32 Undervalued Stocks

Here are our analysts' top ideas in each sector as of midyear.

At the midway point of 2019, the Morningstar U.S. Market Index is up 18.88%. The median stock in our global coverage universe trades at a modest 4% discount to our fair value estimate.

However, the share of 4- or 5-star stocks surpasses those rated 1 or 2 stars: 30% versus 25%, observes Dan Rohr, Morningstar’s of equity research for North America, in his quarter-end wrap-up.

In particular, the energy sector remains compelling, and we’re finding value among consumer cyclical names. Here are some undervalued stocks across sectors that are among our analysts' best ideas.

Basic Materials Escalating trade tensions have weighted on the growth outlook--and on valuations in the basic materials sector. However, some areas of the sector are more insulated from trade than others, notes director Kris Inton. We see opportunities in uranium, lithium, and lumber.

With uranium, we think production discipline will address industry oversupply. We’re bullish on lithium: Our forecast of $12,000 per metric ton is well above consensus-implied prices. And although we trimmed our housing forecast over the near and medium term, we’re still above consensus, with a midcycle forecast of 1.4 million units constructed annually.

Communication Services The communication-services sector is made up of traditional phone companies, cable companies, wireless carriers, and infrastructure firms. Traditional telecom has been lackluster, but the rest of the sector has been on fire, says director Mike Hodel.

Cable companies have been grabbing market share in the Internet access market, which has offset cord-cutting fears. The Sprint S/ T-Mobile TMUS merger has been blessed by the Federal Communications Commission. Moreover, excitement around wireless networks and an interest-rate decline have benefited the shares of telecom infrastructure firms.

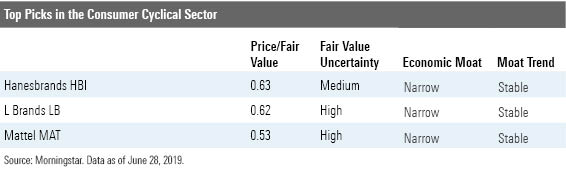

Consumer Cyclical Although the sector is up a bit more than the broad market this year, it has endured some volatility lately, thanks to concerns about global tariffs, worries of a cyclical slowdown in China, and Brexit uncertainty, explains senior analyst Dan Wasiolek. In fact, more than 40% of the stocks we cover in the sector are rated 4 or 5 stars, with the auto, travel and leisure, and entertainment industries trading at the most appealing prices.

Mass merchants continue to generate solid results online, and we think that consumer cyclical companies exposed to e-commerce are well-positioned for long-term growth.

Consumer Defensive This sector is among the richest, with the median stock trading at a 9% premium to our fair value estimate. In fact, the median retail defensive name trades at a whopping 18% premium, reports analyst Sonia Vora.

Nevertheless, we see opportunity in tobacco: We think the market continues to underappreciate opportunities in heated tobacco and remains overly concerned about a menthol ban in the United States. We also see value among alcoholic beverage companies.

Energy Energy stocks slipped in the second quarter, with oil prices recovering to just below $60/bbl by quarter's end. Our midcycle forecast is $55 per barrel, says director Jeffrey Stafford. Energy is the cheapest sector in Morningstar's coverage, with the median stock trading 17% below our fair value estimate.

In particular, we see plenty of opportunity in oilfield-services stocks, which haven’t been this cheap in a decade.

Financial Services The financial-services sector is modestly undervalued, trading about 6% below our fair value estimate. Specifically, more than 40% of the banks we cover are trading in 4-star range.

Although lower interest rates and a recession (both being talked about today) could ding banks, we think the market is overstating the long-term value implications, claims director Michael Wong. In fact, we see comparably more value in the banking industry than in the rest of the sector.

Healthcare Concerns around healthcare pricing pressures have limited gains in this sector to just 9% this year. Yet we view the sector overall as about fairly valued: Just 5% of our coverage universe is trading in 5-star range, observes director Damien Conover. Most of the values are found among drug manufacturers and healthcare providers. In the case of both, we think the market is over-reacting to potential pricing regulations.

Consolidation continues as a dominant theme, and we expect that to continue this year. Scale has become increasingly important on the services side, and the need for continual innovation on the drug and device side should continue to drive mergers and acquisitions.

Industrials Demand remains healthy for most industrials companies, notes director Keith Schoonmaker. Moreover, tariffs are a relatively minor threat for most large diversified industrials. Not surprisingly, the industrials sector is fairly valued overall.

Nevertheless, we’re seeing some opportunity among industrial distributors. We expect these firms to continue to generate healthy cash flows even if economic activity slows, thanks to their countercyclical free cash flow due to reduced working capital requirements during downturns. We’re seeing value in farming and construction machinery, too.

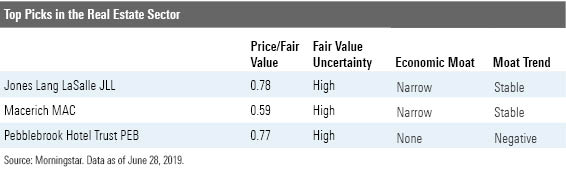

Real Estate Trading at just a 2% discount to our fair value estimate, the sector is fairly valued. In fact, no stocks trade at 5-star levels today.

Real estate stocks typically perform well as rates fall (as they have this year), thanks to their burly yields. However, the relative performance of real estate often mean-reverts during periods of interest-rate stability, reminds analyst Kevin Brown. As such, we’re cautious that much of the sector’s recent outperformance may eventually be given back.

Technology Technology is the top-performing sector this year, despite U.S. and China trade tensions. The median technology stock in our coverage universe trades 4% below our estimate of fair value. We expect the U.S. and China to reach a trade truce that will lead to greater end product demand over the long term, asserts director Brian Colello.

The near-term picture for semiconductors is relatively weak after tremendous growth, but we expect a rebound over time. Online media stocks look cheap by our metrics, too.

Utilities The utilities sector offers good growth prospects, both in terms of dividends and earnings. As interest rates have fallen and the dividends on utilities continue to grow, the sector looks favorable when compared with bonds.

However, utilities stocks are extremely rich, with the median stock in our universe trading at a 12% premium to our fair value estimate. Such heady prices lessen utilities’ attractiveness as defensive investments, suggests senior analyst Travis Miller.

/s3.amazonaws.com/arc-authors/morningstar/35408bfa-dc38-4ae5-81e8-b11e52d70005.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HE2XT5SV5ZBU5MOM6PPYWRIGP4.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/AET2BGC3RFCFRD4YOXDBBVVYS4.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/T5SLJLNMQRACFMJWTEWY5NEI4Y.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/35408bfa-dc38-4ae5-81e8-b11e52d70005.jpg)