Consumer Cyclical: Tariff Uncertainty Leads to Attractive Valuations

Brexit and tariffs weighed on the sector last quarter.

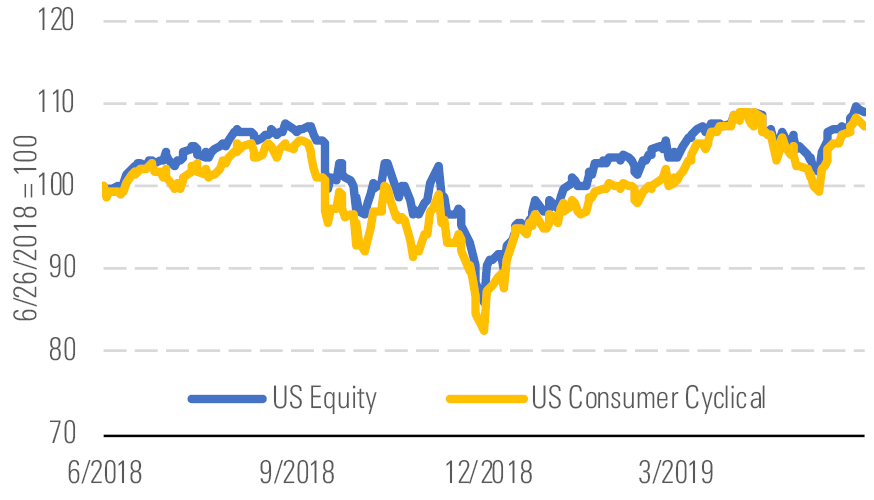

The Morningstar U.S. Consumer Cyclical Index is up 20% year to date through June 21, roughly in line with the broader U.S. equity market (Exhibit 1). But the sector has faced some volatility since the late April peak due to intensifying concerns about global tariffs along with continued worries of a cyclical slowdown in China and Brexit uncertainty in the United Kingdom.

AT&T, Verizon and a combined T-Mobile/Sprint would dominate wireless - source: Morningstar Analysts

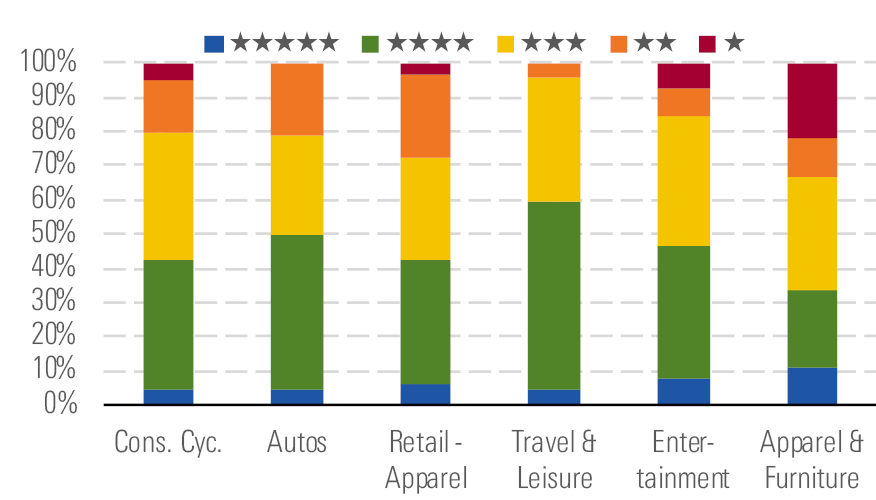

The median stock we cover trades at a 7% discount to our fair value estimate. Roughly 40% are rated 4 or 5 stars—the highest share of any sector except energy. The auto, travel and leisure, and entertainment industries trade at the most attractive valuations (Exhibit 2).

Autos, travel and leisure, and entertainment at attractive valuations - source: Morningstar Analysts

Most consumer cyclical industries have reported minimal impact so far from the 25% tariff placed on $250 billion worth of goods imported from China to the U.S. Still, the Office of the United States Trade Representative has proposed a 25% tariff on an additional 3,805 categories of Chinese goods (including toys, apparel, home goods, shoes, and sporting goods) that amounts to $300 billion of merchandise exported to the U.S. from China each year, which could have a more profound effect on operator financials within the consumer discretionary sector. The USTR proposal could become effective before the June 28-29 Group of 20 summit in Japan, where Presidents Donald Trump and Xi Jinping are expected to meet to discuss trade.

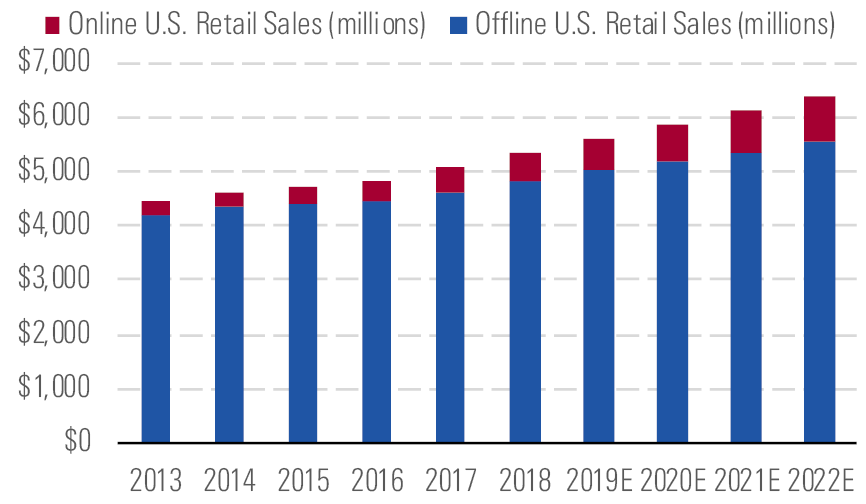

Physical Store Sales Should Remain Key in Driving Retail Performance - source: Morningstar Analysts

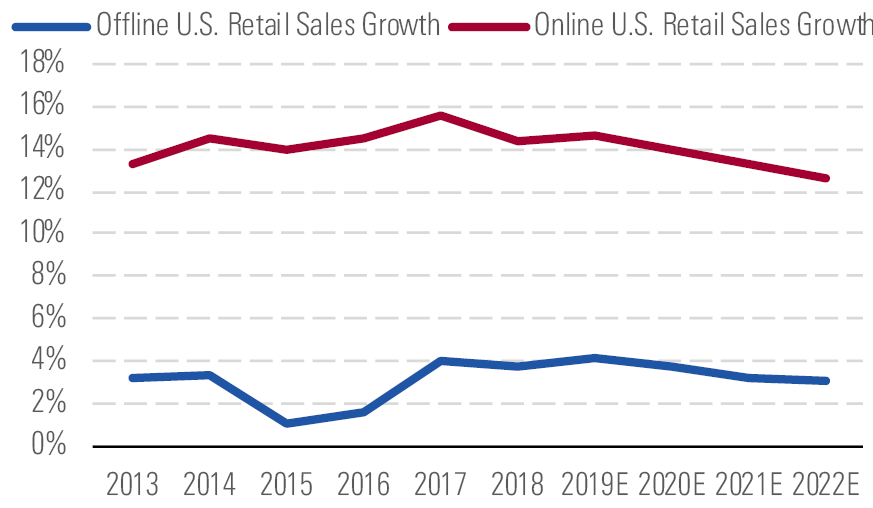

Mass merchants continue to post solid digital results, which underscores our belief that operator efforts to make stores omnichannel fulfillment centers are well founded. Also, we think that mass merchant stores’ proximity to customers should allow them to minimize delivery costs and encourage shoppers to pick up items themselves, which is more lucrative than the ship-to-home channel for these operators. We continue to think that consumer cyclical companies exposed to e-commerce are well positioned for long-term growth. In the U.S., we expect e-commerce growth to remain robust in the years ahead, with online retail growing at a double-digit clip through 2022 versus less than 4% for the brick-and-mortar channel (Exhibit 4).

We expect U.S. online retail growth to outpace U.S. offline retail lift - source: Morningstar Analysts

Top Picks Mattel MAT

Star Rating: 5 Stars

Economic Moat: Narrow

Fair Value Estimate: $21

Fair Value Uncertainty: High

The 2016-17 holiday seasons, the Toys R Us liquidation in 2018, and recent tariff increases have proved difficult for Mattel to navigate, leading to sales declines and margin pressure. This has hindered performance, providing a wide margin of safety for long-term investors. That said, we believe these headwinds are transitory and that strategic initiatives from both former and current CEOs will continue to bear fruit in 2019 and beyond, supporting Mattel’s long-term advantages.

Hanesbrands HBI

Star Rating: 5 Stars

Economic Moat: Narrow

Fair Value Estimate: $27.50

Fair Value Uncertainty: Medium

We view narrow-moat Hanesbrands shares as attractive. We think the market has been overly focused on short-term issues (inventory reductions and leverage) and is overlooking the firm's longer-term opportunities that arise from its intangible-asset-sourced narrow moat. We expect sales growth to average a low-single-digit clip over our forecast. We also think that Hanesbrands has significant potential for margin expansion. We estimate adjusted operating margins will gradually improve to nearly 16% by 2023 from just under 14% in 2018 as the firm extracts inefficiencies from its operations and instills best practices within its acquired businesses.

L Brands LB

Star Rating: 5 Stars

Economic Moat: Narrow

Fair Value Estimate: $42

Fair Value Uncertainty: High

L Brands’ economic moat stems from its brand intangible asset in an industry characterized by the prioritization of quality and fit, along with a rising global awareness, with a good long-run growth opportunity in China. We remain cautious over the near term as Victoria's Secret's operating margin attempts to stabilize (the fourth quarter marked the 12th consecutive quarter of operating margin declines for the segment), but we see promise in the medium term, from discontinued categories being comped, bralette penetration stabilizing, Victoria's Secret Beauty improving, less structured and more innovative bra introductions, and swimwear.

/s3.amazonaws.com/arc-authors/morningstar/2535f698-1e23-4470-9858-dc4e82afe213.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZZNBDLNQHFDQ7GTK5NKTVHJYWA.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HE2XT5SV5ZBU5MOM6PPYWRIGP4.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/AET2BGC3RFCFRD4YOXDBBVVYS4.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/2535f698-1e23-4470-9858-dc4e82afe213.jpg)