Communication Services: Sector Continues to Outperform

We see little strategic reason for AT&T to combine wireless and media businesses.

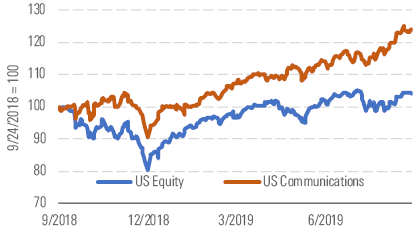

The Morningstar U.S. Communications Services Index (Exhibit 1) continues to handily outperform the broader market, gaining nearly 9% over the past three months. Traditional phone companies AT&T T and Verizon VZ, along with cable giant Comcast CMCSA, dominate the index and largely dictate its direction. All three stocks have performed well recently, but AT&T has been the standout. Market sentiment around AT&T has gradually improved during 2019, helped by falling interest rates, but the shares received an additional lift on the involvement of activist hedge fund Elliott Management.

AT&T, Comcast, and American Tower have driven telecom outperformance. - source: Morningstar

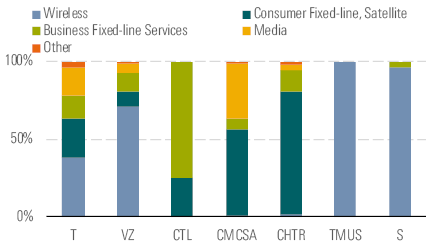

Elliott’s criticism of AT&T nicely highlighted a key risk facing telecom investors: the misallocation of capital. Telecom carriers typically generate strong cash flow and enjoy ample access to the debt markets, creating the temptation to buy assets and other companies. AT&T has been a particularly egregious offender in recent years, in our view, overpaying for acquisitions. Five years ago, Verizon and AT&T’s business mixes looked similar, but as Exhibit 3 shows, the firms have diverged since. AT&T holds strong wireless and media businesses, reflected in our narrow moat rating for the firm, but we see little strategic reason to combine these operations. Both businesses face downside risks amid major industry changes that could become more pressing if management is distracted with grand integration plans. We don’t expect Elliott will force major change at AT&T in the near term, and with the run in its price, we now believe the stock is fairly valued.

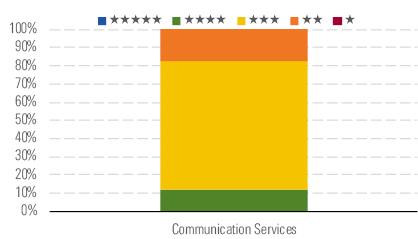

Most of the U.S. telecom sector remains fairly valued or worse. - source: Morningstar

AT&T has significantly diversified relative to most other carriers. - source: Morningstar

Comcast has also pushed into media over the past decade, but it paid an attractive price to take NBC from General Electric GE and infused it with veteran leadership and a willingness to invest in content. These factors, rather than a combination of media and telecom businesses, has allowed Comcast to create value, in our view.

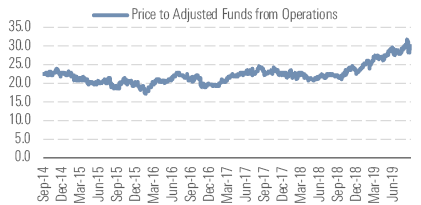

Wireless tower stocks have had a remarkable run in 2019, also likely fueled in part by falling rates, and American Tower AMT has been the third-biggest contributor to the index’s performance during the year. Although we believe secular tailwinds make business prospects good for towers, we find it nearly impossible to justify valuations. At current levels, American Tower trades at around 30 times adjusted funds from operations, a steep premium versus an average of about 22 times over the past five years (Exhibit 4).

American Tower, and its peers, have seen valuations skyrocket. - source: Morningstar

Top Picks

AT&T T Economic Moat: Narrow Fair Value Estimate: $37 Fair Value Uncertainty: Medium We've long disliked AT&T's capital-allocation decisions, but we believe pressure is on management to execute around existing assets rather than pursue additional costly acquisitions. The presence of activist investor Elliott Management should also keep management focused on shareholder value. We believe that the wireless and media businesses remain well positioned competitively and will produce stable cash flow for years to come, enabling the firm to continue repaying debt while also buying back modest amounts of stock. While no longer undervalued, in our view, the shares remain reasonably priced relative to other telecom options.

CenturyLink CTL Economic Moat: None Fair Value Estimate: $18 Fair Value Uncertainty: Very High While CenturyLink is well known as a residential phone company, three fourths of its revenue is now derived from business customers. We expect revenue will decline in the coming years, especially in the consumer business, but we believe the market is overlooking the firm's substantial margin expansion opportunities as the business shifts to more modern technologies. At current levels, the stock is trading at about 4 times projected 2019 free cash flow and offers a dividend yield of 7.9%. We project free cash flow to remain steady over the next few years, which should allow the firm to avoid additional dividend cuts.

America Movil AMX Economic Moat: Narrow Fair Value Estimate: $18 Fair Value Uncertainty: High Mexican telecom carrier America Movil dominates its home market, with nearly 65% share in the wireless business, and holds a strong position across Latin America. Movil serves 30% more wireless customers across the region than its closest rival, Telefonica, providing scale to ride out the inevitable political and economic bumps in the road. Adding stability, the firm has repaid debt in recent years, giving it a solid balance sheet. As consumers across Latin America continue to adopt wireless and fixed-line Internet and data services in the coming years, Movil should be a prime beneficiary.

/s3.amazonaws.com/arc-authors/morningstar/12c6871b-2322-44d8-bd98-0437fa1a0a07.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/TP6GAISC4JE65KVOI3YEE34HGU.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/RFJBWBYYTARXBNOTU6VL4VSE4Q.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/YQGRDUDPP5HGHPGKP7VCZ7EQ4E.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/12c6871b-2322-44d8-bd98-0437fa1a0a07.jpg)