Healthcare: Drugmakers and Providers Look Attractive

We're finding some opportunity in a sector that's fairly valued overall.

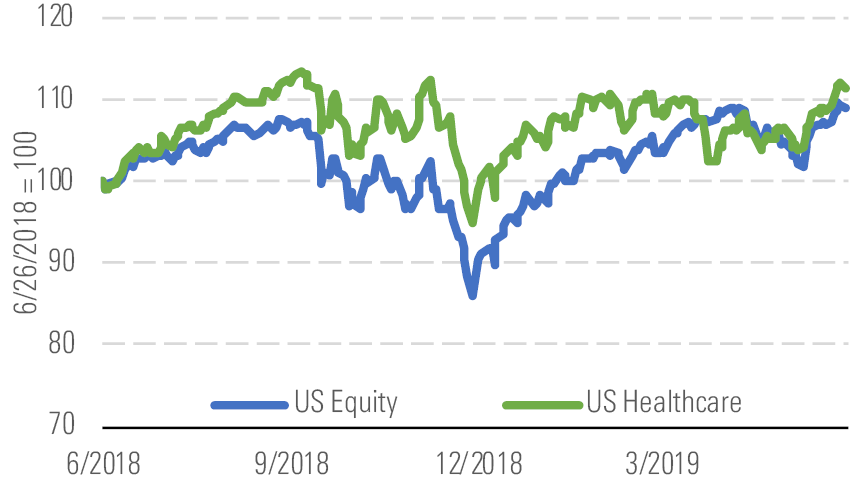

Morningstar's U.S. Healthcare Index has increased 1% quarter to date through June 21 and 9% year to date, trailing the market over both intervals (Exhibit 1) amid concern around healthcare pricing pressures.

Healthcare Sector Index vs. Market Index - source: Morningstar Analysts

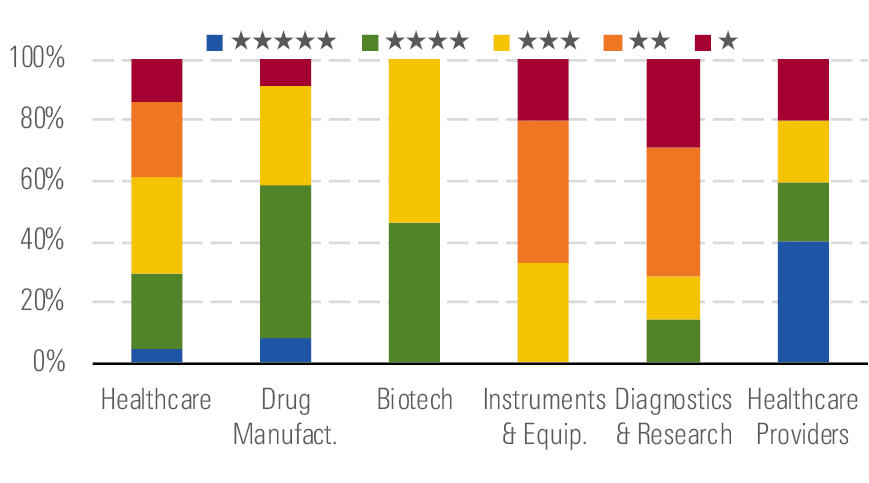

Overall, we view the healthcare sector as fairly valued. Our coverage trades in line with our overall estimate of intrinsic value, with the median price/fair value at 1.00. We see only a few buys, with only 5% of our coverage rated 5 stars. Most 4- and 5-star healthcare stocks are in drug manufacturers and healthcare providers. In drug manufacturing, we believe the market is still ascribing too much valuation pressure on the industry due to potential negative drug pricing regulations.

Star rating distribution and average P/FV for sector and industry groups - source: Morningstar Analysts

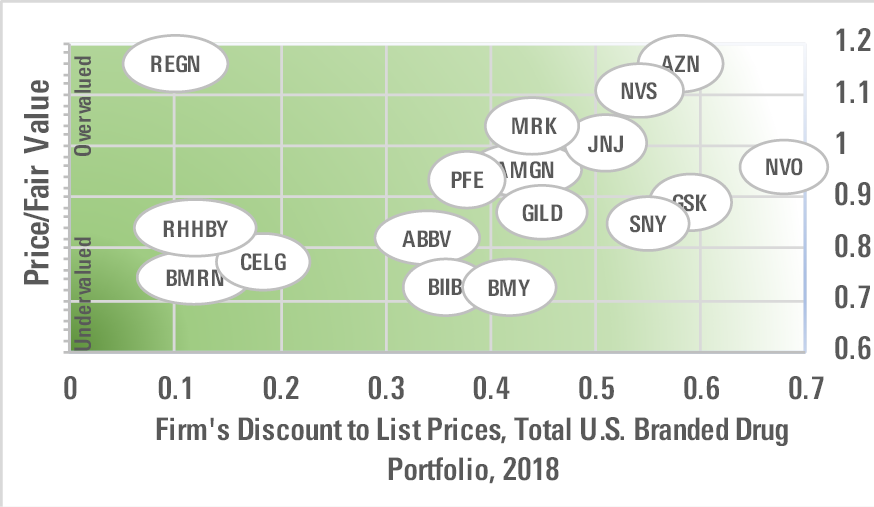

In looking at our projected sales outlook for the Big Pharma and biotech companies (Exhibit 3), we expect recently launched in-line products and new pipeline drugs will more than offset drug sales lost to generic competition. Overall, we expect the similar modest overall drug pricing pressures of the recent past to continue, but innovative drugs should continue to secure steady pricing power.

Firms With Less Rebate Exposure Should Be Less Affected by Rebate Reform - source: Morningstar Analysts

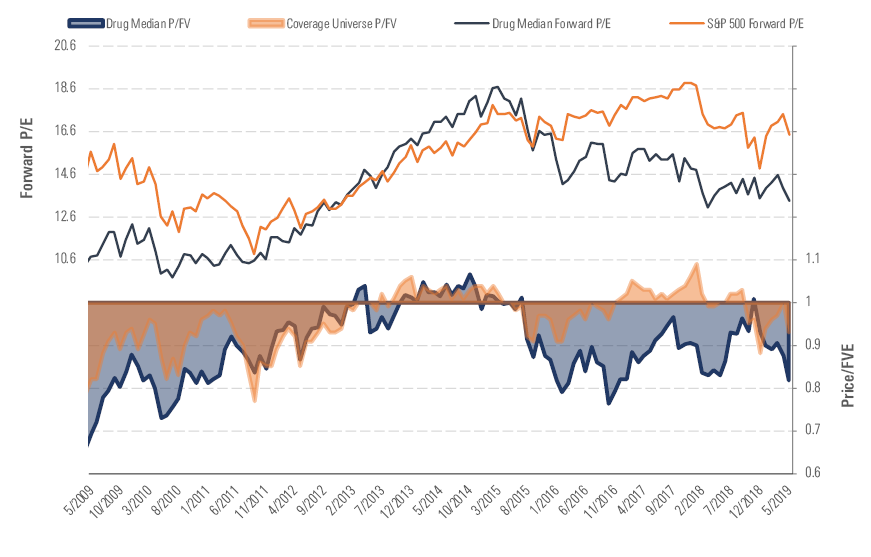

All our valuations are based on discounted cash flow analysis, but looking at a P/E trend (Exhibit 4), the drug stocks look more expensive than the bargain basement prices of 2010 but less expensive than 2014 (before pricing pressures became more of a concern).

Big Pharma/Biotech Valuation Versus the P/E Multiple Over the Last 10 Year - source: Morningstar Analysts

We think the healthcare provider market is overly concerned about potential regulatory changes to pricing, especially in the dialysis industry, where we expect pricing to hold up and drive increased valuations for the leading companies.

Consolidation continues as a major theme, and we expect more deals over the rest of the year. The increasing importance of scale on the service side and the need for continued innovation on the drug and device side are driving many acquisitions, a trend that should continue for several years.

Top Picks CVS Health CVS

Star Rating: 5 Stars

Economic Moat: Narrow

Fair Value Estimate: $92

Fair Value Uncertainty: Medium

CVS' ownership of the largest national pharmacy benefit manager provides it substantial negotiating leverage and cost advantages in claims processing, allowing for best-in-class operating costs per claim. Further, the firm's combination with Aetna should put the company in a much more attractive competitive position as the industry moves toward preferring a more integrated service offering. Lastly, investors should benefit from meaningful cost and selling synergies associated with the combination of a leading medical benefits business with the largest PBM and retail pharmacy network in the country.

DaVita DVA

Star Rating: 5 Stars

Economic Moat: Narrow

Fair Value Estimate: $79

Fair Value Uncertainty: Medium

As the leader in U.S. dialysis services, DaVita has a narrow moat stemming from the scale-derived advantages that manifest in procurement efficiencies and superior negotiating leverage. Dialysis operators benefit from structural 3%-4% volume growth year in and year out, a rarity among healthcare providers. While industry pricing is always the wild card, we expect 1% blended rate growth in the coming years, helped by Medicare's proposed rate increase for 2019. In our view, recent underperformance has been stoked by unwarranted fears that the dialysis industry will ultimately face the ire of regulators.

Biomarin Pharmaceutical BMRN

Star Rating: 4 Stars

Economic Moat: Narrow

Fair Value Estimate: $119

Fair Value Uncertainty: Medium

BioMarin’s orphan drug portfolio and strong late-stage pipeline support a narrow moat, and we think the market underappreciates the firm’s entrenchment in current markets as well as its potential in new markets, particularly with its emerging gene therapy pipeline. BioMarin has several products on the market to treat rare genetic diseases; these products generally have strong pricing and limited competition because of a solid combination of patent protection, complex manufacturing, and BioMarin’s close relationships with patients who rely on its therapies for chronic treatment. We think BioMarin is poised to generate more gene therapy targets and has strong intangible assets due to its innovative products, manufacturing expertise, and global reach among patients with very rare diseases.

MORN DODFX VINIX VWILX TSVA EGO WU Brightstart429plan MRO VZ MOAT T NKE CMCSA GOOG

/s3.amazonaws.com/arc-authors/morningstar/a90c659a-a3c5-4ebe-9278-1eabaddc376f.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/IFAOVZCBUJCJHLXW37DPSNOCHM.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/JNGGL2QVKFA43PRVR44O6RYGEM.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/GQNJPRNPINBIJGIQBSKECS3VNQ.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/a90c659a-a3c5-4ebe-9278-1eabaddc376f.jpg)