Consumer Defensive: Few Values in this Pricey Sector

Market continues to underappreciate tobacco stocks.

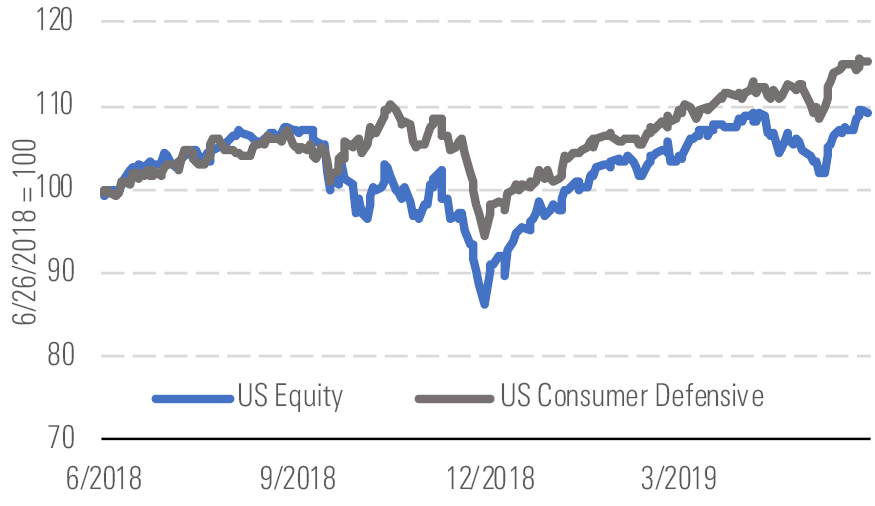

The Morningstar U.S. Consumer Defensive Index gained 5% quarter to date through June 21, in line with the 3% uptick in the broader market (Exhibit 1).

Sector performance has strengthened over the last three months - source: Morningstar Analysts

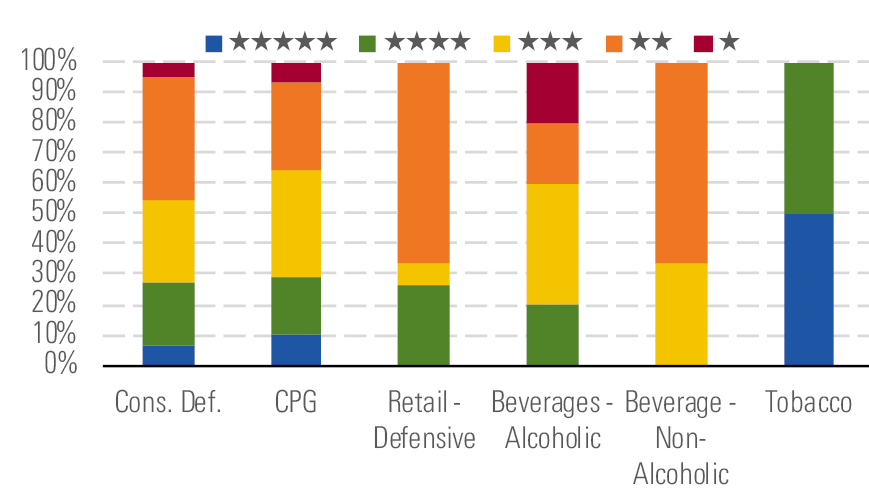

As a whole, the sector isn't terribly attractive valuation-wise. The median stock we cover trades at an 9% premium to our valuation, making consumer defensive the second most expensive sector behind only utilities. Nevertheless, we see bargains in tobacco, where the median stock trades at a 19% discount. We think the market continues to underappreciate opportunities in heated tobacco and remains overly concerned about the risk of a menthol ban in the United States.

We also see some opportunities among alcoholic beverage companies, with 60% of our coverage trading in 3- or 4-star territory compared with lower levels for consumer defensive firms overall (Exhibit 2). The retail defensive space looks more expensive, with the median stock we cover trading at an 18% premium to our valuation and just over a fourth of our coverage trading at 4 or 5 stars.

We still see opportunities in the tobacco sector - source: Morningstar Analysts

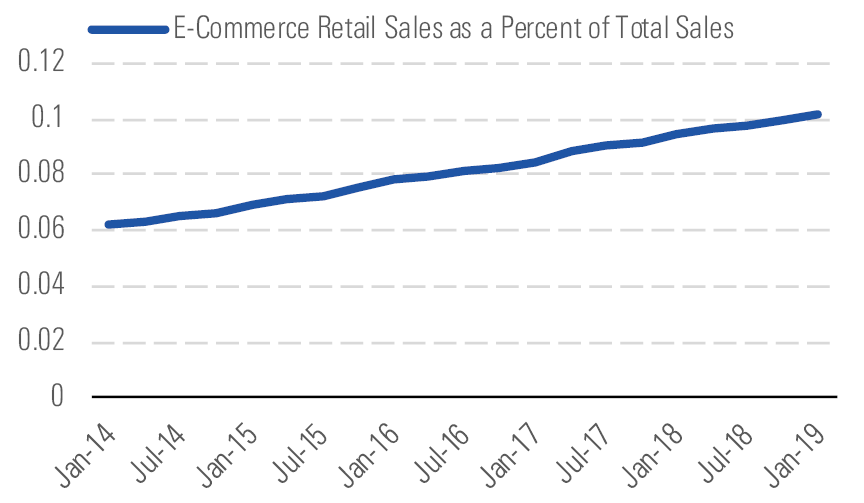

We think the digital channel remains an area of opportunity for consumer goods firms, as e-commerce penetration has been steadily increasing over the last decade. While we acknowledge that this channel has helped lower the barriers to entry for niche competitors, particularly the need to secure shelf space at brick-and-mortar retailers, firms that keep investing in their brands should be able to defend against competition, both in-store and online. We estimate that e-commerce accounted for about 10% of domestic retail sales at the onset of 2019 versus approximately 6% at the beginning of 2014 (Exhibit 3).

E-commerce penetration of retail sales increasing - source: Morningstar Analysts

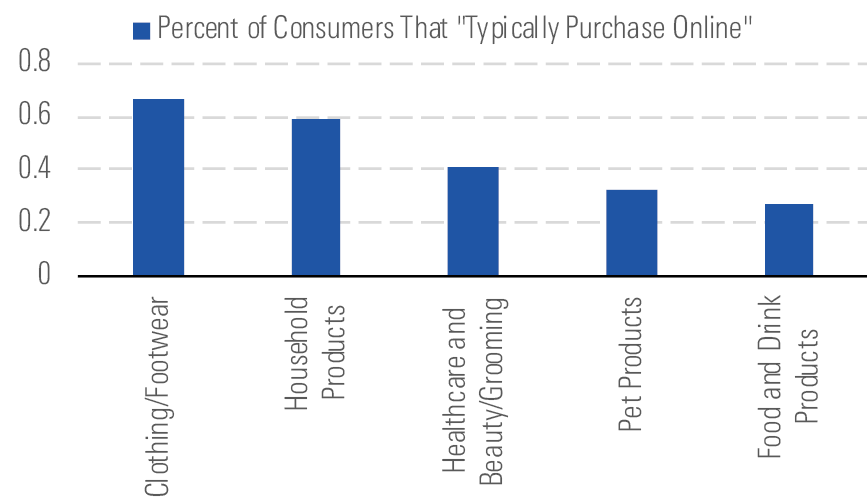

However, digital penetration varies significantly among consumer categories, and a firm's growth in the channel is far from a guarantee. According to a GlobalData survey, just 27% of U.S. consumers listed food and beverage as a category they typically purchase online (Exhibit 4). In contrast, the proportion of consumers who said they typically purchase clothing/footwear and household products online stood at 67% and 59%, respectively.

Consumers less likely to purchase food and drink online - source: Morningstar, GlobalData.

Top Picks Imperial Brands IMBBY

Star Rating: 5 Stars

Economic Moat: Wide

Fair Value Estimate: $48

Fair Value Uncertainty: Low

Imperial's current multiple discount of 9 times price/earnings is much larger than the historical discount, and we think this is unjustified. We are bullish on heated tobacco, and we think a valuation premium for those leading and developing the category is appropriate. However, we think the market is overestimating the value of the first-mover advantage, and if heated tobacco gains traction in markets like the U.S. and Europe, we expect Imperial to leverage its wide moat and follow Philip Morris, British American, and Japan Tobacco into the space with its own technology.

British American Tobacco BTI

Star Rating: 5 Stars

Economic Moat: Wide

Fair Value Estimate: $59

Fair Value Uncertainty: Low

British American has declined along with the rest of the group this year after a sequence of bad news. First, heated tobacco slowed in Japan, causing investors to rethink the assumption that it would support volume trends over the medium term. Then, the U.S. Food and Drug Administration announced that it would seek to ban menthol in cigarettes. Having doubled down on the U.S., an attractive market in our view, with plenty of headroom for pricing, British American would be hit hardest by such a measure. Nevertheless, a worst-case scenario appears to be priced into the stock, and we see long-term upside.

Anheuser-Busch InBev BUD

Star Rating: 5 Stars

Economic Moat: Wide

Fair Value Estimate: $118

Fair Value Uncertainty: Low

We think AB InBev’s stock offers material upside. Following its dividend cut, management has removed an overhang that concerned investors. We estimate the incremental $4 billion to $5 billion in free cash flow will deleverage the balance sheet to 3 times net debt/EBITDA by 2022. While developed markets remain a drag, as industry volume is pressured by consumer migration to wine and higher-quality beer, we think Africa and Latin America offer attractive opportunities for growth. Further, any slowdown in craft beer growth could stabilize volumes in mainstream price segments and act as a catalyst for the stock.

/s3.amazonaws.com/arc-authors/morningstar/c3c7fda1-81b6-4970-9381-d4ae20b2ff83.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/IORW4DN3VVC3BC4JO7AQLSJTF4.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ODMSEUCKZ5AU7M6BKB5BUC6G5M.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/TGMJAWO4WRCEBNXQC6RFO5TOAY.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/c3c7fda1-81b6-4970-9381-d4ae20b2ff83.jpg)