Ultimate Stock-Pickers' Top 10 Buys and Sells

Six of the top 10 conviction purchases are undervalued.

For the past decade, our primary goal with Ultimate Stock-Pickers has been to uncover investment ideas our equity analysts and top investment managers find attractive, in a manner timely enough for investors to gain some value. As part of this process, we scour the quarterly (in some cases, the monthly) holdings of 26 different investment managers: 22 managers oversee mutual funds covered by Morningstar's manager research group and four Stock-Pickers run the investment portfolios of large insurance companies. As holdings data becomes available, we attempt to identify trends and outliers among their holdings as well as any meaningful purchases and sales that took place during the period under examination.

In our last article, we walked through the Ultimate Stock-Pickers' purchasing activity during the second quarter of 2019. The piece itself was an early read on the purchases--focused on high-conviction and new-money buys--that were made during the period, based on the holdings of almost all our top managers. As all of our Ultimate Stock-Pickers have reported their holdings for the period, we think that it is appropriate to examine our managers' high-conviction purchases and sales. As stock prices have changed since our Ultimate Stock-Pickers chose to purchase or sell the holding, we urge investors to analyze securities at current valuation levels before making any investment decisions and we provide our fair value estimates, moat ratings, stewardship ratings, and uncertainty ratings to help investors make these decisions.

We were not surprised to see a continuation of a long-standing trend of net selling by our Ultimate Stock-Pickers. We think that this long-standing trend may be more indicative of capital flowing into passive products than our managers taking a more bearish stance. Despite the net selling, our Ultimate Stock-Pickers still made several high conviction purchases as well as sales.

Our Ultimate Stock-Pickers continued their long-standing trend of buying, selling, and holding high-quality companies that Morningstar believes have developed sustainable competitive advantages. Morningstar's analysis shows that all the top 10 high-conviction holdings have either a narrow or wide economic moat and that nine of the 10 conviction holdings have a wide economic moat. Additionally, nine of the 10 companies composing the top 10 high-conviction purchases and high-conviction sales lists been granted either a narrow or wide economic moat by Morningstar analysts.

From a sector allocation perspective, our Ultimate Stock-Pickers are taking about as active of a stance as they were last quarter. The Ultimate Stock-Pickers used to be meaningfully underweight consumer cyclical stocks, but are now within 100 basis points of the S&P 500 for this sector. The Ultimate Stock-Pickers are now meaningfully underweight real estate. The Ultimate Stock-Pickers remain meaningfully overweight industrials, financial services, and basic materials and remain meaningfully underweight in the utilities and energy sectors.

As many of the Ultimate Stock-Pickers are long-term investors, we were not surprised to see that the composition of our top 10 conviction stock holdings was exactly the same as the prior quarter. We noticed that the relative ordering of the top 10 stock holdings altered somewhat, with Bank of America BAC, JPMorgan JPM, and Mastercard MA moving up the list, while Wells Fargo moved down on the list. Our Ultimate Stock-Pickers continue to hold companies from the financial services and technology sectors with conviction, as these sectors contributed five and three stocks to our list, respectively. We think that most of the top 10 conviction holdings list is fairly valued, with a few notable exceptions. Our research indicates that wide-moat rated Microsoft MSFT, Wells Fargo WFC, and Best-Idea Berkshire Hathaway BRK.B are undervalued. Though we have covered Wells Fargo extensively, we think it is worthwhile to revisit this controversial story, as Morningstar analyst Eric Compton has recently taken a deep dive into the name.

Ultimate Stock-Pickers' Top 10 Stock Holdings (by Investment Conviction)

Compton recognizes that having a long-term view is difficult when Wells Fargo has multiple issues which could pressure the name in the short to medium term. These issues include the asset cap, uncertain CEO succession, and more potential fines. However, he thinks that it is this "ick" factor, and overall investor fatigue which have helped contribute to the discount he sees in the share price. Compton asserts that to justify current valuations, it must be assumed that Wells has no ability to decrease expenses in the future and still faces material revenue declines. Compton believes that, while that outcome is a possibility, it is less likely than a more positive alternative, and he sees no reason why the bank can't cut its current expense base and eventually return to revenue growth. That said, he cautions investors by noting that this isn't a pretty story, it comes with risks, and there are good reasons to believe that it will not play out over the short term. Overall, if an investor can get comfortable with the time horizon risk and execution risk associated with the name, while shares aren't a steal, Compton still sees some value.

The big takeaway from Compton's piece is that that much of the loss of profitability that Wells has experienced over the last three-plus years can be attributed to a confluence of structural factors that have moved against the bank that have very little to do with the sales scandals. Compton does not believe Wells Fargo will be the uncontested leader in banking it once was, but he thinks that the franchise still has the right ingredients for reasonable success over the long term.

Compton highlights changes in the mortgage industry, changes in deposit pricing, and the gradual sell off of pick-a-pay loans as key reasons for Wells' declining profitability over the years. Compton notes that Wells was able to take substantial share in a mortgage market with very little competition during the refinance boom after the financial crisis. Today, Compton sees much more competition in the mortgage market, particularly from nonbank players, which has brought lower margins and share losses, all while and origination volumes are lower for the industry as a whole. Due to this structural shift, Compton does not expect outsize profits to return to this space, which affects Wells more than any peer. Compton also highlights Wells' deposit base. Wells' has historically had one of the best deposit bases in the business, but Compton thinks that this has changed in the most recent rate hike cycle, and he does not see the bank regaining its dominance here. Finally, Compton also highlights the sell off of Wells' higher yielding pick-a-pay loan portfolio, which has led to lower over yields and interest income for the bank's interest earning assets. Compton views the sell-off of this loan book as a prudent move to derisk the balance sheet but thinks that investors should realize that this extra yield is not coming back.

While Compton does not think that the company will return to being the uncontested leader in banking, he thinks that the company has the right ingredients for a successful franchise over the long term. He believes the banks still has key advantages from its scale and scope, and across its franchises, including the community banking segment, the wholesale banking segment. Wells still has the most complete U.S. retail branch network, which gives the bank real advantages. He notes that the bank has the largest U.S. deposit base, a comparably good deposit density per branch, and that customers who only visit a branch once a year are still more likely to choose the bank with the most convenient branch location as their primary bank. Though he recognizes that the community bank is in the middle of an internal restructuring following the sales scandal and that competitive pressures are increasing, he thinks that the bank's robust branch presence and significant existing relationships across the U.S, lead to real advantages for the company.

Regarding the wholesale bank, Compton believes that Wells, similar to a regional banking business model, still maintains a key advantage in the middle market, targeting clients that would be too small for larger peers to generally consider. That said, he notes that competitors, particularly JPMorgan, have been expanding into this segment. While there are risks, Compton notes that it is still very hard to win new relationships in the small and medium enterprise space, Wells is positioned to defend its turf.

Finally, Compton sees scale and scope advantages for the bank. The largest banks, of which Wells is one, have more complete product sets that can be broadly distributed across fixed cost technology platforms. Technology also allows for internal automation, leading to better efficiency and economies of scale. As technology budgets increase with the size of the institution, Compton anticipates that the largest banks will also be the most advantaged.

In summary, Compton believes too much pessimism is baked into the current share price. Though Compton thinks that Wells Fargo's metaphorical stagecoach may not be running as fast as it once did, he doesn’t see it as broken, either.

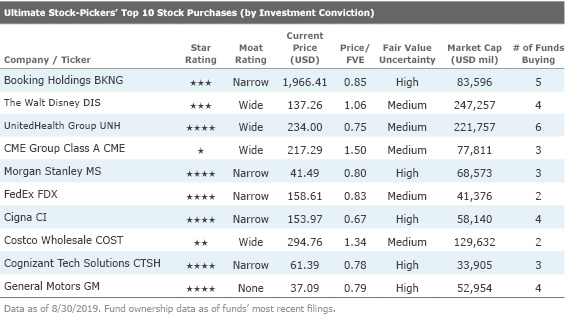

Ultimate Stock-Pickers' Top 10 Stock Purchases (by Investment Conviction)

As we previously mentioned, our Ultimate Stock-Pickers' Top 10 Conviction Stock Purchases list is almost entirely composed of names that have been given moats by Morningstar equity analysts. We found that our Ultimate Stock-Pickers continued to focus their purchasing energy on consumer cyclical stocks, which contributed three names to the list. We have covered several of the undervalued names on the conviction purchases list in the previous editions of Ultimate Stock-Pickers. From a valuation and quality perspective, the cheapest wide-moat stock is UnitedHealth Group UNH, which received a conviction purchase from Jensen Quality Growth Fund JENSX and a conviction new-money purchase from the Alleghany Corporation Y.

Morningstar Analyst Jake Strole also sees value in the name, and the stock currently trades at a material discount to his $310 fair value estimate. UnitedHealth houses the largest private health insurer, a leading ambulatory care and health analytics franchise, and what Strole expects will soon be the second-largest pharmacy benefit manager by volume in the country. Strole thinks that the company's massive scale and scope generate cost advantages and network effects that underpin his wide-moat rating.

Strole believes that the company's scale generates cost advantages in two ways. First, he thinks that a larger membership base allows for greater centralized fixed-cost leverage, increasing the profit potential of the marginal member for the overall enterprise. Second, Strole contends that a larger membership base allows for greater negotiating leverage versus the providers that an insurer needs to create a plan network, which allows for lower medical costs per member and the opportunity to lower premiums or improve its benefits offering to secure enrollment growth.

Strole also sees network effects playing a role between the patient, payer, and provider. Strole contends that as a plan's enrollment grows, the relationship among these three entities becomes more valuable over time. As a plan's negotiating leverage expands, either premiums become relatively more affordable or the plan invests in a broader swath of benefits for its members, which benefits patients. For payers, expanding enrollment allows for greater per-member profitability and a more attractive offering, either through better pricing or a more enticing benefits package. For providers, Strole believes that participating in an expanding plan network provides access to greater patient volume, which is a key component of profitability in a business with high fixed costs over the short run. In sum, Strole expects that these dynamics create barriers to entry for would-be competitors and anticipates that putting together an attractively priced provider network in a new geography is prohibitively difficult without the membership pool and vice versa.

Though Strole anticipates that the national dialogue around healthcare reform is likely to intensify leading into the 2020 election cycle, he contends that UnitedHealth will find a way to weather the storm. He thinks that widespread industry disruption is a relatively low probability event and sees opportunity for private insurers to continue being part of the solution. Based on this, Strole thinks that UnitedHealth is more likely than not to continue earning excess returns well into the next few decades.

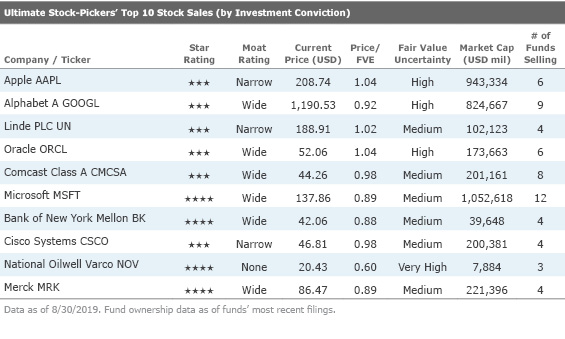

Ultimate Stock-Pickers' Top 10 Stock Sales (by Investment Conviction)

The Top 10 Ultimate Stock-Pickers conviction sales list is a familiar list of standbys in the Ultimate Stock-Picker's portfolios. As has been the case in many prior periods, many of the conviction sales are also conviction holdings. This quarter four of the 10 conviction sales stocks were present on the conviction holdings list, which leads us to believe that many of the conviction sales were profit-taking on what remain high-conviction stories. Much of the selling activity came from the technology sector, which contributed four names to the conviction sales list. From a valuation perspective, the greatest disagreement between our research and the Ultimate Stock-Pickers' sales was no-moat rated National Oilwell Varco NOV, which trades at around 60% of Morningstar Analyst Preston Caldwell's fair value estimate, though Caldwell has a very high uncertainty rating on the name.

Two of our Ultimate Stock-Pickers, the Oakmark Fund OAKMX and Parnassus Core Equity Fund PRBLX, made conviction outright sales of the name. Parnassus' managers provided some commentary on the conviction sale:

Finally, given our view that the global economy will decarbonize over the long term, the Fund exited National Oilwell Varco (NOV), a supplier of equipment and technology for energy companies, and MDU Resources, a utility and materials company. Despite our exit from the investment, we applaud MDU for significantly increasing its renewable power generation. While we realize fossil fuels will be important to power the economy for many years to come, we feel these energy sources face permanently lower relevancy.

Caldwell sees National Oilwell Varco as the undisputed leader in providing rig equipment. The company was well-positioned within the rig-building boom of 2005-15, but unfortunately for National Oilwell Varco, the rig-building era was decisively ended by the U.S. shale boom. Caldwell anticipates that the large incremental volumes from U.S. shale remove the need for the formerly anticipated large volumes of offshore oil and gas. Consequently, Caldwell doesn't expect any large orders for these rigs for National Oilwell Varco in the next decade or longer. Secondly, Caldwell finds that the relentless efficiency gains in U.S. shale mean that shale oil and gas can be developed with fewer rigs. Therefore, Caldwell does not expect a boom in rig-building from demand within the shale space. Despite these real headwinds, Caldwell thinks that market implied outlook is excessively negative, and sees the stock as a bargain. While Caldwell assumes that the rig technologies segment will face continued headwinds, he expects that the company's non-rig segments, such as Completion & Production Services and Wellbore Technologies will benefit from the ongoing recovery in global capital expenditures. Also, although Caldwell does not expect that new rigs will be built, he expects that the company will be able to maintain high-margin revenue from servicing the vast installed base. Finally, management has recently announced a cost savings plan that is expected to reach $160 million per year, which would allow the company to become more efficient.

If you're interested in receiving e-mail alerts about upcoming articles from The Ultimate Stock-Pickers Team, please sign up here.

Disclosure: Burkett Huey has an ownership interest in Berkshire Hathaway. Eric Compton has no ownership interests in any of the securities mentioned here. It should also be noted that Morningstar's Institutional Equity Research Service offers research and analyst access to institutional asset managers. Through this service, Morningstar may have a business relationship with fund companies discussed in this report. Our business relationships in no way influence the funds or stocks discussed here.

/s3.amazonaws.com/arc-authors/morningstar/c32e19fc-79e3-48d7-b503-8c516793755e.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/AET2BGC3RFCFRD4YOXDBBVVYS4.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/IORW4DN3VVC3BC4JO7AQLSJTF4.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ODMSEUCKZ5AU7M6BKB5BUC6G5M.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/c32e19fc-79e3-48d7-b503-8c516793755e.jpg)