Utilities: Rich Prices Could Limit Defensive Prowess

The sector is trading at the largest premium to our fair value estimate since 2017.

Utilities continue to impress, with good growth prospects, secure dividends, and sound balance sheets. That's good news for investors, who could realize 5%-7% annual dividend and earnings growth from many high-quality utilities with narrow moats and 3% yields.

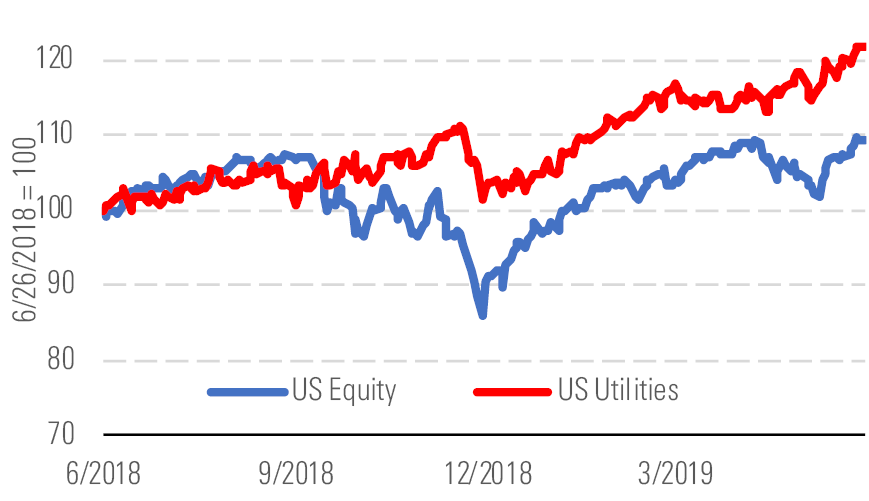

Utilities just keep going and going and going - source: Morningstar Analysts

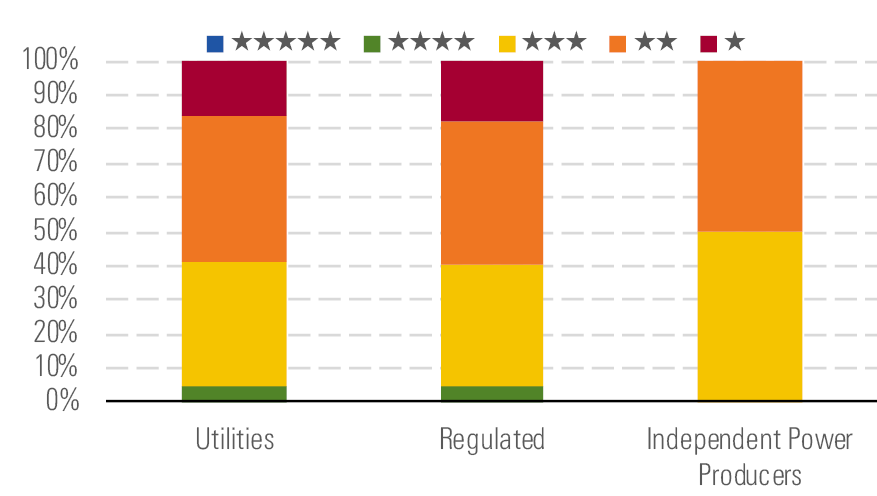

But those strong fundamentals come at a high price. The U.S. utilities we cover trade at the largest premium to our fair value estimates since 2017. Regulated utilities are particularly expensive, with a median 22 P/E and 2.1 P/B, both multidecade highs. No utilities have 5-star ratings, and only one—Dominion Energy—has a 4-star rating. Excessive valuations mean investors' long-term capital is at risk even if utilities make good on their earnings and dividend growth potential.

Hard to find anything cheap in the utilities sector - source: Morningstar Analysts

Rich valuations also lessen utilities' attractiveness as defensive investments. Utilities have outperformed the S&P 500 by wide margins during every bear market going back to the early 1980s. But absolute and relative returns have varied widely.

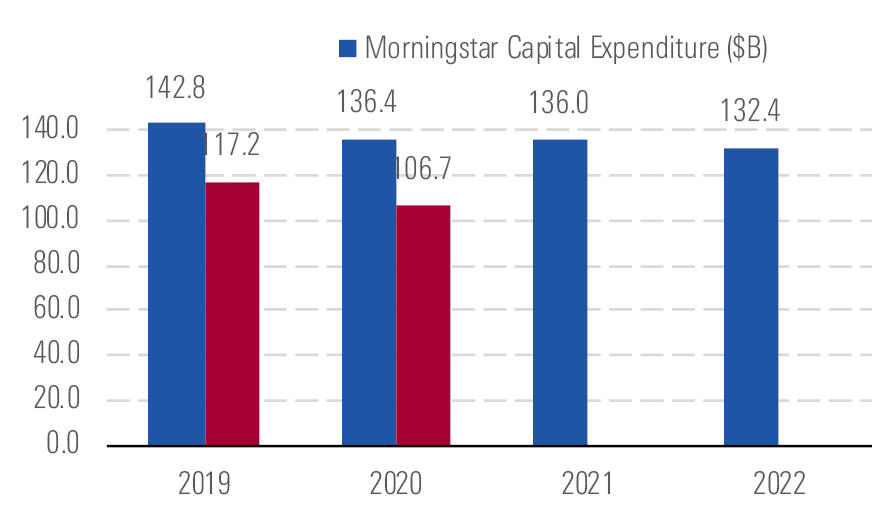

Morningstar capital spending forecast above industry outlook - source: Morningstar Analysts

During the last two major U.S. bear markets, utilities' valuations had a big impact on performance. Utilities entered the 2007-09 bear market with a 19 P/E and outperformed the S&P 500 by 11 percentage points, their worst bear-market performance in 35 years. Utilities entered the 2000-02 bear market with a 13 P/E and outperformed the S&P 500 by 20 percentage points, one of their best performances. During five shorter bear markets since 1983, utilities on average entered with a 16.5 P/E and outperformed by 16 percentage points.

Utilities only look like a good value next to bonds. Rising interest rates last year nearly erased the premium that utilities’ dividend yields had offered for more than a decade. But as interest rates have dropped and utilities’ dividend growth continues, the sector once again looks cheap relative to bonds.

Utilities investors should be selective in this market, focusing on those with the best growth plans or cheap relative valuations to offset a sector pullback we think is coming.

Top Picks Dominion Energy D

Star Rating: 4 Stars

Economic Moat: Wide

Fair Value Estimate: $84

Fair Value Uncertainty: Low

Dominion historically received premium valuations reflecting its high-return assets and constructive regulatory relationships. But the market remains fixated on the prospect of slowing dividend growth. Dominion's dividend increases have averaged 9% over the past five years, but management has targeted 2.5% increases beginning in 2020 due to Dominion’s elevated payout ratio. We believe the dividend is secure, due in part to the strong cash flow from Cove Point and earnings growth from its diverse regulated businesses. Investors willing to accept modest dividend growth in the short run should be rewarded with both a valuation uplift and a return to long-term dividend growth that will outpace Dominion’s peers.

Edison International EIX

Star Rating: 3 Stars

Economic Moat: Narrow

Fair Value Estimate: $68

Fair Value Uncertainty: Medium

The California utility has been wrapped up in market concerns about wildfires and bankrupt neighbor PG&E. But we think Edison’s growth prospects and 4% yield outweigh any fire risk it faces. Edison is on track to invest $26 billion between 2018 and 2023, half of which regulators already have approved. Its investments will go into infrastructure that supports energy security, safety, renewable energy, electric vehicles, and other next-generation energy services. This should drive at least 6% annual earnings and dividend growth. Resolution of political and legal issues involving PG&E during the next six to 12 months should remove the valuation overhang.

Duke Energy DUK

Star Rating: 3 Stars

Economic Moat: Narrow

Fair Value Estimate: $88

Fair Value Uncertainty: Low

Duke operates in mostly constructive regulatory regions, particularly in Florida, which allows it to recover costs in a timely fashion through supportive regulatory outcomes. We anticipate annual capital expenditures to average $8 billion over the next five years, supporting our 5% earnings growth forecast. The company's capital program focuses on grid modernization, renewable energy, natural gas infrastructure investments, and environmental remediation. Key to our long-term growth expectations is the Atlantic Coast Pipeline, which we continue to believe will be completed, given the regional economic benefits.

/s3.amazonaws.com/arc-authors/morningstar/ea0fcfae-4dcd-4aff-b606-7b0799c93519.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/IORW4DN3VVC3BC4JO7AQLSJTF4.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ODMSEUCKZ5AU7M6BKB5BUC6G5M.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/TGMJAWO4WRCEBNXQC6RFO5TOAY.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/ea0fcfae-4dcd-4aff-b606-7b0799c93519.jpg)