Financial Services: Best Values in Stocks With Elevated Near-Term Risks

Investors have to be pickier with financial-services stocks this quarter.

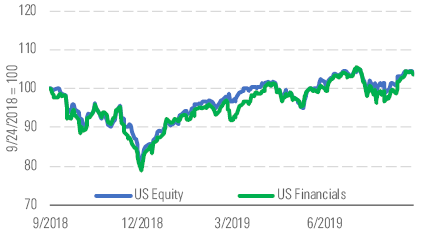

The Morningstar U.S. Financial Services Index rose 1% quarter to date through Sept. 24, in line with the market as a whole (Exhibit 1). Overall, the median U.S.-based financial-services stock trades at about a 2% discount to our fair value estimate, so we consider the U.S. financial sector slightly undervalued.

Financials have recovered from the beginning of the year. - source: Morningstar

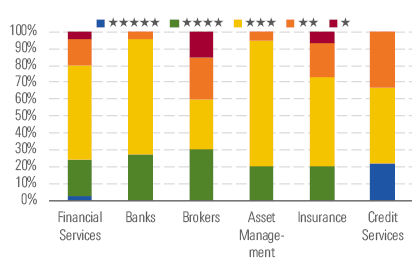

More undervalued names have higher economic sensitivity. - source: Morningstar

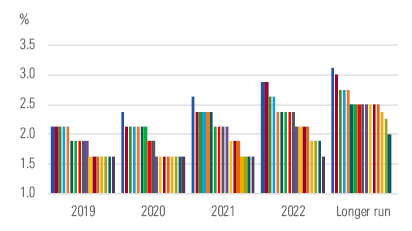

At the conclusion of its September meeting, the Federal Open Market Committee voted to decrease its target rate range to 1.75%-2% from 2%-2.25%. For the third consecutive time under Chairman Jerome Powell's tenure, the vote was not unanimous. The economic picture remains murky, but overall conditions haven't been deteriorating as fast as some may have expected, and two members voted for no change in the benchmark rate, while one voted for a 50-basis-point cut. According to the FOMC dot plot, many contributors expect the federal-funds rate to decrease another 25 basis points (Exhibit 3).

Fed expects to keep rates below 2% through 2020. - source: Morningstar

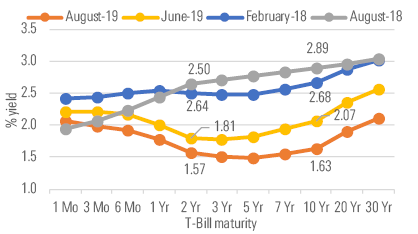

It’s important to consider both short-term interest rates, such as the federal-funds rate, and long-term interest rates, such as the yield on the 10-year Treasury, when looking at stocks in the financial sector. The yield on the 10-year Treasury averaged 1.63% in August 2019 compared with 2.07% only several months ago in June 2019 and 2.89% a year ago in August 2019 (Exhibit 4). With funding sources for financials, such as bank deposits, often linked to short-term interest rates and certain interest-earning assets, such as mortgage loans, tied to long-term rates, a flat or inverted yield curve can pressure net interest income.

The yield curve has dramatically changed in a short period of time. - source: Morningstar

Whereas over the previous year we’ve had times where whole financial industry groups were undervalued, we believe investors should now be much choosier. Most of the undervalued financial stocks in North America either have company-specific issues that we believe the market isn’t appropriately pricing or are more economically sensitive names. While there are near-term risks to the companies we currently regard as undervalued, they also have the greatest probability of long-term outperformance.

Top Picks

American International Group AIG Economic Moat: None Fair Value Estimate: $76 Fair Value Uncertainty: Medium We believe AIG CEO Brian Duperreault's is a good fit for solving AIG's main operational issue: commercial property-casualty insurance underwriting. He was a primary architect behind peer Chubb's strong franchise that has generated industry-leading underwriting margins. He has pledged that AIG will generate an underwriting profit in 2019, and the company is on track to reach that goal. Since we see no structural issues in its core operations, we believe AIG is gradually trending toward peer results. The current market price equates to about 0.8 times book value, a level that implies a long period of poor returns.

Berkshire Hathaway BRK.B Economic Moat: Wide Fair Value Estimate: $253 Fair Value Uncertainty: Medium We continue to be impressed by Berkshire Hathaway's ability to generate high-single- to double-digit growth in book value per share, and we like that the two front-runners for Warren Buffett's CEO job—Ajit Jain and Greg Abel—have plenty of capital-allocation experience. Berkshire has plenty of cash on hand and a disciplined share-repurchase program. The shares are currently trading at a deep enough discount to our $380,000 ($253) per Class A (B) share fair value estimate, equivalent to 1.25 times our estimated end of 2019 book value per share, to warrant the attention of long-term investors.

Capital One Financial COF Economic Moat: Narrow Fair Value Estimate: $133 Fair Value Uncertainty: Medium Investors seem to be concentrating on the recent decline in interest rates and fears about economic growth and applying it across all banks regardless of interest-rate sensitivity or growth prospects. Though economic growth would weigh on Capital One, investors should take comfort that the company's open-source software strategy should help it win market share and develop a cost advantage. Capital One's victory in winning Walmart as a client is important. To us, it signals that businesses are looking at a bank's technological competency when deciding financial institutions with which to partner.

/s3.amazonaws.com/arc-authors/morningstar/75bbf764-3b6f-4f5a-8675-8f9488c74c04.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/PLMEDIM3Z5AF7FI5MVLOQXYPMM.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/I53I52PGOBAHLOFRMZXFRK5HDA.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/CEWZOFDBCVCIPJZDCUJLTQLFXA.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/75bbf764-3b6f-4f5a-8675-8f9488c74c04.jpg)