Sustainable Investing Interest Translating Into Actual Investments

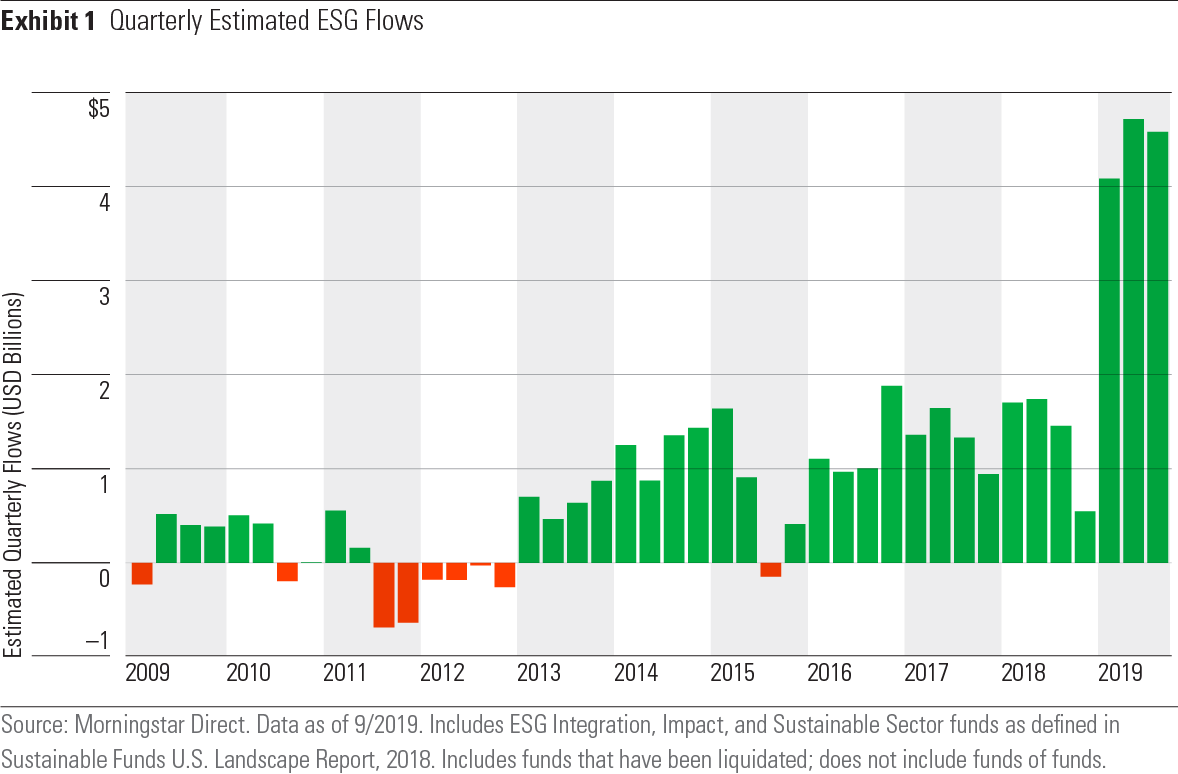

We've seen record ESG fund flows so far in 2019.

This is shaping up to be a record year for flows into sustainable funds. Through September, the estimated flows into the 288 open-end and exchange-traded sustainable funds available to U.S. investors reached $13.5 billion. Flows have been consistent throughout the year, with sustainable funds attracting more than $4 billion in each of the first three quarters of 2019. Prior to this year, flows had never topped $2 billion in any quarter, and the calendar-year record, set in 2018, was just $5.5 billion. Sustainable funds are on track to triple that in 2019.

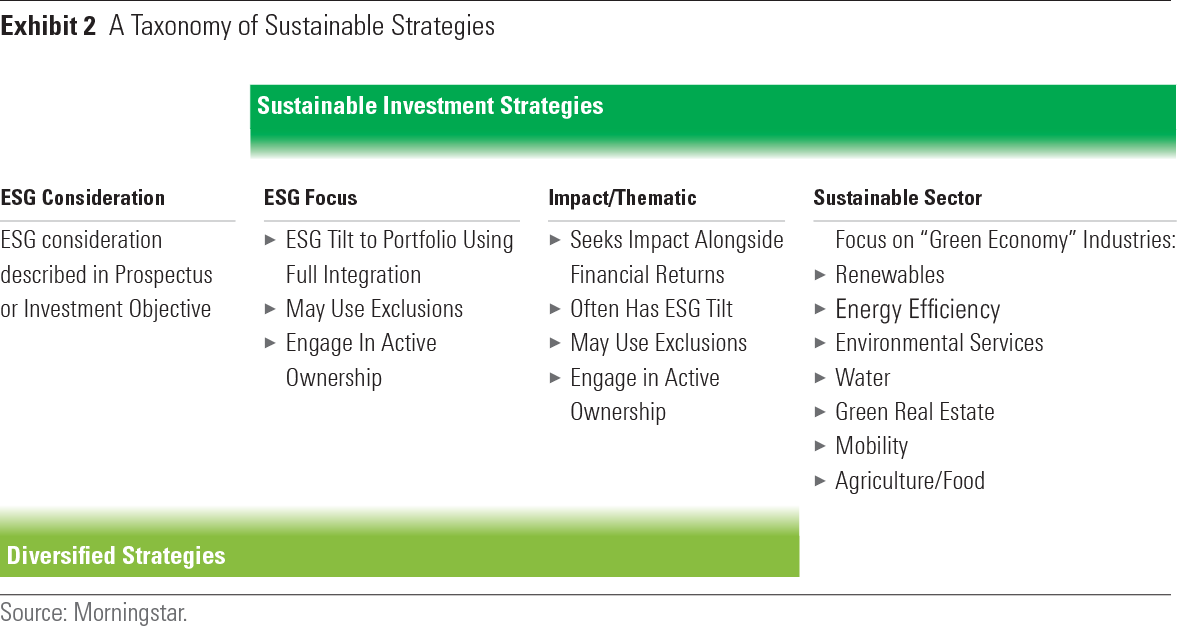

These estimated flows are based on a universe of sustainable funds consisting of those I’ve categorized as ESG Focus, Impact/Thematic, and Sustainable Sector.

I do not include in the flows calculation the 250 or so funds that I’ve identified as “ESG Consideration” because they are conventional funds that have added a mention of environmental, social, and governance factors to their prospectus recently, indicating that ESG criteria are now being considered in the investment process. While this is a notable trend, these funds do not have a primary focus on ESG, impact, or a sustainable sector.

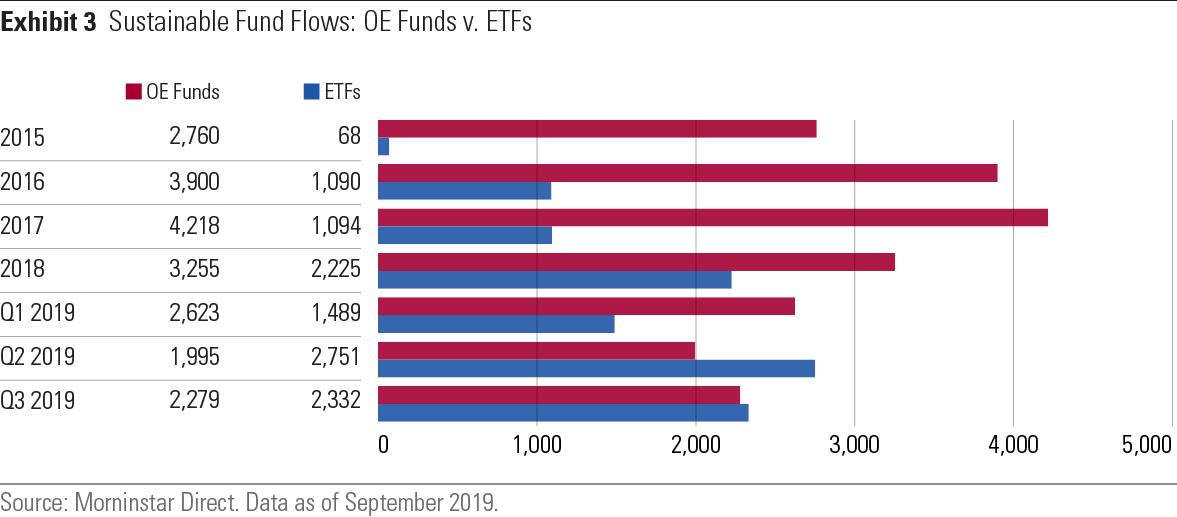

ESG ETF Flows Nearing Parity With Open-End ESG Funds Flows into exchange-traded funds have nearly reached parity with flows into open-end funds. Prior to 2014, most sustainable ETFs were sector funds focusing on renewable energy, environmental services, and clean technology, and only two diversified ESG-focused ETFs existed. Beginning with a wave of ESG and impact-focused launches in 2016, there are now 56 diversified sustainable ETFs. Prior to 2018, open-end funds garnered upwards of 80% of estimated flows. In 2018 and so far in 2019, the split is close to 50-50, with open-end funds maintaining a slight edge.

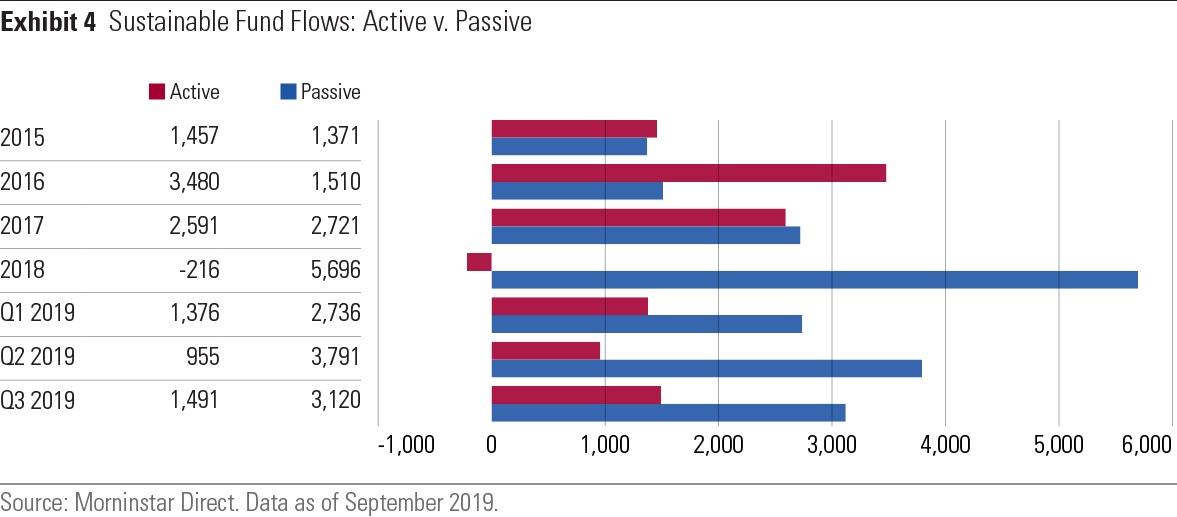

About 70% of ESG Flows Into Passive Funds Following the trend toward passively managed funds in the fund industry overall, flows into passive sustainable funds have outpaced flows into actively managed offerings for the past three years. For 2019 through September, slightly more than 70% of flows went into passive funds.

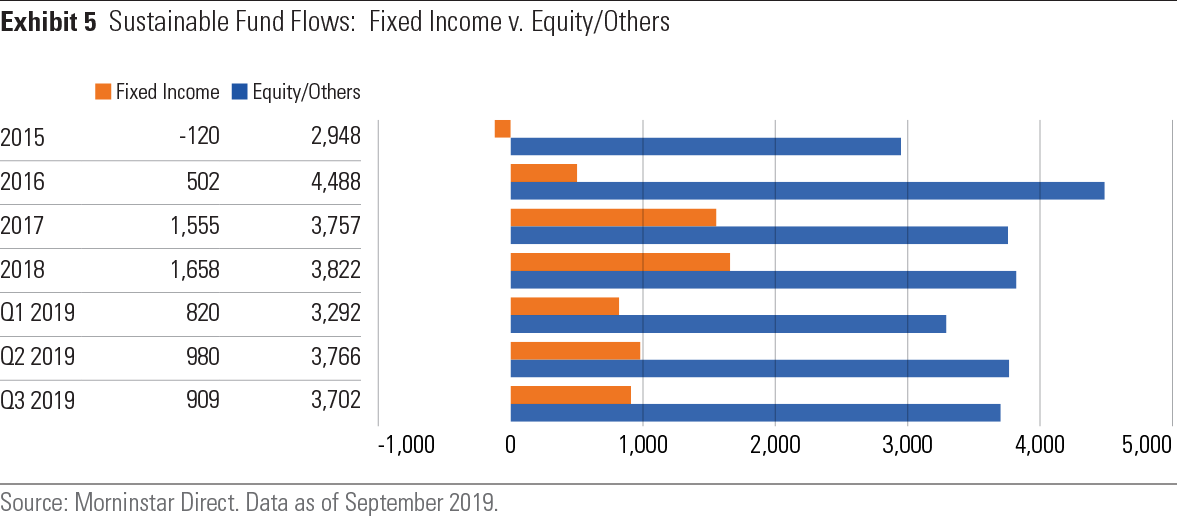

Increasing Flows Into ESG Fixed-Income Offerings Finally, flows into sustainable fixed-income funds have started to pick up. Of the 288 sustainable funds in my universe, just 53 are bond funds and 24 of those have been launched within the past three years.

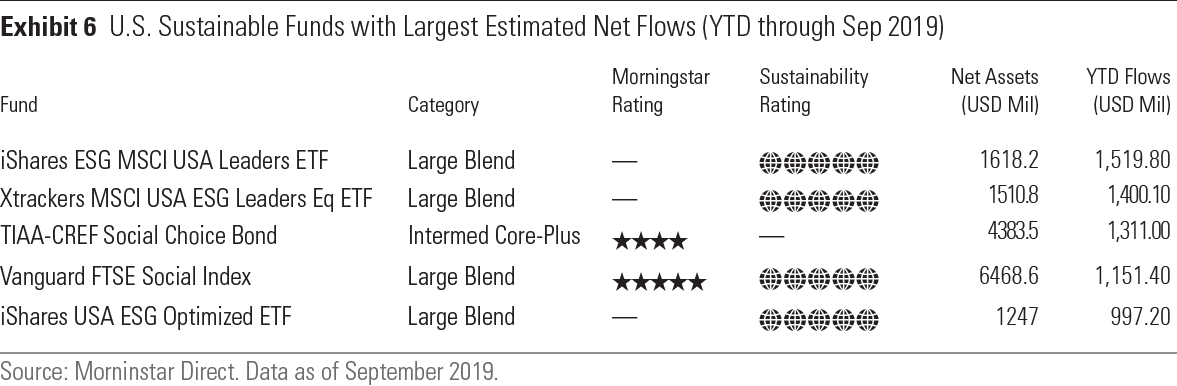

Where Are the Flows Going This Year? The two funds with the largest net flows have the same provenance. IShares ESG MSCI USA Leaders ETF SUSL and Xtrackers MSCI USA ESG Leaders Equity ETF USSG, which are based on the same underlying index, each received around $800 million at launch from Ilmarinen, Finland's largest pension insurance company. The two have attracted significant additional flows since them, pushing them to $1.5 billion and $1.4 billion, respectively, so far this year.

The 4-star, Bronze-rated TIAA-CREF Social Choice Bond Fund TSBIX drew nearly as much from investors without the help of seed money. The same was true for the 5-star, Silver-rated Vanguard FTSE Social Index VFTSX.

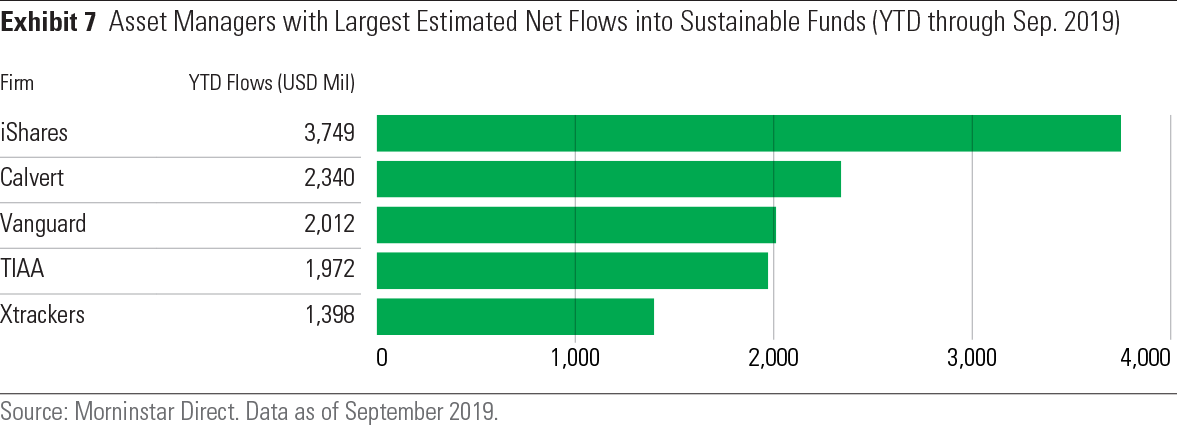

At the firm level, five asset managers have attracted more than $1 billion in flows so far this year. BlackRock’s iShares ETFs have led the way, gathering an estimated $3.7 billion.

A Tsunami of ESG Assets on the Way? A recent Morgan Stanley survey of U.S. investors, released in September, reported record levels of interest in sustainable investing. The first time Morgan Stanley surveyed investors, in 2015, an impressive 71% said they were interested in sustainable investing, but only 19% said they were "very" interested. The remainder (52% of the total) said they were "somewhat" interested.

In this year’s survey, a total of 85% said they were interested in sustainable investing with 49% now saying they were “very” interested. Those are significant changes over a short period of time and an indicator that more investors are ready to take the plunge into sustainable investing, if they haven’t done so already.

In 2015, we had a supply-side problem, but since then, 127 sustainable funds have been launched across a range of asset classes and categories, many of them inexpensive index funds that align with investor preferences for passive investing.

I still hear doubts within the industry that all this interest in sustainable investing will materialize, but the doubters are being too impatient. It takes time for people to act. My partner and I are committed to buying only electric vehicles from now on, but it will be several years before we are actually in the market for a new car. Likewise with a lot of individual investors. Over time, as they have reason to make investment decisions, more and more money will flow into sustainable investments.

A Bank of America report that came out in September predicted a "tsunami of assets is poised to invest" in ESG: "Based on demographics, we estimate over $20 trillion of asset growth in ESG funds over the next two decades." That's as much as is invested in S&P 500 funds today.

Interested in ESG? Check out a curated collection of our latest content on ESG investing.

Jon Hale has been researching the fund industry since 1995. He is Morningstar’s director of ESG research for the Americas and a member of Morningstar's investment research department. While Morningstar typically agrees with the views Jon expresses on ESG matters, they represent his own views.

/s3.amazonaws.com/arc-authors/morningstar/42c1ea94-d6c0-4bf1-a767-7f56026627df.jpg)

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/Q7DQFQYMEZD7HIR6KC5R42XEDI.png)

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/EBTIDAIWWBBUZKXEEGCDYHQFDU.png)

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/DJVWK4TWZBCJZJOMX425TEY2KQ.png)