11 Dividend All-Stars

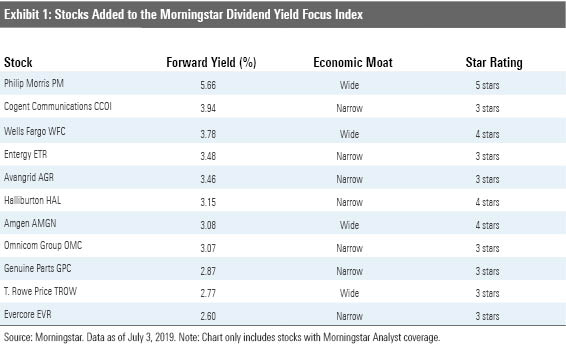

These quality stocks have been added to the Morningstar Dividend Yield Index.

Last night, baseball's biggest names took to the field in Cleveland for Major League Baseball's 90th All-Star Game. The Midsummer Classic (which first took place in my hometown, Chicago, in 1933) brings together fan favorites along with manager and player picks. Sure, the player selection process hasn't been controversy-free. But it's fair to say that the All-Star rosters feature many (if not most) of baseball's best players.

In a nod to the game, we’re looking at some investment all-stars--stocks that were recently added to the Morningstar Dividend Yield Focus Index.

A subset of the Morningstar US Market Index (which represents 97% of equity market capitalization), the Morningstar Dividend Yield Focus Index tracks the top 75 high-yielding stocks that meet our screening requirements for quality and financial health. Dan Lefkovitz, a strategist in Morningstar's indexes group, argues two particular factors--economic moats and distance to default scores--can lead investors to safe dividends.

Companies with moats are able to successfully sustain their profits and fend off competitors; distance to default, meanwhile, measures balance sheet strength and the likelihood of bankruptcy.

"We found that the wider the economic moat and the better the distance to default score, the less likely for a firm to cut its dividend," says Lefkovitz.

How are the stocks selected for the index? Only securities whose dividends are qualified income are included; real estate investment trusts are tossed out. Companies are then screened for quality using the Morningstar Economic Moat and Uncertainty ratings. Specifically, companies must earn a moat rating of narrow or wide and an uncertainty rating of low, medium, or high; companies with very high or extreme uncertainty ratings are excluded. We then screen for financial health using our distance to default measure, which uses market information and accounting data to determine how likely a firm is to default on its liabilities; it is a measure of balance-sheet strength. The 75 highest-yielding stocks that pass the quality screen are included in the index, and constituents are weighted according to the total dividends paid by the company to investors.

In late June, these 11 dividend all-stars entered the index.

Here’s a little about three of the names from the list.

Cogent Communications

CCOI

Though fairly valued today, this narrow-moat firm--with a forward yield approaching 4%--is a must for dividend-seekers’ watchlists.

“Cogent provides Internet and private network connections for enterprises, and it carries Internet traffic for Internet service providers, content-producing companies, and other websites,” explains analyst Matthew Dolgin. “Both businesses face challenges as technological advancements allow those functions to be performed at lower cost. However, in that challenging environment, we think Cogent's strategy leaves it positioned to succeed.”

Cogent's advantages stem from its leased, low-cost, Internet-specific network and the opportunistic buying it did to form its network. Cogent signed long-term leases to procure the rights, adding major portions of its network during times of industry distress and before technology allowed so much capacity on fiber strands.

"When combined with a network architecture that was optimized for the Internet and a lack of legacy products to support, it is in a superior position to most competitors, which include major telecom companies,” Dolgin concludes.

Lastly, the company earns an Exemplary stewardship rating: Management has deployed capital exceptionally well and has raised its dividend every quarter for the last several years.

Entergy

ETR

The integrated power utility is in flux: It’s winding down its once-thriving no-moat merchant nuclear business, thereby leaving behind its strong, narrow-moat regulated utilities business. We’re confident it can gracefully exit without material negative cash flow, says analyst Charles Fishman.

“Although the merchant generation business has not done well, Entergy's regulated utilities are experiencing strong industrial sales growth driven by an industrial boom in the Mississippi Delta region,” he explains. “We forecast 6% annual adjusted operating earnings per share growth for the utility, parent, and other segment between 2019 and 2023.”

Credit a constructive regulatory environment for its narrow economic moat. State and federal regulators grant Entergy’s utilities exclusive rights to charge customers rates that allow their utilities to earn a fair return on the capital they invest to build, operate, and maintain their distribution networks.

"Within this framework, the threat of material long-term value destruction is low and normalized returns should exceed Entergy’s cost of capital, leaving us comfortable assigning a narrow moat rating,” he explains.

Although the last annual dividend increase was only 2.2%, we expect annual increases to step up to the 3%-4% range over the next five years as the company unwinds the merchant nuclear business, concludes Fishman.

The stock offers a forward yield of around 2.5% and is currently fairly valued according to our metrics.

Genuine Parts

GPC

We think narrow-moat specialty retailer Genuine Auto Parts stands to benefit from strong market conditions in the automotive part retail sector.

“As a top distributor of automotive and industrial/electrical parts (56% and 34% of 2018 net sales, respectively), Genuine Parts benefits from industry dynamics favoring its scale-enabled service levels,” says analyst Zain Akbari. “We believe the firm will use its cost advantage to boost sales through its ability to offer a wide variety of parts on short order, building inventory and cost leverage as sales rise while fortifying brand value in a way subscale peers cannot economically replicate.”

The company has consistently generated returns on invested capital above our weighted average cost of capital estimate, and we continue to expect it to do so over the next decade as it effectively leverages its infrastructure, inventory, and part availability to gain from favorable industry dynamics.

The company has consistently raised its dividend, targeting a dividend payout ratio between 50% and 55% of prior-year earnings; Akbari reports that it has, however, exceeded that upper threshold for 2017 and 2018. The stock is fairly valued today according to our metrics.

Disclosure: Morningstar, Inc. licenses indexes to financial institutions as the tracking indexes for investable products, such as exchange-traded funds, sponsored by the financial institution. The license fee for such use is paid by the sponsoring financial institution based mainly on the total assets of the investable product. Please click here for a list of investable products that track or have tracked a Morningstar index. Neither Morningstar, Inc. nor its investment management division markets, sells, or makes any representations regarding the advisability of investing in any investable product that tracks a Morningstar index.

/s3.amazonaws.com/arc-authors/morningstar/35408bfa-dc38-4ae5-81e8-b11e52d70005.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/IORW4DN3VVC3BC4JO7AQLSJTF4.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ODMSEUCKZ5AU7M6BKB5BUC6G5M.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/TGMJAWO4WRCEBNXQC6RFO5TOAY.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/35408bfa-dc38-4ae5-81e8-b11e52d70005.jpg)