9 Exceptional--And Plucky--Core Bond Funds

These Gold-rated funds all hail from the new Intermediate Core-Plus Bond Morningstar Category.

In early May, Morningstar retired the intermediate-term bond Morningstar Category, which was the largest of our fixed-income categories. In its place, we introduced two new categories: intermediate core bond and intermediate core-plus bond.

Why the change?

Although the funds in the old category shared many traits, most landed in one of two camps, explains director of fixed-income strategies Sarah Bush. The first group features intermediate-term bond funds that stick with U.S.-dollar investment-grade debt and carry little exposure to below-investment-grade securities. The second group--the "plus" team--includes intermediate-term bond funds with more flexible mandates that hold larger stakes in below-investment-grade and non-U.S.-dollar debt.

How can investors use these more diverse--and higher-yielding--core “plus” funds in their portfolios?

“Some of Morningstar's longtime favorite funds fall into the core-plus bond category, and many of these are worthy options as investors' linchpin fixed income holdings,” explains Morningstar director of personal finance Christine Benz. However, investors who use core-plus intermediate-term bond funds as their core or sole bond funds should understand that in exchange for their higher yields, these funds' volatility may be a bit higher and their diversification benefit a bit lower than core bond funds. That's because core-plus funds have the latitude to venture beyond very high-quality bonds for at least a portion of their portfolios, so they're apt to be more susceptible to economic and equity-market shocks than core intermediate-term bond funds.”

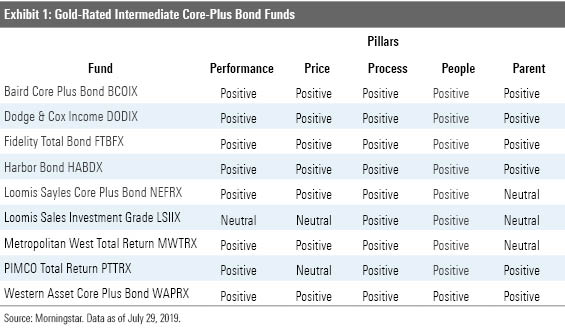

Nine funds in the intermediate core-plus bond category earn Fund Analyst Ratings of Gold. (Premium Members can access a complete list of Medalist Funds across Morningstar Categories here.)

Here are excerpts from the fund analyses of the five funds from the list that earn our highest marks across all Morningstar Pillars: Performance, Price, Process, People, and Parent.

Baird Core Plus Bond

BCOIX

“Baird Core Plus Bond has a strong foundation for success. Its stalwart team, disciplined process, and low fees align to make the fund a dependable choice in the intermediate-bond Morningstar Category, meriting a Morningstar Analyst Rating upgrade to Gold from Silver.

Veteran manager and Baird CIO Mary Ellen Stanek helms the fund with five tenured comanagers whose industry experience averages 35 years. All have been contributors here since the fund's 2000 inception. That group is supported by five additional portfolio managers and 12 dedicated analysts. While that head count is modest compared with some other firms', the team sticks to sectors and bonds that it can thoroughly understand with its resources.

Stanek and her team use a tried-and-true valuation-driven process to outpace the Bloomberg Barclays U.S. Universal Index. A mixture of investment-grade corporate, securitized, and government bonds form the core of the portfolio, with a smattering of high yield (between 4% and 12% over the past decade) and dollar-denominated emerging-markets corporates (less than 5%). When the team ventures into below-investment-grade fare, it prefers to hold a diversified set of well-trafficked names, rather than concentrate in a few positions. The team matches the fund's duration to that of the index and avoids derivatives, leverage, and nondollar bonds. These constraints allow management to focus on its strengths: security selection and sector rotation.

Over its nearly two-decade life span, the strategy has maintained a persistent overweighting in corporate and securitized bonds, and an underweighting in Treasuries. Its bias toward credit has been a boon in the years following the financial crisis but comes with added risk. Yet, the process’ risk controls, such as limitations on position sizing and a preference for shorter maturities in its lower-quality fare, prevent single names from derailing the strategy’s performance. Helped by low fees, the approach has succeeded over the long term.”

--Alaina Bompiedi, analyst

Dodge & Cox Income

DODIX

"An experienced team, a robust long-term approach to investing, and an attractive price tag support Dodge & Cox Income's Morningstar Analyst Rating of Gold.

This fund stands out for its relatively patient and at-times contrarian approach to investing. The fund's managers, who average 21 years of experience, start with an investment horizon of three to five years. They tend to favor corporates, noting that the yield advantage offered by these securities is an important contributor to total returns over time, and run a fairly compact, mostly cash-bond portfolio.

The managers are also not afraid to go against the crowd when they're confident in their analysis. As plunging energy prices took a toll on corporate valuations in 2014 and 2015, the team was quick to take advantage of the sell-off to add to particularly hard-hit names in this sector. This brought the fund's corporates exposure up to 48% of assets as of March 2016 from 38% as of September 2014. As energy prices stabilized and corporates rallied, the team gradually reduced this allocation to 34% as of June 2018, its lowest level since March 2008. Since then, the managers have been selectively adding names like Cigna, Ford Motor Credit, and United Technologies at attractive valuations.

A tilt toward corporates has made this fund more sensitive than peers to credit market swings, and its at-times contrarian approach can be a drag on its relative performance. For instance, during the energy-led credit sell-off from June 2015 through February 2016, the fund lost 1.6% and landed behind its Bloomberg Barclays U.S. Aggregate Bond Index and its typical intermediate-term bond peer by roughly 200 and 300 basis points, respectively. However, the team has demonstrated strong security-selection skills, and its willingness to take advantage of market corrections has served investors well.”

--Benjamin Joseph, analyst

Fidelity Total Bond

FTBFX

“An experienced portfolio management roster benefits from a wealth of support--including sector specialists, quantitative tools, and a robust cohort of analysts--all critical components to this team-managed offering that derives an edge from deep research and nimble implementation. In conjunction with a disciplined track record and attractive fees, that earns Fidelity Total Bond a Morningstar Analyst Rating of Gold.

Besides investing in the typical investment-grade credit, mortgages, and U.S. Treasuries in the fund’s Bloomberg Barclays U.S. Aggregate Bond Index benchmark, lead portfolio manager Ford O’Neil and his comanagers may allocate up to 20% in non-investment-grade bonds, including high-yield and emerging-markets debt, when the team finds market valuations compelling. This gives the fund an edge versus more-conservative benchmark like intermediate-bond peers, but it may also invite more volatility.

The team has executed this mandate with skill. For example, through 2015 and into early 2016, anxiety over dipping oil prices caused volatility in energy-related names, but sector specialists recommended exposures to hard-hit emerging-markets and high-yield bonds, which rebounded sharply later in the year. Following that year’s risk-on fervor, the team pared back risk selectively, exchanging richly valued corporate credit for what the team perceived as more-attractive alternatives with greater liquidity, including Treasury Inflation-Protected Securities and REITs.

[T]he fund's weightings in lower-quality bonds and emerging-markets bonds make it more susceptible to losses and have burned it before (as in 2008), but over time, thoughtful positioning has delivered attractive results.”

--Emory Zink, analyst

Harbor Bond

HABDX

“Harbor Bond offers a proven process and one of the bond market’s best and most well-resourced management teams in subadvisor PIMCO. It carries a Morningstar Analyst Rating of Gold.

Investors began pulling money from PIMCO’s Total Return strategy more than a year before Bill Gross left the firm. While the bleeding eventually slowed in 2017, it has mostly continued since. Once numbering several hundred billions of dollars, assets across all of PIMCO vehicles using the strategy had shrunk to $82 billion by the end of 2019’s first quarter.

PIMCO has managed those outflows well, though, and there were few departures after Gross left. The team has since found balance among its leaders--Scott Mather, Mihir Worah, and Mark Kiesel--and benefits from massive PIMCO resources and the leadership of CIO Dan Ivascyn. Staffing has also been augmented, in some cases by senior-level returnees to the firm.

There have been hiccups, including in early 2019 when shorts on non-U.S. interest rates in a few developed markets, including a notably large short against Japanese debt, hurt returns in March. And while the team benefited from an underweighting in U.S. corporate credit risk and made hay on U.S. rates when higher-risk markets sold off in 2018’s fourth quarter, betting against other developed rate markets offset that success.

The team has gotten a lot right overall, posting returns in the best third of unique offerings in the intermediate-term bond Morningstar Category since Gross’ departure. Although their global interest-rate strategies have had mixed success, sector plays, led notably by allocations to nonagency mortgage and other securitized assets, have kept the strategy in good stead versus its category and the Bloomberg Barclays U.S. Aggregate Bond Index over those years.

Although investors have shed interest in this strategy, that arguably makes it easier to manage. It remains reasonably priced and backed by a very strong asset manager; it continues to deserve plenty of investor confidence.”

--Eric Jacobson, senior analyst

Western Asset Core Plus Bond

WAPRX

"Western Asset Core Plus Bond Fund’s performance in 2018 was weak but doesn’t indicate any deterioration of its underlying qualities. The fund retains its Morningstar Analyst Rating of Gold.

The fund’s (Institutional-share-class) loss of 1.49% in 2018 put it behind its Bloomberg Barclays U.S. Aggregate Bond Index benchmark by 150 basis points, and its average (unique share class) intermediate-term bond Morningstar Category peer by 114 basis points. To put this in its proper perspective, over the 10 years ended Dec. 31, 2018, the fund’s tracking error relative to its benchmark stood at about 300 basis points annualized. In terms of its tracking error the fund was thus half a standard deviation off its index in 2018, hardly worth noting. Given that this was the first calendar year since 2011 that the fund underperformed its benchmark, its long-term competitive performance record hasn’t been much affected.

The fund’s success is rooted in several sources. One is its willingness to take on risk: As a core-plus offering, it always holds out-of-index fare, including below-investment-grade paper. But the fund has used this freedom judiciously in recent years and aims to diversify its sources of risk. Management has been able to make good macro calls more often than not in recent years, as well; its long-duration stance, in place for some years, is particularly noteworthy as an out-of-consensus bet that was motivated partly by doubts that rates were going up as much as many feared, and partly by a desire for insurance against turbulence in risk assets.

The fund has maintained continuity, in the form of veteran managers Western CIO Ken Leech and Mark Lindbloom, but has endured some turnover: Carl Eichstaedt retired at the end of 2018 after 20 years at the fund, while managers Michael Buchanan and Chian-Liang Lian were taken off the fund in 2018 to allow them to focus more effectively on their credit and emerging-markets duties, respectively. John Bellows and Fred Mark--both of whom have been at Western for some years--were added to the roster."

--Maciej Kowara, associate director

/s3.amazonaws.com/arc-authors/morningstar/35408bfa-dc38-4ae5-81e8-b11e52d70005.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/DOXM5RLEKJHX5B6OIEWSUMX6X4.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZKOY2ZAHLJVJJMCLXHIVFME56M.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/IGTBIPRO7NEEVJCDNBPNUYEKEY.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/35408bfa-dc38-4ae5-81e8-b11e52d70005.jpg)