How Have 'Hedge Funds for the Masses' Performed?

About as one should have expected, although it doesn’t seem that way.

Cloning Research Last decade, hedge funds were the glamour investment. For everyday investors, hedge funds were rumors rather than reality, because 1) such funds could be bought only by the wealthy and 2) their performance records were hidden. It was (and is) illegal for hedge funds to publish their returns, as only accredited investors were permitted to view them. Hedge funds were, in a sense, rated X.

The general-public version soon arrived: replication funds. These were funds that would be for everybody.

Their genesis: In 2007, two MIT professors, Jasmina Hasanhodzic and Andrew Lo, published "Can Hedge Fund Returns Be Replicated?: The Linear Case." Using returns-based style analysis, the authors estimated the portfolio strategies of 1,600 hedge funds over the previous 20 years. They created hedge fund "clones" that replicated those strategies by buying or selling market exposures (such as the S&P 500 or high-grade bonds). Then they computed the clones' hypothetical performances.

The results were theoretically great, and practically acceptable.

The theoretically great part was that if the authors evaluated the funds using all 20 years' worth of data, in what they called the "fixed-weight" method, their clones performed magnificently, annihilating the actual hedge funds! If investors could own those clones, they would never hire a hedge fund manager again. But they cannot do so, because the fixed weights cannot be calculated until the time period has concluded. The method is solely illustrative.

The practically acceptable outcome came from using realistic methods. Rather than wait to determine hedge funds' exposures, the authors generated them on an ongoing basis. They used trailing 24-month periods to evaluate how funds were positioned, adjusting the results with each new month's worth of data. The "rolling-window" method, as they termed it, dramatically lowered the clones' returns, so that they trailed the real-worth funds by an annual percentage point.

In the authors' words, "While the performance of linear clones is often inferior to their hedge fund counterparts, they perform well enough to warrant serious consideration as a passive, transparent, scalable, and lower-cost alternative to hedge funds." Their summary was admirably modest, but the product providers that would adopt their approach would be less bashful.

Market Solutions Fund marketers soon responded to the academic research. Goldman Sachs Absolute Return Tracker GARTX launched in spring 2008, Natixis ASG Global Alternatives GAFYX followed that autumn, and IQ Hedge Multi-Strategy Tracker ETF QAI debuted in spring 2009. That made for three replication funds that now have 10-year records, and that's enough history to draw preliminary conclusions.

When the funds began, they faced several criticisms:

- Hedge fund averages don't count. People can't invest in the broad mass of hedge funds as they can with equities. The only investable indexes of hedge funds have limited membership. Besides, who would want to own the entire hedge fund marketplace? There are thousands of second-rate hedge funds. Skip them and select only the proven winners.

- Hedge funds are appealing for their alphas, not their betas. Translating from the investment jargon, the reason to own hedge funds is not for their market exposures (their betas) but instead for the excellence of their managers' decisions (their alphas). Replication funds only accomplish the former. What really matters is how hedge fund managers execute their market exposures--that is, the opportunities they discover. Replication funds miss those entirely.

- Replication funds rely on guesswork. Typically, hedge funds don't disclose their holdings, so replication funds determine their positions by reading the tea leaves of historic returns. In other words, they invest for the future by looking backwards. This can leave them chasing their tails, by forming portfolios based on how hedge funds once were positioned as opposed to how they are invested today. Also, the process inevitably introduces errors. Returns-based analysis, after all, is an estimate.

Replication-fund defenders countered with this:

- Hedge fund averages should count. People don't invest in hedge fund indexes not because the idea is bad, but because they can't. But now, through replication funds, they can. All the reasons that have made stock index funds so successful also apply to hedge fund index funds. Their costs are lower, they eliminate the possibility of buying a bottom-feeder, and past performance gives only the slightest hint about future returns. One can reliably avoid second-rate hedge funds only in hindsight.

- Hedge funds are mostly appealing for their betas. Hedge fund managers claim individuality, but they hunt in packs. They pursue common strategies that may not be called "beta," but which are in fact market exposures. (One example is buying stocks that have high price momentum.) Replication funds can capture the effect of such trades. If the model is sufficiently sophisticated, it will incorporate most so-called alphas.

- Guesswork is good enough. True, returns-based analysis is imperfect. The process introduces errors, and the conclusion is dated. But broadly accurate can suffice. Replication funds need not track the hedge funds exactly; there is no penalty for occasional deviations. And over time, the errors will cancel each other out. Replication funds will benefit from their mis-specifications as often as they will be harmed.

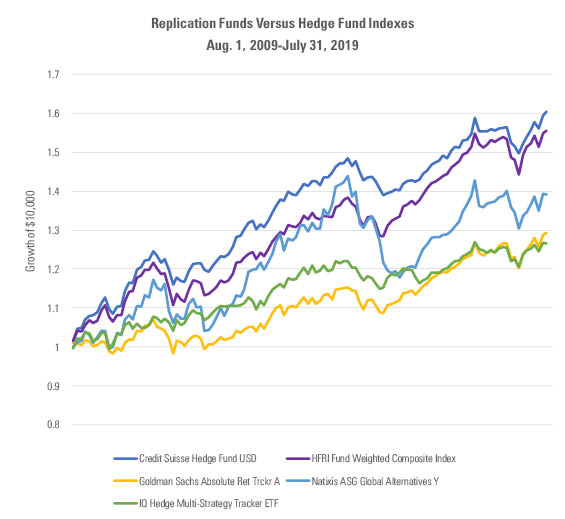

History's Judgment Those were the arguments, with each side supported by multiple Ph.D.s. The claims were difficult to adjudicate. Fortunately, we now have the evidence. The graph below shows the 10-year performance of the three previously mentioned replication funds, along with two hedge fund indexes from Credit Suisse and HFR.

- Source: Morningstar Direct.

The graph is straightforward to interpret: the replication funds have trailed the indexes by about 2 percentage points per year. One hedge fund index gained 60% cumulatively, while the other was close behind at 55%. For their part, the replication funds registered from 26% to 39%. Roughly speaking, the hedge fund indexes posted 5% annualized returns, while the replication funds managed 3%.

This performance has widely been regarded as a failure for replication funds, which is understandable. A 30% gain over a full decade isn't much. At the same time, surprising as it may seem, replication funds have met their original expectations. The Hasanhodzic & Lo paper suggested that clone funds would perform roughly like hedge funds but trail by 100 basis points annually before costs. That is exactly what they have done. The replication funds that were launched have performed roughly like hedge funds while trailing by 100 basis points annually before costs--meaning about 200 basis points after expenses.

By and large, the supporters of replication funds offered sound arguments. However, product marketers oversold the concept, thereby creating unrealistic expectations that could not be met. Add to that mix the disappointing overall performance of hedge funds, and the result was a market failure. Replication funds have few assets, and they are unlikely to attract new buyers anytime soon.

John Rekenthaler has been researching the fund industry since 1988. He is now a columnist for Morningstar.com and a member of Morningstar's investment research department. John is quick to point out that while Morningstar typically agrees with the views of the Rekenthaler Report, his views are his own.

The opinions expressed here are the author’s. Morningstar values diversity of thought and publishes a broad range of viewpoints.

/s3.amazonaws.com/arc-authors/morningstar/1aafbfcc-e9cb-40cc-afaa-43cada43a932.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HTLB322SBJCLTLWYSDCTESUQZI.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/TAIQTNFTKRDL7JUP4N4CX7SDKI.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/1aafbfcc-e9cb-40cc-afaa-43cada43a932.jpg)