Stock Market Outlook: Energy Compelling as Oil Ends Quarter Where It Began

The energy sector is the most attractive from a valuation perspective, particularly oil-services stocks.

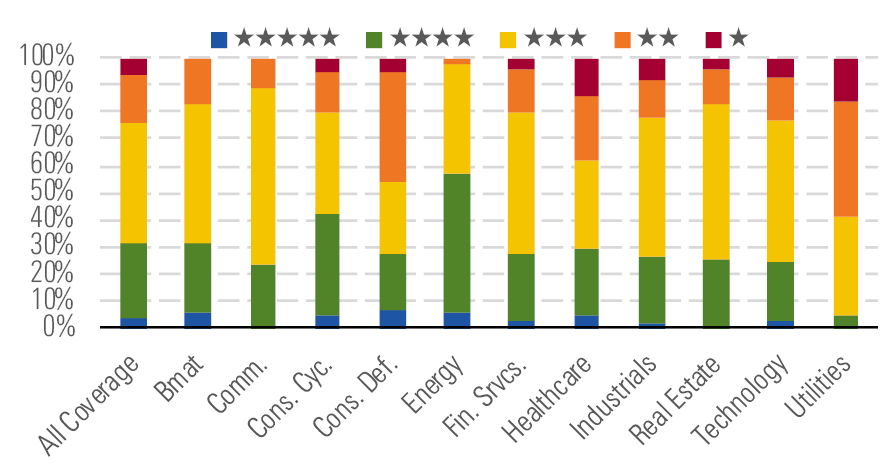

Shares of U.S.- and Canadian-domiciled firms, which account for roughly half of our 1,500-plus global coverage, look slightly less attractive following the Morningstar U.S. Market Index's 3% climb in the second quarter to June 25. The median North American stock trades 4% below our fair value estimate versus a 5% discount near the end of the first quarter. Meanwhile, the share of 4- or 5-star stocks marginally exceeds those rated 1 or 2 stars: 30% versus 25%. The global picture is similar, with the median stock at a 4% discount and the share of "buys" exceeding that of "sells" 32% versus 26%.

- Energy continues to rank as the most compelling sector from a valuation perspective, with oil prices ending the quarter roughly where they began. We see particular opportunity in oilfield-services stocks.

- We see a relatively large share of buying opportunities in the consumer cyclical sector. The auto, travel and leisure, and entertainment industries trade at the most attractive valuations.

- The utilities sector looks overbought as investors clamor for yield. The median utility trades at a 12% premium to our fair value estimate, and the sector is home to only three stocks we rate 4 or 5 stars.

The Energy Sector Is Home to Many Buying Opportunities - source: Morningstar Analysts

/s3.amazonaws.com/arc-authors/morningstar/ecf6f262-5697-406a-a91d-cd20ff52a617.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/54RIEB5NTVG73FNGCTH6TGQMWU.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZYJVMA34ANHZZDT5KOPPUVFLPE.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/MNPB4CP64NCNLA3MTELE3ISLRY.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/ecf6f262-5697-406a-a91d-cd20ff52a617.jpg)