When It Comes to 529s, How Good Is Your State's Tax Benefit?

We examine the incentives that college savers have to stay in-state.

One of the most important choices that investors face when choosing among the more than 50 state-sponsored direct-sold 529 college savings plans is whether to stick with their state's plan or shop around for a better option. Morningstar Analyst Ratings for college savings plans compare programs nationally, since most U.S. residents do have an incentive to shop around, which means we do not consider state-specific incentives when evaluating them. In this article, we'll look at the incentives that college savers have to stay in-state.

Investors who live in states with no incentives to stay, such as state income tax benefits, should look nationwide for the best plan regardless of state affiliation. Indeed, college savers are not restricted to their state's 529 plan. About 42% of the U.S. population resides in one of 16 states that do not have a state tax benefit to entice them to stay in-state, so those investors have the 529 world as their oyster. Another 12% of residents live in seven states that offer tax benefits regardless of which state's 529 plan their residents choose (called tax parity), which gives residents the same freedom of choice. But the 46% of Americans in the remaining 27 states receive tax incentives to stay in state, a benefit that can significantly increase their college nest egg.

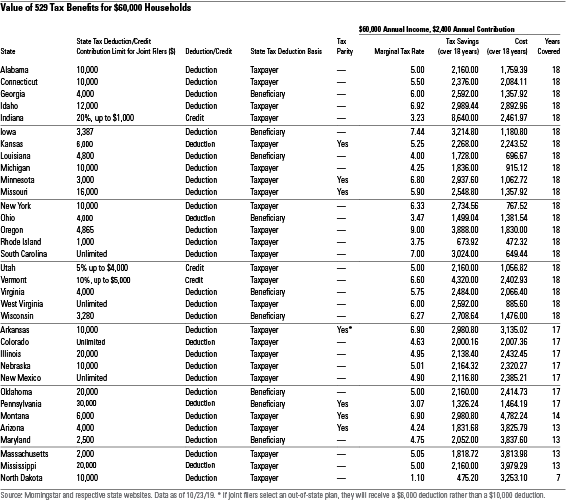

Staying True to Home Residents of the 27 states that offer tax incentives have a strong reason to stay. State tax rates and the related 529 benefits vary significantly, but largely the tax incentives outweigh the fees charged by direct-sold plans. To evaluate the benefit enjoyed by residents we looked at two scenarios. The first considers the joint tax return of the Bennet family. The Bennets have two kids, earn $60,000 a year--about the median annual household income in 2018--and contribute $100 each month per child, or $2,400 a year. The second scenario follows the Erebor family, which also has two kids, but earns $150,000 annually and invests $150 each month per child, or $3,600 a year. In both scenarios, we calculated whether each family would be able to cover the cost of their plan's fees with their tax benefit (assuming both stay constant). To do so we used each state's highest marginal state tax rate for their income level and assumed an annual 6% return on investment.

For example, if the Bennets lived in Oregon, they would be subject to a 9% marginal state income tax rate on their $60,000 income. The state allows them to deduct up to $4,865 of total contributions to the Oregon College Savings Plan, which allows the family to deduct the total $2,400 they contribute annually. That equals a tax savings of $216 a year or $3,888 over 18 years. The plan's college enrollment portfolios have an average fee of 0.31%. Over 18 years, assuming an annual 6% return on investment, that expense ratio translates to a total cost of $1,830 and an ending balance of $74,174. (Lower returns would lead to a lower cost since the ending balance would be smaller, and vice versa.) By staying in-state and taking advantage of the annual tax deduction, the Bennets would save almost double the cost of investing in the plan. It's possible the Bennets could still have a higher ending balance by choosing an out-of-state 529 plan's age-based portfolio, but there's no certainty of that. The value of the tax benefit, however, is secure provided Oregon College Saving doesn't increase fees or the state's tax code doesn't change meaningfully.

Exhibit 1 shows state tax deductions/credits, marginal tax rates, tax savings, and total fees paid over 18 years. It also shows how many years of fees the tax benefit would cover for families like the Bennets considering an 18-year time horizon. For states that offer more than one direct-sold plan, we selected the plan with the highest Morningstar Analyst Rating. If a state offers two highly rated direct-sold plans, we chose the cheaper option.

The tax savings investors enjoy can vary based on their income and contributions. Exhibit 2 shows the benefits enjoyed by the Erebors in states where the number of years covered differs from the Bennets.

With tax benefits equaling (or surpassing) 17 or 18 years of fee coverage, investors have good reason to consider staying in state. For investors like the Bennets, 21 out of the 27 states offer a tax-benefit that covers the plan’s full cost over an 18-year investment horizon from birth to college, a major benefit for investors. An additional seven cover costs for 17 years, and the remaining six cover between seven and 14 years if they are invested over 18 years. Exhibit 3 outlines how many years of expenses each state’s tax benefit will cost assuming investors take advantage of an 18-year investment horizon.

A few states' tax benefits are notable for how exceptional they are. Indiana's average age-based track costs 0.42%, about 0.08 percentage points above the median fee for direct-sold age-based options. However, Hoosiers should likely stay in-state thanks to Indiana's generous tax credit of 20% of contributions up to a total of $1,000. Vermont charges a similar fee of 0.41%, but again residents enjoy a high tax credit that is hard to pass up. Indiana, Vermont, and Utah are unique in offering tax credits instead of deductions. A tax credit directly decreases the tax dollars owed whereas a tax deduction reduces taxable income.

Not all state tax deductions are as helpful. Investors in Maryland and Massachusetts receive a tax benefit that only covers 13 years of investors' fees. Their plans also charge fees higher than the median, and they have a lower tax deduction amounting to $2,500 per beneficiary and $2,000 per taxpayer, respectively. In Massachusetts, neither family gets to deduct 100% of their annual contributions. But even small tax benefits can provide residents with small account balances a slight edge over investing out of state. Regardless, Maryland's Senator Edward J. Kasemeyer College Plan and Massachusetts' U. Fund College Investing Plan both earn Analyst Ratings of Silver, so investors have little incentive to look elsewhere.

The North Dakota Exception Residents of North Dakota have the lowest years covered by their tax benefit given the plan's high cost, and the state's low income tax rate further decreases the value of the tax benefit. The benefit clocks in at only 1.10% of the first-year's contribution and covers about 15% of the total cost over 18 years; the North Dakota College SAVE Plan's age-based track charges an average expense ratio of 0.55%, which ranks among the highest versus direct-sold plans. However, North Dakota has a unique grant benefit that may cause investors to give it a second glance. Married couples making less than $120,000 a year, like the Bennets, can receive a grant up to $300 per year. Families not eligible for the grant, like the Erebors, and out-of-staters should look elsewhere. In this case, residents of North Dakota should take a closer look at their individual circumstances.

Tax-Parity States: Should I Stay or Should I Go? Investors in tax-parity states have good reason to shop around. For instance, Kansas offers two direct-sold plans to its residents. Both options are rated Neutral, and their age-based portfolios have costs higher than the median direct-sold plan. The cheaper option, Schwab 529 College Savings Plan, charges 0.38% for its age-based portfolios. Although Kansas' tax benefit allows residents to comfortably stay in-state, they have the privilege to browse nationally. Investors might as well pick a lower-cost, out-of-state Gold- or Silver-rated plan while still reaping the benefits of their state's generous tax-parity policy.

Investors must read the fine print, as some states offer tax parity with exceptions. For instance, Arkansas has tax parity, but its residents don't receive the full benefit if they venture across state lines (they can deduct $6,000 rather than $10,000). Still, most Arkansas residents should look elsewhere--the state's GIFT College Investing Plan earns a Negative rating for charging high fees of 0.52% on its age-based portfolios. That's about 3 times as expensive as some similar plans that use Vanguard as the investment manager. Arkansans contributing less than $6,000 a year should consider other options.

Not all residents of tax-parity states are as enticed to shop around. Residents of Minnesota and Missouri enjoy a tax benefit that covers the full 18 years of fees and have good in-house options with Morningstar Medalist ratings.

Fees Aren't the Only Thing That Matters, but Direct-Sold Plans Are in Good Shape Price was one of five pillars we looked at when we assigned our forward-looking Analyst Ratings to college savings plans. We also placed a high importance on the quality of the plan's investment options, asset-allocation approach, and oversight from the state and investment manager. Fortunately, each plan we rated that has an in-state tax incentive had at least one positive pillar rating for either People (signifying a strong lineup of investment options), Process (signifying a repeatable and thoughtful asset-allocation process), or Parent (signifying robust oversight). None of the plans had any of those pillars rated negative. A negative rating for People, Process, or Parent would be a sign that even at zero cost, investors should consider other options.

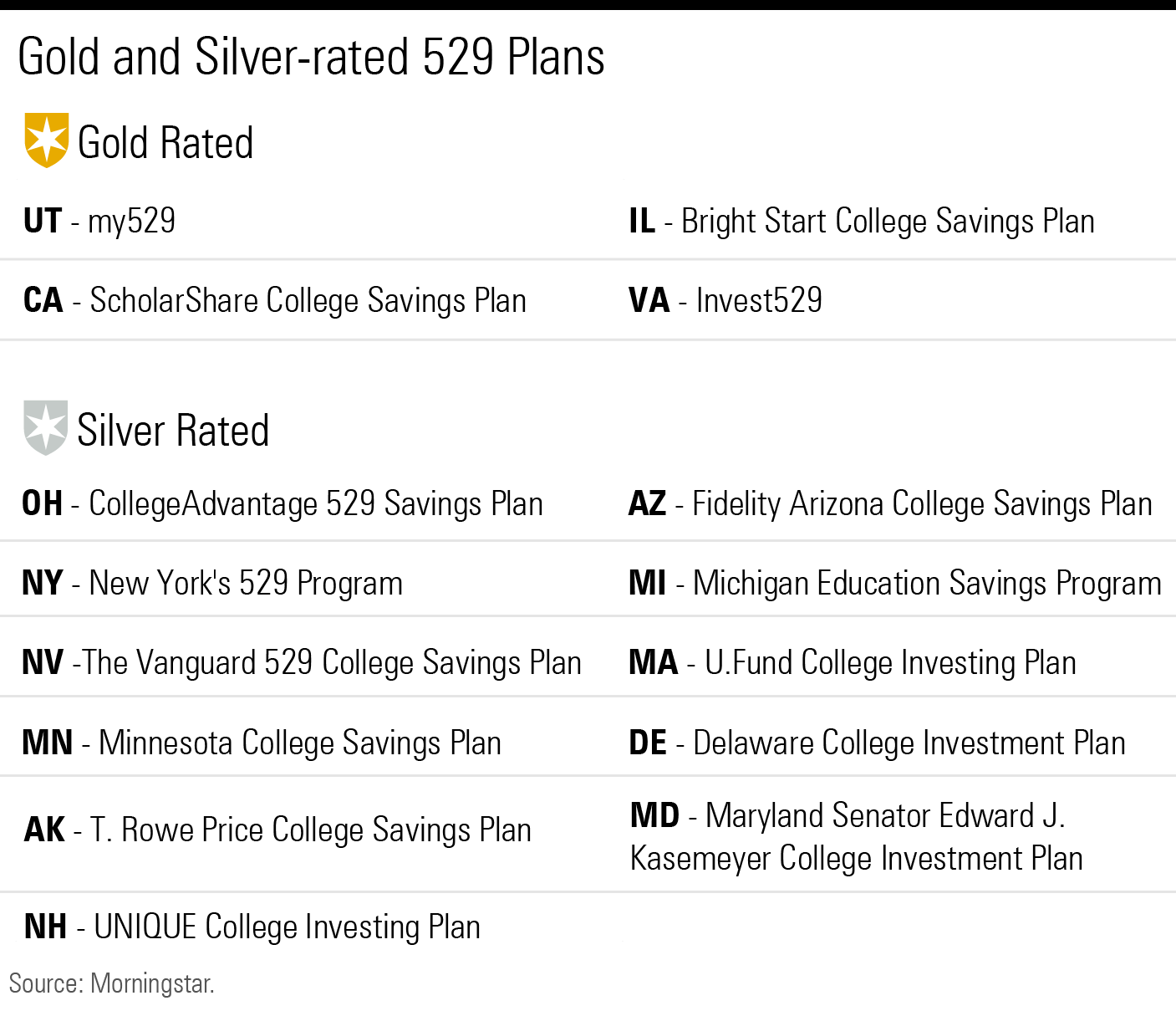

Which Plans Should Investors Turn to When Looking Out of State? Investors living in states that have tax parity or don't offer an incentive to stay in state (either because the state has no state income tax or it doesn't offer a deduction or credit for staying in state) shouldn't feel obligated to stay. This year, Morningstar assigned four 529 plans a rating of Gold and 11 a rating of Silver. Exhibit 4 shows Morningstar's highest-rated 529 plans for investors shopping nationwide.

/s3.amazonaws.com/arc-authors/morningstar/532c09c7-c679-4cfa-bfb6-578ca1149ef7.jpg)

/s3.amazonaws.com/arc-authors/morningstar/af89071a-fa91-434d-a760-d1277f0432b6.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZKOY2ZAHLJVJJMCLXHIVFME56M.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/IGTBIPRO7NEEVJCDNBPNUYEKEY.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HDPMMDGUA5CUHI254MRUHYEFWU.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/532c09c7-c679-4cfa-bfb6-578ca1149ef7.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/af89071a-fa91-434d-a760-d1277f0432b6.jpg)