Revisiting the Case for International

Adding international stocks has some benefits, but it's not a magic bullet.

The case for diversifying an equity portfolio with international stocks seems straightforward enough. For one, the United States isn’t the whole world: U.S.-domiciled stocks made up only about 56% of global market capitalization as of Sept. 30, 2019. In addition, there have also been long stretches of time (such as the 1970s and 1980s) when international stocks have outperformed. Because they’re fundamentally different from equities based in the U.S., non-U.S. stocks shouldn’t perform in tandem with their domestic counterparts. Theoretically, then, diversifying a U.S.-focused portfolio with international stocks should boost risk-adjusted returns over time.

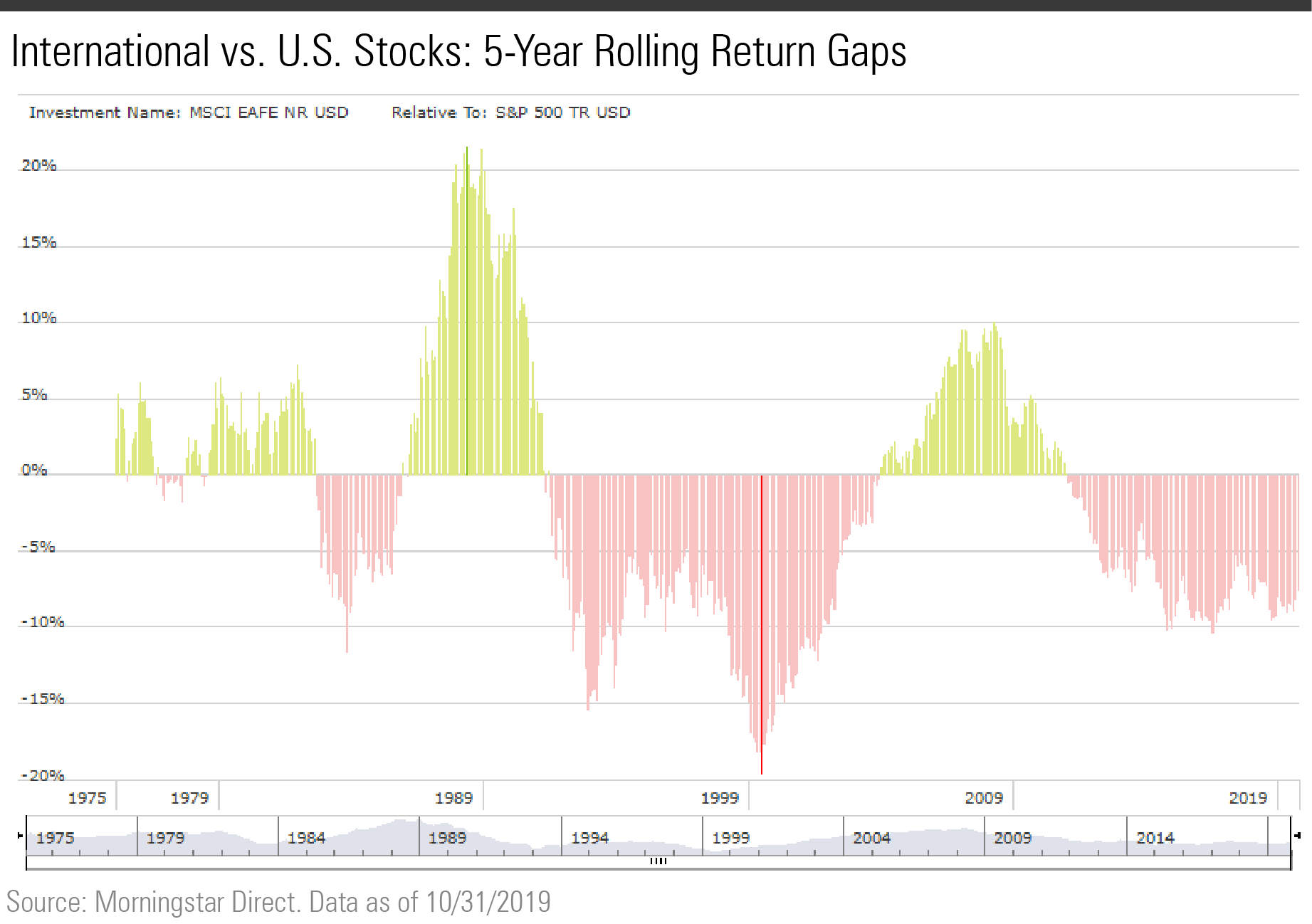

U.S. Versus International Stock Returns Yet the reality is messier, as foreign stocks have lagged their U.S. counterparts. Over the period from 1971 through October 2019, the domestic S&P 500 has posted annualized returns of 10.6% per year, beating out the MSCI EAFE index (in U.S. dollars) by 1.6 percentage points per year, on average. Much of that underperformance stems from the past 10 years, during which the MSCI EAFE index has compounded returns at a paltry 4.3% per year, compared with 10.8% for the S&P 500.

Things don't necessarily look better over longer periods. The index data we have access to goes back only to 1971, but a working paper published by the National Bureau of Economic Research in 1997 reviewed data going back to the 1920s for 39 global markets. After adjusting for inflation, the authors found the U.S. market's 5% real rate of appreciation far outpaced the 1.5% average for other countries. The authors posit that the U.S. is "an exception in a global capital market frequently wracked by financial crisis, political upheaval, expropriation, and war." Whether you agree with this argument for domestic exceptionalism or not, the large return gap over time makes it tough to pound the table for putting large chunks of a portfolio in international stocks.

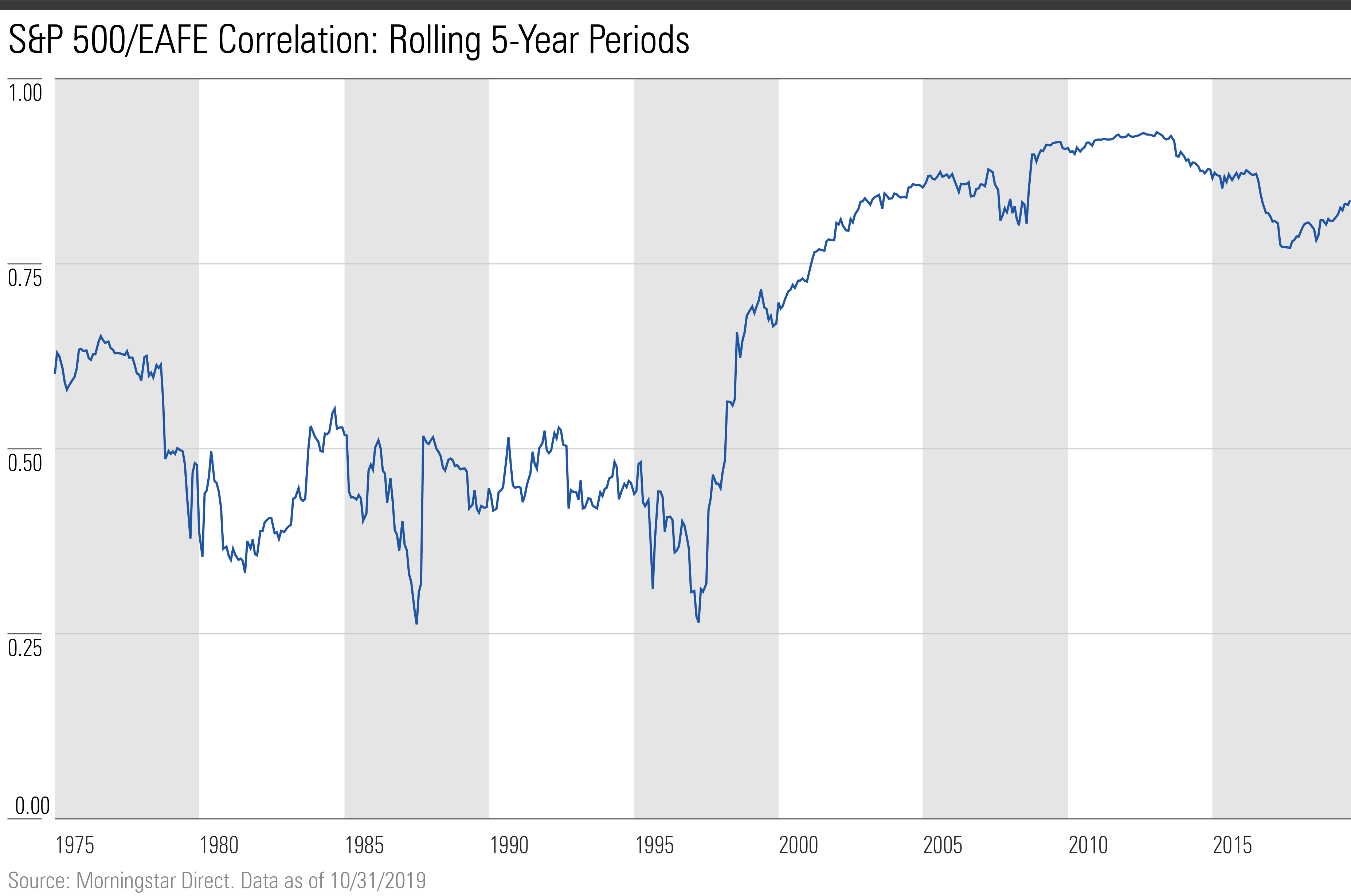

The Case Against International Perhaps most concerning of all, the correlations between the U.S. and global markets have been steadily increasing over time. That means the benefits of diversification--namely, risk reduction at the portfolio level and higher return per unit of risk--have also been eroding. Over the 48-year stretch from 1971 through October 2019, the five-year cross correlation (which we define as the strength and direction of the linear relationship between two variables) between the S&P 500 and EAFE has been as low as 0.26. Since then, it has gradually trended up, peaking at 0.92 in August 2013. For the most recent five-year period, it dipped a tad to 0.83. That's only slightly lower than the S&P 500's five-year correlation with the Russell 2000 Index, a domestic index composed of small-cap stocks.

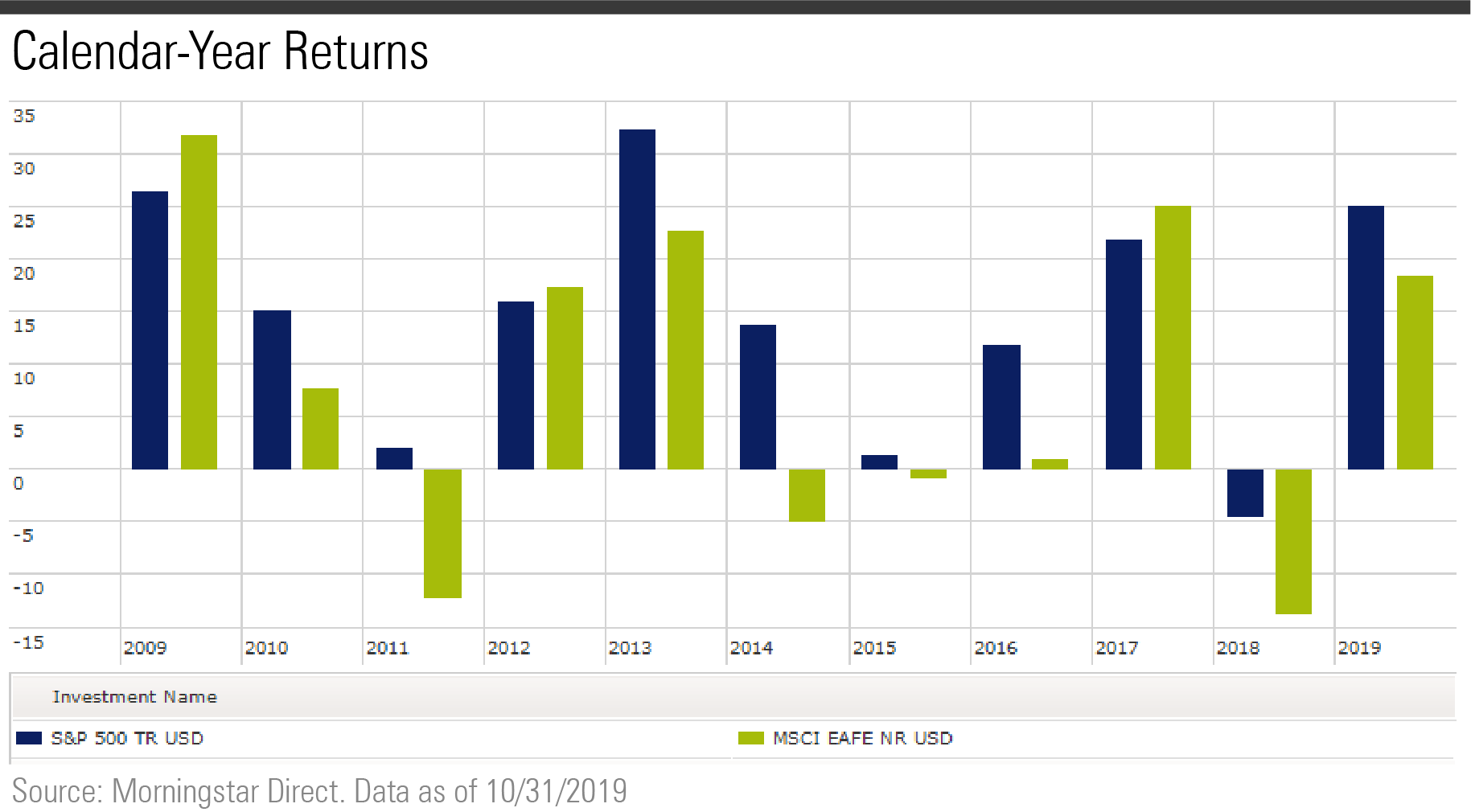

That means that the benefits you’d hope to get from international diversification--the proverbial one asset class zigging when another one zags--just haven’t happened. Instead, international stocks have generally moved in the same direction as large-cap domestic stocks, but more so. When the financial crisis crushed the U.S. market in 2008 (causing it to drop 37%), the EAFE index lost 43%. Similarly, the near bear market in the fourth quarter of 2018 was even worse for international issues. For the full year, U.S. stocks posted a loss of 4.4%, compared with a 13.8% loss on the international side.

Granted, because the correlation between U.S. and international is still below 1.00, diversifying internationally still offers some risk-reduction benefits. But the benefits have been small. Over the full period from 1971 through September 2019, adding a 35% stake in international to a domestic equity portfolio would have reduced the monthly standard deviation to 14.20 from 14.96. Over the past five years, adding international would have reduced the monthly standard deviation versus a domestic-only portfolio to 11.60 from 11.92. Adding international stocks slightly improved risk-adjusted returns over the full period but led to lower returns per unit of risk for the trailing five- and 10-year periods.

If the linkage between the U.S. and other global markets gets looser, we’d see a more compelling risk-reduction benefit from diversification. And if trade wars persist and major countries pursue isolationist policies, it’s conceivable that correlations between the U.S. and other global markets could trend lower. But it seems unlikely that we’d see correlations return to the same low levels as in the past. Capital and information flow across geographic boundaries more easily now than ever before.

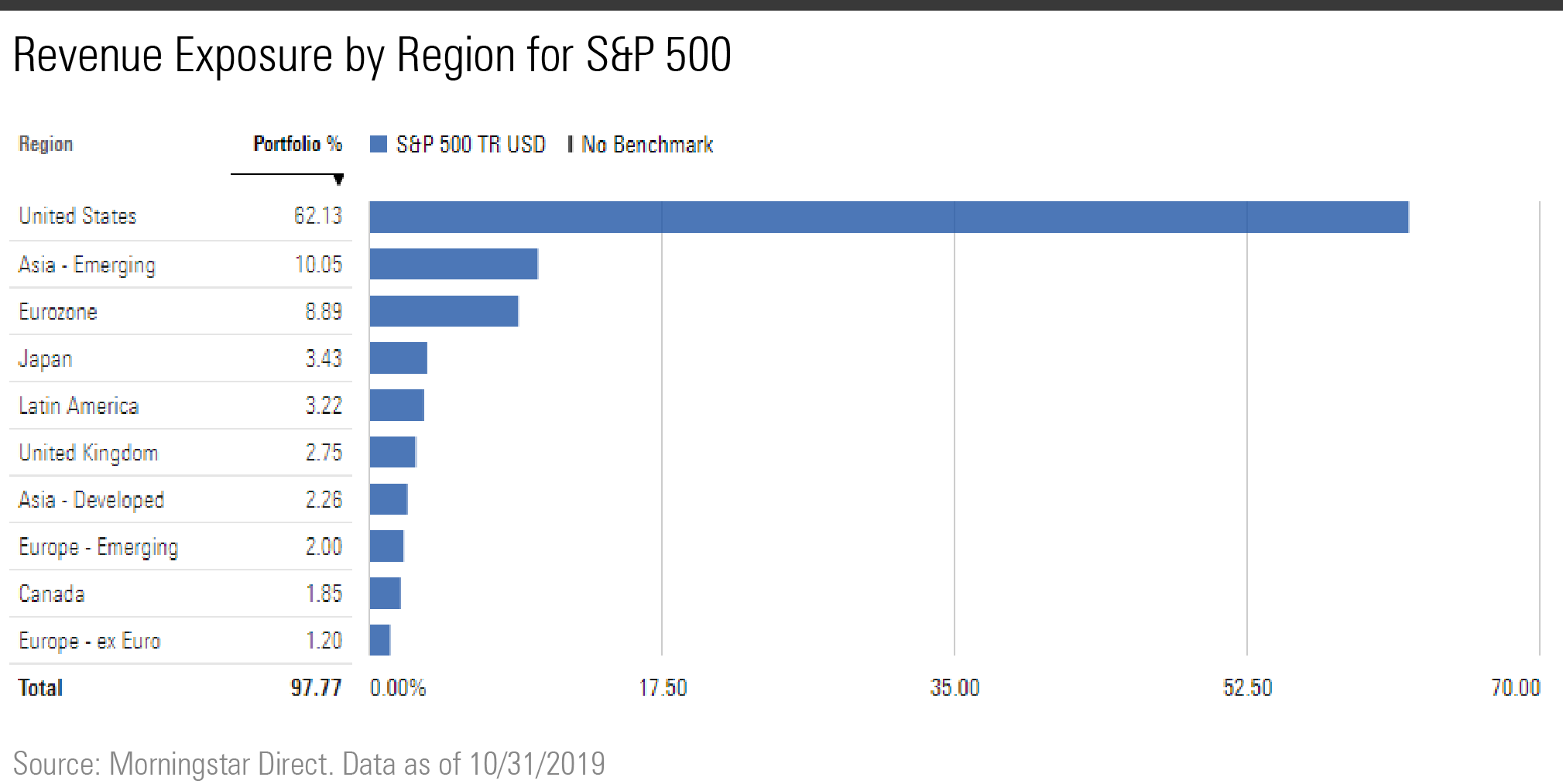

In addition, most larger companies have at least some revenue from outside of their home markets. Morningstar now collects data from SEC filings about each company’s reported revenue by country or region. Based on this holdings-level data, we can drill down into a fund’s portfolio to get an aggregate view of where its underlying holdings generate revenue. We estimate that the companies that make up the S&P 500 generate only about 62% of their revenue from the U.S., with the remainder coming from countries such as China, Japan, Germany, the United Kingdom, and others. So even if you’re investing in a U.S.-only fund, you’re still getting significant international exposure based on the revenue of the underlying holdings.

The Case for International Overall, the case for international investing seems less compelling than it used to be. Does that mean we should follow in the footsteps of the late John Bogle and avoid non-U.S. stocks entirely? I wouldn't go that far. Mean reversion is a powerful force, and international performance trends are no exception. After lagging domestic issues by wide margins for four straight years from 1989 through 1992, for example, international stocks sprung back to life in 1993, trouncing their domestic counterparts by 22 percentage points. The long-term performance trend for international looks particularly dismal right now, but that pattern probably won't last forever. It's also worth noting that part of the recent slump has stemmed from the dollar's strength relative to other currencies. During periods when the dollar is weakening, international stocks tend to perform better.

Because they've lagged by such a wide margin, international stocks now sport more attractive price tags. The price of the S&P 500 relative to long-term, inflation-adjusted earnings (also known as the CAPE or Shiller P/E), is currently at pretty steep levels—about 29.4, which is near its post-crisis peak. Valuations on international issues look more attractive. The average CAPE for developed markets stood at 24.5 as of Sept. 30, 2019, while emerging-market issues trade at an average CAPE of 14.8.

Morningstar’s analyst-driven fair value estimates also point to a divergence between U.S. and international valuations, albeit not as extreme. As of Oct. 31, 2019, the median non-U.S. stock in our coverage universe was trading at a price/fair value ratio of 0.95, compared with 0.99 for U.S.-based stocks covered by our analysts.

The case for diversifying internationally isn’t as strong as it used to be, especially if you’re looking for significant risk reduction or consistently better returns. From a portfolio perspective, we typically recommend a healthy international weighting--roughly 25% of total assets--for investors with longer time horizons. That still makes sense as a starting point, but investors shouldn’t feel locked into a given weighting for international stocks. Instead, some investors may want to adopt a more flexible and opportunistic approach. Indeed, the strongest argument in favor of international is there’s no reason to limit the opportunity set in an increasingly global world.

Maciej Kowara contributed to this article.

/s3.amazonaws.com/arc-authors/morningstar/360a595b-3706-41f3-862d-b9d4d069160e.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/AET2BGC3RFCFRD4YOXDBBVVYS4.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/IORW4DN3VVC3BC4JO7AQLSJTF4.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ODMSEUCKZ5AU7M6BKB5BUC6G5M.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/360a595b-3706-41f3-862d-b9d4d069160e.jpg)