Stock Market Outlook: Energy Sector Again Looks Undervalued

U.S. and Canadian stocks are fairly valued overall, with energy offering the most opportunity and utilities the least.

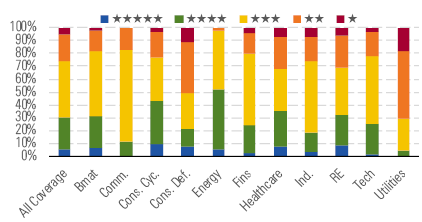

U.S. and Canadian stocks, which account for about half of our 1,500-plus global equity coverage, look fairly valued in aggregate. The median North American stock trades at a 2% discount to our intrinsic value estimate (Exhibit 1), and the share of 4- and 5-star-rated stocks only slightly exceeds that of 1- and 2-star-rated stocks (30% to 27%). Across the 11 sectors, we continue to see the most opportunities in energy and the least in utilities, where share prices have become increasingly delinked from long-term cash flow prospects as investors hunt for yield.

- Oil markets tend toward short-term unpredictability, with the attack on a large Saudi facility providing a dose of drama in the third quarter. Longer term, the economics of supply and demand continue to point to $55 per barrel (WTI), which would make most U.S. energy stocks attractive at today's share prices.

- Utilities stocks continued to rally, as expectations of rate cut manifest in a 25-basis-point reduction to the federal-funds rate target range in September. While utilities offer attractive dividends, and share prices could have more room to run if rates are cut further, prevailing share prices are hard to justify from a long-term, fundamentals-focused vantage point.

- source: Morningstar Analysts

/s3.amazonaws.com/arc-authors/morningstar/ecf6f262-5697-406a-a91d-cd20ff52a617.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/T5MECJUE65CADONYJ7GARN2A3E.jpeg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/VUWQI723Q5E43P5QRTRHGLJ7TI.png)

/d10o6nnig0wrdw.cloudfront.net/04-22-2024/t_ffc6e675543a4913a5312be02f5c571a_name_file_960x540_1600_v4_.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/ecf6f262-5697-406a-a91d-cd20ff52a617.jpg)