8 Upgrades Highlight August Ratings Changes

Morningstar analysts rated 149 strategies in August.

Morningstar rated 149 strategies overall in August. Two of those strategies are new to coverage.

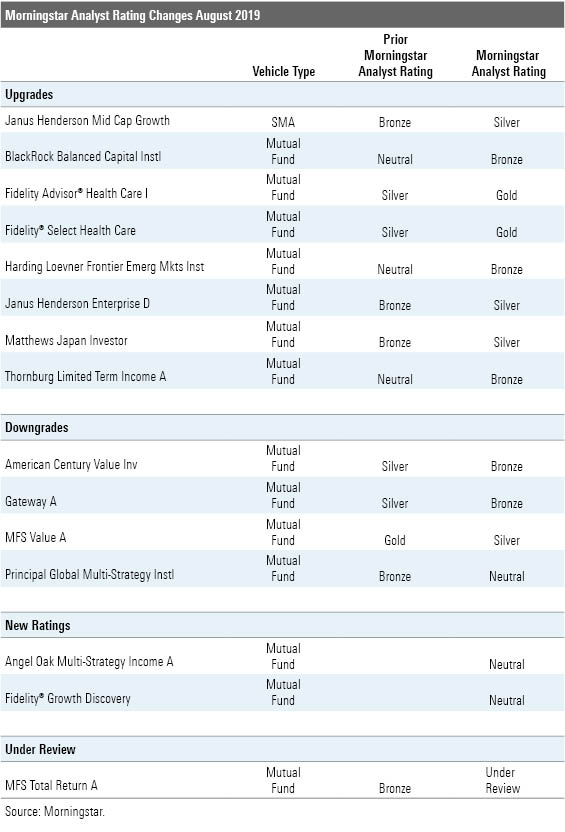

Amid the updates, manager research analysts affirmed the Morningstar Analyst Ratings of 134 strategies, upgraded eight, and downgraded four. Analysts also placed one fund under review and added two funds to coverage. A select group of ratings are showcased below, followed by the full list of ratings for the month.

Upgrades Fidelity Select Health Care FSPHX was raised to a Morningstar Analyst Rating of Gold from Silver as it continues to stand apart from competitors thanks to deep subsector expertise and a strong bench. Eddie Yoon, the strategy's manager since October 2008, is a proven healthcare investor with over 15 years of industry experience. Yoon draws on roughly a dozen analysts with subsector specialties, who help him gauge the worth of preexisting drug pipelines and vet the prospects of novel treatments. He manages risk thoughtfully and his measured approach has led to attractive results on his watch. From October 2008 through August 2019, the fund outperformed peers by roughly 3 annualized percentage points. Finally, competitive fees further contribute to this strategy's appeal.

BlackRock Balanced Capital MACPX increased to a Bronze rating from Neutral following management changes in its core equity fund. In June 2017, BlackRock overhauled its active equity lineup and put its quantitative equity team in charge of several mutual funds, including BlackRock Advantage Large Cap Core MALRX, which is this fund's core equity holding. We rate five mutual funds managed by the quantitative team, and each is a Morningstar Medalist, reflecting our confidence in the team and its process to deliver alpha for investors over the long term. The addition of the quantitative team to this fund's roster complements BlackRock Total Return MAHQX, which has a Silver rating. While the bond fund is an attractive option for fixed-income exposure, our one qualm is that the fund has wide flexibility to invest in high-yield and emerging-markets bonds, which don't reliably provide a ballast during equity market sell-offs, unlike higher-quality bonds. Finally, a cheap price tag bolsters its appeal.

Downgrades MFS Value's MEIAX Analyst Rating dropped to Silver from Gold following the announcement that veteran manager Steven Gorham will step down in December 2020 to focus on other MFS offerings. Gorham will leave the strategy in the capable hands of comanager Nevin Chitkara, who is staying put, and Katherine Cannan, who will join as comanager on Dec. 31, 2019. Still, the team won't be quite as solid without Gorham's experience as lead dating back to 2002. The strategy's proven approach will remain in place, though. The managers focus on identifying durable firms with below-average business risk that they believe can generate cash flow throughout the business cycle, and they hold on to stocks for the long haul. This approach has helped the strategy outperform the Russell 1000 Value Index with a bit less volatility since Chitkara started on the strategy in May 2006. Despite the downgrade, this remains an attractive option for investors.

American Century Value’s TWADX Analyst Rating fell to Bronze from Silver on the back of analyst turnover and recent struggles. Lead manager Michael Liss adds a contrarian bent to American Century’s proven, quality-driven process. However, this contrarian tilt can lead to value traps if the team is not careful. Recent blunders have eroded the strategy’s previously strong record. Poor stock picks over the trailing four-year period have weighed on results, and instability in its analyst ranks also gives pause about the team’s ability to consistently pick strong stocks. The team’s recent analyst churn, with seven of nine supporting analysts joining in the past four years, and the fund’s above-average price tag curb the strategy’s outlook. While still a decent option, its recent woes have lessened its appeal.

New Ratings Angel Oak Multi-Strategy Income ANGLX boasts a strong track record dating to its 2011 inception, but lofty fees hold it back. The strategy receives a Neutral rating. It has been one of the best-performing funds in the multisector bond Morningstar Category from its June 2011 inception through August 2019; however, it has not yet endured a full market cycle and still needs to prove it can hold up in a sustained market downturn. The strategy is backed by an experienced team, but the management bench has not yet run money in this way together for long. The fund's risk profile is not for the faint of heart. It invests predominantly in nonagency mortgages and will also hold sizable stakes in a variety of other securitized sectors, including collateralized loan obligations and asset-backed securities. While the team has proven adept at managing this risk to date, its proclivity for leverage and securities with liquidity risk warrants caution. Finally, all of the fund's share classes rank above their similarly distributed peers' median.

Fidelity Growth Discovery FDSVX has some things going for it, including an experienced portfolio manager in Jason Weiner and an army of analysts backing the strategy, but its approach does not stand out. The strategy receives a Neutral rating. The team looks for companies with strong earnings-growth prospects and allows considerable flexibility so it can invest in stocks across the market-cap spectrum and domiciles. Despite its go-anywhere approach, it tends to favor large, rapidly growing firms with high price multiples relative to the index. Bottom-up, fundamental analysis fuels the approach here and its success depends on the team’s stock-picking prowess. Under lead manager Jason Weiner’s tenure, stock-picking has been mixed and this uneven execution limits Morningstar’s conviction in the strategy.

/s3.amazonaws.com/arc-authors/morningstar/c5cfeb1b-84bd-4fc2-9ea1-ed94bbd92e9f.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HDPMMDGUA5CUHI254MRUHYEFWU.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/OMVK3XQEVFDRHGPHSQPIBDENQE.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/c5cfeb1b-84bd-4fc2-9ea1-ed94bbd92e9f.jpg)