Is My Fund a Liquidity Trap?

The answer is--almost certainly not. But it never hurts to check.

Fear or Fear Not? My colleague John Rekenthaler recently wrote about the hazards of illiquid mutual fund investments. Long story short, mutual funds and illiquid investments are a potentially lethal combination, as funds can't meet daily redemption requests if they can't easily value and trade their holdings. The mousetrap breaks.

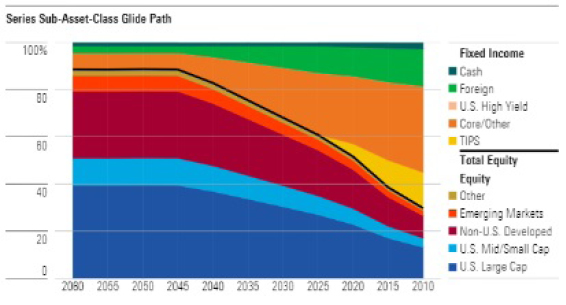

Fortunately, investors don’t need to fret too much that their fund is a liquidity trap. The most popular funds and exchange-traded funds invest largely if not entirely in very liquid securities, like publicly traded large-cap stocks, government debt, and the like. If you own a target-date fund in your retirement plan--as many savers do--odds are it’s funneling most of your dollars into these very wide, deep markets. For example, here’s a snapshot of the asset mix of Vanguard’s popular “Target Retirement” target-date fund series.

- source: Morningstar Analysts

That said, the risk can’t be entirely ruled out, as episodes like Third Avenue Focused Credit and Woodford Equity Income remind us. So, if you’re prone to worry or just want to be as thorough as possible in doing your homework, here are some questions to ask when assessing your fund’s liquidity.

What Do I Own? The best place to start your assessment is with your fund's portfolio holdings. You can easily pull this information up on Morningstar.com, the fund's website, or by checking the fund's periodic reports posted on the SEC's EDGAR site.

Once you’ve got the holdings, there’s some basic checking you can do to determine what types of securities that fund owns and whether they are or could become illiquid. For instance, are any of the securities privately held? (These are typically broken out in a separate section of the holdings list in SEC reports; they also lack the same identifiers of exchange-traded securities, like a ticker.)

Scan the annual and semiannual reports for terms like “liquid.” Under recently adopted rules, funds must provide a “narrative discussion of the operation and effectiveness of the fund’s liquidity risk management program” in their periodic reports. However, the SEC isn’t requiring funds show the breakdown of holdings by liquidity classification. Given this, you’ll have to assess liquidity inferentially.

One way to assess liquidity is based on how a fund values its holdings. To that end, examine the report footnotes, specifically sections called “Valuation of Investments,” “Fair Value Measurements,” or something to that effect. See if the fund owns “Level 3” securities, which fund management must use judgment to value because there’s no market for these investments or it’s otherwise difficult to ascertain their market price. This is often a telltale sign of an illiquid investment.

Funds also provide a breakdown of movements into and out of the Level 3 bucket. Using this information, you can suss-out trends--has the fund been investing more heavily in hard-to-value securities? Has it reclassified some securities from one bucket to another, which can indicate that the market in a particular security has dried up or pricing has become opaque?

You should come away from this step of the process with a better sense of whether a fund invests in illiquid securities and how widespread they might be in the portfolio.

How Much of It Do I Own? Sometimes the problem isn't the security; it's how much of it the fund owns.

Imagine a stock whose daily volume averages 100,000 shares. If a fund owns 10,000 shares, then it shouldn’t run into many problems unloading them, as its stake represents only a fraction of the volume. On the other hand, if the fund owns 1 million shares, then it could spell trouble. If the fund had to sell to meet a large redemption request, it could flood the market with shares, decimating the stock’s price.

This is an example of a scenario where the security itself isn’t illiquid. Rather, the fund’s concentration in it can limit maneuverability and, in extreme cases, impede its ability to meet redemptions altogether. Fund liquidity is multidimensional in that respect--it turns on both the liquidity of the holdings and the portfolio’s structure, making it important to assess each and the interplay between them.

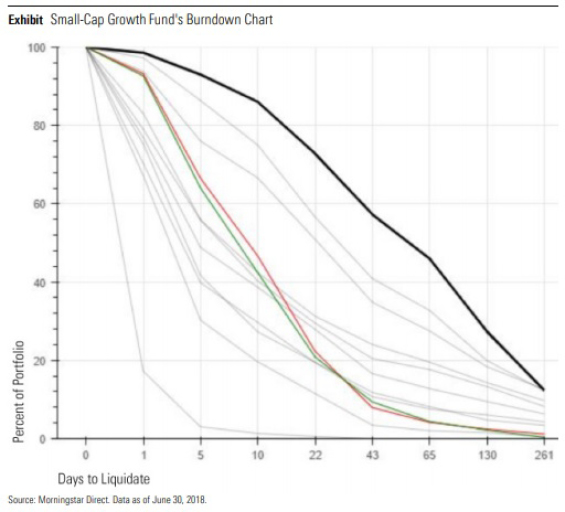

My colleague Tom Whitelaw has examined this dynamic. In his paper, “Evaluating Capacity and Liquidity for Equity Strategies,” he presented a model for evaluating a stock fund’s liquidity profile, and how it’s evolved, by taking together a stock fund’s holdings, its weight in those names, and the volume in those stocks. In this way, one can form a picture of the portfolio’s “burndown,” a hypothetical example of which is shown below.

Each line represents the fund’s portfolio on a given reporting date. The points on each line indicate the fund’s cumulative weight in stocks requiring that number of days to liquidate, or longer. Thus, the differences between points in each line represent the fund’s stake in stocks that require a certain number of days to liquidate (that is, one day, five days, and so on). When we compare the lines, we can infer that this portfolio has gradually become less liquid, as indicated by the fact that the most recent portfolio--the darkest line shown--would take much longer to liquidate than previous portfolios.

This trend might be explained by asset growth into the fund, choice of holdings, concentration in certain names, shifting liquidity of those stocks, or a combination of all of these. Whatever the causes, the framework can be useful in visualizing liquidity trends and, in turn, yielding insights into whether there’s any risk of a liquidity crunch.

How Do I Own It? This is where leverage comes in: If the fund has borrowed to purchase securities, that ups the ante. Why? Because the leverage can magnify volatility, including sharp moves lower. Losses can trigger a margin call, forcing a fund to sell a portion of its holdings in order to repay the portion of the borrowing the lender has called. If those holdings are illiquid, then it can put enormous pressure on the fund to meet the lender's demands by selling the illiquid names at ruinously low prices.

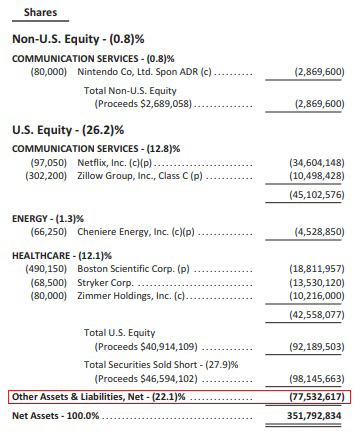

In practice, this isn’t a risk that too many investors will encounter, as there are limits on open-end funds’ ability to borrow and invest in illiquid securities. A simple way to determine whether your fund is employing leverage is to pull up the fund’s most recent shareholder report and see whether its net assets include “Other Assets and Liabilities” (an example of such a presentation is shown, with the borrowings highlighted). If so, then it likely means the fund is leveraging up.

- source: Morningstar Analysts

Who Else Owns It? The first issue to consider is whether a small number of shareholders account for a disproportionate share of the fund's assets. In that scenario, the fund could be vulnerable to a very large redemption request from a significant shareholder who wants out.

If the portfolio’s securities are liquid and the manager can transact efficiently, then it shouldn’t present a problem. But if that doesn’t hold, it can create a huge dilemma for the manager--unload the securities at distressed prices or freeze redemptions to prevent a liquidity spiral? While it’s possible the manager could sell off the portfolio’s more-liquid holdings to meet the redemption request, this would leave the portfolio even more heavily concentrated in the illiquid securities, a potential nonstarter given that funds can’t invest more than 15% of net assets in illiquid securities.

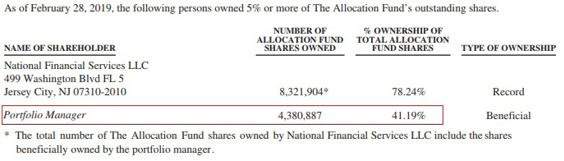

Funds must disclose the names of shareholders who own 5% of more of a share class’ outstanding shares in their filings, including the Statement of Additional Information. Here’s a hypothetical example in which a fund’s portfolio manager owned 41% of its shares. While it’s laudable to see a manager have this much skin in the game, it also courts shareholder-concentration risk, as it’s not unthinkable that the manager would have to sell at some point for some reason.

But I’d caution that the disclosures aren’t always this useful, as the names can include omnibus accounts on custodial platforms (see “National Financial Services, LLC” in the exhibit above), behind which can sit scores of individual investors, meaning it exaggerates any potential shareholder concentration. (Some of the tools we offer make it possible to see whether a fund is owned by other investment vehicles, like funds and institutional separate accounts. This is another way to assess shareholder concentration.)

The second issue to consider is the risk of outflows. Imagine a fund that’s gone on a tear, attracting notice and gathering billions in assets in relatively little time. Then suppose the fund’s luck runs out soon after that, with performance nosediving. That fund is likely to get hit with a wave of redemption from restive shareholders, with all the associated risks as management sells securities to raise proceeds.

But outflows need not be dramatic to create potential liquidity risk. For instance, we’ve seen cases where a fund held relatively modest positions in illiquid securities but experienced gradual outflows over a period of time. As that happened, the manager met the redemption requests by selling off the portfolio’s more-liquid names. In effect, the rest of the portfolio shrunk around the less-liquid securities, magnifying their importance over time.

Am I Alone in Owning It? Lastly, it's worth considering what other investors might be alongside you.

Take a large manager, for instance, that offers a particular strategy both as a mutual fund and a separately managed account. If the separate account’s assets dwarf the fund’s, then analyzing the fund portfolio’s liquidity profile alone would present an incomplete picture. To get the full picture, you’d want to assess the separate account together with the fund. In this way, you’ll have a better feel for how big a manager might be in a particular security and any implications it could have on liquidity.

Let’s return to our earlier example of the fund that owns 10,000 shares of a stock whose average daily trading volume is 100,000 shares. On the face of it, that doesn’t seem problematic, as the fund’s stake is only a fraction of the daily volume. But suppose a companion separate account owns 990,000 shares of the same name. While the concentration isn’t in the mutual fund, per se, the principle is the same--a decision to sell that security would be like the equivalent of 100 people trying to exit through the same narrow door at precisely the same moment.

To get a better feel for a firm’s footprint in a security, consider examining the form 13F-HR that it files with the SEC. That filing compiles an institution’s securities holdings across the various accounts it manages. Thus, it provides a more encompassing tally of how much money the firm has plowed into a given stock.

/s3.amazonaws.com/arc-authors/morningstar/550ce300-3ec1-4055-a24a-ba3a0b7abbdf.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/OMVK3XQEVFDRHGPHSQPIBDENQE.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/550ce300-3ec1-4055-a24a-ba3a0b7abbdf.png)