Our 2019 Rankings of 11 Top HSA Providers

Fidelity emerges as a clear winner in our checkup on health savings accounts.

Editor's note: We have published new research and enhanced our methodology. Read our evaluation of the best HSA providers of 2022.

This article has been updated due to an error regarding Fifth Third for investors. The new ratings are shown below.

Health savings accounts, or HSAs, continue to grow rapidly and have reached more than $60 billion in assets, nearly a 10-fold increase over the past decade. But choosing an HSA is challenging given the industry's young, opaque, and frequently changing nature. What's more, investors have limited resources available to help them navigate the hundreds of HSAs that exist. For these reasons, we released our first-ever evaluation of HSAs in June 2017 and published an updated evaluation in November 2018. We build upon that earlier research in this paper, which evaluates and ranks 11 of the largest HSA providers available to individuals and articulates what we consider best industry practices. Our evaluations identify which HSAs we believe represent the best choices for individuals as opposed to employers, where fees are often negotiable based on a number of factors.

We evaluated the providers assuming two distinct use cases: HSAs as a spending account to cover current medical costs, and HSAs as an investment account to save for future medical expenses. Overall, providers have improved on multiple fronts, so we have raised the standards in our evaluation process to help investors identify the top picks in this evolving space. Still, there's plenty of room for continued progress. Only one provider earns positive marks across the board as a spending account, and none meet that standard as an investing account. Fees vary significantly across providers, and most require individuals to keep money in the checking account before they can invest. Moreover, transparency remains subpar, as most providers' websites fail to disclose all the relevant information needed to select a provider.

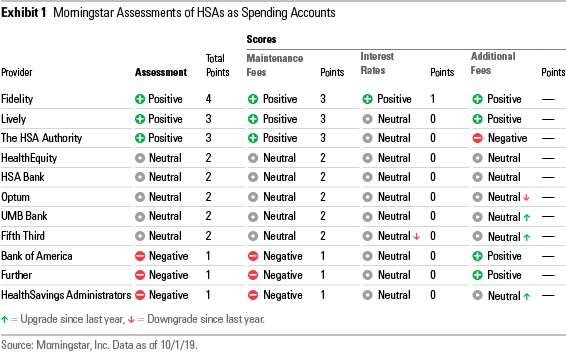

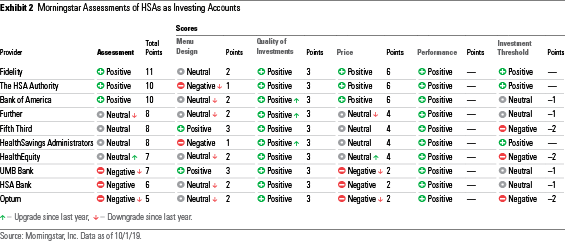

Our assessments are shown below.

In summary, Fidelity, a new entrant to the individual HSA space, is the best HSA provider for both spenders and investors. For HSA spenders, Lively represents the second-best choice. For HSA investors, The HSA Authority and Bank of America are the next best picks. Besides Fidelity, The HSA Authority is the only other provider that we recommend to both spenders and investors.

Exhibit 1 shows Fidelity wins by a landslide in our HSA assessments for spending accounts. Fidelity does not charge maintenance fees, offers much higher interest rates on deposits than competitors, and doesn't have any additional fees. Lively comes in second place; it does not charge maintenance fees or additional fees and offers reasonable interest rates that rank as the third-highest among the group. The HSA Authority comes in third place because it does not charge a maintenance fee, although it has a lot of additional fees (18 in total) and a lower interest rate than competitors.

Our HSA assessments for investors are shown in Exhibit 2, where Fidelity again represents the best choice. It has strong investment options, allows first-dollar investing, and charges rock-bottom fees that no other provider can compete with. For instance, an HSA investor can buy a passive 60/40 portfolio at Fidelity for an all-in cost of 0.02%, compared with 0.29% at the second-cheapest provider and 0.69% at the most expensive provider. The HSA Authority and Bank of America represent the next best picks for investors. Both have good investments and cheaper fees than peers. That said, Bank of America requires investors to keep $1,000 in their checking account before they can invest, creating an opportunity cost, and The HSA Authority should clean up its investment menu--which has too much overlap in strategies--to make it more easily navigable.

Other Key Takeaways from the Report

Best Practices

- HSAs used as spending accounts should avoid account maintenance fees, limit additional fees, offer reasonable interest on deposits, and provide FDIC insurance.

- HSAs used as investing accounts should charge low fees for both active and passive strategies, offer strong investment strategies in all core asset classes, limit overlap among investment options, and avoid investment thresholds that require investors to keep money in the checking account before they can invest.

Upgrades

- HealthEquity's Investing Account Assessment increased to Neutral, because it waives maintenance fees earlier than most competitors that charge them, and it trimmed expenses during the past year.

Downgrades

- We downgraded UMB Bank's and Optum's Investing Account Assessments to Negative because their fees look increasingly unattractive versus competitors that are cutting expenses.

- We downgraded Further's Investing Account Assessment to Neutral because its FDIC-insured offering carries a fee that about matches the norm.

Signs of Industry Progress

- Fees have decreased. Several providers have cut fees, new entrant Fidelity offers its HSA free of maintenance and investment fees (the only provider from our evaluations to do so), and Lively (a new addition to our report) doesn't charge a maintenance fee.

- The quality of investments across HSA providers remains strong and improved for the second year in a row. At each of the 10 providers we evaluated, at least 80% of the investment options to which we assign Morningstar Analyst Ratings earn Morningstar Medals of Gold, Silver, or Bronze.

Room for Industry Improvement

- Each provider that we evaluated has at least one shortcoming: None earns Positive marks across the board as an investing account, and only one earns positive marks on all measures as a spending account.

- Fees vary drastically across HSA providers and remain elevated. Across the 10 investment providers, the average cost for the cheapest passive 60/40 portfolio ranges from 0.02% to 0.69% per year.

- Although investment menu designs have improved since last year, overlapping investment options and hard-to-use niche strategies remain present in most HSA investment menus.

- Seven of the 10 investment providers require investors to keep $1,000 or $2,000 in a checking account before they can invest, which can create an opportunity cost.

- Yields on checking accounts remain depressed at all but one provider, ranging from 0.01% to 1.07%.

- Transparency remains poor. Only five of the 11 providers we evaluated disclose all the relevant information (such as maintenance fees and interest rates) on their websites.

How We Evaluated HSA Providers When evaluating HSAs used as spending accounts, we focused on three main components: maintenance fees, interest rates, and additional fees. In our view, maintenance fees represent the most important consideration when choosing an account for spenders, though in some cases yields have become material differentiators. Additional fees, such as excess contribution fees or paper statement fees, can add up but tend to be avoidable and relatively uncommon, which reduces their importance for our assessments.

We considered five components of HSA providers in assessing their merits as investment accounts: investment menu design, quality of investments, price, investment thresholds, and performance. Price receives the largest weighting because it's the most differentiating component among providers and is predictive of future results. Menu design and quality of investments receive smaller weightings than price; both are important to increase the likelihood of making a strong investment choice, though investors can find several good investment options at each provider we evaluated. Investment thresholds require investors to keep $1,000 or $2,000 in a checking account before they can invest. That creates opportunity costs for investors, so we prefer providers who allow first-dollar investing. Last, we assigned no weighting to performance, which is backward-looking and measures how well a provider's current underlying fund lineup has performed. Many providers make frequent changes to their lineups, which also makes this component less meaningful.

For each criterion, we assigned scores of Positive, Neutral, and Negative. We weighted each criterion differently based on its importance, assigning a point value to each and tallying it up at each provider to offer a more granular measure of our views and help rank providers relative to one another. More details about our methodology are available in our report.

/s3.amazonaws.com/arc-authors/morningstar/41940ba6-d0f1-493c-af96-52ad9419064e.jpg)

/s3.amazonaws.com/arc-authors/morningstar/532c09c7-c679-4cfa-bfb6-578ca1149ef7.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZKOY2ZAHLJVJJMCLXHIVFME56M.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/IGTBIPRO7NEEVJCDNBPNUYEKEY.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HDPMMDGUA5CUHI254MRUHYEFWU.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/41940ba6-d0f1-493c-af96-52ad9419064e.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/532c09c7-c679-4cfa-bfb6-578ca1149ef7.jpg)