33 Undervalued Stocks

Here are our analysts’ top ideas in each sector at the third quarter’s end.

For the new list of Morningstar’s top analyst picks, read our latest edition of ”33 Undervalued Stocks.”

U.S.-China trade tensions, worries about slowing global growth, and impeachment talk limited the S&P 500′s return to just above 1% during the third quarter. The index is up about 19% for the year.

Not surprisingly, we think stocks are about fairly valued today: The median stock in our North American coverage universe traded at a 2% discount to our fair value estimate at quarter's end.

However, the share of 4- or 5-star stocks slightly edges out 1- or 2-star stocks: 30% versus 27%, observes Dan Rohr, Morningstar's director of global equity research, in his quarter-end outlook.

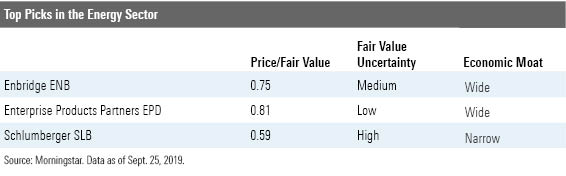

In particular, the energy sector remains compelling, while utilities are still overpriced. Here are some undervalued stocks across sectors that are among our analysts' best ideas.

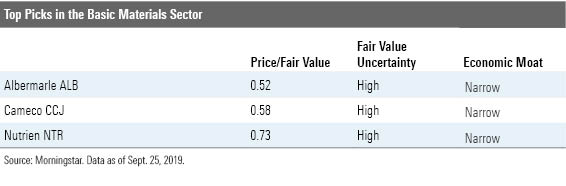

Basic Materials Escalating trade tensions have continued to weigh on valuations in the basic materials sector: Nearly 30% of our materials sector coverage now trades in the 4- and 5-star range, notes director Kris Inton. We see opportunities in agriculture, uranium, and lithium.

Heavy rains have led to the lowest total U.S. acres planted in more than a decade, which will likely lead to lower volumes for seeds, crop chemicals, and fertilizers in 2019, explains Inton. We expect a full recovery in demand in 2020. The market-implied price of uranium stocks suggests little recovery; we, meanwhile, expect production discipline will lift prices. And we remain relatively bullish on lithium.

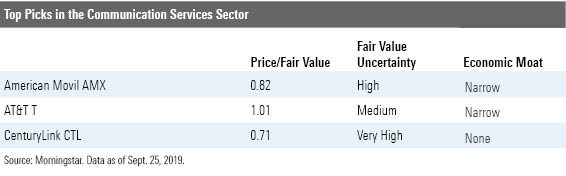

Communication Services The communication-services sector put up strong numbers last quarter, gaining about 9%. "Market sentiment around AT&T T has gradually improved during 2019, helped by falling interest rates, but the shares received an additional lift on the involvement of activist hedge fund Elliott Management," reports director Mike Hodel.

Wireless tower stocks have done well this year, too--also likely fueled by falling rates, says Hodel. Though secular trends are working in favor of towers, we think that, as a group, they're overpriced today.

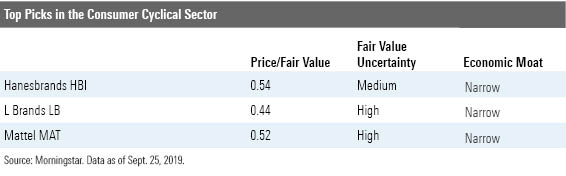

Consumer Cyclical The sector slipped about 3% for the quarter, thanks to tariff concerns and increased volatility in international markets, says senior analyst Dan Wasiolek. However, discounts in the sector are plentiful: About 40% of the stocks we cover are undervalued according to our metrics. Travel and leisure stocks are among the most discounted.

Increasingly dominant online players like Amazon.com AMZN threaten many companies in the sector. "That said, we believe the growing allowance for third-party sellers on leading e-commerce consumer platforms can be an opportunity rather than a hindrance to some consumer cyclical firms, especially as e-commerce as a percentage of retail sales continues to grow," argues Wasiolek.

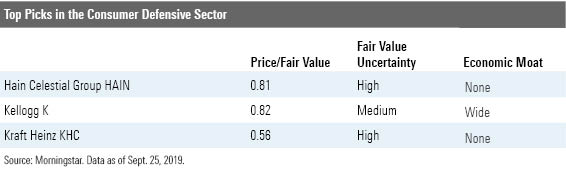

Consumer Defensive The sector thrived last quarter, notching a 5% gain; just 22% of the names in our coverage universe are undervalued today, says director Erin Lash. Defensive retail names and nonalcoholic beverage makers are especially rich, with the median stock in those industries trading at a 26% and 17% premium to our fair value estimates, respectively.

The consumer packaged goods industry in particular has benefited from the ongoing trend toward health consciousness, explains Lash. To keep new competitors at bay, we expect research and development and marketing and advertising to increase across the sector.

Energy Energy stocks slipped last quarter more than the overall market. The median stock in our coverage universe trades at a 17% discount to fair value, making energy the cheapest sector, says director Jeffrey Stafford. Oilfield-services stocks look particularly attractive, he adds, trading at levels we haven't seen in a while.

The attack on Saudi Arabia's Abqaiq oil facility last month led to a spike in oil prices, which have since settled down. "We would urge investors to continue to focus on the long term and not get too caught up in the near-term fluctuations that may come as more details on the Saudi situation come to light," says Stafford.

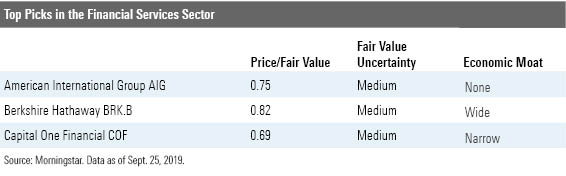

Financial Services The median U.S.-based financial-services stock in our coverage universe trades at a modest 2% discount to our fair value estimate. Financials stocks have recovered from the start of the year, and the most undervalued names today carry higher economic sensitivity, observes director Michael Wong.

"Whereas over the previous year we've had times where whole financial industry groups were undervalued, we believe investors should now be much choosier," warns Wong. "Most of the undervalued financial stocks in North America either have company-specific issues that we believe the market isn't appropriately pricing or are more economically sensitive names. While there are near-term risks to the companies we currently regard as undervalued, they also have the greatest probability of long-term outperformance."

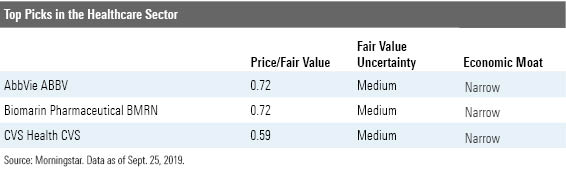

Healthcare Political uncertainty continues to weigh on healthcare stocks, which underperformed the broad market during the third quarter. The sector is about 4% undervalued according to our metrics, relays director Damien Conover, and more than a third of our coverage universe carries 4- or 5-star ratings.

The healthcare provider, managed-care organization, drug, and biotech industries are especially bargain-filled. We think the market is overly concerned about potential regulatory changes to pricing in the healthcare provider industry; in managed care, we don't see universal healthcare coverage as likely. And in the drug and biotech space, we expect drug development in the areas of unmet medical need will continue to support strong pricing, emphasizes Conover.

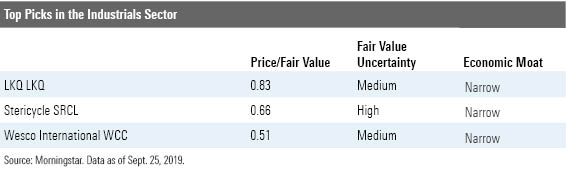

Industrials The industrials sector remains reasonably healthy, posits director Keith Schoonmaker, despite prospects of a global economic slowdown. Tariffs are a minor obstacle for most diversified industrials, he continues.

The industrials sector is about fairly valued according to our metrics, but there are pockets of opportunity, particularly among industrial distributors; most of these are trading at 4- and 5-star levels. While these firms serve cyclical end markets, they also generate free cash flow throughout the business cycle. "In fact, when end market demand slows, industrial distributors tend to generate outsize free cash flow as these working-capital-intensive firms pull back on inventory spending," he stresses. "Distributors can use this excess cash during an economic downturn to return cash to shareholders, make acquisitions at depressed multiples, or reinvest in longer-term organic growth opportunities."

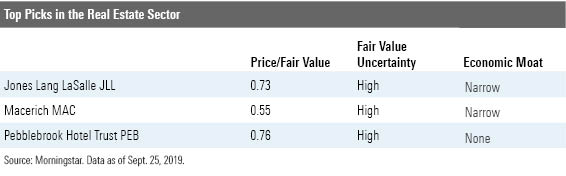

Real Estate Real estate was among the best-performing sectors last quarter: Falling interest rates have made the high dividend payouts of REITs more attractive. The median stock in our coverage universe trades about 4% below our fair value at the end of the quarter. Opportunities are most plentiful among mall and hotel REITs, reports analyst Kevin Brown.

Of course, the high dividend yields of REITs make them interest-rate-sensitive: Brown notes that as rates have fallen almost 180 basis points since November 2018, real estate firms have outperformed by out 13%. But during times of rate stability, the relative performance of real estate stocks often reverts to the mean, reminds Brown. Recent outperformance may be given back during that time.

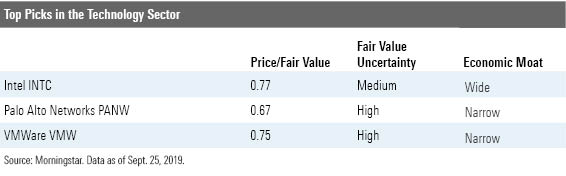

Technology After a solid first quarter, tech stocks have experienced choppiness ever since. Trade concerns continue to dog the sector. "We continue to believe that a highly interwoven tech supply chain will still be quite difficult for the U.S. and China to unwind," explains director Brian Colello. "In turn, our valuations assume a deal (and resumption of sales into Huawei) at some point."

The median technology stock is trading about 3% below our fair value, with about a fourth of the sector undervalued by our metrics. Buying opportunities are most prevalent in software and online media. Colello contends that the single most important trend in tech remains the shift toward cloud computing, which has a significant impact on many of the companies we cover.

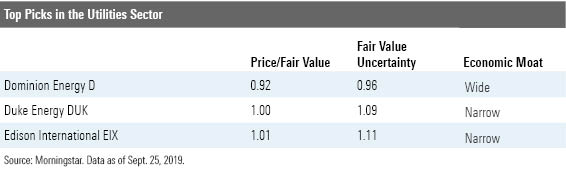

Utilities The median utility under Morningstar coverage is about 15% overvalued today. That's not really surprising, says strategist Travis Miller. The sector has been on a tear, outperforming the broad market this year. "Falling rates mean ample cheap capital for a sector that has the second-largest debt appetite behind financials," he notes. "Nearly all U.S. utilities have good three-year growth prospects, secure dividends, and sound balance sheets." And if rates continue to fall, the rally could persist.

That being said, prices look rich, and we urge caution. High valuations erode some of the sector’s typical defensive benefits if the economy turns, explains Miller, and energy efficiency and customer rate cuts may be headwinds.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/35408bfa-dc38-4ae5-81e8-b11e52d70005.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/I53I52PGOBAHLOFRMZXFRK5HDA.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/CEWZOFDBCVCIPJZDCUJLTQLFXA.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/TQKIUI6SDRCQFMUBSWCMD7OKPI.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/35408bfa-dc38-4ae5-81e8-b11e52d70005.jpg)