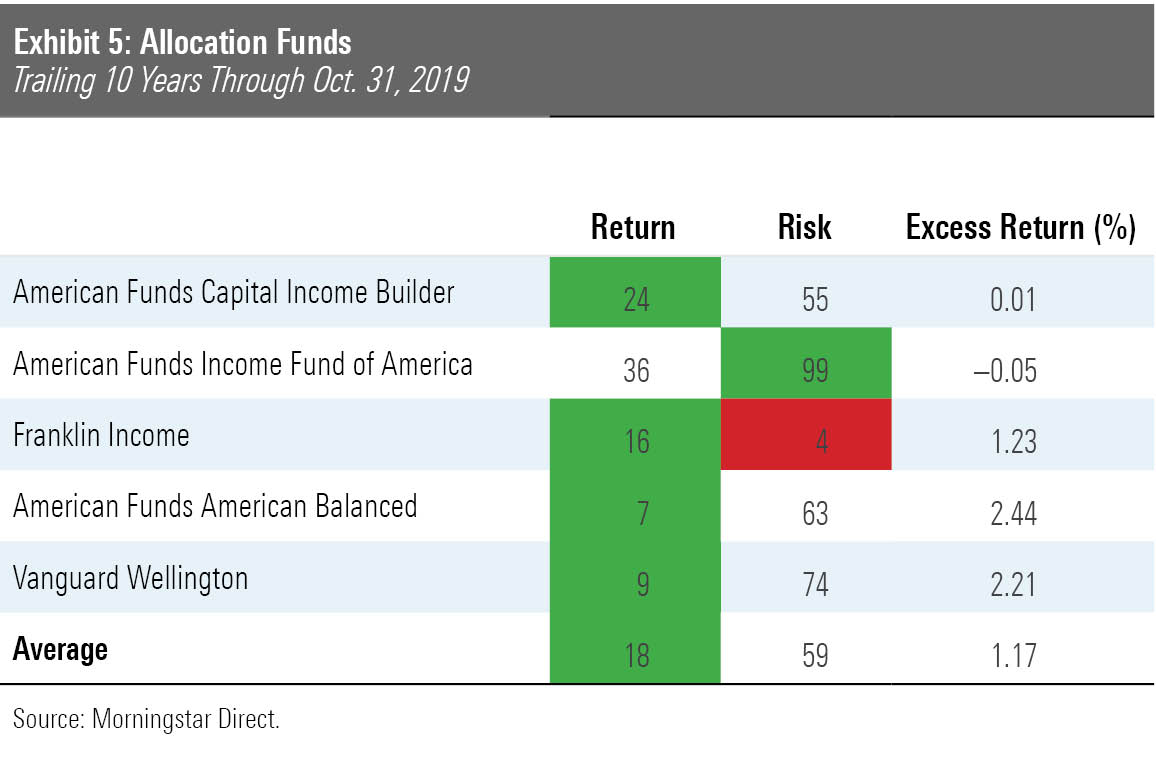

Allocation's Triumph

Finally, allocation funds:

This time, the victory need not be qualified. The big allocation funds performed remarkably well. Indeed, I doubt that any researcher could have assembled a better list, no matter how exhaustive her process. The funds' strong excess returns, perhaps, may be discarded, because finding the correct benchmark for allocation funds is a perilous task. The comparisons may not be apt. But the funds' performances relative to others in their categories cannot be overlooked.

Allocation funds' achievement extended further than the top-five list. Of the next biggest 10 allocation funds, as of November 2019, five scored top-decile returns. I can't explain why they fared better than did the largest U.S. stock, international-stock, and taxable-bond funds. File it under "just one of those things," pending further review.

Summary Buying the biggest funds wasn't a fail-safe tactic, but it certainly avoided trouble. Of this column's 20 funds, all 20 survived the decade. That might not sound like much of an accomplishment, but 35% of all funds expired during the time period. Moreover, none of the 20 funds landed in their category's bottom quintile for returns. The single-worst returns, relatively speaking, came from American Funds Investment Company of America AIVSX, which placed in the 75th percentile. And even there, its risk/return profile was positive, since the fund's risk percentile was below its return ranking.

Survivorship, of course, comes with size. Barring a catastrophe, it takes longer than 10 years to persuade a fund company to fold what once was among the industry's larger funds. To an extent, performance does too, because the big funds almost always have below-average expenses--partially because of economies of scale, and partially because their low costs helped to cause their popularity.

It would be interesting to compare the results for the very cheapest funds from 10 years ago to this column's industry leaders. Perhaps a topic for another day.

John Rekenthaler has been researching the fund industry since 1988. He is now a columnist for Morningstar.com and a member of Morningstar's investment research department. John is quick to point out that while Morningstar typically agrees with the views of the Rekenthaler Report, his views are his own.

The opinions expressed here are the author’s. Morningstar values diversity of thought and publishes a broad range of viewpoints.

/s3.amazonaws.com/arc-authors/morningstar/1aafbfcc-e9cb-40cc-afaa-43cada43a932.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZKOY2ZAHLJVJJMCLXHIVFME56M.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/IGTBIPRO7NEEVJCDNBPNUYEKEY.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HDPMMDGUA5CUHI254MRUHYEFWU.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/1aafbfcc-e9cb-40cc-afaa-43cada43a932.jpg)