13 Stocks to Own

These names are among the top holdings of some of our favorite concentrated-fund managers.

In Steal Like an Artist, author (and artist) Austin Kleon argues that nothing is completely original--we learn by copying. Kleon isn't suggesting that plagiarism is OK. Rather, he tells readers that they should collect good ideas and allow themselves to be influenced by them.

We couldn’t agree more. When it comes to investing, good ideas can come from a variety of places. The trick is taking these tips, researching them further, and deciding whether these investments are good choices for your portfolio based on your personal parameters.

In fact, we frequently look beyond our own analyst teams for investing ideas. For instance, our Ultimate Stock Pickers series meshes stock picks from a roster of great investors with Morningstar's own recommendations. (In fact, we published the latest installment in the quarterly series just yesterday.) We've also shared the stock purchases of some of our favorite managers and examined the holdings of the highest-rated dividend-stock funds.

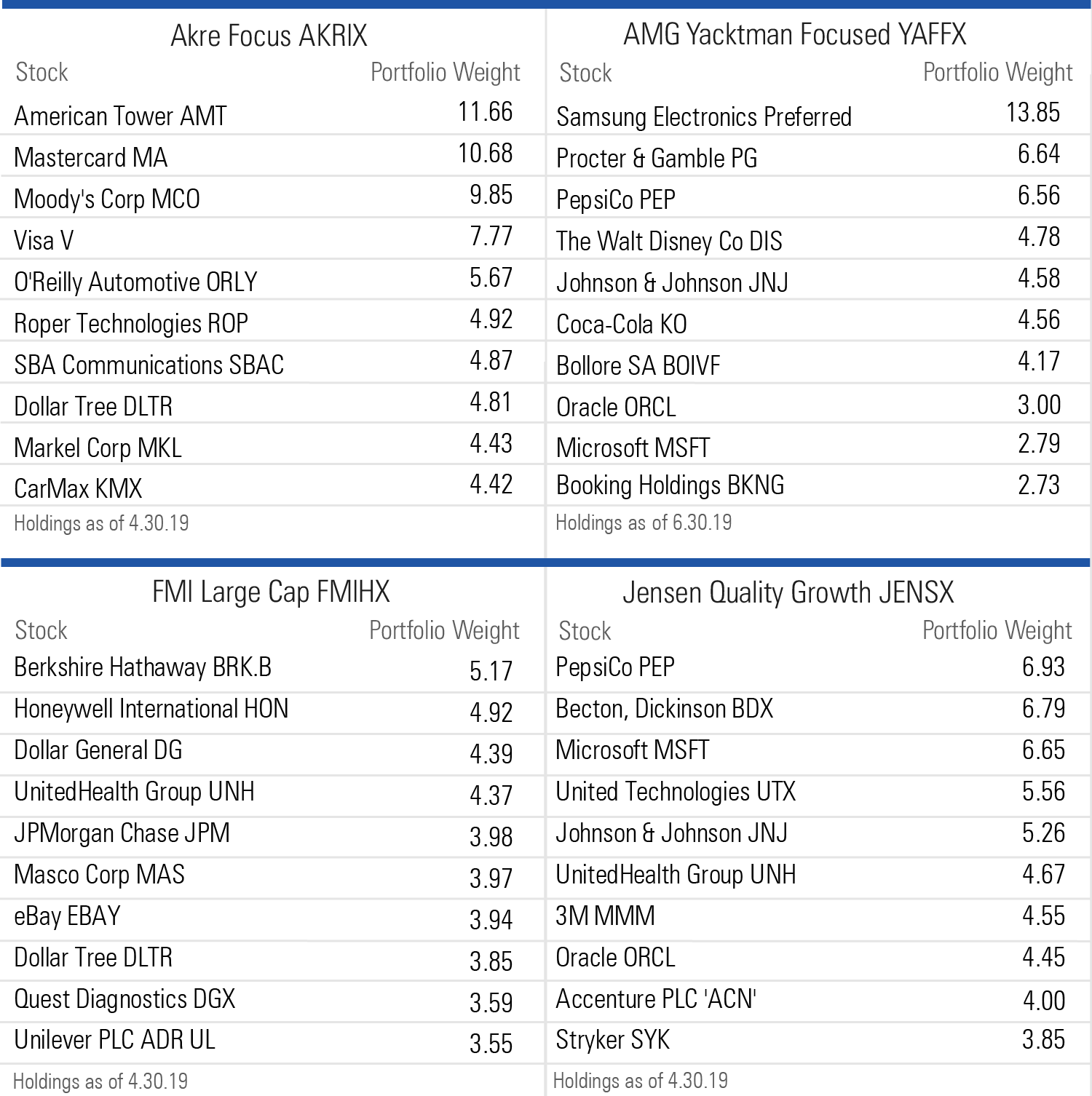

Today we’re taking a peek into the top positions of highly rated concentrated large-cap funds: FMI Large Cap FMIHX, which earns a Morningstar Analyst Rating of Gold, as well as Silver-rated Akre Focus AKRIX, AMG Yacktman Focused YAFFX, Jensen Quality Growth JENSX, Loomis Sayles Growth LSGRX, Oakmark Select OAKLX, Parnassus Core Equity PRBLX, and Sound Shore SSHFX.

Why focus on concentrated funds? These managers invest in fewer stocks--Akre Focus holds the fewest stocks, at 21, while Parnassus Core Equity owns the most, at 39--and are therefore choosier about what they buy. And when they buy, they have high conviction. Moreover, we’ve limited our list to Gold- and Silver-rated funds, meaning that these managers are pretty good at what they do.

Here are the top 10 holdings for these funds as of their most recently reported portfolios.

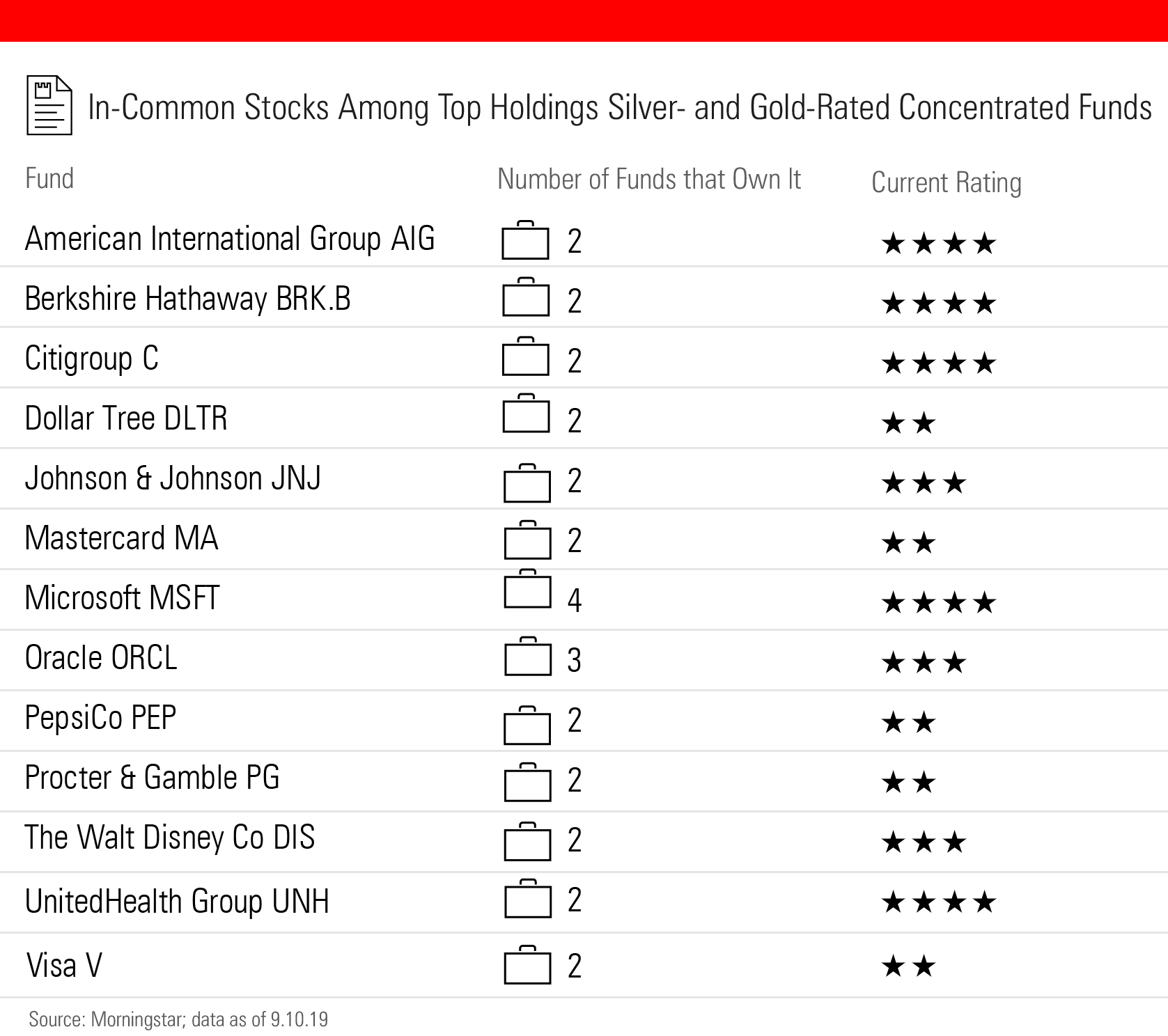

Despite the fact that these managers ply a variety of different strategies--Akre, Jensen, and Loomis Sayles land in the large-growth Morningstar Category; Yacktman and Sound Shore can be found in large value; and FMI, Oakmark and Parnassus are at home in large blend--the portfolios have several top holdings in common. In fact, 13 stocks appear in at least two of the portfolios.

Microsoft MSFT is the most commonly held stock among our concentrated fund managers, appearing in the top 10 of four portfolios. Oracle ORCL pops up among the top holdings of three of the portfolios. Clearly, these two stocks in particular and the others included here are fine ideas to “steal.” But be sure you steal them at the right price: Nine of the stocks in common are currently fairly valued or overvalued according to our metrics. We think these are stocks to keep on your watchlist, for now.

However, five of the in-common stocks are undervalued according to our metrics: American International Group AIG, Berkshire Hathaway BRK.A BRK.B, Citigroup C, Microsoft, and UnitedHealth UNH.

Here’s a closer look at three of the undervalued in-common stocks.

American International Group The insurer has a Morningstar Economic Moat Rating of none and posted a string of terrible results over the past decade.

“The years since the financial crisis have shown that American International Group would have destroyed substantial value even if it had never written a single credit default swap, that noncore businesses needed to be shed, and that material issues in the firm's core operations needed to be addressed,” argues senior analyst Brett Horn.

However, AIG is on the mend, thanks in part to an aggressive goal of new CEO Brian Duperreault--generating an underwriting profit in the company’s property and casualty operations this year. Duperreault has a solid track record of building a successful underwriting culture elsewhere, and the firm’s recent reinsurance deal with Berkshire Hathaway mitigates the risk of reserve development problems in the future. Horn says that the business performance is trending in a positive direction, believing that AIG is capable of moving its underwriting results to a level more in line with its peers.

“In our view, remedying the company’s historical underwriting issues is the key factor in generating acceptable returns over time, and we are pleased to see sustained progress on this front,” he notes.

The stock trades 26% below our fair value estimate of $76 as of this writing.

Berkshire Hathaway With a Morningstar Rating of 4 stars, we think wide-moat Berkshire Hathaway is trading at levels that are among the cheapest we've seen in years.

“We think two big concerns--first, that Berkshire Hathaway's size will prevent it from growing at a decent clip in the future and, second, that the company's shares will get pummeled once Warren Buffett no longer runs the show--have kept some investors on the sidelines,” suggests senior analyst Gregg Warren. “While we do not expect Berkshire to be able to consistently increase its book value per share at a double-digit rate going forward--a feat the firm achieved six times during 2009-18--we think the company is still capable of increasing book value per share at a high-single- to low-double-digit rate annually. This should leave returns solidly and consistently above Berkshire's cost of capital, which is what we expect from companies with wide economic moats.”

{Deep Dive: 5 Reasons to Consider Buying Berkshire Hathaway}

Warren argues that Berkshire is a fine long-term investment idea today not only because of its price but also because it’s likely to hold up better than most companies if and when a downturn comes. Moreover, its near $100 billion in dry powder will be at the ready to make new investments, acquisitions, and share repurchases.

The Class B shares currently trade at a 17% discount to our $253 fair value estimate.

UnitedHealth Group The largest private health insurer in the United States, UnitedHealth has carved out a wide economic moat. The giant boasts more than 43 million medical members nationwide, representing 14% of the insured population.

“We view UnitedHealth Group as uniquely positioned in the healthcare sector broadly and compared with its peers in the managed-care industry,” observes sector director Damien Conover. “UnitedHealth's breadth of scope puts it in a league of its own, in our opinion, and forms the underpinnings of our wide moat rating. While UnitedHealth's business franchises would probably be moatworthy in their own right, the integration of medical benefits, pharmaceutical management, and an ambulatory care network strengthens the performance and durability of the entire enterprise. We're convinced that UnitedHealth's scale and cohesive service model make it more likely than not that the company will continue to earn excess returns for shareholders over the coming two decades.”

{Deep Dive: UnitedHealth: A Cheap, Wide-Moat Health Insurer}

Conover acknowledges that competitors are hooking up to copy UnitedHealth’s strategy, but we think its lead will be difficult to catch over the medium term. Moreover, we’ve awarded the firm’s management team an Exemplary rating, believing that it will continue to successfully shepherd the company through an evolving healthcare system.

The stock trades 24% below our $310 fair value estimate.

/s3.amazonaws.com/arc-authors/morningstar/35408bfa-dc38-4ae5-81e8-b11e52d70005.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/737HCNGRFLOAN3I7RKGB7VPEKQ.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZU2N7Y2TDFFL3EAFRGYANDSBJY.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/FNDLNORUIBFD5KKEXASUD67L6Q.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/35408bfa-dc38-4ae5-81e8-b11e52d70005.jpg)