Sustainable Funds at Midyear

Strong flows, good performance, more funds considering ESG and some intriguing new entrants.

Taking stock of sustainable funds at midyear, here are some highlights: Sustainable funds experienced record flows in the first half of 2019 alongside generally strong relative performance. Conventional funds continued to add environmental, social, and governance criteria to their investment process. While the pace of new launches has slowed, there are several intriguing new entrants to the sustainable funds group.

Flows. In my last piece, I wrote about flows into U.S. sustainable open-end and exchange-traded funds so far this year being on pace to surpass the calendar-year record set last year. Sustainable funds attracted an estimated $8.9 billion in net flows in the first half of 2019, surpassing their $5.5 billion in flows for all of 2018.

What accounts for the increased flows? With so many more funds now available, it’s easier than ever for fund investors and advisors to turn their interest in sustainability into actual investments. The number of sustainable funds has increased significantly over the past three years, including multiple new offerings from major asset-gatherers like Fidelity, iShares, and Vanguard. As of late 2014, there were about 130 sustainable open-end and exchange-traded funds available to U.S. investors. Now, there are 279 and more than 200 others that are not ESG-focused but that have formally added the consideration of ESG criteria to their investment process. Many of these new options have the marketing muscle of large fund companies behind them making them more visible to investors.

The greater availability of ETFs, in particular, is another likely driver of flows. As of late 2014, there were only two diversified ESG ETFs that investors could use for core exposure to stocks, both focused on U.S. large caps. With expense ratios of 0.5%, they were expensive. Today, there are 47 diversified ESG ETFs covering equities (U.S. large-cap, small-cap, non-U.S. developed and emerging markets, and various style-specific options) and fixed-income. Fees on diversified ESG ETFs have come way down: 15 of these ETFs charge between 0.09% and 0.2% in fees and only six charge more than 0.4%.

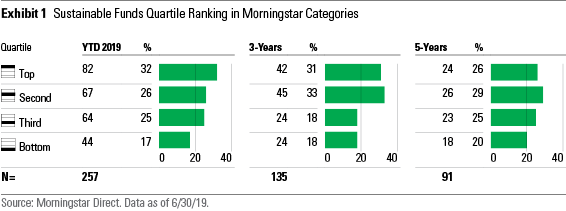

Performance. Sustainable funds, on the whole, have continued to perform well this year relative to their Morningstar Category peers. Based on my list of 279 sustainable funds and using the oldest share class of those with multiple share classes, 58% ranked in their respective Morningstar Category's top half for the year to date through June. Nearly one third (32%) ranked in their category's top quartile and only 17% ranked in their category's bottom quartile.

Based on one-year and three-year annualized returns, the picture is largely the same. Once we get out to the five-year mark, things start to even out a bit, but the number of sustainable funds with five-year records is only 91.

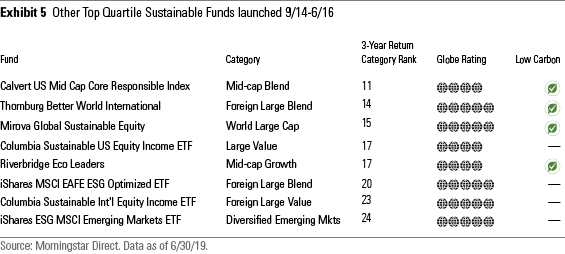

The recent wave of sustainable fund launches began in late 2014, which means that those launched between then and June 2016 now have track records of at least three years. Three years is, of course, a short and arbitrary time period to really discern much about likely fund performance over the long run, but many use it nevertheless as a minimum threshold for considering an investment.

How have the sustainable funds classes of 2014, 2015, and early 2016 fared now that they are past the three-year mark? The answer is--so far, so good.

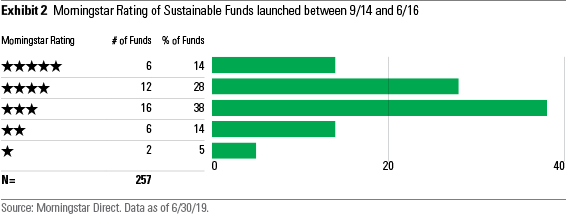

Funds earn Morningstar Ratings (stars) after three years. The star rating is a risk-adjusted performance evaluation relative to category. Funds with risk-adjusted returns ranking in the top 10% of each category get 5 stars, the next 22.5% get 4 stars, the middle 35% get 3 stars, the next 22.5% get 2 stars, and the bottom 10% get 1 star.

As of the end of June 2019, based on their three-year annualized risk-adjusted returns relative to category, the distribution of stars for the 42 sustainable funds that have recently “come of age” is as follows:

These results show pretty impressive initial performance from sustainable funds. In the overall universe, the number of 5-star and 1-star funds is about the same; among these sustainable funds, 3 times more are 5-star than 1-star funds. Or, think of the distribution in thirds: In the overall universe, about one third of funds receive 4 or 5 stars, about one third receive 3 stars, and about one third receive 2 or 1 stars. For these sustainable funds, the distribution is 43% top third, 38% middle third, 19% bottom third.

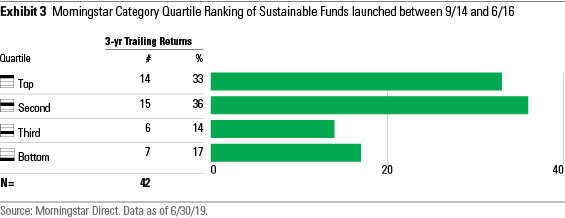

Another way to assess performance is by looking at how these funds’ three-year returns rank within their categories. This removes the risk adjustment but still controls for it to some extent by comparing returns with category peers. I assigned the funds to quartiles based on their three-year annualized returns.

As of the end of June 2019, the three-year trailing annualized returns of the 42 sustainable funds that have recently passed the three-year mark place as follows within their categories:

Nearly seven of 10 of the newly of-age funds ranked in the top half of their respective categories.

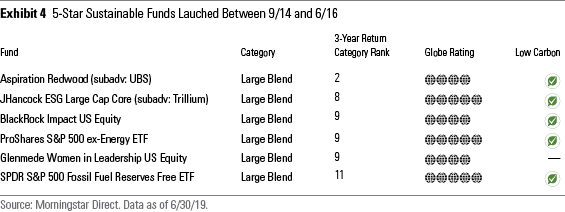

Here are the 5-star funds out of the group:

And several others have three-year trailing annualized returns that rank in their respective Morningstar Category’s top quartile:

More funds considering ESG. I wrote last quarter about the many conventional funds that are adding ESG criteria to the investment objective in their prospectus. More than 100 did so in the first half of the year, including funds from Brandywine, Calamos, ClearBridge, Driehaus, Franklin Templeton, Hartford, and Jensen, and Transamerica, bringing the total to more than 200.

I've been calling these funds ESG consideration funds to highlight the difference between them and those for which broad sustainability criteria or themes are central to the process. Funds considering ESG use ESG criteria as a complement to their existing process.

This trend reflects the growing recognition among asset managers that taking ESG factors into consideration is just common sense given the material sustainability challenges many companies face today. This view has become increasingly mainstream, as illustrated by the CFA Institute's recently released position statement on ESG:

“The CFA Institute encourages all investment professionals to consider ESG factors, where relevant, as an important part of the analytical and investment decision-making process, regardless of investment style, asset class, or investment approach.”

Moreover, the CFA Institute’s view is that factoring ESG into the investment process:

“is consistent with a manager’s fiduciary duty to consider all relevant information and material risks in investment analysis and decision-making.”

Intriguing new entrants. While more funds are deciding to consider ESG, the number of new sustainable fund launches has slowed from the record levels of the last four years. Seven were launched in the first half of 2019, including some intriguing new entrants:

Two ETFs, based on the same underlying MSCI index, launched in the first half and now lead the race to lower fees. DWS came out first with Xtrackers MSCI USA ESG Leaders Equity ETF USSG, launched in March, followed by iShares ESG MSCI USA Leaders ETF SUSL in May. A Finnish insurance company called Ilmarinen provided ample seed capital to both funds, which enabled them to come out of the gate with expense ratios of only 0.1%.

Based on the MSCI USA ESG Leaders Index, the ETFs hold the highest ESG-rated companies in each sector by market cap, with the overall portfolio remaining sector-neutral. They exclude companies with business involvement in alcohol, tobacco, gambling, nuclear power, controversial and conventional military weapons, and civilian firearms. They avoid companies with serious ESG-related controversies.

While Vanguard launched a couple of ESG ETFs last year, I wasn’t particularly impressed with them because they are heavily exclusion-based rather than basing stock selection even partly on overall ESG evaluations of companies. But the new, actively managed Vanguard Global ESG Select Stock VEIGX, subadvised by Wellington Management, has promise.

Just launched in June, the fund will have a compact portfolio, intended to be low turnover, consisting of companies that Wellington believes have leading ESG practices along with strong business fundamentals and proven management. Wellington will be responsible for shareholder-engagement activities and proxy voting.

I like that profile; too many active managers water down their portfolios with weak-conviction stocks, a tendency that can work against sustainable portfolios, which often end up looking not terribly different from conventional ones. A long-term-oriented portfolio of high-conviction stocks of companies committed to sustainability should prove attractive to investors. While its ESG work has been largely under the radar, Wellington is a top-quality manager that can be expected to implement ESG in a thoughtful way.

Interested in ESG? Check out a curated collection of our latest content on ESG investing.

Jon Hale has been researching the fund industry since 1995. He is Morningstar’s director of ESG research for the Americas and a member of Morningstar's investment research department. While Morningstar typically agrees with the views Jon expresses on ESG matters, they represent his own views.

/s3.amazonaws.com/arc-authors/morningstar/42c1ea94-d6c0-4bf1-a767-7f56026627df.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HDPMMDGUA5CUHI254MRUHYEFWU.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/OMVK3XQEVFDRHGPHSQPIBDENQE.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/42c1ea94-d6c0-4bf1-a767-7f56026627df.jpg)