Building a Low-Cost, Fossil-Fuel-Free ETF Portfolio

It's possible, but you'll have to pick funds with short track records.

It's easier than ever for investors just starting out to incorporate sustainability into their portfolios. A reader asked me last week about fossil-fuel-free exchange-traded funds and how they could be used in a basic fund portfolio for a beginning investor.

Here are some ideas:

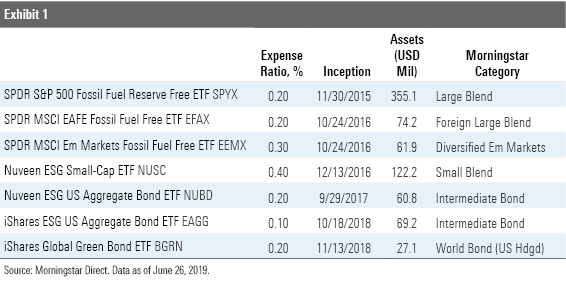

State Street Global Advisors offers three fossil-fuel-free ETFs that focus on U.S. large-cap, non-U.S. developed-markets, and emerging-markets stocks. SPDR S&P 500 Fossil Fuel Reserve Free ETF SPYX has the longest track record, launched in late 2015. Its 12% three-year annualized return through May ranks in the best decile of the large-blend Morningstar Category. Its expense ratio is 0.2%.

Investors can get non-U.S. exposure via SPDR MSCI EAFE Fossil Fuel Free ETF EFAX, which also charges 0.2%, and SPDR MSCI Emerging Markets Fossil Fuel Free ETF EEMX, which charges 0.3%. While those two funds will not hit their three-year marks until October, they have been performing in line with their category averages.

All three SPDR ETFs are based on MSCI indexes that remove companies that hold fossil-fuel reserves. According to MSCI, these are companies that have "proved & probable coal reserves and/or oil and natural gas reserves used for energy purposes." Keep in mind that such a restriction does not keep the indexes or the funds derived from them out of fossil fuels completely. These SPDR ETFs have 3.5% to 4% of assets exposed to fossil-fuel-related power generation and oil & gas production, according to Morningstar data. That’s not nothing, but it is far less than the exposure of most conventional funds. The average overall fossil-fuel exposure in the funds’ three Morningstar Categories is between 10% and 11% of assets.

Investing in these three reasonably priced ETFs still leaves open a couple of slots in an overall fossil-fuel-free portfolio: namely, U.S. smaller-cap stocks and bonds. Let's take a look at small caps first. Keep in mind that small-cap stocks are generally not highly exposed to fossil fuels. The average overall fossil-fuel exposure of the U.S. small-blend category is only 1.5%, so a fossil-free small-cap fund may not be a "must-have" for fossil-fuel-free investors, provided they are willing to settle for a "mostly" fossil-fuel- free portfolio.

That said, one option to consider is Nuveen ESG Small-Cap ETF NUSC, which has barely half the category average exposure to fossil fuels and none of it in actual fossil-fuel reserves (so it is fossil-fuel-reserve-free) Launched in late 2016, NUSC charges 0.4% and so far, so good on performance: Its 6.9% two-year annualized return through May ranks in the top decile of the small-blend category.

That brings us to bonds. While there are no bond ETFs that advertise themselves as fossil-fuel-free, several have a more general focus on environmental, social, and governance criteria. Again, it is important to note that the average overall fossil-fuel exposure for the intermediate bond category is only 2.1%. Nuveen ESG US Aggregate Bond ETF (0.2% expense ratio) has overall exposure of 1.3%, and the iShares ESG US Aggregate Bond ETF (0.1% expense ratio) has overall exposure of 1.6%. Both are very young funds but are based on the Bloomberg Barclays U.S. Aggregate Bond Index as modified by MSCI using ESG criteria (and slightly different MSCI indexes).

While we're on the subject of bonds, let's talk about green bonds, which are issued to finance projects that contribute to climate-change solutions. The iShares Global Green Bond ETF BGRN tracks the Bloomberg Barclays MSCI Global Green Bond Select (USD Hedged) Index and has an expense ratio of 0.2%. Because it is hedged into the U.S. dollar, the fund is protected from foreign-currency fluctuations. And because its bonds must be investment-grade and are a mix of government and corporate issues, it could fulfill part of an investment-grade bond allocation.

All of the funds discussed here have been launched within the past three years and, in two cases, within the past year. I would characterize their performance and those of the indexes they track as generally off to a good start. These funds clearly would suffer were fossil-fuel stocks to experience an extended rally. And even if your view is that you want to rid your investments of fossil-fuel exposure as we transition to a low-carbon economy, there could still be multiple short-term ups (and downs) in fossil-fuel stocks over the coming years.

On the plus side, all the ETFs discussed here and their underlying indexes are sponsored by firms that have made commitments to the broad sustainable investing space, have competitive expense ratios, and have fared reasonably well in attracting assets over a short time frame. These factors suggest to me that they have staying power.

Jon Hale has been researching the fund industry since 1995. He is Morningstar’s director of ESG research for the Americas and a member of Morningstar's investment research department. While Morningstar typically agrees with the views Jon expresses on ESG matters, they represent his own views.

/s3.amazonaws.com/arc-authors/morningstar/42c1ea94-d6c0-4bf1-a767-7f56026627df.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HDPMMDGUA5CUHI254MRUHYEFWU.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/OMVK3XQEVFDRHGPHSQPIBDENQE.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/42c1ea94-d6c0-4bf1-a767-7f56026627df.jpg)