The Bond Landscape Through an Index Prism

Benchmarks reveal the changing nature of the fixed-income market.

This article originally appeared in the fall 2019 issue of Morningstar magazine. To learn more about Morningstar magazine, please visit our corporate website.

The issuance of bonds traces its history to early human civilization, when payments were made in grain and terms were chiseled on tablets. In the 12th century, European rulers funded military adventures through debt instruments, giving rise to the sovereign credit market. Borrowing made possible through long-term obligations propelled the development of the West, supplying the capital not just for wars but also for global trade and foundational infrastructure such as canals and railroads. Generations of American investors have bought Treasury bills, notes, and bonds backed by the "full faith and credit" of the U.S. government.

To this day, the bond market stands as a pillar, not just of the global financial system, but of the real economy and, more broadly, society. By setting the price of borrowing, the bond market provides a feedback mechanism for policymakers, corporate executives, and a range of other debt issuers. The bond market's ability to reward prudence and punish profligacy is seen by many as a force for law and order, property rights, and responsible stewardship of capital. Its wrath is feared in boardrooms and ministries the world over.

For investors, bonds play a critical role in a diversified portfolio. Their regular income stream is prized by investors of all sizes, from retirees to asset owners looking to match future known liabilities. Bonds counterbalance the risk of equities and serve as portfolio ballast, especially useful during times of market stress. When fixed-income strategies lose money, their drawdowns tend to be far milder than those of stocks.

A Prism to the Changing Market Bond indexes, for their part, define and structure the market. They delineate the opportunity set for investors, offer measuring sticks for active managers, and underpin passive investment vehicles.

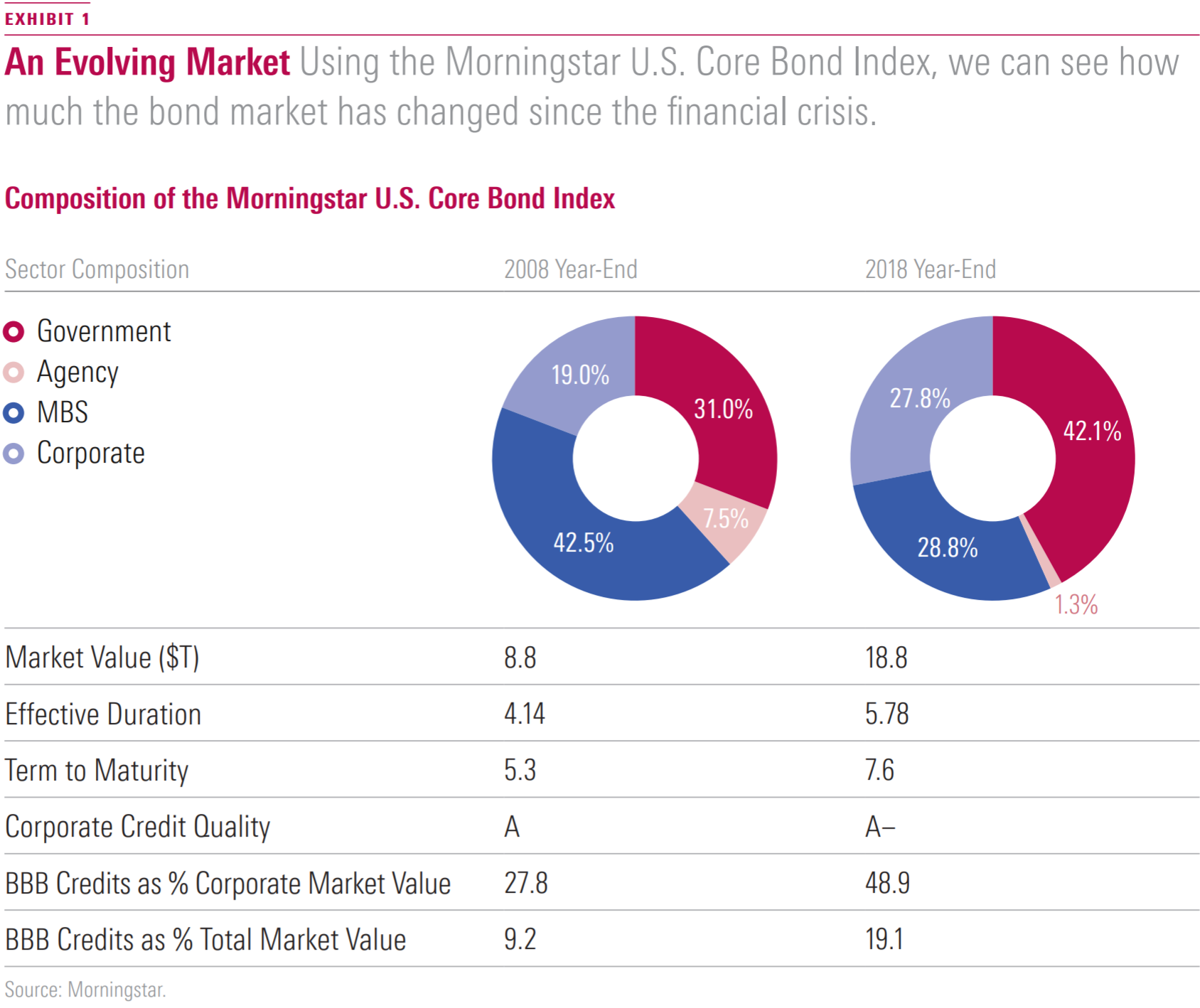

Indexes also provide a prism through which to view shifts in the landscape for fixed income. These shifts have been especially pronounced since the 2008 global financial crisis. By looking at the changing makeup of indexes, we can observe how dramatically different the bond market is today than it was a decade ago.

In the years immediately after the financial crisis, massive stimulus caused developed-markets government debt to proliferate. In the United States, the Federal Reserve bought some of the Treasury's issuance, while sucking up government agency-backed mortgage securities in the trillions through a quantitative easing, or QE, program.

The European Central Bank also began its QE program in mid-2009, but with an aggressive decision to begin buying covered bonds rather than government debt, before expanding that mandate in later years to governments, agencies, and European institutions. The European Central Bank only announced it would stop adding to its bond holdings in December--more than nine years after it began. Quantitative easing and anemic European inflation have translated into sovereign bond yields that have actually been negative, which is where German government debt still stood at the end of 2018.

Meanwhile, rock-bottom interest rates have prompted a flood of corporate debt issuance, especially in the U.S. Companies across the economy have taken advantage of cheap borrowing to go to the bond market. Much of the issuance has been lower on the quality spectrum.

The Morningstar US Core Bond Index illuminates the changing nature of the fixed-income landscape (Exhibit 1). Government bonds consumed 42% of the index's weight as of the end of 2018, up from 31% in 2008. Mortgage-backed securities, which played a central role in the U.S. housing market bubble that sparked the crisis, declined by an even greater share. And the increase in corporate borrowing, especially in the BBB rated space, is responsible for lower index-level credit quality. Meanwhile, the index's altered sector composition has resulted in an increase in its interest-rate sensitivity. The Morningstar US Core Bond Index's duration rose from around four years in 2008 to near six years in 2018.

Another change since the financial crisis is the ballooning amount of debt at the lower end of the investment-grade market. PIMCO portfolio manager and Morningstar Investment Conference panelist Sonali Pier told attendees this spring that 47% of the investment-grade market is made up of bonds rated BBB, up from 32% a decade ago. With high equity valuations and falling rates, she said, the cost of capital became so cheap for companies that they added debt to pay for acquisitions and buy back shares. The BBB market is now bigger than the high-yield and bank-loan markets combined. Having such a large part of the market one downgrade away from junk could be a concern, although Pier said that she's not too worried.

"What would it look like if the synergies in M&A did not pan out or sector fundamentals deteriorated?" she said. "Our estimate is there could be maybe $60 billion to $120 billion worth of fallen angels. That's something the high-yield market over time could accommodate." (Fellow panelist Laird Landmann of TCW wasn't so sanguine.)

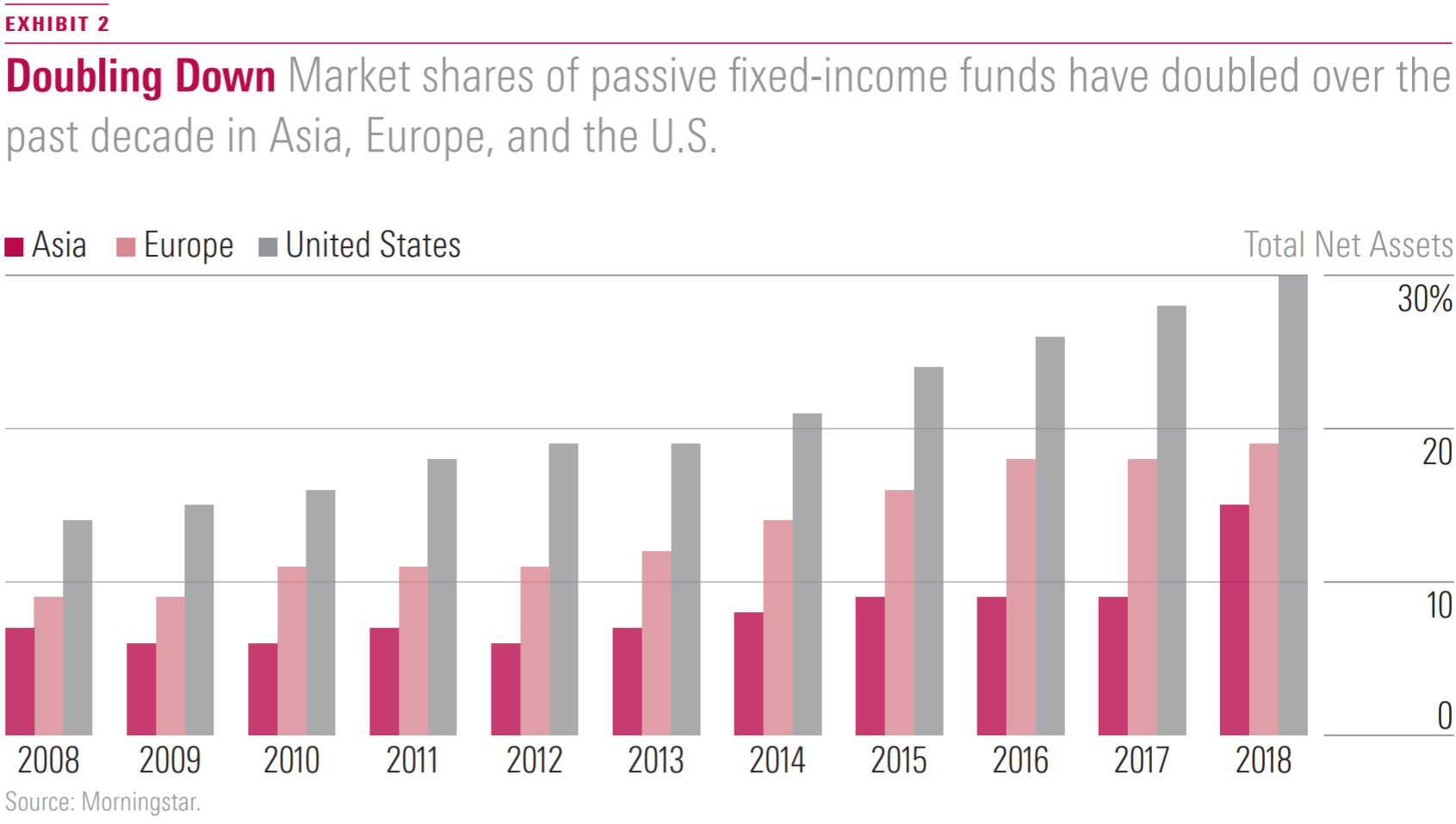

Meanwhile, investor capital has increasingly flowed to passively managed fixed-income strategies over the past 10 years. Investing in bonds via index trackers lags passive share on the equity side, but it is gaining traction. The exchange-traded fund revolution has included fixed income, with bond ETFs surpassing a milestone, $1 trillion in assets under management, in early 2019. When we add in index-tracking fixed-income mutual funds, the passively managed figure is closer to $2 trillion.

From less than 15% market share in the fund and ETF space in 2008, passively managed strategies as a percentage of overall fixed-income fund assets approached 30% in the U.S., 20% in Europe, and 15% in Asia at the end of 2018 (Exhibit 2). This compared with passive share of roughly 45% of equity fund and ETF assets in the U.S. and 35% in Europe.

Despite their rising popularity, passive fixed-income strategies are far trickier to implement than equity index trackers. In a study on the performance of bond funds, Morningstar researchers Mara Dobrescu, Matias Möttölä, and James Li blamed the complexity of bond benchmarks for the struggles of many managed fixed-income strategies to outperform. They wrote: "In markets where transaction costs are particularly elevated, both active funds and ETFs have struggled to match the performance of the index." The transaction costs they referenced include illiquid and hard-to-trade securities, as well as frequent rebalancing.

Liquidity Concerns Transaction costs are as much of an issue as ever, thanks to a confluence of factors that bond index providers, including Morningstar, must address. Global regulatory reform has affected broker/dealer balance sheets, leading to higher capital costs on trading desks and lower bond inventories. The result has been a significant erosion of market liquidity. While the amount of corporate bond issuance has exploded in recent years, trading volume has fallen.

Why? Companies have taken advantage of low interest rates to issue lots of debt, but with multiple bonds from the same issuer on the market, investors have preferred the latest issues. Turnover on bonds declines rapidly within months of issuance. The secondary market has dried up. This has led to rising transaction costs for trading in the cash market and protracted times for executing trades.

One way for index providers to address the challenges of changing market dynamics is to build indexes using the most recently issued "on the run" securities, which tend to be the most actively traded and liquid. These bonds can then proxy a larger number of similar securities from the same issuer. The weightings of each issuer, based on market capitalization, can continue to reflect the full complement of securities outstanding. The resulting indexes should have fewer securities and superior liquidity relative to peers. But their tracking error versus those peers should usually be low.

A Complicated History Bond indexing has long been a challenge for investors. Whereas data and publishing firms have always dominated the world of equity indexing, bond indexes were historically the province of investment banks. The banks' near monopoly on bond trading data gave them a handy tool with which to control bond indexes. The banks also enjoyed the benefits of relationships with investment-banking clients issuing securities who expected research coverage, not to mention inclusion in indexes used by the banks' customers buying those instruments on the other side of the house.

Index construction under this paradigm was never really geared to serve end investors. Over the years, indexes became sprawling, evolving into complex collections of eclectic sets of benchmarks. Many employed a tremendous level of fine slicing and duplication, as well as sector combinations meant to approximate strategies for very specific investment styles.

While those tools were undeniably valuable to many of the institutions they were designed to serve, they didn't always jibe with the way that individuals and advisors think about investing. Further, bond index families as a whole were daunting for the average investor or financial advisor to sort through and select from. Given their breadth and complexity, many lacked clear and self-evident family-level organization. Indexes within the same family, for example, often overlapped each other. And their names were confusing. Terms such as "aggregate," "multiverse," and "universal" were used interchangeably, and maturity tenors were expressed in both words ("short-intermediate") and numbers ("1–7").

That was problematic, because bond benchmarks play a critical role in structuring, defining, and shining a light on the fixed-income market in ways that are simply less necessary for equities. Indexes also serve a democratizing function. In the words of Vache Mahseredjian and Mark Friebel: "Indexes make the bond market more efficient by eliminating the information advantage formerly held by a few." [1]

The bond market needs structuring because it is far broader, more layered, and more fluid than the stock market. In addition to corporate issuance, it includes debt from governments and municipalities, and a vast range of securitizations with different rates, maturities, and cash flow structures. Old bonds are always maturing, while new bonds are coming to market, often from the same issuers. Thus, bond indexes must rebalance more frequently than equity benchmarks in order to capture new issuance and bonds that are called or maturing.

The over-the-counter nature of bond trading also presents challenges. In the absence of a central exchange and with many bonds not trading regularly, liquidity is a perennial concern. Pricing data can be difficult to obtain. "Transparency" is a term rarely associated with the bond market--or for that matter, the bond index providers.

Indeed, the broad provision of information was never the goal of the traditional bond index providers. Underlying index composition and data were difficult to obtain or cost-prohibitive.

Yield and basic return information were often the only data made available.

While regulators often require funds to release their holdings at regular intervals, no such requirement exists for the indexes against which they're benchmarked. An investor without access to underlying data for the index against which her portfolio is managed, therefore, may not know that her investment's risk profile is different from that of the broader market on parameters such as sector allocation, credit quality, and interest-rate sensitivity. A fund can sport an exceptionally high yield or outperform because of a large bet on bonds with low credit quality or local-currency emerging-markets debt, but it's important for investors to grasp the risk of those bets reversing course during different market conditions.

Banks Aren't What They Used to Be Changes in the banking world have been myriad, and the stuff of headlines, ever since regulators stepped in to rescue the industry from complete collapse in 2008, and then later addressed scandals like the manipulation of the London Interbank Offered Rate in 2014. Policymakers in the U.S. and Europe imposed a host of new regulations to prevent banks from bringing down the global economy in the future. Capital requirements have been raised, assets ringfenced, and bail-in mechanisms created. Surviving investment banks converted to commercial banks. Others were sold in a hurry at distressed prices. The once-dominant Lehman Brothers filed for bankruptcy.

That altered the calculus of relationships, profit margins, and business strategies across swaths of the industry, putting large index arms of investment banks onto their back burners and eventually leading to spin-offs of those groups. Now more independent of banking and under pressure from investors who are more reliant on indexes than ever, bond index providers have begun to refine index design and construction to align with best practices focused on investors.

Challenge Continues The bond market has long been the backbone of the global financial system and economy.

Today, it is broad, diverse, and constantly in motion--and fundamentally different than it was before the global financial crisis. Bond indexes, which have a critical role to play in defining the investable universe for fixed-income securities and serving as benchmarks for managed strategies, give us a view of how the market has changed. We can see that massive global stimulus in response to the financial crisis and low interest rates have led to an increased supply of developed-markets government debt and lower-quality corporate issuance in the market.

Meanwhile, investor capital has increasingly flowed into passively managed fixed-income strategies. Investment banks, which ran the biggest bond trading desks while also maintaining bond indexes--a model riddled with conflicts--have seen their role diminished.

These recent events have elevated the stature of the bond index. Providers are now in the spotlight and must continue to make indexes more investable, understandable, and accessible to investors of all stripes. Given aging demographics across the developed world, bonds will become even more important to investors.

[1] Mahseredjian, V., & Friebel, M. 2004. "Fixed-Income Benchmarks." In Active Index Investing. Edited by Steven A. Schoenfeld (New York: Wiley).

Disclosure: Morningstar, Inc. licenses indexes to financial institutions as the tracking indexes for investable products, such as exchange-traded funds, sponsored by the financial institution. The license fee for such use is paid by the sponsoring financial institution based mainly on the total assets of the investable product. Please click here for a list of investable products that track or have tracked a Morningstar index. Neither Morningstar, Inc. nor its investment management division markets, sells, or makes any representations regarding the advisability of investing in any investable product that tracks a Morningstar index.

Morningstar, Inc. licenses indexes to financial institutions as the tracking indexes for investable products, such as exchange-traded funds, sponsored by the financial institution. The license fee for such use is paid by the sponsoring financial institution based mainly on the total assets of the investable product. A list of investable products that track or have tracked a Morningstar index is available on the resources tab at indexes.morningstar.com. Morningstar, Inc. does not market, sell, or make any representations regarding the advisability of investing in any investable product that tracks a Morningstar index.

/s3.amazonaws.com/arc-authors/morningstar/033528a9-55cc-40aa-90a9-8d2d98697cf5.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/RYIQ2SKRKNCENPDOV5MK5TH5NY.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/6ZMXY4RCRNEADPDWYQVTTWALWM.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/6NPXWNF2RNA7ZGPY5VF7JT4YC4.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/033528a9-55cc-40aa-90a9-8d2d98697cf5.jpg)