Retired Couple Aim to Live Their Best Life Without Fear of Running Out

A strong market has propelled the portfolio of this retired couple, but what if the next decade isn't as good?

This article is part of Portfolio Makeover Week 2019.

Daniel, 80, and Nancy, 70, worked side by side in a consulting firm they launched together. Years later, this married couple is looking forward to being retired together, too. Daniel has been retired for a few years now, while Nancy expects to fully retire next year.

The couple is in the process of selling off their business. An earlier sale of some of the firm’s assets netted $250,000, and they invested that money back into their portfolio, while they expect the sale of additional assets to net $125,000 in proceeds. They have one son who’s grown and financially independent, as well as one grandchild.

Daniel has been taking Social Security and required minimum distributions for many years now, but Nancy has just begun both Social Security and RMDs. Together, their Social Security payments total about $4,500 per month. Daniel calculates that their Social Security income, along with income from two small annuities, required minimum distributions, and income distributions from their portfolio should provide their ongoing living expenses in most years. In the coming year, however, they expect to sink $80,000 into home improvements, with an eye toward remaining in their home for the rest of their lives. They’ve relocated to a Sunbelt city that they absolutely love.

So far so good, but they’re concerned about what lies ahead for the market. Having enjoyed the tailwind of strong stock and bond returns over the past decade, they’re pleased with their portfolio’s growth, but they’re concerned about how it might behave if their full retirement coincides with a down market.

Asking the question that’s on so many retirees’ minds these days, Daniel wrote, “How can we best protect our principal while at the same time maintaining enough stock or alternative investments to share in any remaining upside market momentum?”

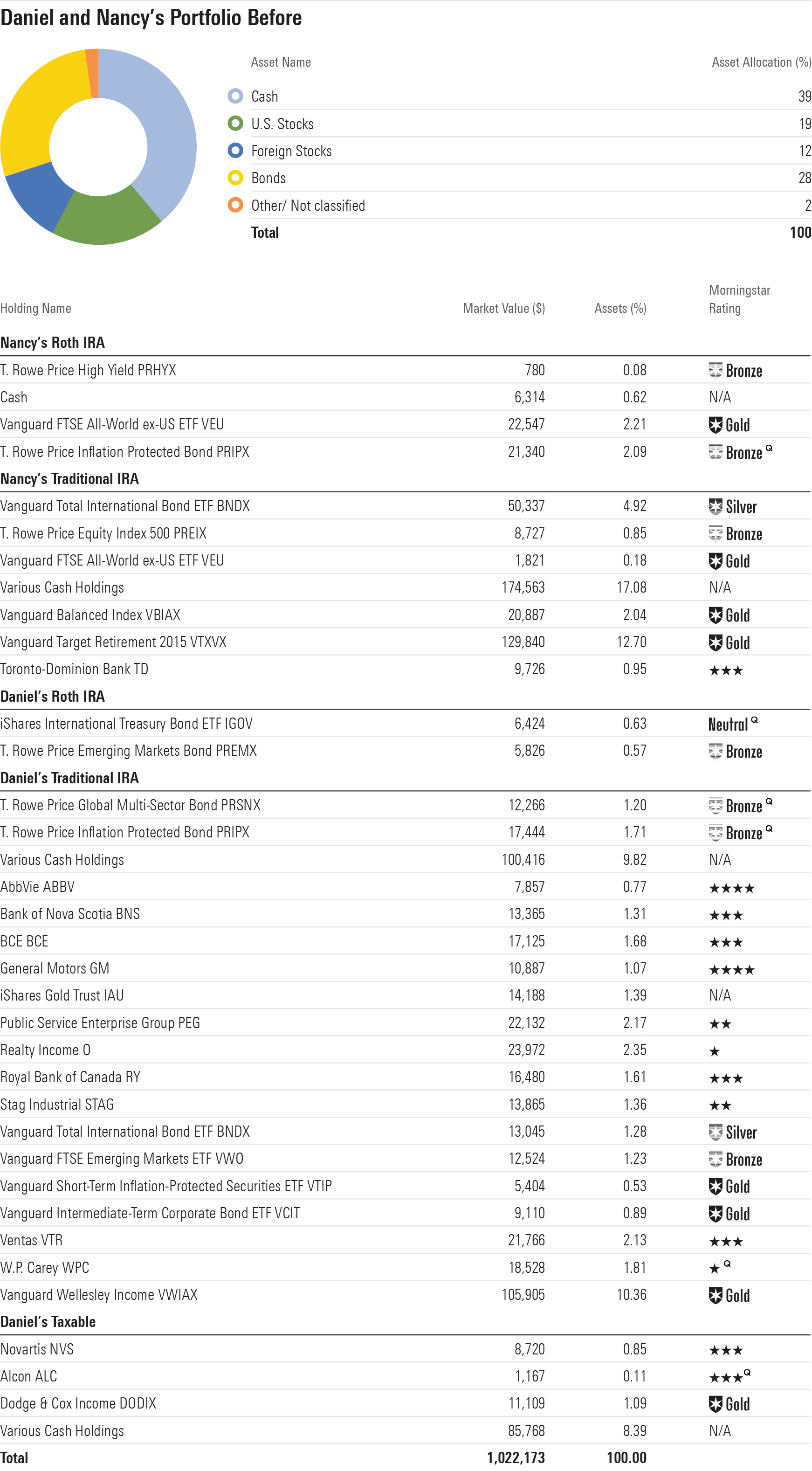

The Before Portfolio Their portfolio currently totals about $1 million, conservatively positioned with about two thirds of assets in cash and bonds and the remainder in equities. Overall, their equity portfolio tilts heavily toward dividend-paying stocks and has a heavy emphasis on large-value names; nearly half of the equity assets in the portfolio reside in that square of the Morningstar Style Box. The bulk of their assets are in their two traditional IRAs, though they each have smaller Roth IRAs as well. In addition, Daniel holds a taxable portfolio and two small annuities, one providing an income stream of about $6,000 per year and the other just less than $2,000. Daniel is an avid Morningstar.com reader, and nearly all of the mutual funds in their portfolios receive Medalist ratings from Morningstar's analysts.

Daniel’s traditional IRA makes up the largest pool of assets; it consists of a hefty cash stake, individual dividend-paying stocks, and a broad swath of mutual funds and ETFs, mainly bond funds. Nancy’s traditional IRA is cash-heavy, too, but she also has a sizable position in Vanguard’s Target Retirement 2015 fund VTXVX, a balanced fund, and core index-tracking equity funds, both U.S. and foreign. Their Roth IRAs consist largely of mutual funds and ETFs. Finally, the taxable account includes a sizable stake in a grab-bag of cash holdings, the excellent Dodge & Cox Income DODIX, and a handful of individual stocks.

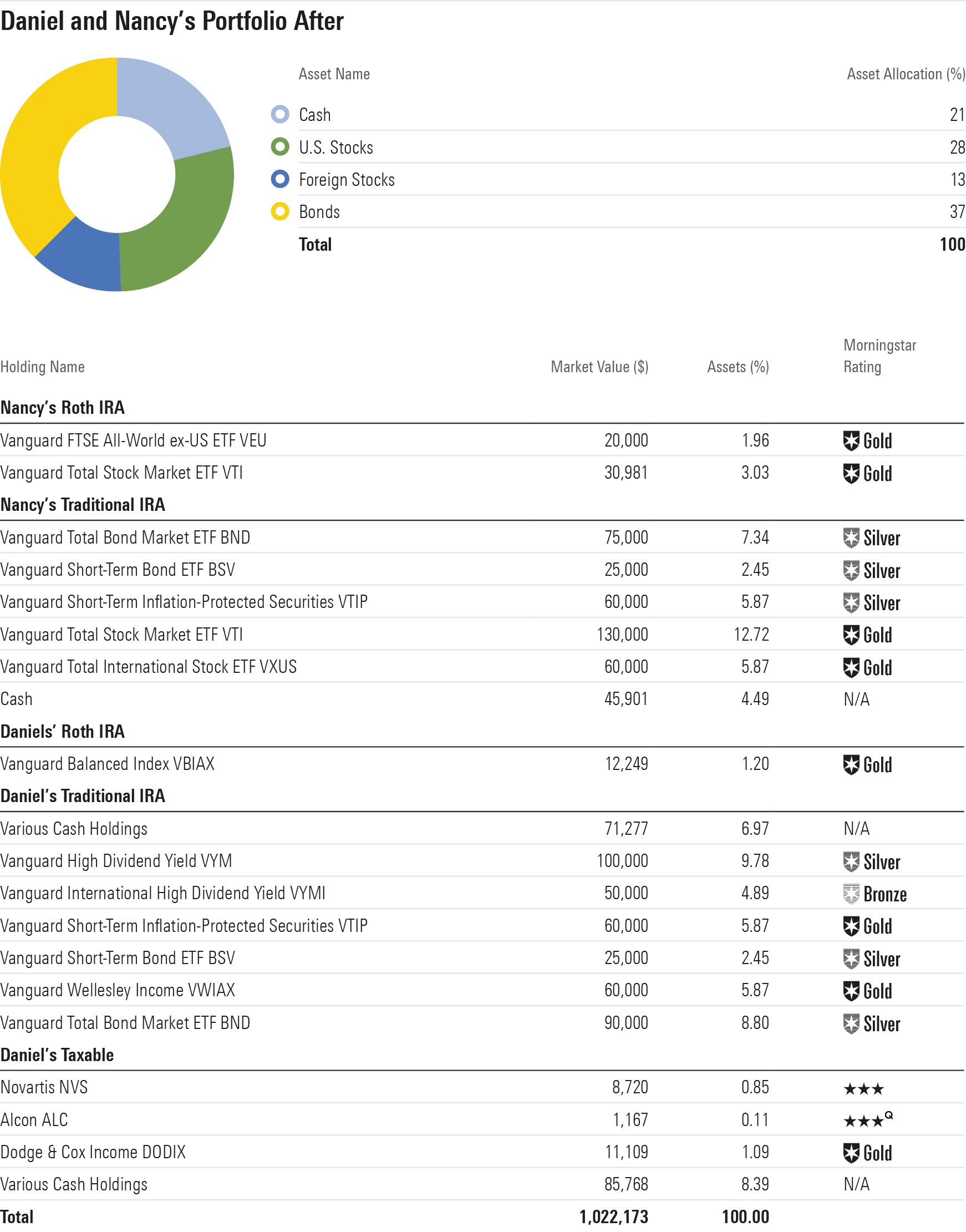

The After Portfolio Because Daniel and Nancy are coming into their first year without a paycheck, the first order of business is to check up on the viability of their plan--namely, their spending rate relative to their current assets. They receive about $54,000 of their annual $100,000 income needs from Social Security and another $8,000 from Daniel's income annuities. That means that the remaining $38,000, or about $43,000 when you account for taxes, must come from their portfolio. That's a 4.3% withdrawal rate based on their current portfolio balance. Given their ages as well as the fact that they're expecting an additional influx of cash from the final sale of their business, their spending rate seems reasonable, even considering the $80,000 they plan to take out for home improvements.

The next step is to assess their asset allocation. I implemented a bucket approach in each of their traditional IRAs, because RMDs from those two accounts will supply most of their portfolio withdrawals. My goal was to steer roughly 10 years' worth of withdrawals in each of their IRAs to safer assets--cash and bonds. That way, if a stock market drop materializes in the near future and stocks stay down for an extended period of time, they can use a combination of income distributions and withdrawals from safer assets to meet their cash flow needs.

Toward that end, each of their IRAs includes ample cash and short- and intermediate-term bonds, as well as stakes in Treasury Inflation-Protected Securities for protection against an inflationary shock. In a nod to Daniel’s focus on generating income from his portfolio, I steered his equity holdings into two dividend-paying ETFs, one focused on U.S. stocks and the other on international. Both ETFs boast healthy yields--a 4.3% SEC yield for the international fund and 3.3% for the U.S.-focused fund. That’s a bit lower than the yield on Daniel’s portfolio of individual stocks, but the ETFs avoid the idiosyncratic risk that accompanied the individual equity positions. I also retained a position in Vanguard Wellesley Income VWIAX, an allocation fund with a Morningstar Analyst Rating of Gold that Daniel likes for its stability and comfy yield. I steered Nancy’s equity holdings toward total stock market trackers in an effort to neutralize the heavy emphasis on large-value names inherent in Daniel’s income-seeking approach. For their Roth accounts, which are a small piece of the total, I stuck with index funds for Nancy’s portfolio and a balanced fund for Daniel’s.

In addition to adjusting their asset allocations, the changes to my “After" portfolio aim to streamline and reduce the couple’s ongoing oversight obligations so that they can enjoy their retirement together. I cut most of the individual equities, slicing the number of holdings in the portfolio by roughly half. Meanwhile, using broad-market ETFs improves the portfolio’s diversification while also making it easy to spot where they should rebalance.

My “After” portfolio calls for getting some of their cash holdings invested, and neither stocks or bonds look especially cheap today. Given that, my bias would be to move the money into their long-term holdings gradually, over a period of one or two years, employing a dollar-cost-averaging system.

One wild card in Daniel and Nancy's plan is long-term care. Nancy has a policy, whereas Daniel does not because of a pre-existing health condition that put long-term care out of reach. There are no good answers to this conundrum, though a reverse mortgage may be a backup plan.

Amy Arnott, Jess Liu, Chris Margelis, and Michael Schramm contributed to this report.

/s3.amazonaws.com/arc-authors/morningstar/66112c3a-1edc-4f2a-ad8e-317f22d64dd3.jpg)

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/EGA35LGTJFBVTDK3OCMQCHW7XQ.png)

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/LUIUEVKYO2PKAIBSSAUSBVZXHI.png)

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/GQNJPRNPINBIJGIQBSKECS3VNQ.jpg)