A Close Look at the Big Five Personality Traits

A new study by contributor Michael Pompian examines the relationship between the dimensions of personality and investor biases.

This is the second article in a series focusing on the Big Five personality traits and how they relate to the behavioral biases of investors. Over the years, I have followed a debate between the effectiveness of the Myers-Briggs test versus another widely used personality test, the Big Five. More recently, the debate has intensified. I decided to conduct a study of the Big Five. Specifically, I studied 120 investors, examining the relationship between the Big Five and investor biases. Why? Because taking the time to understand the underlying personality of the investor leads to better advice and results.

Today we'll examine the Big Five in detail.

Overview of the Big Five Many personality psychologists over the years have boiled down the myriad human personality traits into five basic dimensions of personality, referred to as the Big Five personality traits. The five broad personality traits described by the theory are extraversion, agreeableness, openness, conscientiousness, and neuroticism. An easy way to remember these are by two acronyms: OCEAN (openness, conscientiousness, extraversion, agreeableness, and neuroticism) or CANOE (for conscientiousness, agreeableness, neuroticism, openness, and extraversion).

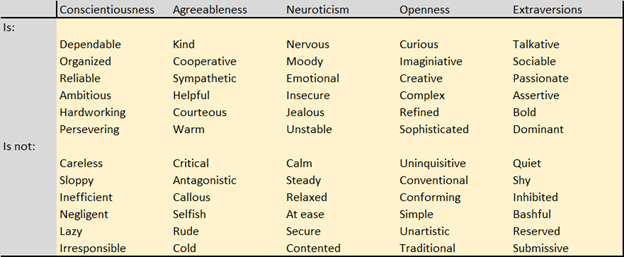

Importantly, each of the five personality factors represents a range between two endpoints. For example, extraversion represents a continuum between maximum extraversion and maximum introversion. Each of the Big Five categories is described below.

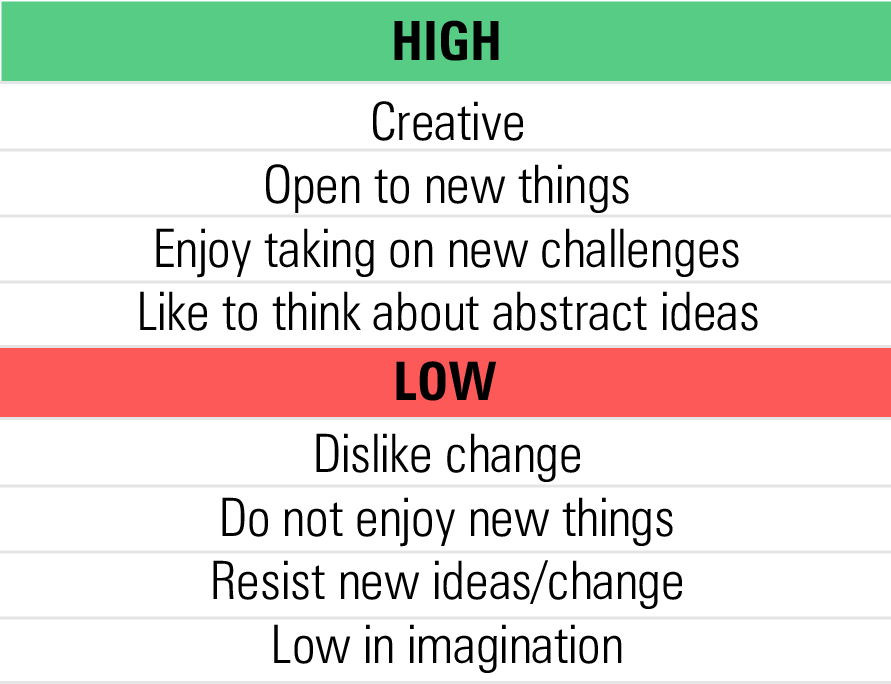

Openness This trait's primary characteristics are imagination, curiosity, and creativity. People who are high in openness tend to have a broad range of interests and skills. They are inquisitive about the world and other people--and are eager to learn new things and have new experiences. "Openness" people tend to be adventurous and creative. People low in this trait are more traditional and may struggle with abstract thinking.

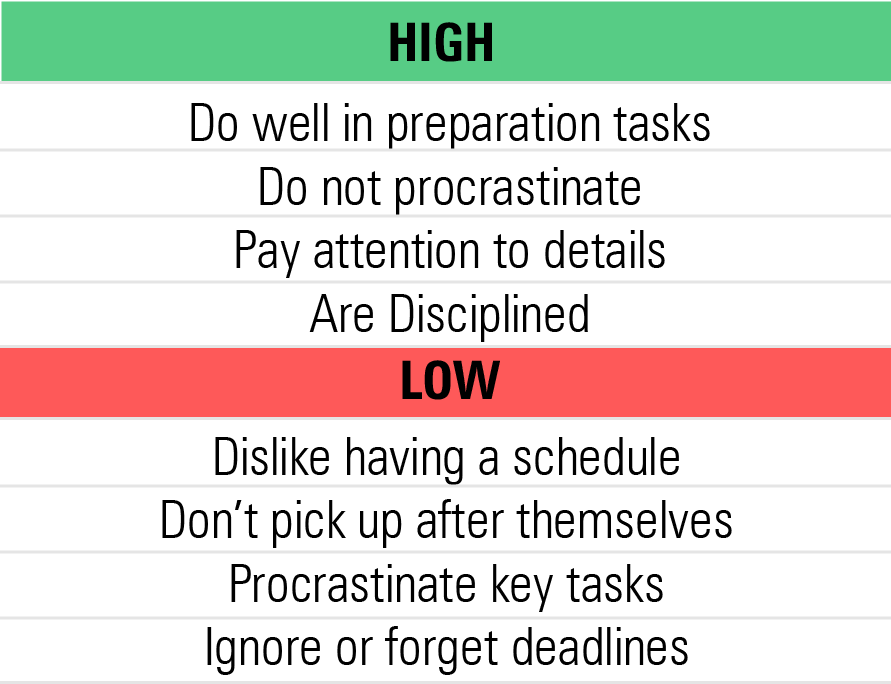

Conscientiousness People high in this trait are thoughtful, goal oriented, strong with impulse control, and disciplined. Those high in conscientiousness are well organized and pay attention to detail. These people are planners and think about how their behavior affects others. Lastly, they are mindful of deadlines.

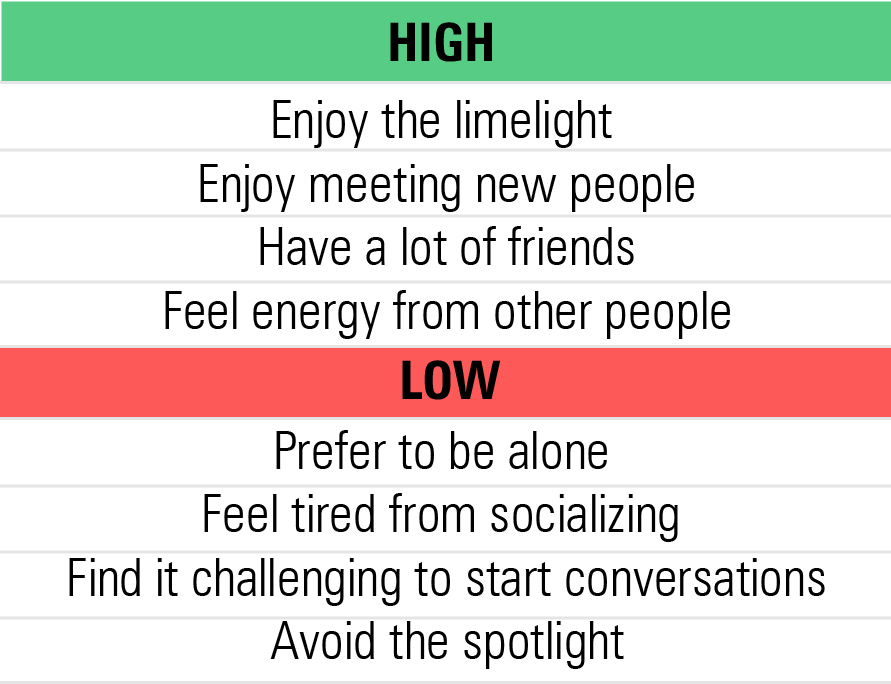

Extraversion Extraversion (also known as extroversion) is a trait described by talkativeness, assertiveness, and expressiveness. People high in extraversion are outgoing and get energy from the people around them. Being in social situations makes them feel energetic or even excited. People who are low in extraversion (also known as introverted) tend to be reserved and have to expend energy in social settings. They often prefer to be "in the corner" away from others.

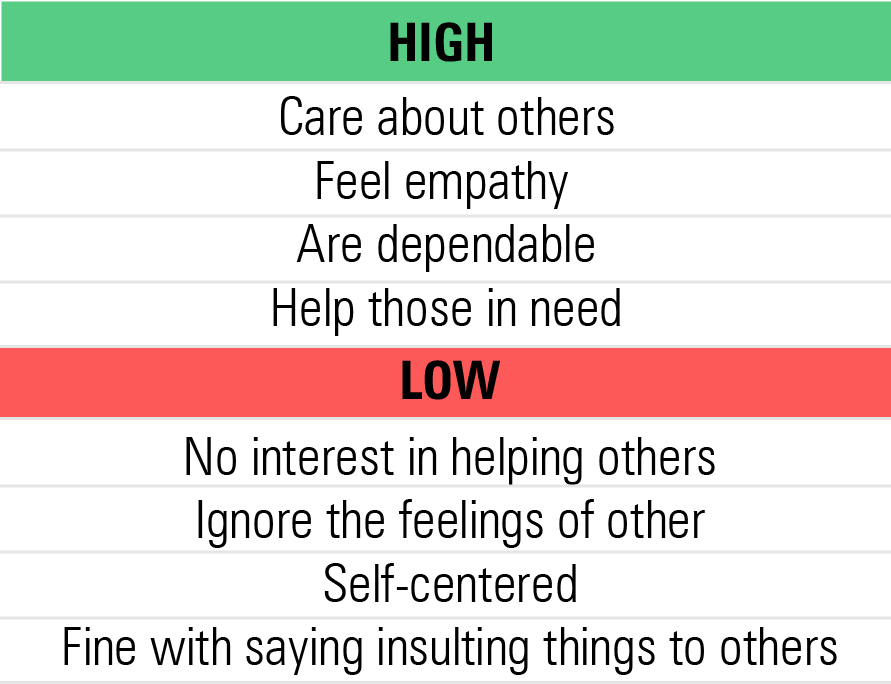

Agreeableness People high in agreeableness tend to be trustworthy, kind, affectionate, and altruistic. These folks tend to be cooperative and easy to work with, while those low in this trait tend to be more competitive and/or manipulative.

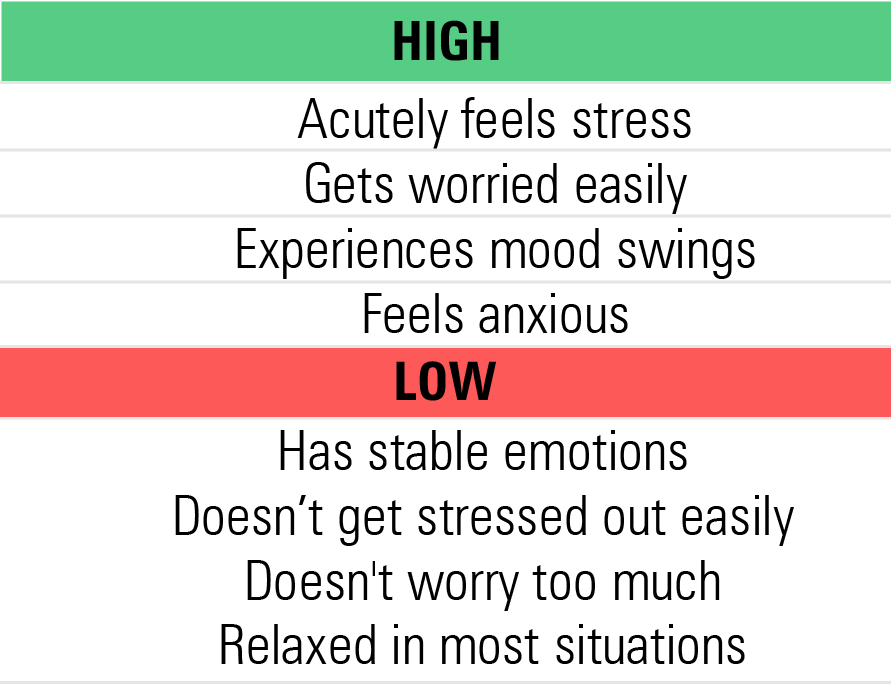

Neuroticism Neuroticism is a trait characterized by sadness, moodiness, and emotional instability. Individuals who are high in this trait tend to experience mood swings, anxiety, irritability, and sadness. Those low in this trait tend to be more emotionally resilient.

Summary Below is a helpful chart that summarizes in single words each of the Big Five personality traits.

What's Next? The Study I tested 120 investors for the Big Five personality traits and for the following investor biases: loss aversion, status quo, recency, hindsight, confirmation, availability, and overconfidence. In upcoming articles, each of the Big Five personality traits will be examined in relation to each of these biases. The results of the study show what percentage of the population is (a) subject to each of the Big Five traits and (b) subject to each of the biases. For those personality traits that have a large percentage subject to a given bias, we will discuss strategies to work with clients based on these behaviors.

Michael M. Pompian, CFA, CAIA, CFP is an investment consultant to ultra-affluent clients and family offices, and is based in St. Louis. His book, Behavioral Finance and Wealth Management, is helping thousands of financial advisors globally build better relationships with their clients. Contact him at michael@sunpointeinvestments.com.

The author is a freelance contributor to Morningstar.com. The views expressed in this article may or may not reflect the views of Morningstar.

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/6ZMXY4RCRNEADPDWYQVTTWALWM.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/6NPXWNF2RNA7ZGPY5VF7JT4YC4.png)