Demystifying U.S. Mid-Cap Indexing

Mid-cap stocks warrant more attention than they currently garner.

If you stop the average investor walking down the street and ask him what a large-cap stock is, he might respond Apple AAPL, Alphabet GOOG, Amazon.com AMZN, or maybe Bank of America BAC. However, most investors would probably struggle to name a mid-cap stock, even though names like Burlington Stores BURL, Tractor Supply TSCO, and Whirlpool WHR may be familiar to them. Mid-cap stocks are often overlooked, and yet, over the past 15 years, they have outperformed both large- and small-cap stocks. There is no structural reason to justify this, nor is there a reason to believe it will continue. However, mid-cap stocks warrant more attention than they currently garner.

Mid-Caps: The Big Picture As their name implies, mid-cap stocks fall in the middle of the market-capitalization spectrum between large- and small-cap stocks. These companies may have graduated from the small-cap space and consequently have more mature businesses than smaller companies. These companies typically grow their earnings at a faster clip compared with large companies but are on firmer financial footing compared with small companies. This often makes them attractive acquisition targets.

Most importantly, for the investor, mid-caps can be an effective way to diversify or manage various sources of risk. The mid-cap segment as proxied by iShares Core S&P MidCap 400 ETF IJH provides better sector- and single-stock diversification compared with large caps, as measured by iShares Core S&P 500 ETF IVV. For example, technology stocks make up roughly 17% of IJH's portfolio versus 24% for IVV. Mid-cap funds are also more diversified at a single-stock level. IJH's top 10 holdings represent about 6% of its portfolio versus about 21% for IVV. Finally, mid-caps provide more targeted exposure to the U.S. economy than large caps. Morningstar's revenue exposure by region data shows that the companies in IJH's portfolio generate roughly 77% of their revenues in the United States versus 62% for IVV. Much of this difference can be explained by IJH's 7% overweight in the real estate sector and 6% underweight in technology stocks as compared with IVV. Real estate companies typically generate most of their sales in their home markets, while technology companies tend to sell more outside their home market, in this case the U.S.

Diversification is one of the most powerful tools an investor has to manage risk. Yet, when it comes to their U.S. equity allocations, investors are often underexposed to mid-cap stocks. This is evidenced by the fact that as of August 2019, roughly 11% of all assets in U.S. equity funds were in dedicated mid-cap funds, according to Morningstar data, although mid-caps represented about 15% of the total U.S. market by market cap.

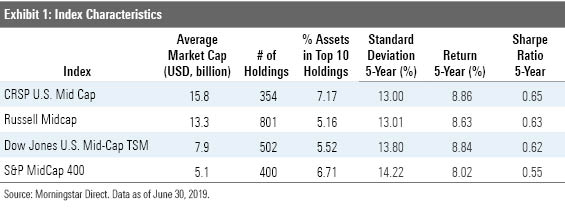

Definitions Differ You may be surprised to know that there is no consensus definition of mid-cap stocks. Index providers such as Dow Jones, CRSP, S&P, Russell, and MSCI construct their mid-cap indexes differently.

The Center for Research in Securities Prices, or CRSP, ranks all U.S.-listed stocks from largest to smallest. After the stocks representing the top 70% of cumulative U.S. market cap have been accounted for, it takes the next 15% and calls them mid-caps. This differs from the count-based approach employed by the Dow Jones U.S. Mid-Cap Total Stock Market and the Russell Midcap indexes. The Dow Jones index ranks U.S. stocks by descending order of market cap, identifies the largest 600 stocks, and then targets the next largest 500. Similarly, the Russell index ranks all U.S. stocks by descending order of market cap, excludes the largest 200 stocks, and targets the next largest 800 stocks. The S&P MidCap 400 Index takes an altogether different approach. Index constituents are managed by a committee. Stocks must also pass a financial viability hurdle to be added to the index.

Choices, Choices So which index should investors choose? There is no one good answer, but there are several good options. Generally speaking, investors should select an index tracker that levies a low fee, is broadly diversified, tracks its benchmark precisely, and is backed by a solid sponsor. Additionally, investors should consider the fit within their portfolio. It is important to avoid combining funds that may have significant overlap, as this may have the unintended consequence of overweighting some stocks.

As an example, a fund that tracks the S&P MidCap 400 Index should be combined with a fund that tracks the S&P 500. Similarly, a fund that tracks the CRSP U.S. Mid Cap Index should be paired with a fund that tracks the CRSP U.S. Mega Cap Index, while a fund that tracks the Russell Midcap Index would pair well with a fund that tracks the Russell Top 200 Index. Pairing funds that are underpinned by indexes from the same family will prevent unintentional overlap and ensure that investors are eking out the diversification benefits they are seeking when spreading their assets across the market-cap spectrum.

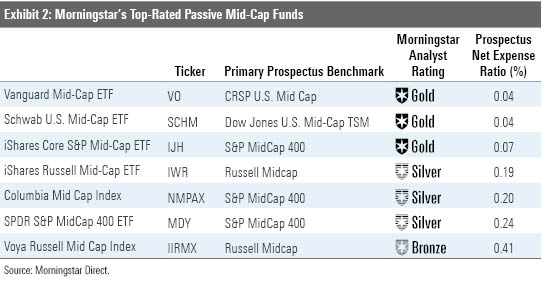

The table below features our top-rated mid-cap index mutual funds and exchange-traded funds. Each of these funds is a Morningstar Medalist, carrying a Morningstar Analyst Rating of Gold, Silver, or Bronze.

Disclosure: Morningstar, Inc. licenses indexes to financial institutions as the tracking indexes for investable products, such as exchange-traded funds, sponsored by the financial institution. The license fee for such use is paid by the sponsoring financial institution based mainly on the total assets of the investable product. Please click here for a list of investable products that track or have tracked a Morningstar index. Neither Morningstar, Inc. nor its investment management division markets, sells, or makes any representations regarding the advisability of investing in any investable product that tracks a Morningstar index.

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/T2LGZCEHBZBJJPPKHO7Y4EEKSM.png)

/d10o6nnig0wrdw.cloudfront.net/04-18-2024/t_34ccafe52c7c46979f1073e515ef92d4_name_file_960x540_1600_v4_.jpg)

/d10o6nnig0wrdw.cloudfront.net/04-09-2024/t_e87d9a06e6904d6f97765a0784117913_name_file_960x540_1600_v4_.jpg)