Dividend Funds Under the Microscope

Not all dividend strategies are the same.

Combine historically low interest rates with a growing number of income-seeking retirees, and it’s no surprise that funds with a dividend focus have grown in popularity over the past decade.

In our white paper, "U.S. Dividend Funds Under the Microscope," we took a closer look at dividend funds in Morningstar's database, sorted them into groups based on portfolio characteristics, and compared their traits and performance.

This research aims to tease out the differences between these groups and help dividend investors choose a fund to help them reach their goals. It highlights some of the more promising funds and reviews characteristics that are important to consider when selecting a dividend-oriented fund.

Dividend Growth Versus Dividend Income For this research, we sorted the dividend-focused funds in Morningstar's database into three different classifications—dividend growth, dividend growth and income, and dividend income—based on the characteristics of their portfolios.

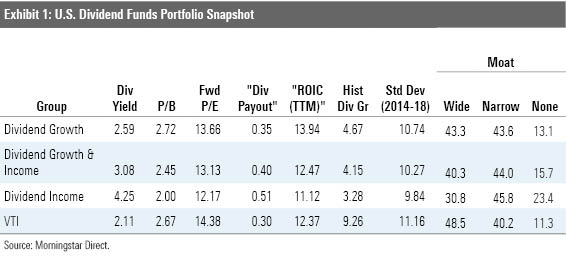

Exhibit 1 shows the differences in average portfolio characteristics of these three groups. Dividend income funds, on average, had higher yields and payout ratios, but their dividends grew at a slower rate than the other two groups. They also tended to have a more pronounced value tilt. On average, their holdings traded at lower price/book ratios than the other groups, and they were less profitable, as measured by return on invested capital.

At the other end of the spectrum, Exhibit 1 also shows that dividend growth funds provided lower yields than the dividend income group, but they focused on companies with stronger fundamentals and dividend-growth rates than the other two. Dividend growth funds, on average, tended to hold more-profitable companies. They had a higher fraction of their portfolios dedicated to firms with narrow and wide Morningstar Economic Moat Ratings (an indication of their preference for stocks with durable competitive advantages) than those in the dividend income and dividend growth-income groups.

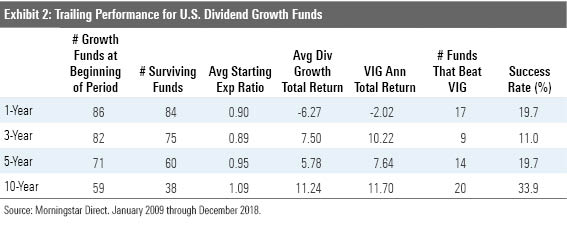

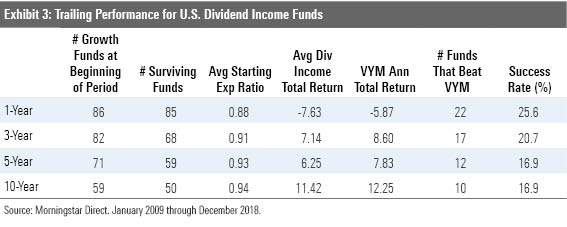

Performance We benchmarked dividend growth and dividend income funds against low-cost options that represent each fund type's respective style. Exhibits 2 and 3 show how the dividend growth group, on average, performed against Vanguard Dividend Appreciation ETF VIG over the trailing one-, three-, five-, and 10-year periods through December 2018. The same numbers are shown for the dividend income group relative to Vanguard High Dividend Yield ETF VYM.

These results show that most funds in both the dividend growth and dividend income groups failed to survive and outperform their respective benchmark. High fees are one possible culprit for the low success rates. The average fund in these two groups charged an expense ratio of about 0.90% or more at the start of each time period examined. By comparison, VIG cost 0.28% while VYM’s fee was 0.25% when they were launched in 2006.

What to Look For Investors need to look beyond dividend yield and past performance to select good dividend funds. Keeping costs low can be one of the simplest and most effective ways to improve the probability of success. Our research shows that the lowest-fee funds from each group had a better total return, on average, than their more-expensive competitors.

Risk management is another key factor of success. Investors can improve their odds of success by sticking to funds that hold stocks with the desire and capacity to continue making dividend payments. Screening for funds with relatively higher average profitability is one way to identify those that favor these types of stocks because profitability can be a proxy for stocks with the capacity to continue making dividend payments. Our research showed that dividend funds with a higher average profitability tended to outperform those with lower profitability, on average.

Disclosure: Morningstar, Inc. licenses indexes to financial institutions as the tracking indexes for investable products, such as exchange-traded funds, sponsored by the financial institution. The license fee for such use is paid by the sponsoring financial institution based mainly on the total assets of the investable product. Please click here for a list of investable products that track or have tracked a Morningstar index. Neither Morningstar, Inc. nor its investment management division markets, sells, or makes any representations regarding the advisability of investing in any investable product that tracks a Morningstar index.

/s3.amazonaws.com/arc-authors/morningstar/78665e5a-2da4-4dff-bdfd-3d8248d5ae4d.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/T2LGZCEHBZBJJPPKHO7Y4EEKSM.png)

/d10o6nnig0wrdw.cloudfront.net/04-18-2024/t_34ccafe52c7c46979f1073e515ef92d4_name_file_960x540_1600_v4_.jpg)

/d10o6nnig0wrdw.cloudfront.net/04-09-2024/t_e87d9a06e6904d6f97765a0784117913_name_file_960x540_1600_v4_.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/78665e5a-2da4-4dff-bdfd-3d8248d5ae4d.jpg)