Practice Wise: How Advisors Can Compete Against Robos on Tax Efficiency

Sheryl Rowling discusses the industry and robo-advisors.

This article originally appeared in Morningstar Direct Cloud and Morningstar Office Cloud.

Robo-advisors have emerged as real competitors to traditional financial advisors. The attraction for investors can be boiled down a handful of factors:

• They want to pay less for investment services.

• They like the idea of doing everything on their own time.

• They want the tax benefits offered by robos.

Many years ago, I was taught that a business can compete in three areas: price, service, and quality--and you can only do two out of three.

In my opinion, advisors should not even attempt to compete on price. Robos aren't playing on a level playing field, as they are subsidized in one way or another. Many are not required to break even, and they are spun off by parent companies with many business lines or funded by venture capitalist dollars. Additionally, robos are regulated in ways that don't equate to those required of Registered Investment Advisors.

When it comes to service, the robo-versus-advisor picture is becoming increasingly muddled. At first, robos lacked the human touch, and one could only engage the company through a financially rudimentary online experience. Advisors were people you met face-to-face in their physical office. The two couldn't have been any more different. As technology costs have decreased, today's advisors are rapidly adopting new technologies to enhance their client relationships. No longer can an advisor get by on the old customer-relationship management. Tech-savvy firms now incorporate digital onboarding, web portals, website chat bots, online scheduling tools, and video conferencing into their client experience. Robo-advisors have also become more human than ever, offering low-cost, unlimited access to real, certified professional with whom you can speak on the phone.

So, advisors should not compete on price, and they are currently competing on that perfect balance between digital experience and human element. The sophistication of tax efficiency is a different story. Here is where we can save clients real money over robos while addressing each client's personal goals--but, only if advisors are willing to roll up their sleeves. Let's start by looking at the tax-efficient strategies that offer several top robos:

1) Schwab Intelligent Portfolios: Daily tax-loss harvesting if an investor signs up for it with a $50,000 minimum.

2) Wealthfront: Daily tax-loss harvesting.

3) Betterment: Daily tax-loss harvesting, location optimization, high-cost lots sold first, ability to donate appreciated shares directly through platform.

Looking only at tax efficiency techniques, all three of these robos offer daily tax-loss harvesting. This is good, but advisors can do it better.

Daily tax-loss harvesting without minimum savings (as determined appropriate for a client based on percentage and dollar amount) can result in a lot of small losses without the ability to take larger losses if there was a transaction within 30 days. It can also cause excess short-term gains. By frequently purchasing new shares, rebalancing gains will tend to be short-term. It is not certain that tax losses will exceed gains--and because of this high possibility, the client might pay higher capital gains taxes in exchange for small tax losses. Finally, without managing all of an investor's accounts, the potential for (unexpected) wash sales increases.

Because Betterment can have electronic access to outside account information (with permission from the investor), it can eliminate the possibility of unexpected wash sales. That's good, but it still doesn't overcome the issue of too-frequent harvesting transactions.

Betterment offers much more in tax-efficient strategies. In fact, I would say that not many advisors do more than Betterment in this area. However, utilizing robust rebalancing tools, like Morningstar Total Rebalance Expert, can outsave Betterment.

Betterment's additional tax offerings include location optimization, high-cost lots sold first, and the ability to donate appreciated shares directly through the platform. With location optimization, Betterment can place investments in different account types (traditional, Roth, and taxable accounts) based on tax treatment. Municipal bonds will be held in the taxable account; taxable bonds will be held in traditional IRAs, while low-tax (appreciating) investments will be held in taxable accounts and high-return investments will be held in Roth IRAs. This is extremely beneficial to end clients because it can result in "permanent" tax savings over merely holding investments proportionately in each account.

Advisors can be better positioned to save clients more with location optimization. For example, an advisor can assess the client's tax situation to determine if municipal bonds are appropriate at all. Additionally, the advisor is able to customize investment classifications for what type of assets to hold in each account. Morningstar offers an ordered list of high-to-low tax efficiency and high-to-low return expectations, organized overall ratings for each asset type of where it should be bought and where it should be sold, as well as priorities. This type of analysis can provide greater tax savings than what Betterment offers.

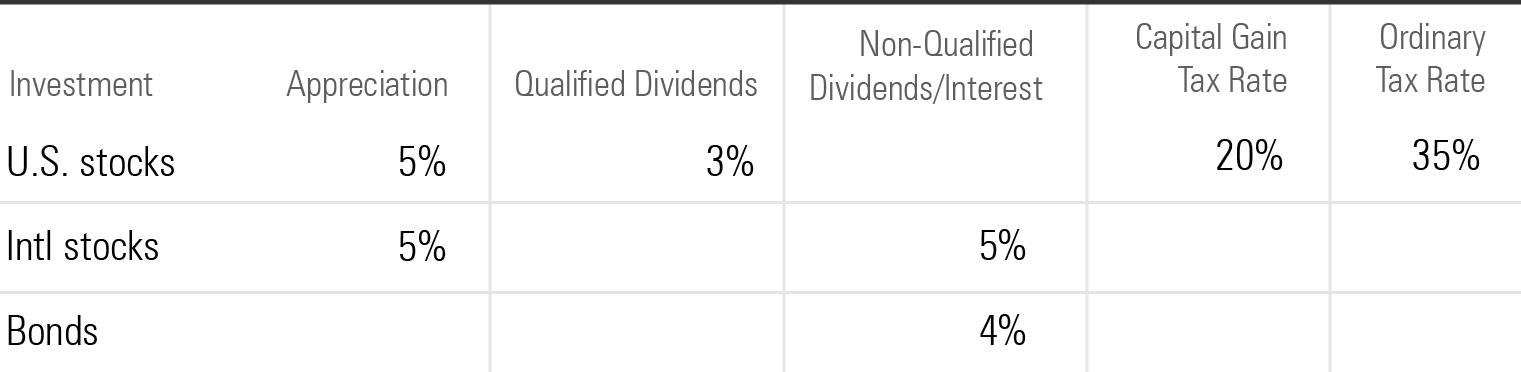

For example, let's say an investor has an allocation strategy of 40% U.S. stocks, 20% international and emerging-markets stocks, and 40% bonds. The investment details are:

Source: Morningstar.

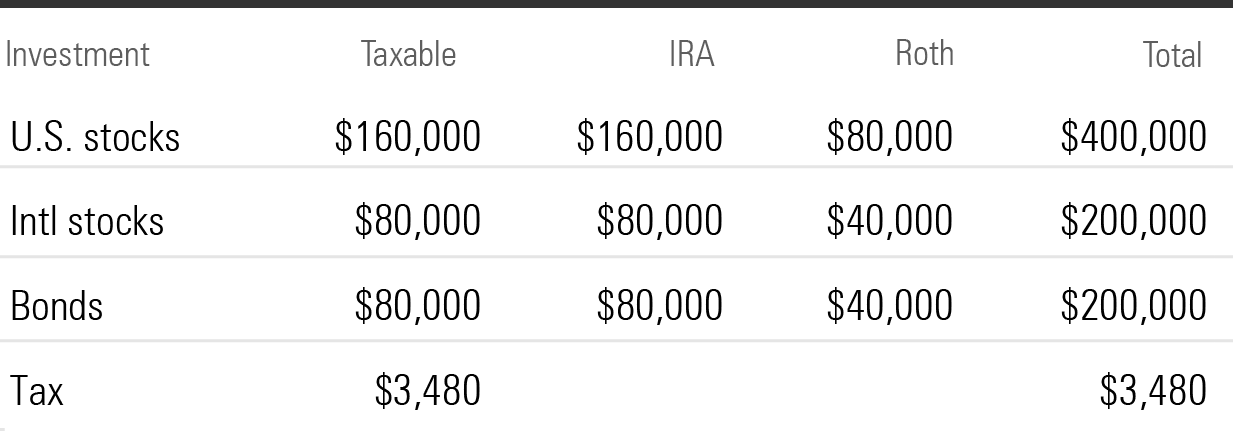

In this example, with a $1 million portfolio consisting of $400,000 in U.S. stocks, $200,000 in international stocks, and $400,000 in bonds, held proportionately in a taxable account of $400,000, an IRA of $400,000, and a Roth IRA of $200,000, taxes would be $3,480, as follows.

Source: Morningstar.

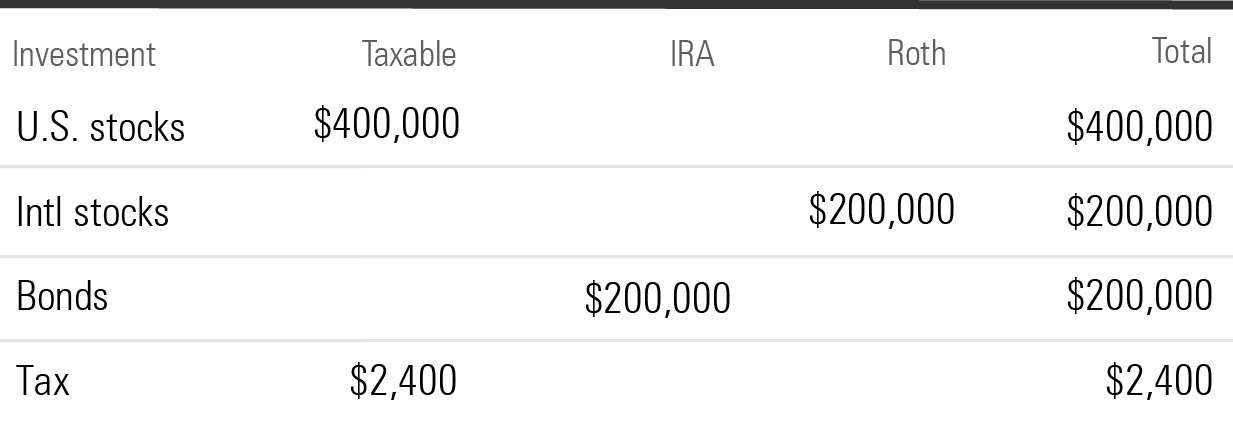

With location optimization, taxes would be $2,400, as follows.

Source: Morningstar.

Note that current tax reduction is in addition to long-term savings by putting the highest return investments in an account that will never be taxes; putting the high, ordinary income-generating investments in the IRA (to defer ordinary tax on future ordinary tax); and putting the appreciating investments in the taxable account (resulting in eventual capital gains tax or full step-up at death).

Betterment sells high-cost lots when making trades. But we human advisors can do better by also considering short term versus long term. For example, if an investor needs to sell 5,000 shares of an investment worth $5,000, would it be better to recognize a short-term gain of $1,800 or a long-term gain of $2,200? If the tax rates are 35% ordinary and 20% capital gains, selling the higher-cost lots will net $4,370, while selling the long-term lots will net $4,560. Choosing high cost does not necessarily mean lower tax.

Finally, Betterment's ability to identify appreciated shares and make contributions directly to charity is also easy for an advisor to do.

In summary, based on tax efficiency, Betterment seems to do the best job of the robos discussed above. However, for clients who enjoy personalized service, human interaction, and more-customized tax strategies, an advisor not only can compete, but still has the edge.

The opinions expressed here are the author’s. Morningstar values diversity of thought and publishes a broad range of viewpoints.

/s3.amazonaws.com/arc-authors/morningstar/256953a9-ba08-4920-baa8-ccdc229ed9f9.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/JNGGL2QVKFA43PRVR44O6RYGEM.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/IFAOVZCBUJCJHLXW37DPSNOCHM.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/GQNJPRNPINBIJGIQBSKECS3VNQ.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/256953a9-ba08-4920-baa8-ccdc229ed9f9.jpg)