Proxy Season Shows ESG Concerns on Shareholders’ Minds

Investors voted on 177 shareholder resolutions addressing sustainability issues.

Active ownership is about shareholders exercising their right via the proxy process to address issues with company management that may affect shareholder value. If you own mutual funds, it is the funds that own the shares and therefore have the ability to exercise these rights, which include voting on management and shareholder resolutions at company annual meetings, the ability to propose shareholder resolutions, and the informal means to engage directly with management about issues of concern.

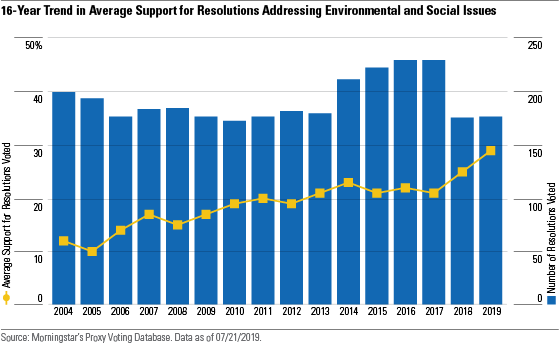

It is through active ownership that sustainable investors are helping companies understand and address environmental and social risks. Over the past 16 years, the level of overall shareholder support of these measures has increased from 12% to 29%. In addition, constructive dialogue has often resulted in companies coming to an agreement with shareholders about their concerns, which has led to many proposed shareholder resolutions being withdrawn prior to the annual meeting.

The 2019 proxy season ended in June with investors having voted on 177 shareholder resolutions addressing environmental and social concerns. Although we do not know how mutual funds voted because they are not required to report their votes until the end of August, average shareholder support of these resolutions was 29%, up from 25% in 2018--that's two years in a row of record-setting levels of support. In 2019, 14 resolutions garnered the support of a majority of voted shares.

At first glance, those may seem like modest numbers, especially considering that resolutions receiving majority support are nonbinding on management. But much lower levels of support are typically considered significant. First-time resolutions receiving as little as 3% of shares voted are eligible for resubmission the next year. In year two, they must receive at least 6%, and in year three, 10%. Set by the SEC, these thresholds reflect the idea that a small number of shareholders can raise important and relevant issues for management to consider. This notion is also reflected in the modest level of ownership required for a shareholder to be able to propose a resolution: holding shares worth at least $2,000 or 1% of voting shares outstanding, for at least 12 months. Not just any resolution can be placed on a proxy ballot, however. Resolutions must meet several criteria, including relevance to the company's business.

Resolutions usually receive low absolute levels of support because much of the voting routinely follows the recommendations of company management. Prior to the vote, a proxy statement is sent to shareholders, which includes management's response to arguments made by shareholder proponents in support of the proposed measure, as well as a vote recommendation, which is nearly always negative. That almost one third of shares were voted in support of environmental and social resolutions and against management's recommendations this year is therefore highly significant. This level of support is often sufficient to spur management to take action to address shareholder concerns.

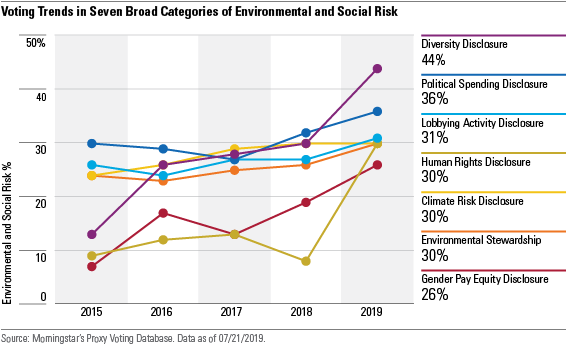

Investors Want Companies to Be More Transparent About Environmental and Social Risks Most shareholder resolutions request companies to disclose information about issues that may pose risks to the business to provide investors more clarity. These resolutions gained more support across several areas this year.

Attracting the highest level of support and the second-largest increase in support over last year were the 11 resolutions asking companies to disclose information about workforce diversity and strategies for improving diversity on the board and in senior management. Another 15 resolutions addressing human-rights risks averaged 30% support, up significantly from 8% average support in 2018.

The largest group of resolutions requested companies to improve their disclosure of spending on political campaigns and lobbying. These 62 resolutions averaged 36% and 31% support, respectively, representing healthy increases over 2018. These votes are evidence that shareholders are increasingly concerned about a company's political activities having a detrimental impact on its reputation, especially when they do not align with its public statements.

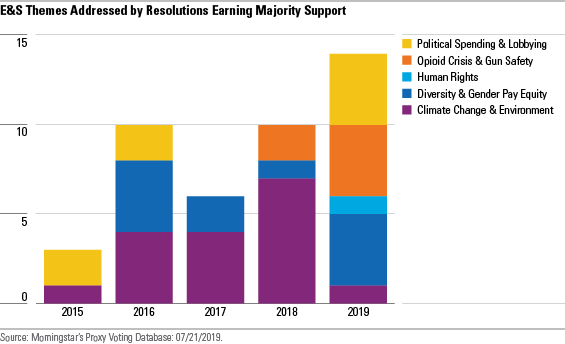

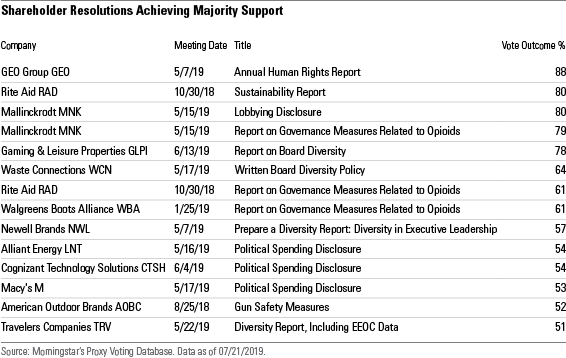

Investors Connect Negative Societal Impact to Reputational Risk Most resolutions earning majority support in recent years addressed climate and related environmental risks. The record number of resolutions that drew majority support in 2019 reflected a wider variety of issues. Three companies were asked by a majority of shares cast to report on how they are addressing their exposure to the opioid crisis. A gunmaker was asked to report on its activities related to gun safety.

A resolution asked private-prison company GEO Group for annual reporting on how the firm implements its own human-rights policy--in particular, the portion of it addressing "Respect for Our Inmates and Detainees." The supporting text of the resolution cites official investigations finding improper treatment, security breaches, forced labor, and inhumane living conditions of immigrant detainees. In a rare move, GEO Group management decided to support the resolution, which helped drive its high level of support.

The GEO Group resolution was one of several attracting majority support that connected negative social impact to reputational risk. These resolutions reflected shareholder concerns over the possible erosion of a firm's social license to operate, as employees, customers, lenders, and supply-chain partners may withdraw support for and collaboration with companies that are perceived to be producing negative societal externalities.

The Proxy Process Supports Engagement Growing support for shareholder resolutions is not the only measure of investor success in the proxy process. In fact, the withdrawal of resolutions before they come to a vote is often an indicator of success. That's because the proxy process facilitates interaction between shareholders and management. Filing a resolution is often the first step in a constructive dialogue. When dialogue is successful, shareholders withdraw their resolution, and the company takes action that addresses the concerns raised.

This is happening with increasing frequency around climate. In 2016, 57 resolutions were voted on asking companies to report on their business risks and strategy with respect to climate change. In 2019, there were more withdrawals of climate-risk disclosure resolutions than the 17 that actually went to a vote.

Trillium Asset Management, for example, filed a resolution at EOG Resources EOG requesting the company set and disclose methane emission reduction goals. After a successful engagement, the company committed to reduce its methane emissions and set longer-term reduction goals. As a result, the resolution was withdrawn.

With increasingly sophisticated global investor action on climate change and growing calls for decision-useful climate-related disclosures in line with recommendations laid out by the Task Force on Climate-Related Financial Disclosures, corporate boards have become more willing to engage with shareholders on the subject.

Active Ownership Helps Protect Long-Term Shareholder Value Shareholder resolutions are raising awareness about the social and environmental risks that companies face--risks that can result in operational and reputational costs. The record levels of support for resolutions are helping drive successful engagements with companies, many of which are coordinated by coalitions of investors, such as Climate Action 100+ and the Investor Alliance for Human Rights.

When shareholders vote their proxies and engage with corporate boards and management, they're taking an active role in shaping the governance arrangements at companies in which they're invested. As a growing portion of corporate ownership accumulates in passively managed investment strategies, active ownership becomes an even more important way for shareholders to protect the long-term value of their investments.

Interested in ESG? Check out a curated collection of our latest content on ESG investing.

Jon Hale has been researching the fund industry since 1995. He is Morningstar’s director of ESG research for the Americas and a member of Morningstar's investment research department. While Morningstar typically agrees with the views Jon expresses on ESG matters, they represent his own views.

/s3.amazonaws.com/arc-authors/morningstar/42c1ea94-d6c0-4bf1-a767-7f56026627df.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/NNGJ3G4COBBN5NSKSKMWOVYSMA.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/6BCTH5O2DVGYHBA4UDPCFNXA7M.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/EBTIDAIWWBBUZKXEEGCDYHQFDU.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/42c1ea94-d6c0-4bf1-a767-7f56026627df.jpg)