How Should Bond Investors Position for What Comes Next?

In part eight of the report, we conclude with a look at positioning for market swings.

Editor's note: This article is part of our "How and Why to Invest in Bonds" series. Click here to read other articles.

A properly constructed, long-term investment strategy, by definition, shouldn't require portfolio changes in response to market swings. But some investors with shorter-time horizons may decide to make tilts within their broader allocations.

Investors should remember that timing ups and downs of the bond market is hard, as it is with any investment. Sarah Bush, director of Morningstar Research Services’ fixed-income manager research, notes that big bets on changes in the economy, especially significant adjustments to portfolio interest-rate sensitivity, can be difficult for even professional investors to get right consistently. For much of the postcrisis period, many intermediate core and core-plus fund managers ran their portfolios with a tilt toward defending against rising interest rates--meanwhile, rates fell for most of the period. Some bond shops, including Fidelity and Baird, avoid interest-rate calls altogether while many manage duration within a fairly limited range around a benchmark.

Still, investors can see what some of these big fund managers are expecting from the economy and markets. PIMCO, for example, offers its annual Secular Outlook, an overview of key economic and market trends. Vanguard publishes an annual outlook that includes long-term return expectations. In its May 2019 report, Vanguard felt that fixed-income markets were generally fairly valued and that bond investors should expect 2.5%–4.5% returns over the next decade.

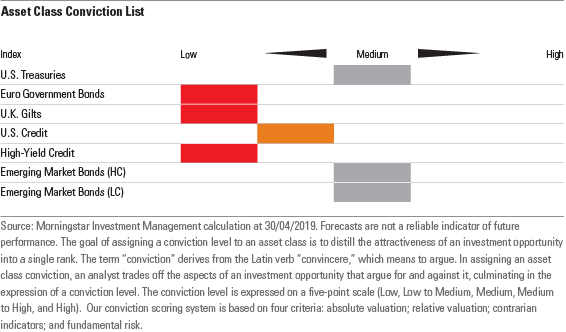

Here's the Morningstar Investment Management group's long-term outlook as of April 2019:

Government Bonds Incredibly low yields hint that government bonds are significantly overvalued and poised to deliver low future returns. This is especially true in the United Kingdom, Europe, and Japan, where yields are at or around zero. U.S. Treasuries offer better relative value but still look expensive in a historical context, especially after recent moves. That is, investors are being forced to accept lower yields on these bonds, even though they have a longer time to maturity. This is a poor trade-off, as it reduces future income while increasing the risk of capital loss.

High-Quality Corporate Bonds U.S. investment grade corporate isn't a compelling asset class to own, as more than half of it is rated in the lowest BBB rated tier, which presents a greater credit risk. Given the high concentration of BBBs and internal and external beliefs that as much as 20% of BBBs could be downgraded during the next credit wave, we feel the near-record level of risk in this space far exceeds the level of reward currently being offered.

High Yield The two biggest challenges the Morningstar Investment Management group sees for high yield are 1) a possible sell-off contagion from the loans space and 2) a credit downgrade wave overwhelming the market. However, the group believes that overall fundamentals appear constructive. Companies don't appear overly leveraged, defaults are low, earnings growth has been a nice tailwind, and credit quality has been improving. In fact, late-cycle financial "misbehaving" seems mostly relegated to the loans market, possibility further bolstering this view. But many concerns remain, and valuations (spreads) aren't exactly compelling.

What Are Some Key Scenarios to Consider? Given the very long bull market for bonds, many bond investors have been eyeing the exits for a while, only to have some geopolitical news or other hiccup cast their plans into disarray.

Heading into the end of 2018, bond markets were braced for the Fed to continue a path of long-awaited interest-rate increases, which would be bad news for the bond market. But the global economy ran into a speed bump, thanks in part to trade tensions between the United States and other major economies. As 2019 got underway, the Fed signaled it was putting additional rate increases on hold. Bond markets rallied, especially in riskier areas such as high-yield bonds. As this article was written, investors were expecting the Fed to cut rates.

With a firm eye on their goals and cash flow situations, investors should consider these four scenarios that may unfold in the near to medium term:

Scenario 1: Federal Reserve Lowers Rates When the Fed lowers interest rates, it is primarily via the federal-funds rate, which is the overnight borrowing rate the Fed charges banks. The Fed-funds rate is a short-term rate, so short-term fixed-income investments are the ones most directly affected. So in a period of interest-rate easing, the value of shorter-term bonds will rise more than long-term bonds. In fact, at times, long-term bond funds may struggle when the Fed is easing because the goal of the Fed lowering rates is to boost the economy, which tends to increase inflation, which is bad for long-term bonds.

John Rekenthaler tackled investing in bonds during periods of low inflation--often periods when the Fed is lowering rates. Rekenthaler wrote that one form of defense is to stick with short-term bonds:

“Three-month Treasuries now pay 2.3%, more than 10-year notes and almost as much as the long bond. At least for government-guaranteed securities--corporates are a different matter--bond investors can have their cake and eat it, too. They can match their income by swapping from bonds to bills, while being largely immune from inflation spikes.

"The catch, of course, is that things change. Short-term yields are competitive today, but they may not be competitive tomorrow. Also, that seemingly free lunch often comes with a hidden cost, because it signals that bonds will soon rally. In which case, those who swapped bonds for bills sold for relatively low prices, and if they later wish to lengthen their portfolios, they will need to buy high.”

Scenario 2: Federal Reserve Increases Rates After a few decades' worth of declining interest rates, rates have much more room to go up than they do to go down further. That could spell trouble for bond prices if rates head up and continue to spike.

The Morningstar Investment Management group notes that multiple factors have been keeping a lid on bond yields. Demographic changes like the aging population and longer life expectancies, higher savings rates in emerging-markets economies, and technological advances have all been cited in studies to justify rates staying lower for longer.

Still, bond yields will eventually trend higher and revert to their estimated fair value levels, but the path and timing of such moves are unclear. The danger for investors, the group says, is trying to time the market by exiting bonds and then attempting to re-enter when interest rates normalize at higher levels. Additionally, even with a muted return outlook, investors should remember that bonds play a valuable role in a diversified, multi-asset portfolio. Therefore, it may be appropriate to maintain bond allocations but to hold investments that might be less affected by rising rates.

It is not as though rising bond yields are a universal negative--for investors, it all depends on their time horizon. True, a spike upward in rates will tend to lead to short-term losses in high-quality bonds of all maturities. For retirees dependent on portfolio withdrawals to pay the bills, a short-term loss could throw their finances off track.

But for a saver with a longer time horizon, the higher yields that can come with a bond market sell-off should pass through to the investor, eventually making up for the near-term drop in principal value. A 2010 research paper from Vanguard shows how a 3-percentage-point interest-rate hike would play out on a year-to-year basis. For a portfolio invested in long-term bonds, the rate increase would lead to a devastating loss that would take eight years to recover from--even though the investor would also partake of the newly available higher yields as long as he was reinvesting in the market. But a broadly diversified bond portfolio would recover much more quickly: Because of higher yields in the years following the rate shock, the investor who bought and held the portfolio would have recouped her losses and moved back into the black on the investment within three years of the rate shock.

In general, investors worried about central bank interest-rate increases should tilt their bond portfolios toward shorter-term bond funds. But even these carry risks. Many investors piled into bank-loan funds during the 2018 series of Fed rate increases only to see losses at the end of the year thanks to a sell-off in the low-quality loans those funds tend to own.

Scenario 3: Widening Credit Spreads The Morningstar Investment Management group argues that the importance of focusing on bond quality should not be underestimated in current markets. It notes that BBB rated issuers--those just one notch above so-called junk status--now account for around half of the whole investment-grade market in the U.S. and Europe. There are several reasons for this. To name a few: Firms are using debt to fund acquisitions, carry out stock buybacks, and make dividend payouts. Meanwhile, Federal Reserve officials having begun issuing warnings about the overall rise in corporate debt.

For bond investors worried about this trend, that means applying prudence when buying corporate-bond funds and tilting portfolios toward funds that have higher-quality debt and fewer high-yield bond holdings. For example, that could include swapping out a fund that lands in the core-plus bond Morningstar Category for one in the intermediate core bond category, which tends to have higher-quality portfolios.

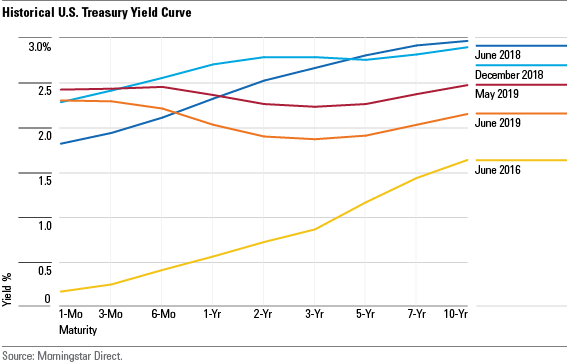

Scenario 4: Yield-Curve Inverting Recent headlines have been dominated by the concepts of yield-curve inversion and recession risk. Normally, long-term interest rates are higher than short-term rates. An inverted yield curve is when the picture goes in the opposite direction--that is, long-term interest rates are lower than short-term ones. In early 2019, the yield on the U.S. Treasury 3-month bill moved above the yield on a U.S. Treasury 10-year note, the first time this alignment took place since before the financial crisis.

This may seem like wonky bond market talk. Even if this bond market signal has a pretty compelling track record of predicting recession, for the Morningstar Investment Management group, the focus is on the opportunity set in the market. In the case of the inverted yield curve, that means investors can earn just as much in yield on low-volatility short-term debt as they could on longer-term debt.

The real question here is whether bond investors have predictive abilities over the economy or markets. When it comes to managing a portfolio, we only really care about the markets, where the relationship is tenuous at best. It is useful to understand risk, but it is not something that directly affects our investment decision-making. The better approach is to think about duration, where an investor is typically not rewarded for holding longer-term bonds.

Conclusion Bonds have their own sets of risks that are important to understand, but they can provide both an anchor in times of market and economic uncertainty and an opportunity for additional returns.

As with any investment, choices around bond investments should be made in the context of a broad financial plan and meeting financial goals. Investors can consider other factors across their investment portfolio that can help meet those goals, such as keeping investment costs low, not chasing after hot corners of the market, and not bailing on a long-term plan in the face of short-term losses.

Since its original publication, this piece may have been edited to reflect the regulatory requirements of regions outside of the country it was originally published in.

The following authors contributed to this series: Tom Lauricella, Editorial Director, Professional Audiences Christine Benz, Director of Personal Finance Sarah Bush, Director, Fixed-Income Strategies Jeff Westergaard, Director, Fixed-Income Data

Click here for important information about this commentary.

/s3.amazonaws.com/arc-authors/morningstar/ed529c14-e87a-417f-a91c-4cee045d88b4.jpg)

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/6ZMXY4RCRNEADPDWYQVTTWALWM.jpg)

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/G3DCA6SF2FAR5PKHPEXOIB6CWQ.jpg)