Consumer Defensive: Strong Growth Leaves Few Values

Shifting consumer health trends are having a big impact on the sector.

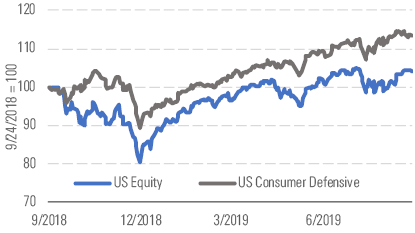

Consumer defensive continued its string of outperformance in the third quarter, gaining 5% versus 1% for the broader U.S. equity market through Sept. 24 (Exhibit 1).

Sector performance outpacing the market lately. - source: Morningstar

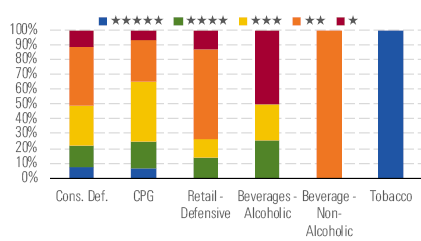

Investors seeking undervalued stocks in the space will find opportunities somewhat scarcer than most sectors, with 22% of our consumer defensive coverage rated 4 or 5 stars compared with 30% of our North American coverage overall. Meanwhile, the median consumer defensive stock trades at a 7% premium to our fair value estimate, second only to the utilities sector's 15% premium.

The retail defensive arena, as well as nonalcoholic beverages, are the most expensive, in our view, with the median stock in those industries trading at premiums of 26% and 17%, respectively.

Even with a dearth of options, tobacco has yet to heat up. - source: Morningstar

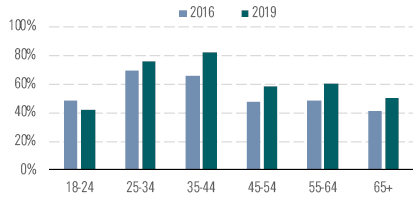

The consumer packaged goods industry, the largest within the broader consumer defensive sector, offers a few compelling opportunities, though the median stock trades at a slight premium of 2%. Here, the dominant trend has been a continued shift toward health-consciousness. Since 2016, we have seen an 11% increase in consumers who actively seek products to improve their health (Exhibit 3). To grow with this trend, packaged food companies continue to push toward perceived healthy products, while attempting to maintain a similar taste profile. This is essential to combat increased competition from smaller, niche companies targeting the health-aware consumer.

Consumers proactively seeking health-improving products increasing. - source: Morningstar

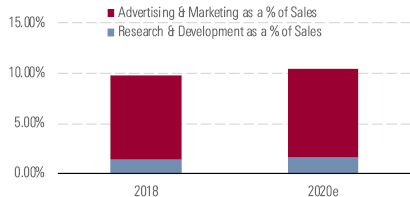

Although we expect consumer packaged goods to be the most affected by this trend, it's apparent across the broader sector. We have already seen a boom in products such as hard seltzer offering the consumer a low-carb and low-calorie alternative to traditional beer and cider. Therefore, in order to stem the tide of new competitors entering the market, we expect research and development, as well as marketing and advertising, to increase across the board, with our forecast calling for a spending increase to over 10% of sales by 2020 from the high single digits in 2018 (Exhibit 4).

Firms increasing spend to ensure fare evolves with consumer trends. - source: Morningstar

Top Picks

Kraft Heinz KHC Economic Moat: None Fair Value Estimate: $50 Fair Value Uncertainty: High Kraft Heinz's shares have waned this year as a result of myriad unfavorable developments, including profit contraction and an SEC investigation into its procurement accounting. However, we believe new CEO Miguel Patricio seems to appreciate the value and importance of rooting out inefficiencies (as opposed to an outsize focus on cutting costs) and boosting brand investments, which we view as critical given the competitive landscape. However, we don't expect near-term catalysts to materially narrow the gap relative to our assessment of Kraft Heinz's intrinsic value and suggest investors exercise patience with this no-moat name.

Kellogg K Economic Moat: Wide Fair Value Estimate: $78 Fair Value Uncertainty: Medium Trading at a 20% discount to our $78 fair value estimate, Kellogg is a rare moaty bargain in the packaged food aisle. Even though Kellogg has failed to reignite sales, unlike some of its peers, it has laid the groundwork for top-line gains. The move away from direct-store distribution has allowed Kellogg to elevate brand spending, and expansion beyond cereal (with a greater snacking mix) has continued, with recent acquisitions, such as RXBar. When combined with its 4% dividend yield, we think investors should consider building a position in this wide-moat name.

Hain Celestial Group HAIN Economic Moat: None Fair Value Estimate: $26.50 Fair Value Uncertainty: High Due to a historical lack of investing behind the firm's brands, no-moat Hain's performance has come under pressure lately. But with a comprehensive turnaround strategy aimed at focusing resources on the core brands, which represent 90% of profits, we think Hain is set to increase its revenue over the long term, with our forecast long-term revenue growth recently increasing to 4.3%. By eliminating unprofitable products, the firm can reap savings, which can be reinvested in the firm's highest-potential brands, stabilizing market share losses. Trading 25% lower than our valuation, Hain is a clear standout.

/s3.amazonaws.com/arc-authors/morningstar/c612f59b-89e0-422a-8f71-3eb1300d1a2c.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/IORW4DN3VVC3BC4JO7AQLSJTF4.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ODMSEUCKZ5AU7M6BKB5BUC6G5M.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/TGMJAWO4WRCEBNXQC6RFO5TOAY.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/c612f59b-89e0-422a-8f71-3eb1300d1a2c.jpg)