3 Ways to Boost Equity Income

A closer look at three approaches to boost income without loading up on the riskiest areas of the market.

A version of this article previously appeared in the June issue of Morningstar ETFInvestor.

Many investors obsess over investment income, and it's easy to understand why. Retirements are lasting longer, and with longer life expectancies come higher medical costs and greater risk of outliving one's assets. While demands on savings have increased, so has the challenge of meeting them with investment income. Interest rates are lower now than they have been historically, as are dividend payout ratios.

It isn't necessary to live solely on investment income, but many still focus on it, driven by a desire to not dip into principal for fear that such withdrawals may not be sustainable. That intention is good, but the focus on yield is often misplaced. Yield doesn't tell the full story of any investment. Aggressively chasing it can lead to risky areas of the market. Here, I'll highlight three approaches to boost equity income without taking much greater risk than the market.

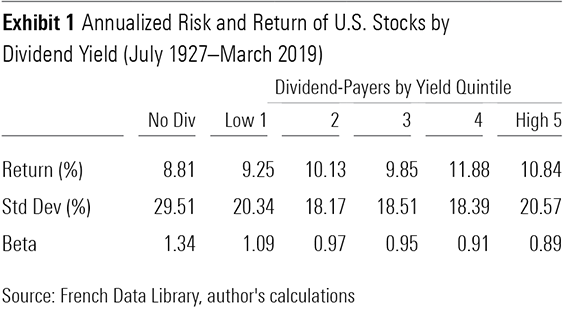

Dividend Income One of the justifications often cited for dividend investing is that high-yielding dividend stocks have historically offered better returns than their stingier counterparts, as Exhibit 1 shows. This is partially because high dividend yields are usually accompanied by low valuations, and cheap assets have tended to outperform pricier ones.

There are other reasons to favor high-dividend-payers. These stocks tend to be more profitable and less speculative than non-dividend-payers. The market tends to punish firms that cut their dividends, so most firms don't commit to them unless they are confident they can honor them throughout the business cycle. Consequently, higher-yielding firms are typically more mature and less sensitive to the business cycle than lower-yielding stocks. These firms often pay out a larger share of their earnings.

High payout ratios can impose discipline on corporate managers, leaving them less money to squander on low-return investments. However, it also leaves less of a cushion to protect dividend payments if earnings fall.

So, what's wrong with aggressively targeting the highest-yielding stocks? The richest dividend yields can point to firms with weak or declining profits, which could threaten the sustainability of the dividend and, more importantly, the price of the stock. Funds that weight their holdings by yield, such as SPDR S&P International Dividend ETF DWX, are particularly susceptible to this issue because they rebalance into stocks as their yields climb, which is often because of falling stock prices, reflecting deteriorating fundamentals.

Aggressively chasing yield can also increase exposure to value investment style risk, as the highest-yielding stocks tend to be deep-value names. When value stocks are out of favor, that tilt can hurt performance.

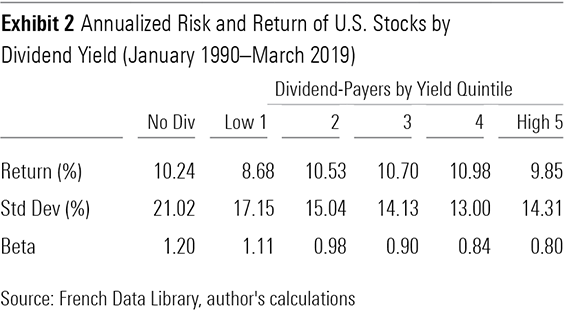

The highest-yielding stocks don't necessarily offer the highest returns, as Exhibit 1 illustrates. Over the better part of the past three decades, non-dividend-payers posted slightly higher returns than the highest-dividend-payers (with higher volatility), as shown in Exhibit 2. During that time, dividends have declined in importance as firms have increasingly used share repurchases to return cash to shareholders.

Strategies that target high-yielding stocks can still deliver attractive returns. The key is to stick to broadly diversified portfolios, where a few bad apples won't derail performance, or strategies that screen for both yield and quality.

Strong Dividend Strategies Vanguard High Dividend Yield ETF VYM is my favorite U.S. dividend-income strategy and one of the cheapest (0.06% expense ratio). It earns a Morningstar Analyst Rating of Silver.

This strategy relies on broad diversification to limit risk. It targets stocks representing the higher-yielding half of U.S. dividend-payers (excluding REITs) and weights them by market capitalization.

This simple approach has been effective. The fund beat the Russell 1000 Value Index by 1.46 percentage points annualized from December 2006 through April 2019. Owing to its value tilt, it lagged the Russell 1000 Index during that time, but it was less sensitive to market fluctuations and tended to hold up a little better during market downturns.

Schwab U.S. Dividend Equity ETF SCHD matches VYM on price and carries a Silver rating. While it has a more concentrated portfolio, this market-cap-weighted strategy limits risk by screening for both quality and yield. It targets 100 high-yielding stocks with strong return on equity, cash flow/debt, and dividend growth over the past five years.

Despite its more concentrated portfolio, this strategy has exhibited similar volatility, market sensitivity, and defensive downside performance to VYM from November 2011 through April 2019.

Create Your Own Dividend It isn't necessary to target high-dividend-paying stocks to earn higher income distributions than the market. Sometimes it can be more effective to simply own the market portfolio, with a fund like Vanguard Total Stock Market ETF VTI, and sell a small percentage of the position each year to generate cash to supplement the market's dividends. Withdrawals of 2% or lower each year should be sustainable, as there's a good chance that earnings per share can grow at that rate (above inflation) over the long term.

This approach yields better diversification than dividend funds, and it avoids the value style risk common to most of those strategies. It should also be more tax-efficient than a dividend of equal size because only the gain is taxed, which should be less than the value of the sale, assuming the cost basis is greater than zero.

There are some trade-offs to consider. Harvesting a fixed percentage of the portfolio each year can result in more-volatile distributions than investing in a dividend strategy, as dividend payments from U.S. firms tend to be more stable than stock prices. However, anchoring the sell rule to the average of the portfolio's values over the past few years can help reduce this volatility. It's also important to keep in mind that withdrawing funds will likely reduce the portfolio's long-term returns. But the same is true of investors who spend their dividends rather than reinvesting them. Perhaps the real downside is that homemade dividends require investors to act, while traditional dividend strategies don't.

Covered-Call Strategies Covered-call strategies may also be worth considering to boost income. This is where an investor owns a stock (or portfolio of stocks) and writes a call option on that security, giving the option buyer the right to purchase that stock at a set price. In exchange, the option writer receives a premium. This effectively trades the stock's upside potential for current income, but it leaves the investor fully exposed to the stock's downside risk.

At first blush, that seems like a lousy deal. Why would anyone want to keep all the downside risk and cap their gains? If the market is efficient, the premium income the option writer receives should offer fair compensation for this asymmetric risk. But research suggests that the market tends to overvalue these options, owing to loss aversion and demand for upside participation.[1]

While the covered-call strategy is sound in theory, it hasn't worked as well in practice. Consider Invesco S&P 500 BuyWrite ETF PBP (0.49% expense ratio), the oldest covered-call ETF listed in the United States. This fund owns the S&P 500 and sells call options on the index expiring in the next month with the closest strike price above the index's current market price, holding these positions until maturity.

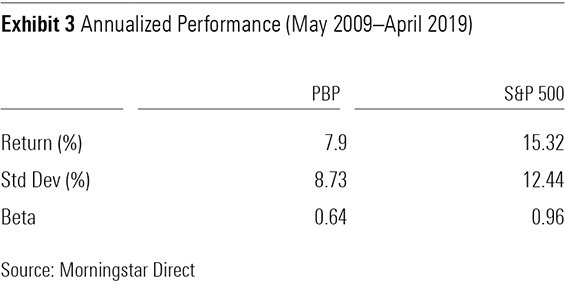

From January 2008 through April 2019, the fund was less volatile than the S&P 500. But it posted considerably lower returns, resulting in less-attractive risk-adjusted performance, as shown in Exhibit 3. That said, it may look better in a weaker environment for stocks.

This strategy was also considerably less tax-efficient than most dividend income strategies. Because of the way this fund is structured, it is subject to a tax rule that requires it to mark its holdings to market daily. That doesn't allow it to defer taxes, and many of its gains are considered short-term.

First Trust BuyWrite Income ETF FTHI is more tax-efficient than PBP because it is structured to avoid the daily mark-to-market tax requirements. Tax management is a central focus for this fund, and so far, it has not made any capital gains distributions. This improvement goes a long way to justifying its higher 0.85% fee. FTHI is an actively managed fund that tilts toward stocks with higher dividend and shareholder yields than the market, but it still offers a broadly diversified portfolio.

Income distributions from covered-call strategies tend to be more volatile than most dividend strategies, as option premium income is tied to market volatility, which constantly changes. When expected volatility is low, call options carry smaller premiums because it's less likely they'll end up in-the-money. So, it's not prudent to anchor on these fund's past yields.

Key Takeaways

- Don't blindly chase yield. Stick to broadly diversified portfolios or strategies that screen for both yield and quality.

- Selling a small part of a stock investment each year can be an effective way to boost income.

- Covered-call strategies may offer attractive income and risk-adjusted performance over the long term, but their income distributions can be volatile.

[1] Israelov, R., Neilsen, L., & Villalon, D. 2017. "Embracing Downside Risk." J. Alternative Investments, Vol. 19, No. 3, P. 59.

Disclosure: Morningstar, Inc. licenses indexes to financial institutions as the tracking indexes for investable products, such as exchange-traded funds, sponsored by the financial institution. The license fee for such use is paid by the sponsoring financial institution based mainly on the total assets of the investable product. Please click here for a list of investable products that track or have tracked a Morningstar index. Neither Morningstar, Inc. nor its investment management division markets, sells, or makes any representations regarding the advisability of investing in any investable product that tracks a Morningstar index.

/s3.amazonaws.com/arc-authors/morningstar/56fe790f-bc99-4dfe-ac84-e187d7f817af.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/T2LGZCEHBZBJJPPKHO7Y4EEKSM.png)

/d10o6nnig0wrdw.cloudfront.net/04-18-2024/t_34ccafe52c7c46979f1073e515ef92d4_name_file_960x540_1600_v4_.jpg)

/d10o6nnig0wrdw.cloudfront.net/04-09-2024/t_e87d9a06e6904d6f97765a0784117913_name_file_960x540_1600_v4_.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/56fe790f-bc99-4dfe-ac84-e187d7f817af.jpg)