Roth or Traditional IRA: Which Should You Choose?

Here’s a simple system to help you break down the choice.

Editor’s note: A version of this article was initially published on Aug. 26, 2019. This content is part of Morningstar’s Tax and IRA Guide special report.

I get this question a lot. Or, rather, it's usually something like, "Which is better?"

Traditional IRAs and Roth IRAs both offer tax-advantaged growth of money. The contribution for both account types for 2021 is $6,000, or $7,000 if over age 50. The biggest difference between the account types comes down to when you pay taxes on the money.

With that in mind, here is the first question to ask yourself: Do you think you'll be in a higher or lower tax bracket in retirement than you are now?

You'll be forgiven if--like me--you don't really know the answer to this question. But here's the conventional wisdom: If you have reason to believe you will be in a lower tax bracket in retirement than you are now, it might be wise to stick with a traditional IRA (in other words, pay taxes on the money later, when your income tax rate will be lower).

Conversely, if you are just starting your career and there's a good chance that you will be in a higher tax bracket later in life, a Roth could be a better choice because you'll pay income tax at your current (lower) tax rate. But there are other considerations, too. If you are on a very tight budget and could really use the tax deduction now, a traditional IRA could be the way to go.

Here are some additional questions to help you decide.

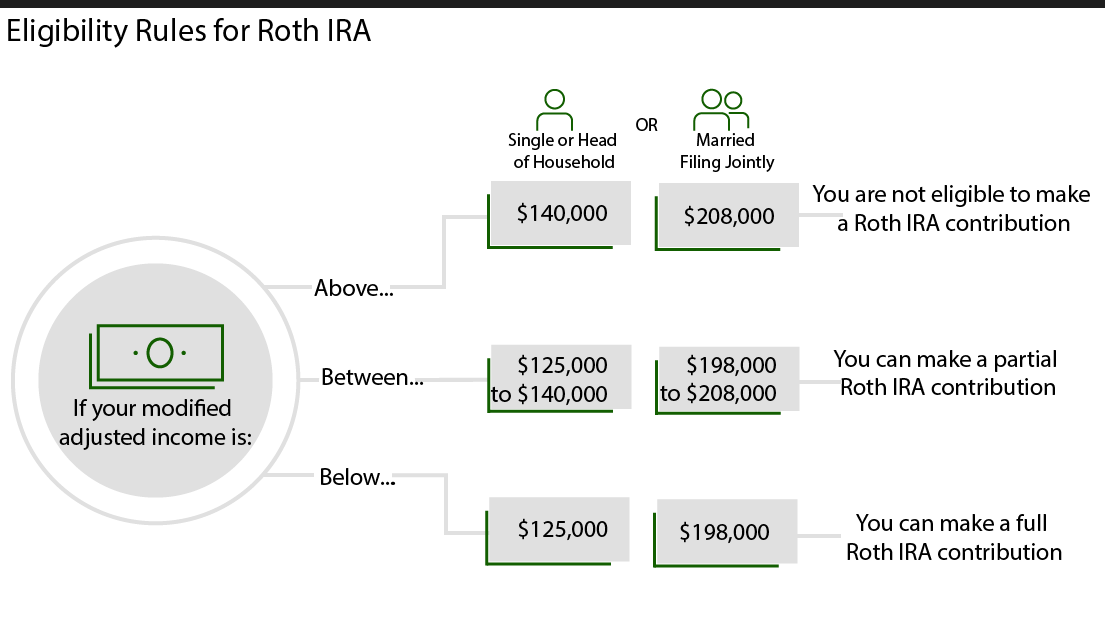

I Think My Tax Bracket Will Be Higher in Retirement If you think your tax bracket will be higher in retirement than it is now, you might lean toward a Roth IRA. But you need to ask yourself a few more questions to see if you qualify.

Source: Morningstar.

Of course, if you really want to open a Roth IRA but you aren't eligible to contribute because your income is too high, you can do a backdoor Roth maneuver.

With a Roth IRA, you pay tax now. You contribute to a Roth IRA using aftertax money, and you can't deduct the contribution from your taxable income. But when you do withdraw the money in retirement, it's tax-free.

- Roth IRA contributions are also subject to certain income limits. A single filer and head of household can make a full contribution if your income is below $125,000 and a partial contribution up to $140,000. For married filing jointly, you can make a full contribution if your income is less than $198,000, and a partial contribution up to $208,000.

- You can withdraw contributions you made to your Roth IRA anytime, tax- and penalty-free. However, you may have to pay taxes and penalties if you withdraw the earnings in your Roth IRA prior to age 59 1/2. If you are 59 1/2 or older but haven't had the account for more than five years, your earnings may be subject to taxes but not penalties.

- Unlike a traditional IRA, you aren't required to take withdrawals after age 72.

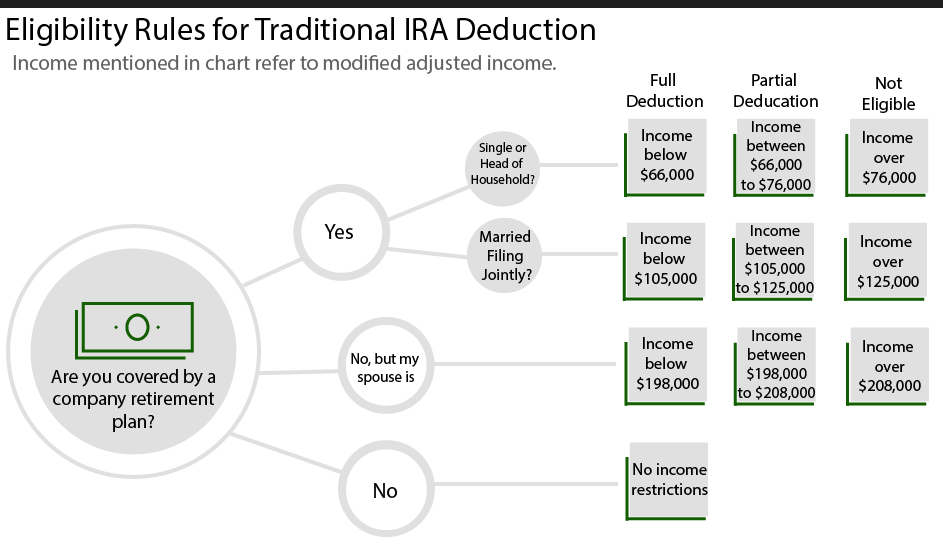

I Think My Tax Bracket Will Be Lower in Retirement If you think your tax bracket will probably be lower when you're in retirement than it is now, a traditional deductible IRA might serve you better. But there are some considerations with that, too:

Source: Morningstar.

With a traditional IRA, you pay tax later. When you contribute to a traditional IRA, if your income is below certain limits, you may be eligible to deduct the contribution from your adjusted gross income, which means you won't pay tax on it now. Beginning at age 59 1/2, you can withdraw money from your traditional IRA; at that time, you will pay income taxes on the amount withdrawn.

- For single filers who are covered by a company retirement plan, you can deduct the full contribution if your modified adjusted gross income, or MAGI, is below $66,000, and a partial deduction up to $76,000 ($105,000 and $125,000 for married filing jointly). If your spouse is covered by a retirement plan but you are not, the deduction is phased out between $198,000 and $208,000. If neither you nor your spouse is covered by an employer-sponsored retirement plan, you are eligible to take the full deduction.

- If you withdraw the money before you turn 59 1/2, you may be subject to a 10% penalty on the withdrawal.

- Beginning at age 72, you will be required to take taxable withdrawals from your account or you will be subject to a penalty.

I Have No Idea What My Tax Bracket Will Be When I Retire! If you don’t know what the future holds--and many people fall into this category!--it’s a tax-savvy idea to split the difference. Contribute to both account types if you can. If you do, you will have the freedom to choose whether you pay taxes on your income in retirement or not.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/3a6abec7-a233-42a7-bcb0-b2efd54d751d.jpg)

/d10o6nnig0wrdw.cloudfront.net/04-24-2024/t_a8760b3ac02f4548998bbc4870d54393_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/O26WRUD25T72CBHU6ONJ676P24.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/U772OYJK4ZEKTPVEYHRTV4WRVM.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/3a6abec7-a233-42a7-bcb0-b2efd54d751d.jpg)