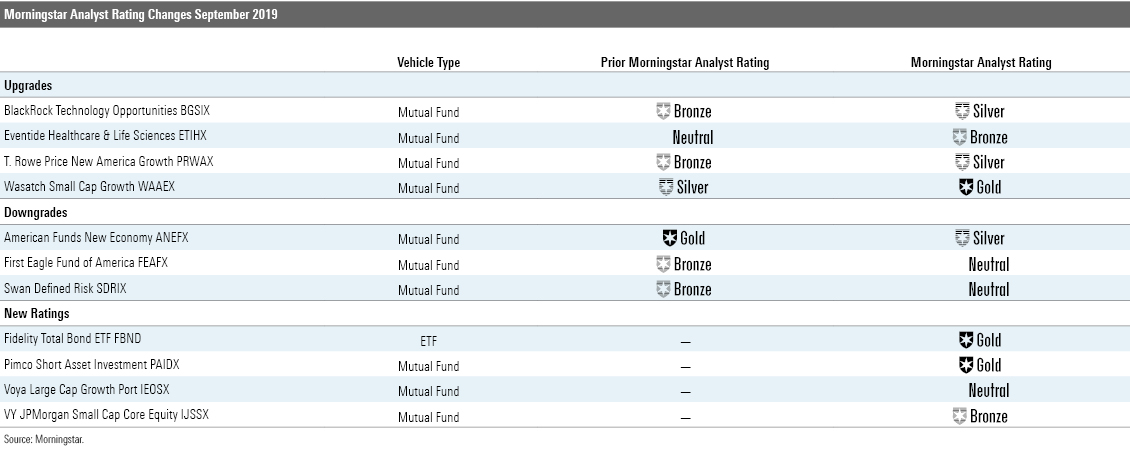

4 Upgrades, 3 Downgrades in September

Overall, 120 strategies were rated, four of which were new to coverage.

Overall, 120 strategies were rated, four of which were new to coverage.

In September, Morningstar manager research analysts affirmed the Morningstar Analyst Ratings of 109 strategies, including six separately managed accounts and one CIT. The ratings of four funds were upgraded, three were downgraded, and no funds were placed under review. A select group of ratings are showcased below, followed by the full list of ratings for the month.

Upgrades Wasatch Small Cap Growth's WAAEX lead manager, J.B. Taylor, has ably filled the shoes of a celebrated, longtime manager who retired in 2016. Taylor became comanager here in 2013 and lead manager in 2016 following the retirement of Jeff Cardon, who had run the fund since its 1986 inception. Two experienced comanagers support Taylor, and they leverage Wasatch's 33 managers and analysts, many of whom have spent their whole careers at the firm. The team's collaborative culture is a competitive advantage. Managers and analysts work together to identify profitable, well-run firms with market caps under $3 billion that can double their earnings in five years. They pay particularly close attention to company management. Each month, they rank the stewardship for all holdings to better monitor those that rank low. As was the case under Cardon, Taylor and team are willing to pay up for attractive growth rates and financial stability. The typical portfolio holding has above-average profitability and financial health metrics and a top-quintile forward price/earnings ratio relative to peers. Overall, its veteran leader and well-defined process led to a Morningstar Analyst Rating upgrade to Gold.

The team behind Eventide Healthcare & Life Sciences ETIHX is well-suited to guide this unique offering. It continues to execute well, warranting an upgrade of the strategy’s Morningstar Analyst Rating to Bronze from Neutral. Finny Kuruvilla has managed this strategy since its late 2012 inception. He has an impressive background, including a medical degree and a stint investing in healthcare startups. This experience provides him with the scientific and investing acumen needed to assess the emerging biotech stocks that dominate this portfolio. He collaborates with analyst Agustin Mohedas, who joined the team in early 2017. The team primarily targets small- and mid-cap biotech firms, which generally have no earnings and depend on the uncertain prospects of a handful of drugs in development. They may have groundbreaking discoveries, but with the potential for large gains comes the risk of sharp losses. Kuruvilla attempts to mitigate these risks by looking for firms with well-capitalized balance sheets, developing price targets after assessing a range of scenarios, and adjusting position sizes to reflect the level of certainty he has in its prospects. Kuruvilla has demonstrated clear investment skill, but investors shouldn't lose sight of risks here.

Downgrades Swan Defined Risk's SDRIX process lacks robustness over multiple scenarios, and its fees are losing their competitiveness relative to the options-based Morningstar Category, resulting in a downgrade of its Morningstar Analyst Rating to Neutral from Bronze. The strategy is designed to capture some upside of the equity market while mitigating drawdowns in deep and prolonged equity market sell-offs. While the strategy is likely to deliver in bear markets, it hasn't been as resilient in shallower market sell-offs as peers. Management's decision to sell short-term put options, in addition to short-term call options, to help cover the cost of the fund's long-term put option used to hedge the portfolio and generate excess returns leaves it vulnerable to spikes in market volatility. The fund's fees are losing their edge, too. Its institutionally distributed share class charges 1.27%, above the 1.14% median for similarly distributed peers.

American Funds New Economy’s ANEFX Morningstar Analyst Rating was dropped to Silver from Gold following the unexpected Sept. 9, 2019, departure of sleeve manager Mark Denning. American parent Capital Group’s multimanager system minimizes key-person risk but doesn’t remove it. As one of four named managers at the time he left, Denning commanded about 15% of this fund’s $21 billion asset base. Redeploying Denning’s assets won’t be a problem, but his loss hurts. In nearly four decades at the firm, he distinguished himself as a savvy, if aggressive, value-oriented manager whom more than one colleague singled out as uniquely skilled. Albeit within the large-growth Morningstar Category, this strategy has also lost some of its geographic balance. Assets had been split between two sleeve managers oriented toward non-U.S. stocks--London-based Denning and Hong Kong-based Harold La--and two U.S.-based sleeve managers with more of a domestic focus. In the wake of Denning’s departure, the firm publicly named San Francisco-based Caroline Jones to the team. She has been an analyst at Capital for 15 years and for the past 2.5 years has shown promise picking stocks across sectors in a relatively tiny sleeve of the fund.

New Ratings Pimco Short Asset Investment PAIDX benefits from the same high-caliber team and resources as its open-end sibling, Pimco Short-Term PTSHX, as well as a similarly strong, albeit more constrained, process focused on capital preservation. Cheaper fees here boost this fund's Morningstar Analyst Rating to Gold. The roster supporting Pimco's short-term strategies remains impressive. Pimco veteran Jerome Schneider has called the shots here since the strategy's launch in 2012. The core team supporting him is composed of seven specialists focused on areas including collateral and funding, credit, derivatives, and nondollar rates, while also tapping other sector and country specialists at the firm. The team has the expertise to employ a wider range of tactics than many of its ultrashort bond Morningstar Category competitors. But while that can translate to a bit more risk at Pimco Short-Term, Schneider follows a buttoned-up process here. Unlike its sibling, this strategy makes relatively limited use of derivatives and avoids high-yield corporate debt and non-U.S.-dollar currency exposure.

An experienced investor’s nondescript approach limits Voya Large Cap Growth Portfolio’s IEOHX ability to outperform its benchmark, meriting a Morningstar Analyst Rating of Neutral. Voya veteran Jeff Bianchi became lead manager in June 2010, but the underlying team has seen changes. In the past two years, the 11-person growth team lost two tech analysts, one of whom was a 28-year industry veteran. As tech names absorb over a third of the Russell 1000 Growth Index, these departures stung. To fill the void, Bianchi recruited Kristy Finnegan as a comanager and tech analyst. Finnegan spent the past four years comanaging Voya’s value strategies, a curious fit given her previous eight-year tenure contributing tech and consumer picks to Bianchi’s growth strategies. Despite the comanager addition, the straightforward approach hasn’t changed. Bianchi combines quantitative screening and fundamental analysis to build a concentrated version of the Russell 1000 Growth Index. The team uses a sector-specific scoring system to rank stocks. Bianchi’s benchmark-sensitive tack informs his strict sell discipline, as he seeks to mitigate risk by keeping sector weightings within 3 percentage points of the bogy. Still, this approach has generated high portfolio turnover and mediocre returns.

/s3.amazonaws.com/arc-authors/morningstar/d40a2fd9-48c7-4b1b-9f14-4a62f5f471bf.jpg)

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/OMVK3XQEVFDRHGPHSQPIBDENQE.jpg)