Industrials: Sector Fairly Valued Overall, but Industrial Distributors Look Compelling

Industrials has outperformed despite signs of an economic slowdown and fears over tariffs.

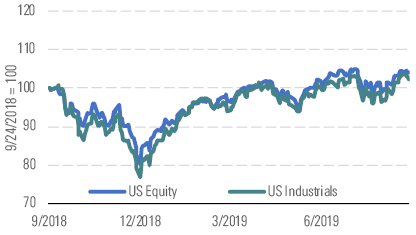

The Morningstar U.S. Industrials Index has outperformed the broader U.S. equity market by 3% year to date as of Sept. 24, even amid tariff concerns and mounting signs of an economic slowdown (Exhibit 1).

Industrial stocks are in line with the broad market. - source: Morningstar

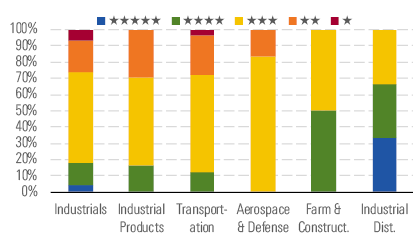

In general, the industrials sector is fairly valued, with the median stock we cover priced at a 1.00 price/fair value ratio. Nevertheless, we see opportunities in most spaces within the sector, especially among industrial distributors, where the majority of our coverage trades in 4- or 5-star territory (Exhibit 2).

We see bargains among industrial distributors. - source: Morningstar

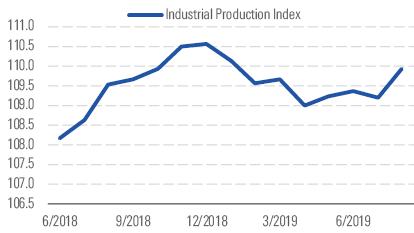

Broadly speaking, the U.S. industrial sector remains reasonably healthy despite prospects of a global economic slowdown. The growth in industrial production peaked in late 2018, fueling those fears, but the economic measure has recently rebounded to early 2019 levels (Exhibit 3).

Industrial production is down since April, despite trade concerns. - source: Morningstar

We continue to view tariffs as a minor obstacle for most diversified industrials. Companies are finding ways to moderate costs, raise prices, and relocate production closer to products’ end markets.

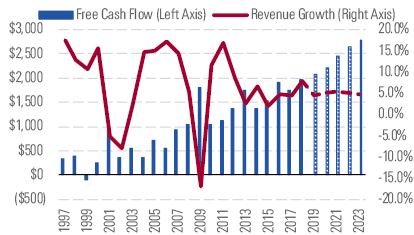

We observe compelling opportunities among the industrial distributors stocks we cover, which in aggregate, have underperformed the broader equity market by 12% in 2019. While industrial distributors serve cyclical end markets, these firms generate free cash throughout the business cycle. In fact, when end market demand slows, industrial distributors tend to generate outsize free cash flow as these working-capital-intensive firms pull back on inventory spending (Exhibit 4). Distributors can use this excess cash during an economic downturn to return cash to shareholders, make acquisitions at depressed multiples, or reinvest in longer-term organic growth opportunities.

Industrial distributors will yield free cash flow through the cycle. - source: Morningstar

We regard distributors’ direct tariff exposure as relatively modest and manageable. So far, the group has mitigated tariff costs with price increases, cost-saving initiatives, and supplier optimization actions. We're confident that industrial distributors will continue generating healthy free cash flows even if global growth continues to slow and trade tensions increase.

Top Picks

Wesco International WCC Economic Moat: Narrow Fair Value Estimate: $88 Fair Value Uncertainty: Medium Wesco is our preferred industrial distributor stock. The company is poised to benefit from multiple long-term secular growth drivers, including data center expansion, power-grid modernization, and increasing demand for outsourced supply chain management. Further, Wesco is embracing digitalization and Big Data to improve its operational and financial performance, and the firm's efforts are already positively affecting results. We view the firm's improving fundamentals, share-repurchase program, and involvement of a notable activist investor (Blue Harbour Group) as potential catalysts. In addition, if close peer Anixter stumbles with its enterprise resource planning implementation, Wesco could take market share from its rival. Wesco's stock looks cheap, trading at a 47% discount to our fair value.

LKQ LKQ Economic Moat: Narrow Fair Value Estimate: $38 Fair Value Uncertainty: Medium LKQ is a leading alternative automobile-parts distributor. It boasts unparalleled scale of operations by salvaging parts from over 300,000 automobiles annually and sourcing new products from low-cost overseas manufacturers. After recent acquisitions, Europe constitutes LKQ's largest but least profitable segment. Nevertheless, we believe centralized procurement will boost the segment's margins, narrowing the gap from those of the more mature North American segment. Additionally, LKQ may modestly benefit during weak economic conditions as owners delay new car purchases and automobile fleets age. We view the stock as undervalued, with shares trading at a 16% discount to our fair value estimate.

Stericycle SRCL Economic Moat: Narrow Fair Value Estimate: $74 Fair Value Uncertainty: Medium Medical-waste specialist Stericycle continues to grapple with negative sentiment after numerous guidance shortfalls in recent years, painful contract concessions in the flagship med-waste division, and a pullback in major recall projects in the communication solutions unit. The recent decline in recycled paper prices, which will temper Shred-it segment growth this year, has contributed, as well. That said, our analysis suggests the market is baking in overly pessimistic long-term growth assumptions. While the enterprise resource planning system implementation adds uncertainty, the recent senior-leadership overhaul increases the prospect of an execution rebound, and med-waste pricing headwinds of the current magnitude are likely temporary. With shares trading 33% below our fair value estimate, we consider Stericycle a compelling opportunity for patient value investors willing to weather heightened near-term volatility.

/s3.amazonaws.com/arc-authors/morningstar/aa7e0d87-9b96-4b66-bc66-87152c9713ed.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/737HCNGRFLOAN3I7RKGB7VPEKQ.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZU2N7Y2TDFFL3EAFRGYANDSBJY.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/FNDLNORUIBFD5KKEXASUD67L6Q.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/aa7e0d87-9b96-4b66-bc66-87152c9713ed.jpg)