Enhancement to Sustainability Rating Emphasizes Material ESG Risk

The globe rating now reflects company ESG risks both within and across industry groups.

Since we launched the Morningstar Sustainability Rating in March 2016, sustainable investing has continued to grow. One study reported that assets under management across all sustainable investing strategies (institutional and retail) grew 38% to nearly $9 trillion from the start of 2016 to just the start of 2018, nearly two years ago. Sustainable funds in the United States have been attracting record inflows. They set calendar-year records in 2017 and 2018, and through September 2019, they have attracted nearly 3 times more than in all of 2018.

More asset managers have added the consideration of environmental, social, and corporate governance criteria to their investment process. More than 2,300 have signed the Principles for Responsible Investment. In addition, nearly 300 funds available to U.S. investors have recently noted the addition of ESG criteria to their process in their prospectus. When we launched the Sustainability Rating, about 165 funds available to U.S. investors had a sustainable investing mandate. Today, that number is 291 and counting.

But there remains a huge gap between interest in sustainable investing and actual investments. Morgan Stanley recently reported that an astounding 85% of investors it surveyed said they are interested in sustainable investing, an increase from an already high 71% who indicated interest in a similar survey from 2015. While most of that 71% in 2015 said they were only "somewhat" interested in sustainable investing, most respondents in 2019 said they are "very" interested.

For these high levels of interest to result in more investments, investors, consultants, and financial advisors need research tools to help them analyze sustainability in portfolios. The Morningstar Sustainability Rating was created to give investors such a tool. The rating uses company ESG assessments from Sustainalytics to evaluate portfolios and then to compare portfolios with their peers. Ultimately, a fund is assigned from 1 to 5 globes based on how well its Portfolio Sustainability Scores over the past 12 months stack up relative to peers.

A Focus on Materiality Over the past three years, ESG analysis of companies has taken an important step forward, becoming increasingly centered around the concept of materiality. An ESG issue is considered to be material if it can be reasonably expected to have a financial impact on the company. Not all ESG issues are material across every industry or company. One important study found that firms with better performance on material ESG issues outperformed those that had worse performance on material ESG issues and also outperformed those that focused on ESG issues without regard to their materiality.

A greater focus on materiality also highlights the fact that industries may vary in their overall exposure to material ESG issues. To this point, the Morningstar Sustainability Rating has been based on industry-relative company evaluations that assessed general preparedness to address ESG issues. The rating was able to identify “leaders” and “laggards” within industries but not to compare ESG risks across industries, even though some industries clearly face more ESG risks than others.

Beginning this month, our Morningstar Sustainability Rating incorporates this concept of materiality by adopting a new company-level ESG risk framework developed by Sustainalytics. As a result, the rating now provides greater insight into how well companies in a portfolio are managing the material ESG issues they face both relative to their industries and across industries.

How It Works Our enhanced rating continues to use company ESG assessments from Sustainalytics to evaluate portfolios and then to compare portfolios with their peers. But the rating now incorporates Sustainalytics' company-level ESG Risk Rating introduced in 2018. Sustainalytics defines material ESG risks as those that could have a financial impact on a company if they are not managed appropriately.

Companies in different industries have different sets of material ESG risks, and those risks have different weightings. In the integrated oil and gas industry, for example, greenhouse-gas emissions, other emissions, effluents and waste from operations, management of human capital, community relations, and bribery and corruption issues have been identified by Sustainalytics as the key material ESG risks. By contrast, in the enterprise and infrastructure software industry, the most important material ESG risks include data privacy and security issues, management of human capital, and corporate governance.

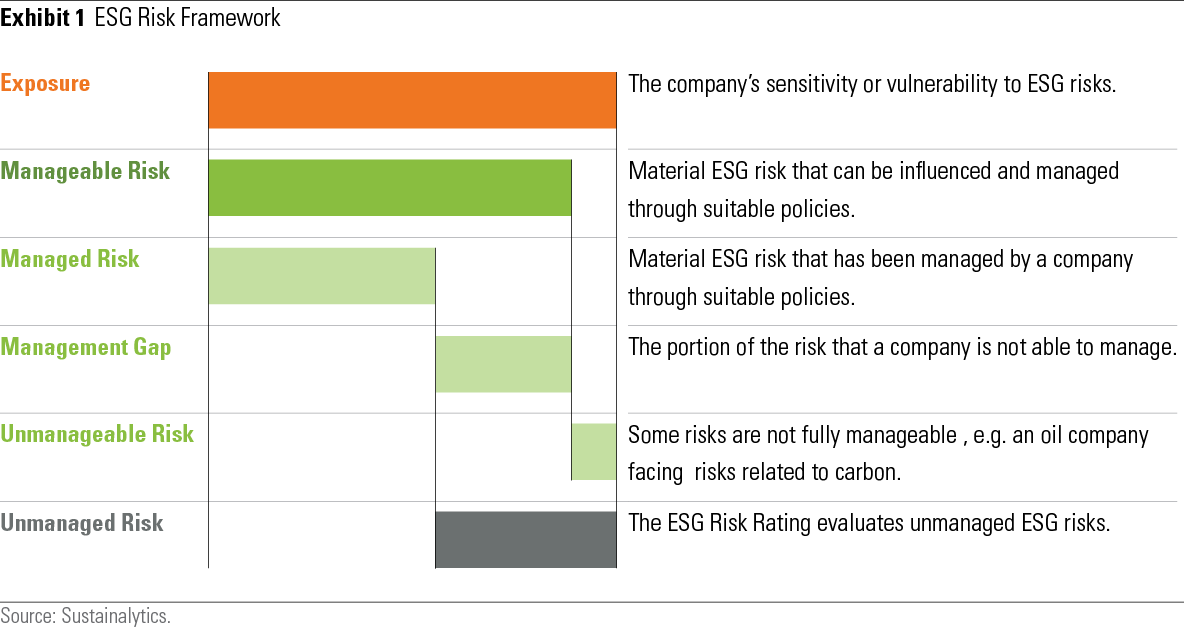

Evaluating a company’s ESG risk begins by assessing its overall exposure to material ESG risks in both its operations and its products and services. Next comes an evaluation of how much of a company’s ESG risk is mitigated through specific actions taken by the company. Not all ESG risk can be managed. In the integrated oil and gas industry, for example, companies cannot manage away all of their exposure to carbon risk. But other ESG risks can be, and often are, reduced through initiatives and processes that a company has put in place. A company’s ESG Risk Rating is the amount of ESG risk that remains after taking into account its ESG management activities.

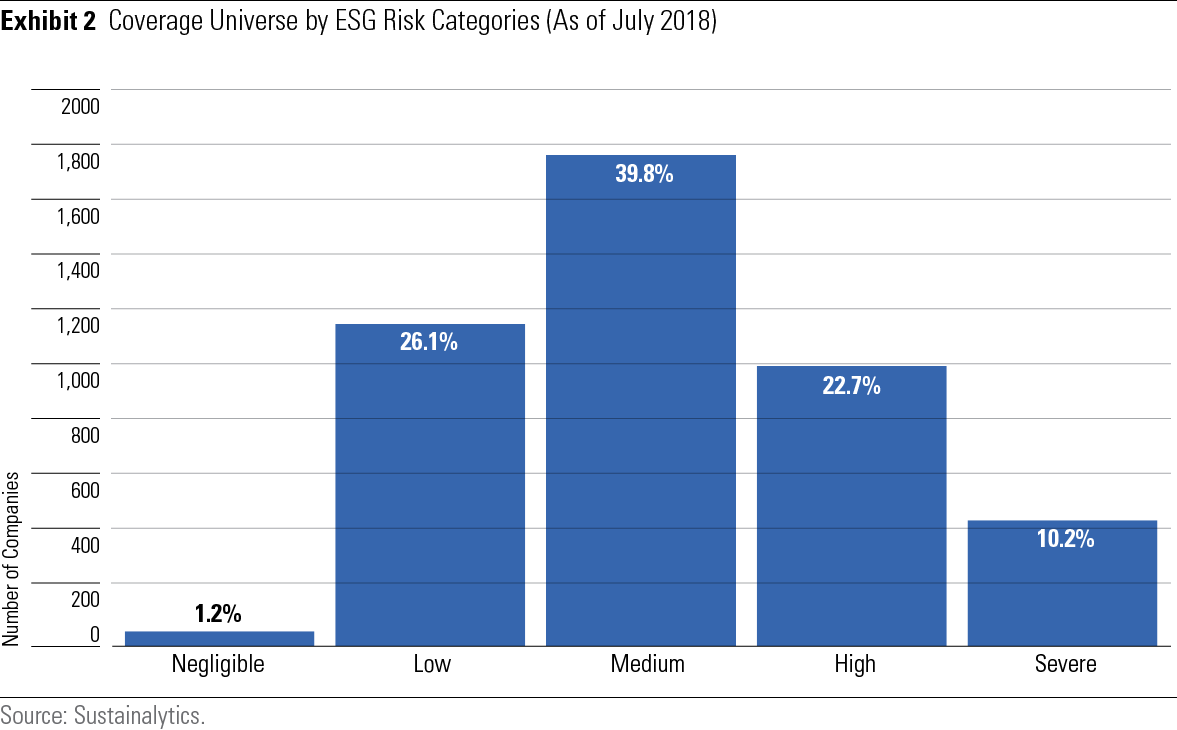

Company ESG Risk Ratings are rendered on a scale from Low to High, with lower scores indicating lower ESG risk. A score of zero would indicate that a company has no unmanaged ESG risk, while a score of 40 or higher is an indicator of Severe ESG Risk, which remains even after taking into consideration the company’s management efforts. The distribution of company ESG Risk Ratings can be seen in Exhibit 2.

To arrive at the Morningstar Sustainability Rating for a fund, we first calculate an asset-weighted roll-up of the ESG Risk Rating of the holdings in each portfolio from the most recent 12 months. To receive a score, at least two thirds of a portfolio’s assets must have a company ESG Risk Rating. (The percentage covered is rescaled to 100%.) Next, portfolio scores are aggregated using an exponentially weighted average that weights recent portfolios more heavily than older ones. The resulting overall fund score is rendered on the same scale as company ESG Risk Ratings: Lower scores are better, indicating lower portfolio ESG risk.

Based on these scores, portfolios are compared with their Morningstar Global Category peers. A portfolio is then awarded 1 to 5 globes based on how its score ranks within its category, as seen in Exhibit 3.

Materiality, Cross-Industry Comparisons, Simpler and More Transparent The enhanced version of the Morningstar Sustainability Rating improves on the original not only because of its focus on material ESG risk but also because it allows for comparability across industries and results in a simpler and more transparent calculation.

First, as we’ve seen, the rating now has a clear focus on material ESG risk. The original version was more limited in that it was based on a more general assessment of how well-prepared a company was to handle a range of ESG issues relative to its industry peers. To a large degree, it was focused only on what is called “managed risk” in Exhibit 1 without regard to how much ESG risk exposure a company faced in the first place. And while there was greater emphasis within industry groups of more-relevant ESG issues in Sustainalytics' older ratings framework, there was not an explicit materiality lens applied.

Second, the company ESG Risk Rating allows for comparability across industries. The older company ratings on which the original version of the Sustainability Rating was based reflected within-industry differences only, not differences in ESG risk across industries.

For example, in the older company ratings, Royal Dutch Shell and Microsoft both scored 75 out of 100 within their industry groups, ranking in the best quartile among their peers. (Higher scores were better in this version.) These were good scores, indicating the two companies were among the best-in-class ESG performers in their respective peer groups. At the portfolio level, assuming their position size was the same, they would have had the same impact on the Portfolio Sustainability Score.

In the new company ESG Risk Rating, by contrast, Royal Dutch Shell’s score is 34, an indicator of High ESG Risk, while Microsoft’s score is 13.8, an indicator of Low ESG Risk. While both companies do reasonably well managing the material ESG risks they face relative to their peers--one reason why their old scores were similar--Royal Dutch Shell operates in an industry that carries far more ESG risk exposure. As a result, its ESG Risk Rating has a much more negative impact on the Portfolio Sustainability Score compared with Microsoft’s rating.

That said, the new rating remains sensitive to best-in-class comparisons. For example, a portfolio that holds an oil company would be better off with exposure to Royal Dutch Shell, with its ESG Risk Rating of 34, than with exposure to ExxonMobil, which has an ESG Risk Rating of 40.5.

Finally, the enhanced version of the Morningstar Sustainability Rating is easier to calculate and reflects a more direct link between the Portfolio Sustainability Score and the ESG Risk Ratings of the underlying company holdings. The original rating required a more complicated calculation that included a deduction for a company’s involvement in ESG-related controversies. The ESG Risk Rating now more fully incorporates the impact of those situations in the company’s risk management score, so we have eliminated the Controversy deduction. It is now much easier to see the connection between company ESG Risk Ratings and the portfolio’s overall score.

In Sum The Morningstar Sustainability Rating now provides investors with an assessment of ESG risk embedded in a portfolio that is evaluated relative to peers. It focuses on materiality and reflects both within-industry and across-industry assessments of company-level ESG risk.

The rating provides investors with a way to evaluate any portfolio on ESG risk. Investors can use it to evaluate how much ESG risk is in the funds they own and to identify funds with lower levels of ESG risk. While those wanting to invest in, or evaluate, intentional sustainable investment funds should expect those funds to have relatively low ESG risk, the rating should just be a first step in a broader evaluation of those funds. Investors may also want to know how funds with a sustainable investing mandate engage with companies, vote proxies, and, more broadly, seek to provide impact alongside financial return.

Interested in ESG? Check out a curated collection of our latest content on ESG investing.

Jon Hale has been researching the fund industry since 1995. He is Morningstar’s director of ESG research for the Americas and a member of Morningstar's investment research department. While Morningstar typically agrees with the views Jon expresses on ESG matters, they represent his own views.

/s3.amazonaws.com/arc-authors/morningstar/42c1ea94-d6c0-4bf1-a767-7f56026627df.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/NNGJ3G4COBBN5NSKSKMWOVYSMA.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/6BCTH5O2DVGYHBA4UDPCFNXA7M.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/EBTIDAIWWBBUZKXEEGCDYHQFDU.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/42c1ea94-d6c0-4bf1-a767-7f56026627df.jpg)