Real Estate: Strong Performance as Investors Seek Income Amid Falling Rates

Opportunities in real estate live in the mall and hotel REITs.

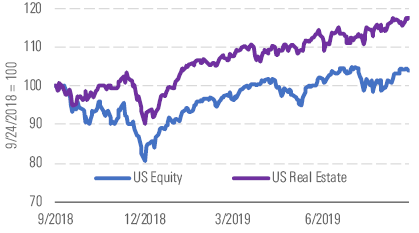

The Morningstar U.S. Real Estate Index is up 25% year to date as of Sept. 24 (Exhibit 1). Real estate was among the best performing sectors in the third quarter as growing economic concerns have led to declines in interest rates, which have made the defensive nature of long-term leases with tenants and the high dividend payouts of REITs more attractive to investors.

Real estate is up and has outperformed the U.S. Equity Index. - source: Morningstar

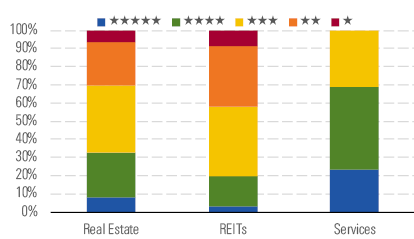

Our real estate coverage looks fairly valued. The median stock trades at a 4% discount to our estimate of intrinsic value. Nevertheless, there are pockets of opportunities, including in mall and hotel REITs, where 4-star and 5-star names can be found (Exhibit 2).

Sector has mostly 3-star names, but there are some bargains to be found. - source: Morningstar

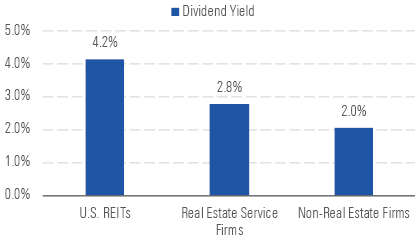

The average dividend for real estate firms is higher than the rest of our coverage (Exhibit 3). To receive tax-free status, REITs are required to pay out most of their net income as dividends to shareholders. These companies are frequently included in portfolios of income-oriented investors. As a result, the yields of REITs are often compared to government bond yields.

REITs have higher dividend yields than service firms and other sectors. - source: Morningstar

Their high dividend payouts make REITs sensitive to changes to interest rates. When the yields of risk-free government bonds fall, REIT yield spreads widen, prompting income-oriented investors to shift out of government bonds and into REITs.

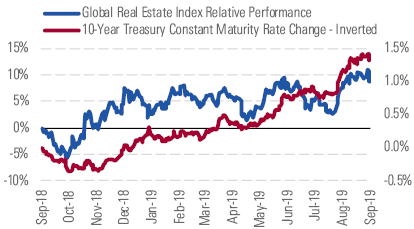

Movements in the 10-year U.S. government bond have corresponded with periods of real estate outperformance and underperformance. When the interest rate rose 40 basis points in September/October of 2018, real estate underperformed by 6%. However, with interest rates dropping almost 180 basis points since November 2018, real estate firms have outperformed by approximately 13%.

However, we caution that the relative performance of real estate often mean-reverts during periods of interest-rate stability, and the correlation with long-term outperformance isn't as strong. Therefore, we are cautious that much of the recent outperformance may be given back in the future.

Real estate relative performance has moved in line with interest rates. - source: Morningstar

Top Picks

Macerich MAC Economic Moat: Narrow Fair Value Estimate: $57 Fair Value Uncertainty: High Class A malls continue to outperform other forms of brick-and-mortar retail. Over the past 12 months, Macerich's tenants have produced 8.7% sales per square foot growth and occupancy costs dropped to 12.4%, the lowest point in six years. This has let Macerich continue to push double-digit re-leasing spreads. The stock has underperformed recently due to several tenant closures that will negatively affect cash flows in 2019. However, we view these as opportunities to redevelop the assets and replace out-of-favor tenants, which should yield significant returns over the next few years.

Pebblebrook Hotel Trust PEB Economic Moat: None Fair Value Estimate: $36.50 Fair Value Uncertainty: High Growth for hotels has steadily slowed over the past few years. Despite hotels reaching all-time highs in occupancies, operators have been unable to push prices as online travel agencies dramatically increase price discoverability for consumers. However, Pebblebrook has an opportunity to push net operating income growth higher than its peers over the next few years through expense-saving measures. It acquired LaSalle Hotel Trust, a company Pebblebrook's current CEO previously founded, in 2018 and management believes they know how to drive industry-leading margins out of the acquired portfolio.

Jones Lang LaSalle JLL Economic Moat: Narrow Fair Value Estimate: $185 Fair Value Uncertainty: High Narrow-moat Jones Lang LaSalle continues to take share from smaller brokers amid consolidation in the commercial real estate services industry. Although the market seems concerned about how JLL might fare in a cyclical downturn, we think its expansion into the more stable facilities management business insulates it somewhat. We also think investors are attaching an unnecessary valuation premium to CBRE due to its larger size. Although we forecast slightly better growth and margin figures for CBRE, we think both firms are similarly positioned to compete for contracts.

/s3.amazonaws.com/arc-authors/morningstar/b9459b20-3908-4448-a36c-b728946ddbe5.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZM7IGM4RQNFBVBVUJJ55EKHZOU.jpg)

/d10o6nnig0wrdw.cloudfront.net/04-22-2024/t_d910b80e854840d1a85bd7c01c1e0aed_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/K36BSDXY2RAXNMH6G5XT7YIXMU.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/b9459b20-3908-4448-a36c-b728946ddbe5.jpg)