Pre-Retirees Ask: Can We Retire?

With retirement on the horizon, a couple checks up on the viability of their plan.

This article is part of Portfolio Makeover Week 2019.

Allen and Bridget, ages 63 and 62, respectively, are looking ahead to retirement within the next few years. But not working won’t exactly come naturally.

“Working hard is all we know and we really came from nothing,” wrote Bridget, noting that she and Allen are the children of immigrants. They were married 40 years ago and have raised four children, now grown; they also have three grandchildren. Along the way, they both logged plenty of hours in their careers, Bridget as a scientist and Allen as a computer engineer. In addition, they both pursued advanced degrees while they were working. Their household income is a healthy $245,000 a year.

At this life stage, they’re starting to think about enjoying the fruits of their labors. Bridget would like to retire at age 65 or earlier, if possible, while Allen plans to hold off until age 67 if he can. “We are both getting a little tired,” Bridget wrote, but she also notes that Allen loves his job. “He’d work forever if I let him,” she joked. The pair has always been frugal. “We always saved and lived a simple life and knew the importance of saving for retirement,” Bridget noted. Having sold their home recently in an effort to downsize and simplify in advance of retirement, their portfolio currently sits at a healthy $2.2 million. But about two thirds of those assets are sitting in cash and cash-like investments. That owes to a variety of factors: Their home-sale proceeds remain in cash, and they decide to take profits from appreciated equity holdings in 2018. “Our plan was to reinvest; however the money is still sitting in cash because we were not sure if we were facing a recession. This is the first time we ever did anything like this and we do not feel 100% confident in our decision,” said Bridget. Also bolstering their exposure to cash-like investments is Bridget’s 401(k) from a former employer, which is parked in a stable-value fund earning a very healthy 3.25% per year. She and Allen would like a check on their retirement portfolio’s viability given their expected retirement dates, and they’d also like to develop a plan for getting some of their funds invested.

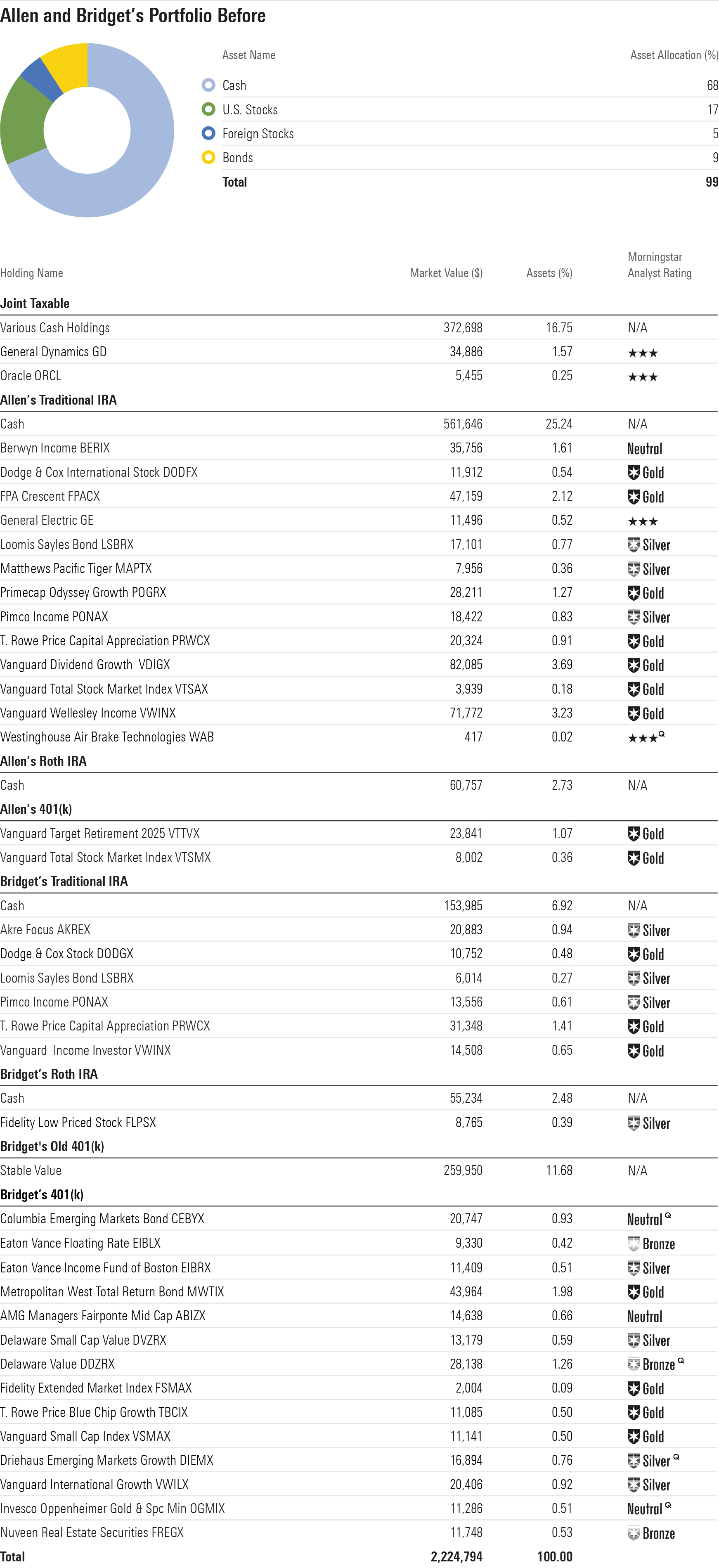

The Before Portfolio Like many dual-earner couples, Allen and Bridget hold their assets in a variety of different accounts, some tax-sheltered and some taxable, some jointly held and others individually owned. In addition to being diligent savers, Allen and Bridget have done their homework on their investments; their portfolio has a heavy emphasis on lower-cost mutual funds and index funds that are rated highly by Morningstar's analyst team. "We've tried to always be as aggressive as possible in our investments but always did our research, too," Bridget wrote.

Their joint taxable account consists largely of cash, the proceeds from their recent home sale. The couple is renting an apartment currently, but will likely spend a like amount, if not more, on a new home, so it makes sense to keep that amount in cash and consider it distinct from their long-term retirement portfolio.

Allen’s Traditional IRA, the result of a rollover from his 401(k) plan from a former employer, is the household’s largest single account. It too is conservatively positioned, with nearly three fourths of the assets parked in bonds and cash. The long-term positions in the portfolio are all topnotch mutual funds; nearly all earn Morningstar Analyst Ratings of Gold or Silver. Allen also has a Roth IRA, all in cash. His 401(k) with his current employer is invested in Vanguard’s Target 2025 fund VTTVX, as well as a smaller position in a total stock market index fund.

Bridget’s accounts are positioned quite conservatively. As noted above, a 401(k) with a former employer is parked in the stable-value fund; such offerings are not guaranteed, but they employ insurance contracts to maintain a stable net asset value. Her traditional and Roth IRAs have heavy cash weightings as well. Her current 401(k) is an outlier; it holds more than 70% of assets in stocks and a heavy emphasis on small- and mid-cap growth names. The fixed-income holdings in her 401(k) also tend to be of a more aggressive, volatile nature. She has exposure to high-yield, floating-rate, and emerging-markets bond options.

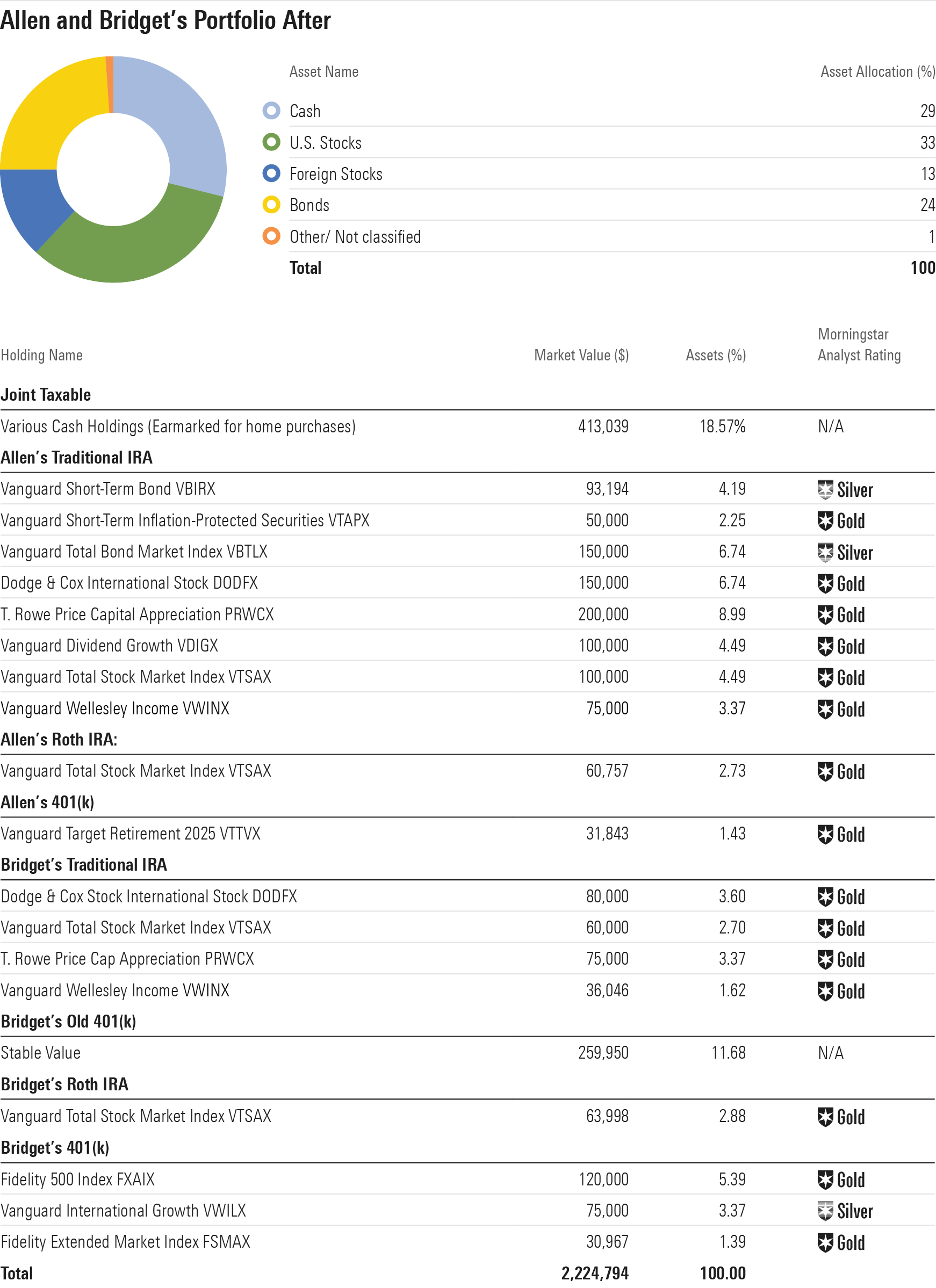

The After Portfolio Because Allen and Bridget are currently renting but expect to steer the proceeds from their home sale into new home, it makes sense to segregate their taxable account--which holds those assets--from the analysis of their retirement preparedness. They expect that they'll purchase a home outright with those funds, enabling them to enter retirement debt-free. If they think they'll need additional funds for the home sale, above and beyond what's in their taxable account, they should work with a tax advisor to determine whether to pull those assets from their traditional or Roth accounts. (Carrying a mortgage in retirement doesn't often make sense, even if it means a larger portfolio, in that the mortgage-servicing costs often exceed what one could earn by investing the money instead. The more conservative the portfolio, the better the case for not carrying a mortgage.)

Setting aside their taxable portfolio/home fund, their retirement accounts total $1.84 million. That’s a healthy sum, but they’ll need to balance their desire to retire relatively soon alongside other key variables: their planned in-retirement spending, when they’ll claim Social Security, and the probability of success they’re seeking to achieve with their plan. Their portfolio’s asset allocation is in the mix, too. All those factors play together to affect the success or failure of their plan.

Allen and Bridget estimate that they’ll need about $120,000 per year to be comfortable in retirement, and significantly less if they buy their new home outright. Assuming they start Social Security at their full retirement ages, about $64,000 of that amount will come from Social Security. The remaining $56,000, or about $63,000 when you consider that their money would be coming at least in part from tax-deferred accounts, must come from their portfolio. That’s a 3.5% withdrawal rate, well within the safe zone for sustainability over their retirement time horizon. Retiring sooner would add risk to their plan, but those risks could be mitigated if Bridget were to continue to work part-time, Allen works longer, and one or both of them delay Social Security. Those are highly personal decisions, especially when you factor in questions like whether they’d both like to be retired at the same time. But at this life stage, delaying Social Security to full retirement age or beyond is the best way to ensure a successful plan, even if it means they need to draw more from their portfolios in the early years of retirement.

It’s also important to point out that any discussion of safe withdrawal rates assumes a balanced portfolio. Given their hefty allocation to cash currently, they most certainly don’t, and their portfolio’s return potential is reduced accordingly. Thus, a key next step for Allen and Bridget is arriving at a reasonable long-term asset allocation, then developing a plan to invest their cash hoard. A starting point for figuring out how much cash to keep on hand is deciding how much they’ll need to spend on their new home. After all, it won’t make sense to get their portfolio fully invested, then pull that money out to buy their home. They’ll also want to be sure to leave themselves a cash cushion to serve as an emergency fund for unexpected expenses and extra costs related to moving into their new home.

For the rest of their portfolio, I like the idea of doing some “pre-bucketing,” as retirement is close at hand. As regular readers know, I’m a fan of backing into a sensible in-retirement asset allocation using estimated portfolio withdrawals to guide the way. While it’s too early to raise significant cash holdings, it’s not too early to think about carving out a healthy allocation to high-quality short- and intermediate-term bonds. In case of an equity-market shock that coincided with the early years of Allen and Bridget’s retirement, the bond component would be unlikely to lose much, and may even gain a bit. Thus, they could draw upon it for living expenses.

Note that my “After” portfolio includes a hefty 29% allocation to cash, but that reflects their home-purchase assets. It also reflects the fact that I retained the stable-value fund in Bridget's 401(k) because its yield beats what’s available from cash holdings today, and it beats high-quality bond yields as well. Stable value doesn’t fit neatly into any of the asset allocation categories, so for asset-allocation purposes I assumed that stake was half cash and half short-term bond.

To help improve liquidity in advance of their home purchase, my “After” portfolio cuts two smaller individual stock positions--both rated 3 stars currently--and steers that amount into cash. Of course, Allen and Bridget will want to check their cost basis before making that trade, as it could have tax implications if those positions have appreciated since purchase.

I did the real bucketing with their 401(k) and IRA portfolios. While they’re not yet retired, so it doesn’t make sense to raise significant cash holdings, I added positions in plain-vanilla high-quality short- and intermediate-term bond funds to Allen’s portfolio. The stable-value fund will provide liquidity and stability for Bridget’s tax-deferred accounts. I also cut positions in more aggressive fixed-income funds like Loomis Sayles Bond LSBRX and Pimco Income PONAX given that they don’t provide significant diversification. However, I retained positions in fine stock/bond funds like T. Rowe Price Capital Appreciation PRWCX and Vanguard Wellesley Income VWINX. Both funds provide varying degrees of equity exposure, but with the cushion of fixed income assets and cash, too.

Bridget’s 401(k) was invested in a preset mix of investments, but that portion of the portfolio seems overly busy and, more important, includes exposure to several Neutral-rated funds. In an effort to lower costs and improve its quality, I switched into a more utilitarian mix: Fidelity index funds for its U.S. equity exposure and Vanguard International Growth VWILX for foreign-stock exposure.

For Allen’s 401(k), continuing contributions into Vanguard Target Retirement 2025 makes sense. It’s a fine, low-maintenance choice that takes the guesswork out of asset allocation for this portion of his portfolio, especially considering that it’s small relative to his IRA.

I parked both Allen's and Bridget’s Roth IRAs in a total stock market index fund, with the expectation that they’d tap those accounts last in retirement. However, they should work with a tax advisor to settle on a tax-efficient withdrawal sequence. In some years, it may make sense to tap the Roths for part of their withdrawals while leaving the other assets intact.

Of course, the timing of implementing any such changes is crucial; at this point in the market cycle, it seems risky to shift into a fully invested portfolio all in one go. My bias would be to not try to time the changes perfectly but rather dollar-cost average into a more fully invested position over the next few years, after they’ve determined how much they’ll need for their new home. Dollar-cost averaging guarantees that their timing in putting the money to work won’t be exactly correct, but nor will it be exactly wrong.

Finally, Allen and Bridget will need to think through a plan for long-term care, as they don’t currently have coverage. There are no perfect solutions to the long-term care conundrum, unfortunately; at their current ages, purchasing a long-term care policy may be cost-prohibitive. If they decide their best/only option is to self-fund long-term care, it’s wise to segregate those assets from their in-retirement spending assets. A reverse mortgage might also be a backup plan if one of the partners were to incur long-term care costs.

Amy Arnott, Jess Liu, Chris Margelis, and Michael Schramm contributed to this report.

/s3.amazonaws.com/arc-authors/morningstar/66112c3a-1edc-4f2a-ad8e-317f22d64dd3.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/6ZMXY4RCRNEADPDWYQVTTWALWM.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/URSWZ2VN4JCXXALUUYEFYMOBIE.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/CGEMAKSOGVCKBCSH32YM7X5FWI.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/66112c3a-1edc-4f2a-ad8e-317f22d64dd3.jpg)