Where Are the Economies of Scale?

Morningstar’s global study demonstrates that when funds become bigger, they don't necessarily become cheaper.

Price Wars Periodically, Morningstar publishes a study entitled Global Investor Experience, which evaluates the quality of the world's mutual fund marketplaces. The latest version of the report, published last month, measures fund costs. It shows that economies of scale aren't dependable. Fund companies consistently benefit from gaining new assets, but for investors, the advantages are hit or miss.

The GIE study estimates the ongoing cost paid by mutual fund investors in 26 countries, by calculating the median asset-weighted expense ratio for the funds that they own. The study does not include exchange-traded funds, which reduces its ability to assess the entire investor experience, but which improves its usefulness for this article. The cost comparison will be apples to apples, as the cliche goes.

That said, another feature does reduce comparability. In some countries, mutual funds pay financial advisors for their services, by charging "trail fees" to shareholders that are then handed over to the advisors (and/or their employers). In other places, such as Australia, the Netherlands, and the United Kingdom, such payments are banned. Because advisors in those countries charge separately for their services, their mutual funds tend to have lower expense ratios.

Also, the GIE report does not account for entry and exit fees--what in the U.S. are called "front-end" and "deferred" loads. Such charges are becoming less popular, and do not greatly harm long-term shareholders, but nevertheless their omission also damages comparability. Neither the effects of sales charges nor those of trail fees are large enough to prevent the analysis of how economies of scale influence (or do not influence) fund costs, but they must be considered in the analysis.

A final complication is that in most countries, investors can buy both offshore and local funds. They cannot in the United States, as American investors are restricted to U.S.-domiciled offerings (unless they are wealthy enough to qualify as accredited buyers). Throughout Europe, though, shareholders may hold either their own country's investments or funds based in offshore locations such as Luxembourg or Ireland.

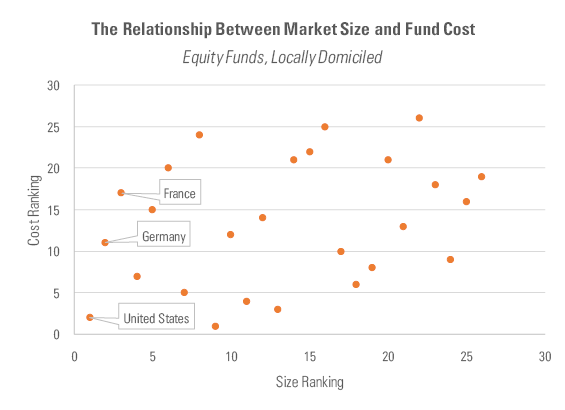

A Fuzzy Pattern To make those waters clearer, this column looks only at the results for locally based funds. The graph below plots the size ranking for each country (with 1 being the highest) against its cost ranking, as measured by the median cost paid by investors in its equity mutual funds.

Sources: Morningstar Direct, Investment Company Institute

The U.S. is the largest mutual fund marketplace, while offering the second-cheapest equity funds. Germany comes next in size; its equity mutual funds are the 11th cheapest. France is third largest, with a cost ranking of 17. As suggested by those examples, there is indeed a positive relationship between market size and low cost. Among the largest 50% of mutual fund marketplaces, only Canada rates among the five most expensive. Conversely, none of the smallest 50% are among the five cheapest. Some economies of scale do exist.

However, the association is tenuous. Yes, the dots drift upward as one moves to the right, thereby indicating that smaller marketplaces tend to be pricier, but the penchant is moderate. (The official correlation is 0.30.) At first glance, it would be easy to conclude that there is no pattern at all.

Worse Yet That was the strong case that scale leads to lower costs. Fixed-income funds provide the weak case--actually, the nonexistent case. The five cheapest countries for bond mutual funds, again as measured by locally domiciled investments, are 1) Switzerland, 2) Norway, 3) Sweden, 4) Spain, and 5) Korea. None of those marketplaces place among the globe's 10 largest. Conversely, Japan ranks fifth for size, but 25th on expenses. With bonds, bigger markets simply do not correlate with lower costs.

More remarkable, locally domiciled bond mutual funds are consistently cheaper--usually far cheaper--than their offshore rivals. They are bafflingly cheaper, given that offshore funds control so many more assets. For example, mutual funds based in Luxembourg and Ireland contain 50 times as many assets as Norwegian mutual funds, but their bond funds are 3 times pricier (as measured by what Norwegian investors own). That's a puzzle that can't be explained.

That pattern extends to equity and asset-allocation funds, too, albeit not quite as dramatically. In theory, offshore funds should be cheaper than local offerings because offshore funds can be sold anywhere. They are not restricted to a single, smaller marketplace. In practice, it rarely works that way. Across countries, across asset classes, local funds are almost always the cheaper of the two alternatives.

Don't Count On It To an extent, this finding owes to distribution decisions. For example, if the country's direct investors--who typically are cost-conscious--tend to invest locally, while its advisors use offshore funds, then the assets in local funds would have lower median expense ratios, all things being equal. However, distribution effects cannot account for the full discrepancy. No matter how one adjusts the data for marketplace differences, the conclusion remains: Economies of scale are elusive.

The evidence from the GIE report confirms the U.S. experience. Despite the industry's enormous growth, mutual fund costs have mostly risen rather than fallen. For example, the nation's oldest mutual fund, MFS Massachusetts Investors Trust MITTX, carries an annual expense ratio of 0.71% today, as opposed to 0.19% in 1959. True, the fund's front-end sales charge has been reduced, but for shareholders with a 10-year horizon, grandpa's version of the fund was cheaper--even though today's rendition is plenty large, at almost $6 billion in assets.

Forty years ago, the SEC approved a new mutual fund fee under Rule 12b-1, which assumed that if investors paid higher expenses to help a fund attract additional assets, that the fund eventually would return the favor by lowering its overall expenses. Shareholders fulfilled their share of the bargain, but fund companies did not return the favor. Such, it seems, has been the behavior worldwide.

John Rekenthaler has been researching the fund industry since 1988. He is now a columnist for Morningstar.com and a member of Morningstar's investment research department. John is quick to point out that while Morningstar typically agrees with the views of the Rekenthaler Report, his views are his own.

The opinions expressed here are the author’s. Morningstar values diversity of thought and publishes a broad range of viewpoints.

/s3.amazonaws.com/arc-authors/morningstar/1aafbfcc-e9cb-40cc-afaa-43cada43a932.jpg)

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/OMVK3XQEVFDRHGPHSQPIBDENQE.jpg)

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/WJS7WXEWB5GVXMAD4CEAM5FE4A.png)