Basic Materials: Opportunities Surface Amid Share Price Declines

We're especially keen on the uranium, lithium, and lumber industries.

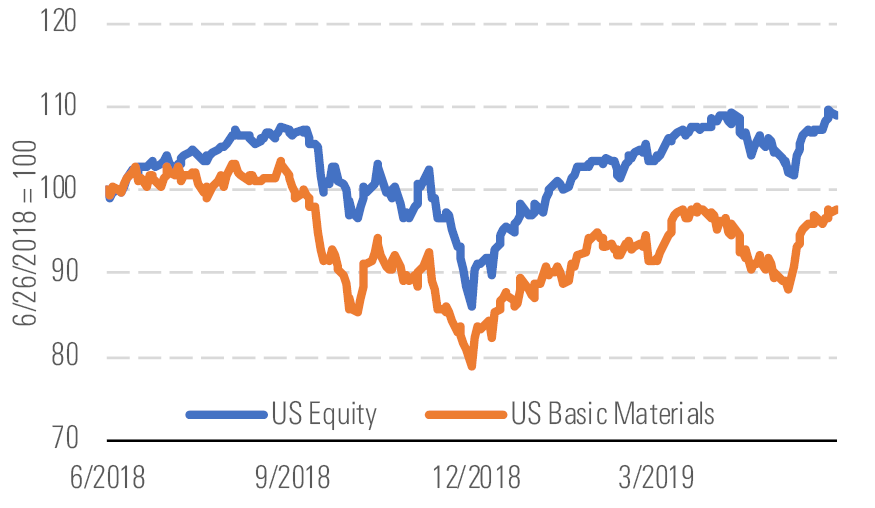

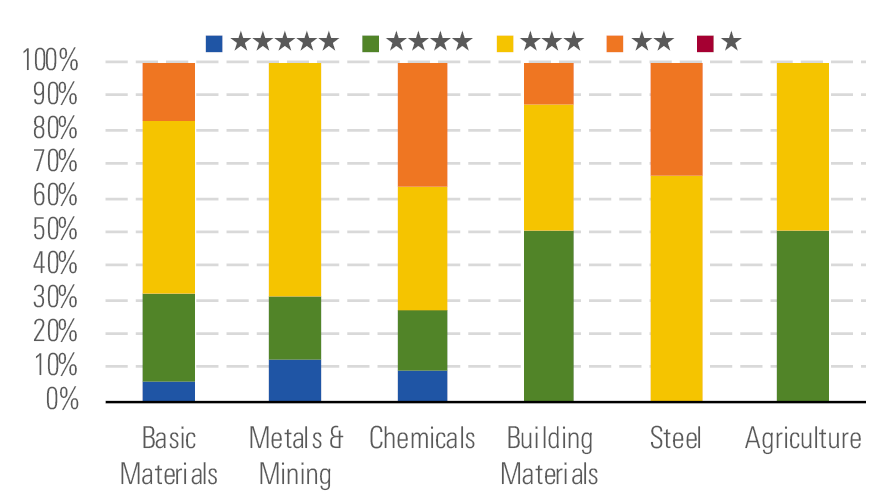

The Morningstar U.S. Materials Index has underperformed the broader market over the trailing one-year period (Exhibit 1), as trade tensions escalated and weighed on the growth outlook. As a result, a handful of stocks now trade in 5-star territory (Exhibit 2).

BMat Has Underperformed, but We See Opportunities - source: Morningstar Analysts

Underperformance has led to 30% of coverage in 4- or 5-star territory - source: Morningstar Analysts

The Trump administration has taken an aggressive approach to renegotiating trade relationships that it sees as unfair to the U.S., particularly with China. Positive and negative impacts have been felt across numerous materials industries, including steel, gold, and agriculture. With the ultimate resolution and timing unclear, uncertainty weighs on sector valuations. However, some portions of the materials sector are more insulated from U.S. trade efforts than others, creating opportunities in uranium, lithium, and lumber.

Through the first half of 2019, uranium spot prices have fallen more than 15% to roughly $24 per pound, weighed by the threat of actions resulting from a U.S. national security investigation into import dependence and weak spot market activity. Although the market-implied price suggests little recovery left, we disagree. We believe production discipline will continue to help address industry oversupply, leading to a recovery of prices to $65 per pound by 2021.

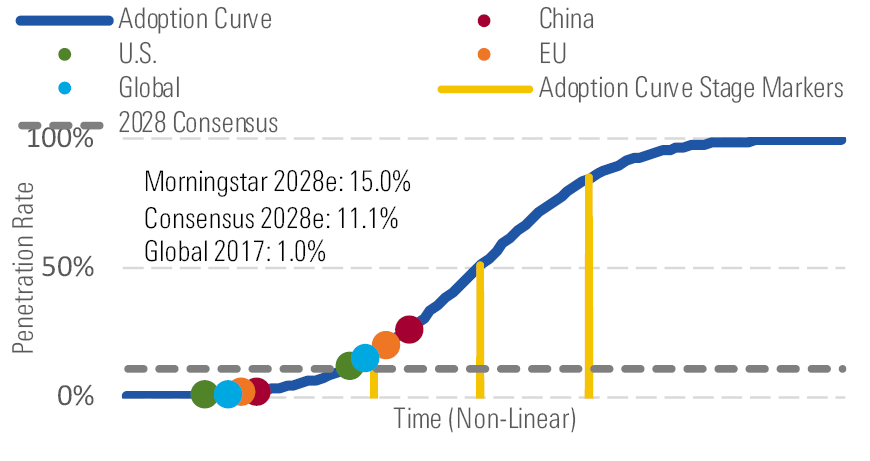

We are bullish in our outlook for lithium. Although we forecast lithium carbonate prices to slightly decline in 2019 real terms from $12,915 per metric ton (on a Chilean export basis) to $12,000, we are well above consensus-implied prices of $8,000 due to our above-consensus electric vehicle adoption forecast of 15% in 2028 versus consensus of 11.1% (Exhibit 3).

Our above-consensus forecast for EV adoption underpins our lithium forecast - source: Morningstar Analysts

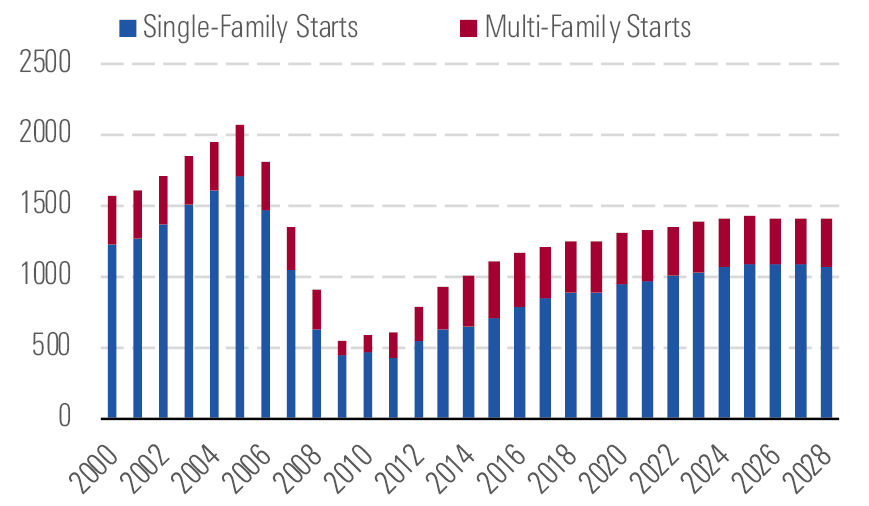

Although we’ve lowered our housing forecast over the near and medium term, we remain above consensus. We see a gradual climb toward our midcycle forecast of just over 1.4 million units constructed annually, as aging millennials require a growing housing stock after reducing the number of vacant units. Despite student debt burdens and poor real-wage growth, aging is the single largest driver of new-home demand in the long run (Exhibit 4).

Aging millennials will drive a gradual climb in new-home construction - source: Morningstar Analysts

Top Picks

Canfor CFP

Star Rating: 4 Stars

Economic Moat: None

Fair Value Estimate: CAD 17

Fair Value Uncertainty: High

Canfor is our preferred way to play U.S. housing within the wood products space. Shares trade nearly 50% below our CAD 17 fair value estimate. Lumber companies often trade closely with prevailing lumber prices. Following a recent rise in supply and slump in demand, lumber prices are severely depressed. We expect demand to gradually climb with new homes built in the United States, and ongoing supply cuts should rebalance the market, improving margins. Over the long run, we’re confident that Canfor will be able to earn its cost of capital based on our midcycle lumber price forecast.

Cameco CCJ

Star Rating: 5 Stars

Economic Moat: Narrow

Fair Value Estimate: $19

Fair Value Uncertainty: High

Weak spot market demand and a federal investigation on the security of U.S. supply have weighed on uranium prices in 2019, but we don’t see either issue as a lingering risk. Meanwhile, long-term demand continues to grow as China brings more nuclear reactors on line. The consensus view expects little upside for prices, but we disagree. The still-improving supply/demand balance should help increase uranium prices, allowing Cameco to eventually resume full operations at more attractive margins.

Albemarle ALB

Star Rating: 5 Stars

Economic Moat: Narrow

Fair Value Estimate: $130

Fair Value Uncertainty: High

Narrow-moat Albemarle trades at a nearly 50% discount to our $130 fair value estimate, as the market is concerned that lower lithium prices will weigh on profits. However, with nearly all lithium volumes under contract through 2021, Albemarle should generate steady profits. We contend that higher lithium prices will be needed to incentivize lower-quality supply to meet demand from growing electric vehicle adoption. With low-cost lithium production, Albemarle is well positioned to grow profits. We think current share prices are an attractive entry point for a quality lithium producer.

/s3.amazonaws.com/arc-authors/morningstar/220f0649-85f9-4004-a281-b91d9bc53139.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/TP6GAISC4JE65KVOI3YEE34HGU.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/RFJBWBYYTARXBNOTU6VL4VSE4Q.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/YQGRDUDPP5HGHPGKP7VCZ7EQ4E.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/220f0649-85f9-4004-a281-b91d9bc53139.jpg)