Templeton Global Bond’s Flexibility Sets it Apart

This strategy’s freewheeling style makes it a better fit in the nontraditional bond Morningstar Category.

On Sept. 30, 2019, we moved Templeton Global Bond TGBAX, Templeton Global Total Return TTRZX, and Templeton International Bond FIBZX to the nontraditional bond Morningstar Category. These benchmark-agnostic strategies employ bolder tactical calls on duration, currency, and emerging-markets exposures than most funds in the world bond category, which makes them a better fit for the nontraditional bond peer group.

The strategies had resided in the world bond category for more than a decade given their focus on non-U.S. sovereign bonds and small inclusion of non-U.S. corporates in the case of Templeton Global Total Return. Morningstar’s world bond category is home to predominantly investment-grade portfolios that invest 40% or more of their assets in bonds issued outside the United States, the most conservative of which focus on high-quality, developed-markets debt. Many of these are run in a nearly 100% unhedged fashion versus a global bond index such as the Bloomberg Barclays Global Aggregate Index, giving investors exposure to the underlying currencies.

The Templeton strategies always sat on the more-adventurous side of the group. Their benchmark-agnostic style allowed the portfolios to hold larger stakes in lower-quality emerging-markets sovereigns and make significant active currency bets. Over the past five years, manager Michael Hasenstab has been showing increased flexibility by increasing the focus on emerging-markets debt and taking the portfolios’ duration into negative territory. This has caused the differences between these strategies and the world bond peer group to widen over time.

An Assortment With Some Common Threads Given this increasingly flexible approach, the strategies are a better fit in the nontraditional bond category, which houses strategies that have few or limited constraints on exposure to credit, sectors, currency, or interest-rate sensitivity. Funds in this group typically have the flexibility to manage duration exposure over a wide range of years and to take it to zero or a negative value. Nontraditional bond funds also have the ability to use a broad range of derivatives to take long and short market and security-level positions.

While the Templeton Global Bond suite has a narrower focus than some of these funds given that it mainly targets government debt, it does look similar to these funds in that it has broad freedom to manage interest-rate sensitivity, including the ability to take duration negative. These strategies are also similar in their ability to use fixed-income derivatives to a significant level within their portfolios.

The nontraditional bond category is also home to strategies that attempt to minimize interest-rate volatility but explicitly court significant credit risk in order to generate high returns. Others aim to produce returns uncorrelated with the overall bond market. Here, too, the Templeton strategies have some similarities because Hasenstab’s investment philosophy seeks to avoid the low- or negative-yielding debt that dominates many global bond indexes. They focus instead on higher-yielding emerging-markets bonds, while aiming to protect against losses in interest-rate-driven sell-offs.

Templeton Global Bond's Increasing Flexibility For years, Hasenstab has focused on short-dated sovereign debt which kept the strategies' durations well short of the typical world bond fund's. But his decision to increase the short on U.S. Treasuries, which in the team's view is meant to counteract inflation surprises, has made the portfolios' overall duration posture strikingly different than most rivals. Templeton Global Bond, Templeton Global Total Return, and Templeton International Bond sported durations ranging from negative 1.3 years to negative 2.8 years as of September 2019. Flagship strategy Templeton Global Bond has expressed the most extreme positioning: Its duration dipped slightly negative at times in 2015 and 2016 but was increasingly negative since August 2017 and peaked at negative 2.8 years in July 2019. This view hasn't been as pronounced in Global Total Return or International Bond, but those strategies' durations have been negative since April 2018 and fell into negative territory at other times since 2016.

By contrast, no other world bond funds sported negative durations this year, and the typical level for the cohort clocked in at around six years as of September 2019. The Templeton funds also stand out among the negative-duration cohort in the nontraditional bond category. Ten other strategies in the nontraditional bond category had negative durations (roughly one fifth of the strategies that reported duration to Morningstar) in September.

The outsize emerging-markets stake and freewheeling currency strategy also sets the Templeton strategies meaningfully apart from other funds in the world bond category. For the past several years, the funds’ key positions have been in emerging-markets local-currency debt, notably Brazil, Mexico, Indonesia, and India since 2015. These positions have often accounted for more than half of the fund’s bond exposure, and three fourths to four fifths of its currency exposure. World bond funds with heavier allocations to emerging-markets local debt have typically allocated no more than one third of assets to such fare and are notably less exposed to emerging-markets currency volatility.

The team’s decisions to short currencies tend to be very long-term in nature, but other world bond managers generally don’t engage in active foreign-currency management on this scale. For more than a decade, the strategies have maintained a significant short (30%-40% of overall foreign-currency exposure) to the euro, due in part to the team’s view that the European Central Bank would have to maintain quantitative easing for longer than the U.S. The strategies had a similarly sized short on the yen until May 2019 when Hasenstab started moving to a long position to provide insulation in the event of a risk-off environment. (Templeton Global Bond sported a 41% long yen position as of September 2019). Hasenstab has also routinely had shorts (5%-20%) in other currencies, including the Australian and New Zealand dollar. Some world bond managers do not short currencies, and those who do typically limit individual currency shorts to low- to mid-single-digit positions.

Corralling the Uncorrelated The world bond category description does not contain inclusion requirements based on duration, developed- versus emerging-markets status, or foreign-currency management. This is intentional, as the category is meant to serve as a home to a fairly broad array of strategies which share a common goal of global bond investing. (In practice, though, a portfolio that routinely invested more than roughly two thirds of its assets in emerging-markets debt would land in one of the emerging-markets bond categories; a portfolio with more than one third of assets in below-investment-grade fare would likely qualify for the multisector bond category.)

Rather than specify such requirements, we exercise judgment with an eye toward reclassifying funds that are clear outliers based on their portfolio attributes. In addition, we examine the funds’ correlation to the peer group itself, focusing attention on those whose performance diverges meaningfully from the category average as well as relevant indexes.

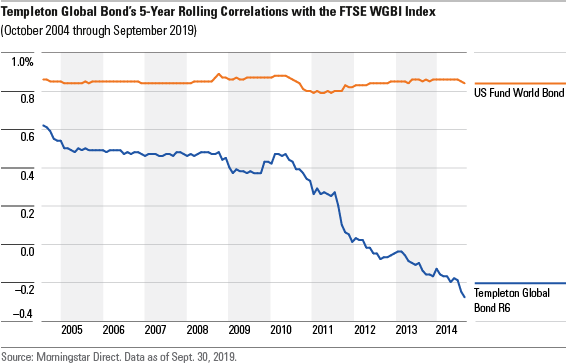

Over time, the Templeton strategies’ returns have become increasingly uncorrelated with the average world bond fund’s returns, reflecting the team’s divergent approach. The graph below shows the strategy’s and the average world bond fund’s rolling five-year correlations with the FTSE WGBI Index over the past 15 years.

From 2004 through 2015, the Templeton Global Bond strategy exhibited some of the lowest rolling five-year correlations to the index before heading steadily lower and into negative territory as of May 2017, due in part to the short to negative duration stance. These funds also exhibit a 10-year correlation to the S&P that is more in line with the typical nontraditional bond peer, a reflection of their greater credit and/or currency risk.

These funds also exhibit a 10-year correlation to the S&P that is more in line with the typical nontraditional bond peer, a reflection of their greater credit and/or currency risk.

In the end, inclusion in the nontraditional bond category is informed by a balance of factors determined by Morningstar analysts. As we’ve observed changes to the Templeton strategies over the past several years, the stylistic differences at the root of this do not appear to be fleeting or immaterial. The Templeton strategies’ persistent differences from most world bond funds are congruent with the manager’s views and conviction and underpin our decision to move them to the nontraditional bond category.

/s3.amazonaws.com/arc-authors/morningstar/9117d33d-7edf-4c01-b517-49ddd5f2b25c.jpg)

/d10o6nnig0wrdw.cloudfront.net/04-25-2024/t_d30270f760794625a1e74b94c0d352af_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/DOXM5RLEKJHX5B6OIEWSUMX6X4.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZKOY2ZAHLJVJJMCLXHIVFME56M.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/9117d33d-7edf-4c01-b517-49ddd5f2b25c.jpg)