Our Enhanced Analyst Rating Is Easier to Understand and Use

We refocused the Morningstar Analyst Rating around its most predictive elements and gave fees even more weight.

We've made improvements to our Analyst Rating for funds that will make it easier to understand and use. Specifically, the enhanced rating will provide better guidance for investors choosing between active and indexed strategies, or deciding between different share classes of the same fund.

You will begin to see the new ratings on Morningstar.com beginning Oct. 31. We'll update the ratings for an initial batch of funds under the new framework, and then we'll update the ratings for the rest of the funds we cover on a rolling schedule over the next 12 months.

Greater Emphasis on Fees Under our new ratings system, price is given even more weight than it was before.

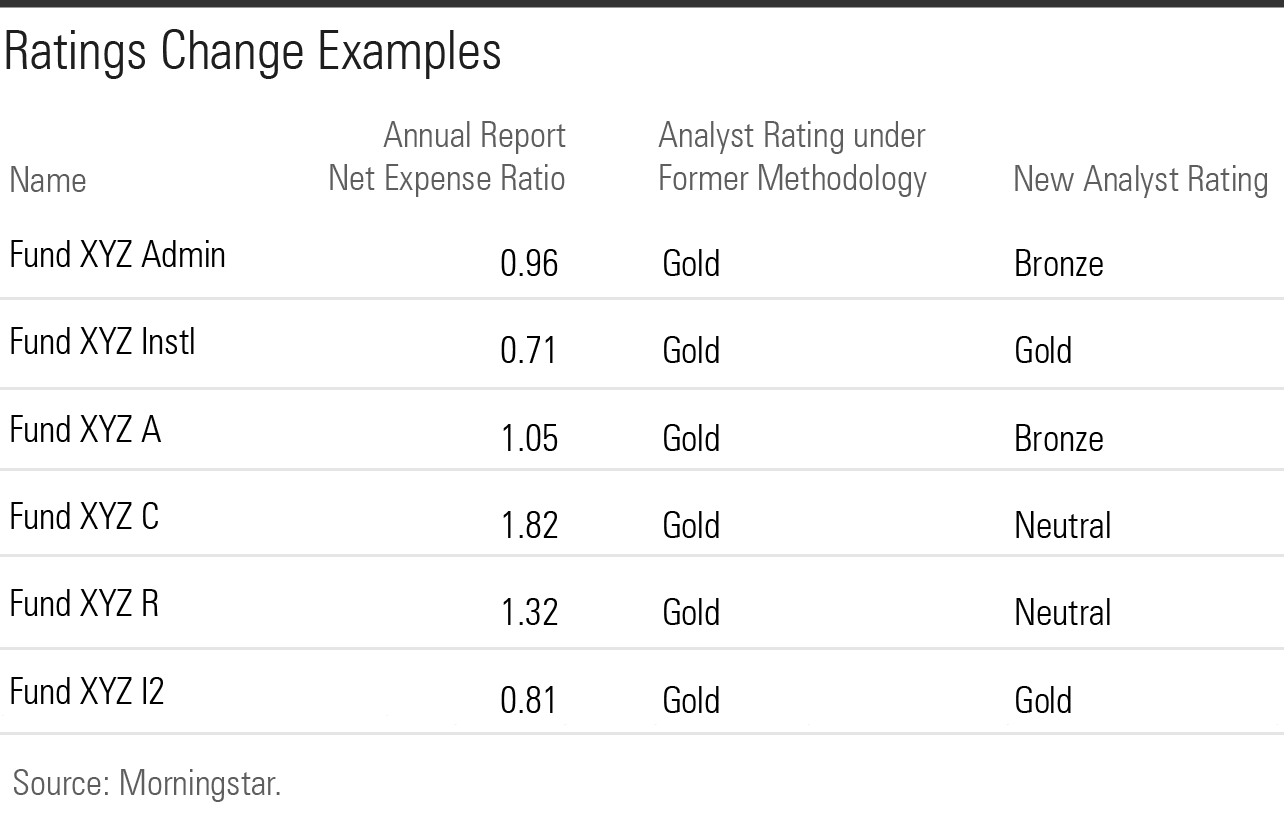

Most mutual funds have multiple share classes that charge different fees. We used to assign a Price rating based on a single, representative share class. Now we rate the price of each share class separately. As a result, when there is a wide range of fees charged among share classes, the Morningstar Medalist ratings for each share class of the same fund can vary. (The table below is for illustrative purposes only.)

Higher Bar for Active Funds We made it even tougher for an active fund to earn a Morningstar Medalist rating under our new rating system. The fund must demonstrate that it has the potential to add value relative to its category benchmark and its average peer after accounting for fees.

We've centered the new Analyst Rating around the three areas (or “Pillars”) of our analysis that are most predictive of future performance: Process, People, and Parent. Funds rated under our new fund rating system will display three pillars. (Eventually all funds under coverage will move to our new system, but during the transition some funds rated under our former method will continue to display five pillars.)

The two Pillars that were removed, Performance and Price, are still accounted for in our new rating. An analysis of performance will be incorporated into the Process, People, and Parent Pillars going forward, and price will now be evaluated at each share class level.

We also moved to a five-point scale from a three-point scale for scoring the Process, People, and Parent pillars: Low, Below Average, Average, Above Average, and High. This more-refined rating scale allows analysts to better emphasize the strength or weakness of a certain pillar and allows for finer-grained comparisons.

More Reading Introducing the Enhanced Morningstar Analyst Rating for Funds

Looking Forward to Changes to Our Forward-Looking Ratings

/s3.amazonaws.com/arc-authors/morningstar/3a6abec7-a233-42a7-bcb0-b2efd54d751d.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZKOY2ZAHLJVJJMCLXHIVFME56M.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/IGTBIPRO7NEEVJCDNBPNUYEKEY.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HDPMMDGUA5CUHI254MRUHYEFWU.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/3a6abec7-a233-42a7-bcb0-b2efd54d751d.jpg)