A Defensive Approach to Junk Bonds

These ETFs seek to provide safer exposure to the high-yield bond market.

High-yield bonds carry considerable credit risk, which makes them more volatile and susceptible to the business cycle than investment-grade bonds. Most traditional high-yield bond index exchange-traded funds don’t attempt to mitigate this risk. Rather, they offer broad exposure to high-yield issuers and weight their holdings by market value, which can increase their exposure to issuers as they become more heavily indebted. However, there are a few good strategic-beta ETFs that attempt to turn down the risk of investing in high-yield bonds and may be worth considering.

Xtrackers Low Beta High Yield Bond ETF HYDW (0.20% expense ratio) attempts to mitigate risk by targeting the lower-yielding half of the high-yield corporate-bond market. It tracks the Solactive USD High Yield Corporates Total Market Low Beta Index.

The index’s investment universe consists of USD-denominated corporate issuances with between one and 15 years until maturity and at least $400 million in total face value. An issuer must have at least $1 billion in total debt outstanding. Bonds are weighted by market value, and there is a 3% issuer cap. The index is rebalanced monthly. After the eligibility pool is set, the 30-day moving average yield-to-worst is calculated and issues with yield-to-worsts higher than their category medians' are removed.

Yield-to-worst is the lesser of the yield-to-maturity and the yield-to-call. These metrics estimate the future return of a bond, effectively acting as measure a bond’s internal rate of return. The yield is averaged over 30 days, smoothing any short-term blips. If data is not available on an issue, it is left out of the index.

While the removal of the highest-yielding securities may limit the fund’s return potential, it also reduces volatility and potential for losses. This should be a more effective approach than simply removing the lowest-rated bonds because market prices, and thus yields, are usually quicker to pick up changes in credit quality than the ratings agencies.

IShares Edge High Yield Defensive Bond ETF HYDB (0.35% expense ratio) isn't quite as conservative as HYDW. Like that fund, it attempts to avoid the riskiest issuers, but it then reaches for yield (adjusted for risk) among the remaining issuers.

HYDB’s investment universe consists of USD-denominated corporate bonds with at least one year until maturity. However, there is no upper maturity limit and the issue must have $350 million in total face value. The strategy attempts to screen out the 30% of issuers with the highest probability of default, based on a proprietary model. It then uses an optimizer to select and weight bonds from the remaining universe that maximize the portfolio’s expected return from credit risk, based on option-adjusted spread less expected losses from defaults. The portfolio cannot underweight an issuer by more than 150 basis points relative to the starting universe or overweight it by more than 75 basis points. The index is rebalanced monthly.

This fund prefers its own analysis of an issuer’s credit risk over implicitly trusting that the market has correctly priced these securities. This fund also attempts to deliver the strongest returns possible for investors through its optimization weighting. As a result, the fund should deliver the most volatile returns of any of the three funds in this article.

Goldman Sachs Access High Yield Corporate Bond ETF GHYB (0.34% expense ratio) is the least active of the three strategies. It offers broad, market-value-weighted exposure to the market but attempts to avoid 15% of issuers with deteriorating fundamentals. To do this, it calculates a composite score based on the year-over-year change in each issuer's debit service and leverage ratios. Issuers that are becoming more heavily indebted and less able to service their debt are probably more susceptible to ratings downgrades and underperformance during economic downturns than most.

As was the case with HYDW, the eligibility pool consists of USD-denominated corporate issuances with between one and 15 years until maturity and at least $400 million in total face value. Additionally, issuers must also have at least $1 billion in total debt outstanding, and the index is rebalanced monthly. If there is no debt service and leverage data available, the issuer is still eligible but there is a 2% cap. If there is information available, there is a 3% issuer cap.

Like HYDB, GHYB prefers its own analysis of an issuer's ability to pay down its obligations when deciding which issuers to screen out. Unlike HYDB, this fund relies upon the market’s collective wisdom to weight its holdings. As a result, its performance should mirror more closely a traditional market-value-weighted high-yield bond fund, save for less-severe drawdowns because of the screening process.

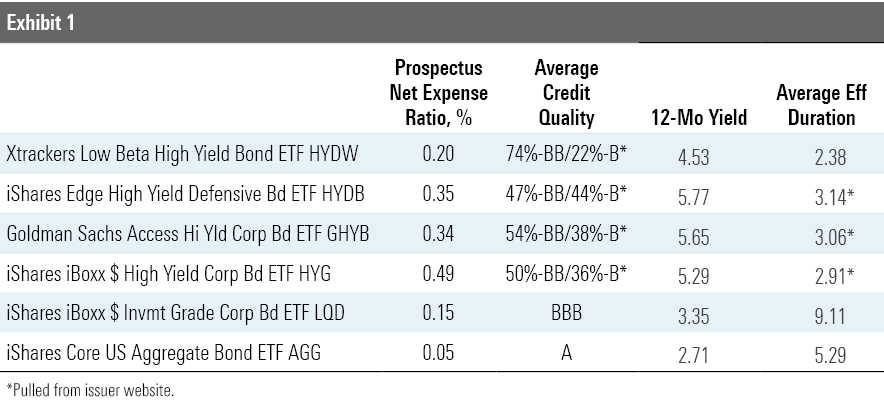

Holdings Comparison As noted in Exhibit 1, HYDW generates the smallest 12-month yield, which makes sense considering it removes the highest-yielding half of the market. It is also not surprising then that HYDW has the highest percentage of its assets in BB rated debt, the highest possible rating for sub-investment-grade bonds.

GHYB maintained the largest portion of assets in CCC rated debt, with 6.1%, while HYDB and HYDW only maintained 4% and 0.25% of their assets, respectively. GHYB is still more conservative in terms of the credit quality of its portfolio compared with iShares iBoxx $ High Yield Corporate Bond ETF HYG, a traditional market-value fund that does not attempt to limit its risk in providing exposure to the high-yield corporate-bond market. HYG maintained nearly 10% of its assets in CCC rated debt.

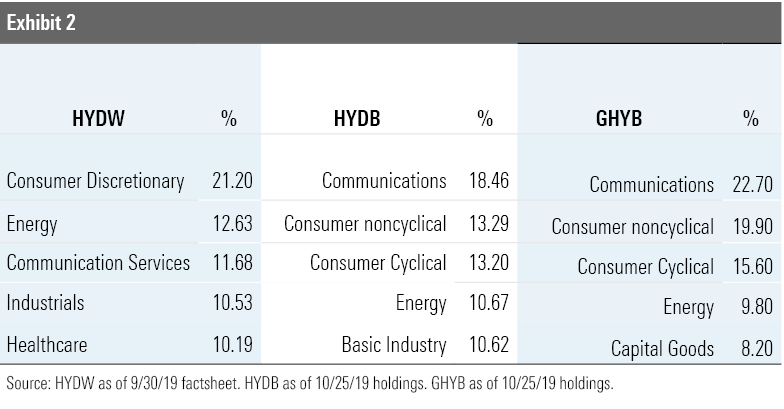

All three funds appear relatively similar in terms of sector concentration, with each fund holding most of its assets in sectors related to consumer spending, communications, or energy.

All three funds are generally in line with each other in terms of interest-rate risk, with each around three years in duration.

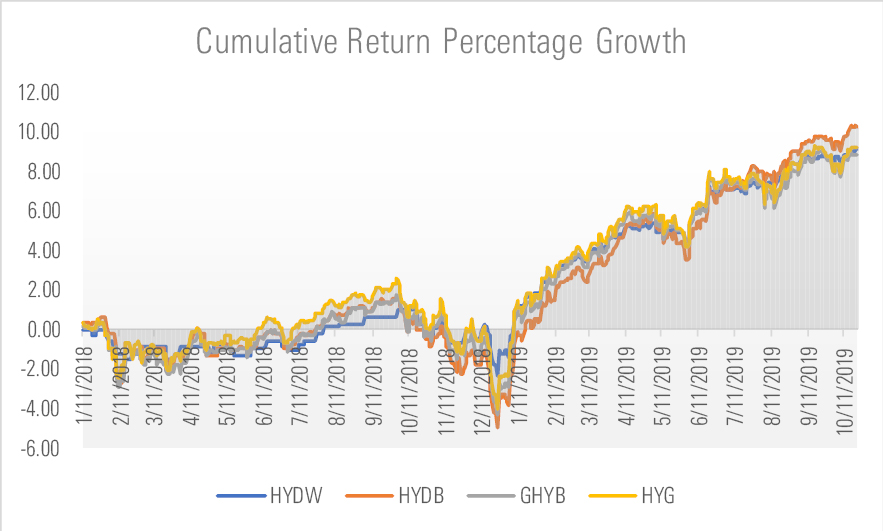

Performance All three funds are less than three years old. HYDB launched in July 2017, GHYB launched September 2017, and HYDW launched in January 2018.

Of these three funds, only HYDB delivered higher returns than iShares iBoxx $ High Yield Corporate Bond ETF HYG, which is not a surprise considering that their goal is to mitigate risk. As the chart below shows, all four funds have delivered similar returns since January 2018.

- source: Morningstar Analysts

Given that none of the funds are more than two years old, there is not enough monthly return data for a standard deviation calculation (and thus a Sharpe ratio calculation) to be statistically significant. It does bear noting, however, that HYDW’s maximum drawdown since inception was negative 2.07%, which is less than half of the maximum drawdown experienced by HYG (negative 4.34%), and 93 basis points better than the Bloomberg Barclays US Corporate Bond Market Index (negative 2.99%), the Corporate Bond category index. HYDB had the most severe maximum drawdown, with negative 4.84%, while GHYB’s worst period saw it return negative 4.08%.

Conclusion Risk and reward are highly correlated in the fixed-income market. However, this relationship is not perfect. Debt rated below investment grade does not always offer yields commiserate with its risk. The three funds discussed in this article each take different approaches to mitigating the risk of investing in the high-yield corporate-bond market.

Xtrackers Low Beta High Yield Bond ETF HYDW trusts the market implicitly, relying on the pricing of these bonds to identify the riskiest issuers, which are screened out. HYDB and GHYB both incorporate an analysis of an issuer's ability to service its debt in its screening process.

Both HYDW and GHYB employ market-value-weighted strategies, while HYDB utilizes an optimizer. Accordingly, the performance results of HYDW and GHYB should more closely mirror the performance a traditional market-value-weighted aggregate high-yield bond market, although they should provide better downside protection.

While all three funds effectively dial down credit risk, HYDW is probably the best choice to deliver better risk-adjusted performance than HYG over the long term. The fund is the most conservative in its screening process, filtering out the highest-yielding half of the junk-bond market, and it should hold up the best during market downturns as a result. It is also the cheapest, which is always an important predictor of future success.

/s3.amazonaws.com/arc-authors/morningstar/30aa6d58-cc92-46c5-8789-50161dc392a9.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/T2LGZCEHBZBJJPPKHO7Y4EEKSM.png)

/d10o6nnig0wrdw.cloudfront.net/04-18-2024/t_34ccafe52c7c46979f1073e515ef92d4_name_file_960x540_1600_v4_.jpg)

/d10o6nnig0wrdw.cloudfront.net/04-09-2024/t_e87d9a06e6904d6f97765a0784117913_name_file_960x540_1600_v4_.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/30aa6d58-cc92-46c5-8789-50161dc392a9.jpg)