Industrials: Bargains Among Industrial Distributors, Farm & Construction Machinery

The stocks in this sector look fairly valued, and tariffs seem to be only a minor threat.

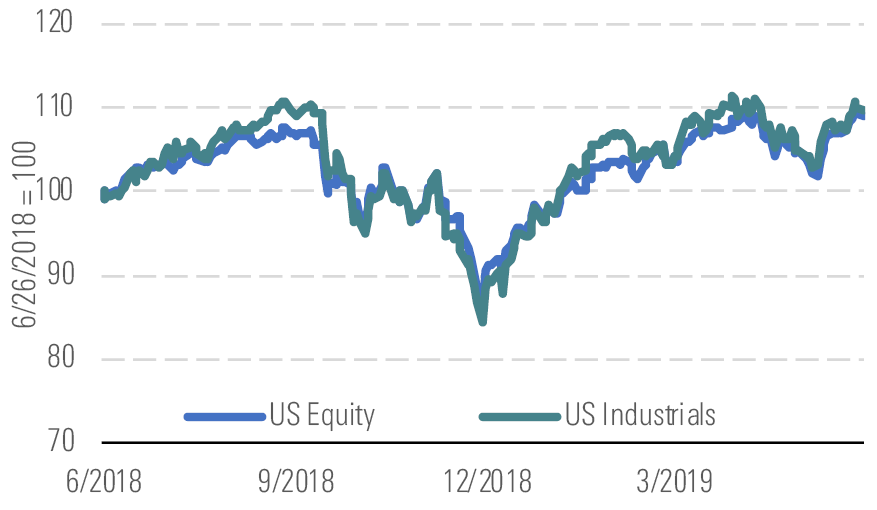

The Morningstar U.S. Industrials Index performed roughly in line with the broader U.S. equity market in the second quarter and year to date.

Industrial stocks are in line with the broad market - source: Morningstar Analysts

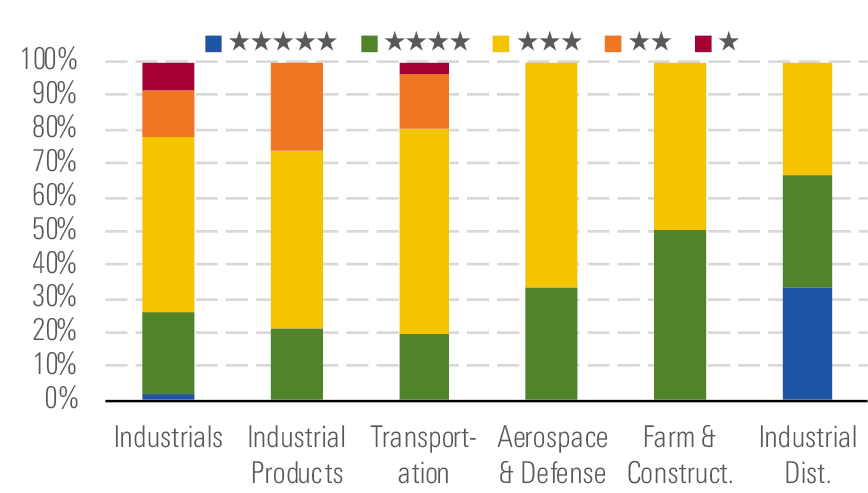

Overall, we view the industrials sector as fairly valued, with an average price/fair value ratio of 1.00. That said, there are still pockets of value, particularly among industrial distributors and farming & construction machinery, with over 50% of the stocks in these subsectors trading in either 4- or 5-star territory (Exhibit 2).

We see bargains among industrial distributors - source: Morningstar Analysts

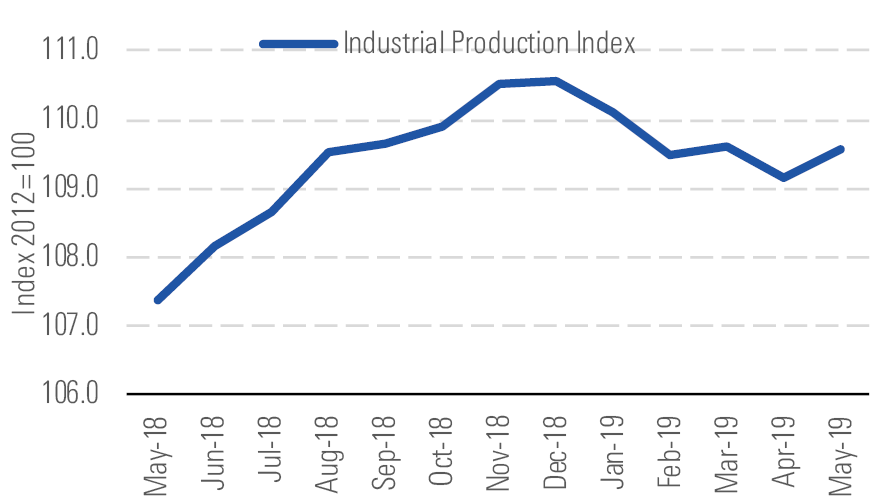

Broadly speaking, demand remains healthy for most industrial companies. Despite a slight slowdown since the beginning of 2019, industrial production is up 2% year over year (Exhibit 3). Furthermore, tariffs appear to be a relatively minor threat for most large diversified industrials, as companies are countering the impact of tariffs by reining in costs, raising prices, and shifting production to where products are sold.

Industrial production is down since January but up year over year - source: Morningstar Analysts

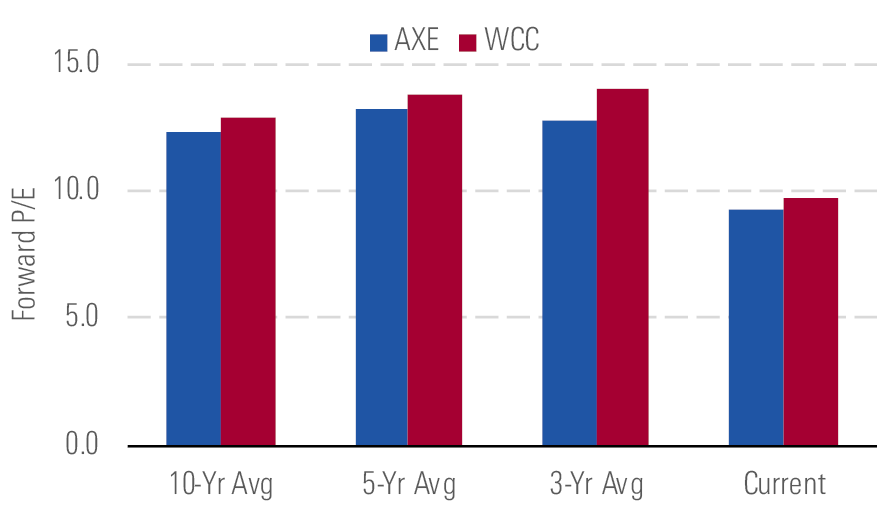

We see compelling opportunities among industrial distributors, as forward multiples remain below historical valuations (Exhibit 4). Although it may be challenging for industrial distributors to match the impressive revenue growth they delivered in 2018, we still expect solid top-line growth in 2019. Furthermore, despite persistent gross margin pressure caused by the growing prominence of lower-margin national customer accounts, we expect distributors’ operating margins to improve as they realize strong operating leverage. An attractive aspect of the business is the countercyclical free cash flow due to reduced working capital requirements during downturns. This gives us confidence that industrial distributors will continue generating healthy cash flows even if economic activity slows down.

Industrial distributors still trade below historical P/E multiples - source: Morningstar Analysts

There are also a number of 4-star stocks in farming and construction machinery, as poor weather and the trade war with China have weighed on share prices in recent months. Despite these short-term headwinds, we still expect the sector to benefit from pent-up replacement demand and favorable long-term secular trends, including increased mechanization of farming in emerging economies and the demand for advanced equipment to increase productivity.

Top Picks

Wesco International WCC

Star Rating: 5 Stars

Economic Moat: Narrow

Fair Value Estimate: $88

Fair Value Uncertainty: Medium

Wesco is our preferred industrial distributor stock. The company is poised to benefit from multiple secular growth drivers, including data center expansion, power-grid modernization, and increasing demand for outsourced supply chain management. The company’s share repurchase program and the involvement of a notable activist investor (Blue Harbour Group) could be catalysts. Lastly, if close peer Anixter makes any missteps with its enterprise resource planning implementation, Wesco could gain ground on its rival. The stock looks cheap, trading at a 44% discount to our fair value estimate.

LKQ LKQ

Star Rating: 4 Stars

Economic Moat: Narrow

Fair Value Estimate: $38

Fair Value Uncertainty: Medium

LKQ is a leading alternative automobile parts distributor. Its ability to source new products from low-cost overseas manufacturers and to obtain parts by salvaging more than 300,000 automobiles annually gives LKQ unparalleled scale of operations. The ongoing progress in Europe is a central part of our thesis. After recent acquisitions, Europe is the largest and least profitable segment, but we think that centralized procurement will help lift the segment’s margins closer to those of the more mature North American segment. We view the stock as undervalued, with shares trading at a 31% discount to our fair value estimate.

Stericycle SRCL

Star Rating: 4 Stars

Economic Moat: Narrow

Fair Value Estimate: $74

Fair Value Uncertainty: High

Medical-waste specialist Stericycle is grappling with negative sentiment from persistent guidance shortfalls and painful contract concessions, but we think the market is overly pessimistic. While the enterprise resource planning system implementation adds uncertainty, in our opinion the recent management overhaul increases the prospect of an execution rebound, and pricing headwinds of the current magnitude are probably not permanent. With shares trading 39% below our fair value estimate, we consider Stericycle a compelling opportunity for patient value investors capable of stomaching heightened near-term volatility.

/s3.amazonaws.com/arc-authors/morningstar/aa7e0d87-9b96-4b66-bc66-87152c9713ed.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/RFJBWBYYTARXBNOTU6VL4VSE4Q.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/YQGRDUDPP5HGHPGKP7VCZ7EQ4E.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/5WSHPTEQ6BADZPVPXVVDYIKL5M.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/aa7e0d87-9b96-4b66-bc66-87152c9713ed.jpg)